- newsletter

- Cpa Insider

Government report finds deficiencies in most US hospices

Advise clients to do their research before choosing hospice care.

Please note: This item is from our archives and was published in 2019. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

Financial planning for clients who have suffered traumatic brain injuries

Prepare clients for a sudden elder health care crisis

What CPAs should know about ‘gray divorce’

The oldest Baby Boomers are now in their mid-70s. Declining health and contemplating their own mortality will soon be their focus, if it isn’t already. Aging brings with it physical and cognitive challenges that impact your clients’ financial planning needs. Many of the conversations with your clients at these times will be difficult but important — especially the ones regarding end-of-life planning and the role of hospice care.

Hospice care has been covered by original Medicare since 1983. Medicare Advantage (MA) plans do not cover hospice care, so MA beneficiaries will receive hospice care through original Medicare. Beneficiaries do pay some out-of-pocket costs for hospice care; for instance, hospice coverage requires a copayment of up to $5 per prescription drug for pain and symptom management.

Hospice care is typically provided at home, including an assisted living facility, or in a health care facility such as a hospital or skilled nursing facility. Medicare covers both types of hospice care. Occasionally beneficiaries and their caregivers may make use of respite care. This provides the caregiver with time to rest. For that purpose, the beneficiary may be moved to a Medicare-approved facility such as a hospice inpatient facility, hospital, or nursing home. Beneficiaries are responsible for a coinsurance payment of 5% of the Medicare-approved amount for respite care.

Clients should exercise caution when choosing a hospice

With so much of the hospice cost covered by Medicare, beneficiaries and their families can focus on the quality of care available from local hospices. Clients choosing a hospice for themselves or their family members should carefully research all the available options. The importance of this research is underscored by a recent report that reveals that many hospices have serious problems.

In July 2019, the U.S. Department of Human Services Office of Inspector General (OIG) issued a report titled Hospice Deficiencies Pose Risks to Medicare Beneficiaries. The report, which covered almost all hospice care providers in the U.S., found that over 80% had at least one “deficiency,” or a failure to fulfill a requirement for participating in Medicare. This report should raise a concern with CPAs who regularly work with clients on Medicare issues or who have family members receiving hospice care.

Obviously, some deficiencies are worse than others. Serious deficiencies, termed “condition-level” deficiencies by the report’s authors, affect the quality of care and can mean that the hospice’s capacity to furnish adequate care is substantially compromised, or that the health and safety of beneficiaries is being jeopardized. The report found that 20% of hospices had at least one condition-level deficiency.

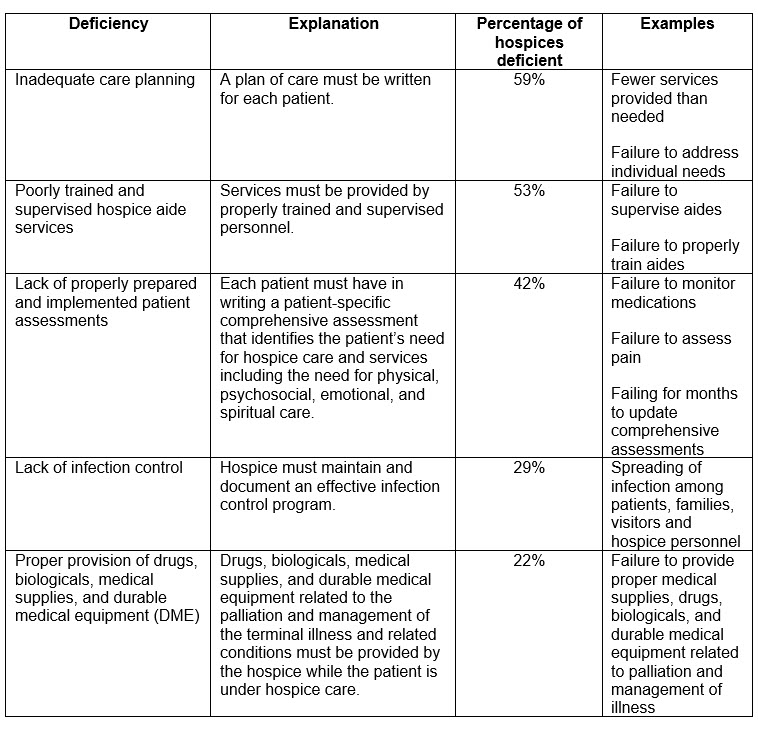

Below is a partial list of some of the most common deficiencies identified by the report and the percentage of hospices found deficient:

The report also found that, from 2012 through 2016, one-third of all hospices had complaints filed against them. For almost half of these hospices, the complaints were severe.

Where to find information on hospice quality

Advise clients choosing a hospice to carefully weigh their options. Clients can obtain some information on the quality of the hospices in their geographic area at Medicare’s Hospice Compare site. The site presents information about hospices’ quality of care, based on the Centers for Medicare & Medicaid Services data and a survey of family caregivers. However, it does not provide information about complaints filed against individual hospices.

You can also direct clients to the variety of websites that offer guidance on how to locate a good hospice. Typically, these websites are disease-specific, but they discuss what questions to ask as part of due diligence, a topic applicable to patients with any condition. Helpful pages can be found on the American Cancer Society’s website and the ALS Association’s website.

Find more information on how to advise your clients in The Adviser’s Guide to Retirement and Elder Planning (available to AICPA PFP/PFS members), including two parts — Financing Retirement Healthcare and Life Transitions — authored by James Sullivan, CPA/PFS.

James Sullivan, CPA/PFS, is a financial planner in Wheaton, Ill. He specializes in working with clients suffering from chronic illness. He is also a volunteer for Seasons Hospice & Palliative Care. Julie Papievis is a national speaker on the physical, emotional, and financial impact of traumatic injury. She tells her story in her book Go Back and Be Happy. To comment on this article or to suggest an idea for another article, contact senior editor Courtney Vien at Courtney.Vien@aicpa-cima.com.