- newsletter

- Extra Credit

How Excel COUNTIF function saves time when analyzing final grades

Please note: This item is from our archives and was published in 2021. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

Format column headings in Excel to make them easier to read

Various ways to display formulas in Excel

When analyzing grades (especially for a large class) the COUNTIF function in Excel can be extremely helpful.

For example, suppose you have entered your final letter grades, and you need to report how many students have earned a certain letter grade. You can easily determine this using the COUNTIF formula.

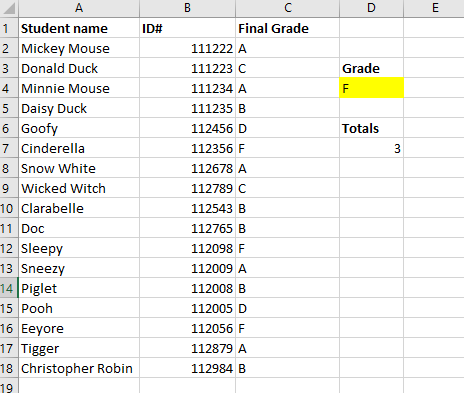

COUNTIF will count how many items (letters, numbers, or words) within the range you select meet the search criteria you set. Say, for example, you want to know how many students earned a final grade of F in your class, as illustrated in the example below. Begin by typing =COUNTIF( in an empty cell, followed by the range you want to search (C2:C18 in the example below) and the cell that contains that criteria you want to search for (D4 in the example below), and press Enter. (If you prefer, rather than typing the cell names in the formula, left-click on the start of the range and hold and drag to the end, type in a comma, click on the cell with the criteria, type in a close parenthesis, and press Enter.)

You will then see the total number of the criterion you searched for. In this example, we see the number 3, indicating that three students received a grade of F.

You can also manually input the range directly into the COUNTIF formula in the cell’s text input bar by placing it in quotation marks. In this example, for instance, you would type the formula COUNTIF(C2:C:18,“F”).

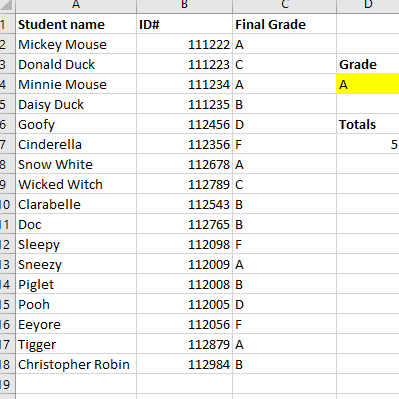

However, in this case, rather than specifying that the criteria was “F” within the COUNTIF formula, we had the formula reference the highlighted cell (D4) instead. When you use COUNTIF this way, you can easily change the letter grade and the count will automatically update, without needing to alter the formula. For example, if you now want to know how many students earned an A, you only need to change the letter grade in the highlighted cell and press Enter. The count automatically updates, as you can see in the screenshot below:

Although this technique might not seem as helpful with small amounts of data, using it with larger class sizes can be a huge time saver!

— Wendy Tietz, CPA, CGMA, Ph.D., is a professor of accounting at Kent State University in Kent, Ohio; Jennifer Cainas, CPA, DBA, is an instructor of accountancy at the University of South Florida in Tampa; and Tracie Miller-Nobles, CPA, is an associate professor of accounting at Austin Community College in Austin, Texas. See their site AccountingIsAnalytics.com for resources they have developed for teaching data analytics in introductory accounting. To comment on this article or to suggest an idea for another article, contact senior editor Courtney Vien at Courtney.Vien@aicpa-cima.com.