- newsletter

- Extra Credit

An online pivot can be an opportunity

A faculty member reconfigured her finance class in the wake of the COVID-19 crisis to teach soft skills.

Please note: This item is from our archives and was published in 2020. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

Get started teaching blockchain

Mental health concerns on campus: What faculty can do

If you have never taught online, it can be intimidating, especially when you do not have much time to practice and plan. However, if you are open to the opportunity, teaching online can foster the skills our students need most.

We constantly hear that we need to teach our future finance professionals critical thinking, communication, and creative problem-solving skills. So, when, as an adjunct professor, I was told that I was allowed to alter the delivery and content of my finance capstone course when transitioning it to an online class amid the pandemic, I immediately acknowledged it as an amazing opportunity to rethink how I deliver the curriculum to better approach those types of skills.

Below, I’ll explain how I adapted my class and assignments to work online. I acknowledge that I am better prepared for this change than many faculty members, as I was facilitating webinars 15 years ago, but I’ll share advice that can work for anyone teaching online. (I also want to give a shoutout to campus technology staff and the higher-education community for all of the resources and support brought to bear almost overnight.)

A revised assignment grounded in the current situation

We spent the first online class discussing risk management. This is normally the last class of the semester, but I think it sets the tone for where we are right now. We talked about the concepts underlying COSO’s enterprise risk management framework and the importance of looking broadly at an organization, but also looking deeply into the varying risks associated with each division.

We then spent time talking about the upside of risk. I showed students that, yes, there is an upside! If you understand your risk and manage it well, you can differentiate yourself from your competitors, build deeper and more trusting relationships with customers, and even support social good, as the distilleries making hand sanitizers or auto manufacturers making ventilators are doing during this pandemic.

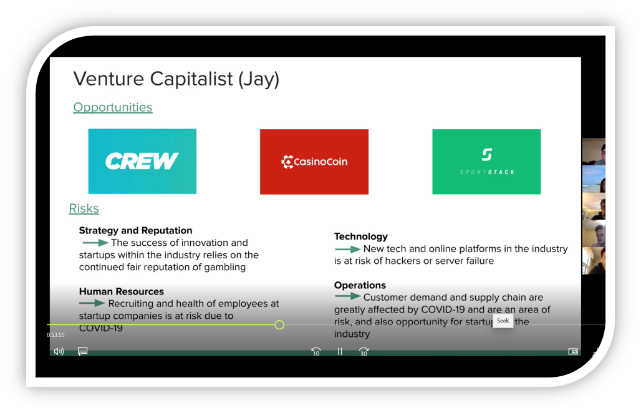

I then gave them the assignment. I divided the class into four groups and asked each group to select an industry. From there, each student within the group was asked to select a professional role based on their career interest. Their goal is to research their industry and identify potential significant risks within the next four to eight weeks of the pandemic but also to consider the longer term horizon of residual risk of a recession. Then, they will give a presentation to the “CEO” and “Board” (roles played by me and the rest of the class) on what those risks are, and more importantly, from their “professional” perspective, tell us what they would do to minimize those risks or leverage them to create opportunity.

Fostering critical thinking skills

This exercise will prioritize critical thinking and problem-solving over memorization. Instead of requiring students to memorize formulas, I’ll ask them to focus on the underlying components and concepts behind the formulas. Committing formulas to memory is a very narrow skill and does not teach students how to think critically or solve problems that they have never seen before — skills that are becoming more and more critical with the emergence of globalization and technology.

I also want students to learn not just what was defined in the course syllabus, but also to help them take on the perspective of a CFO, an investment analyst, a venture capitalist, or another role during a major world crisis that is financially impacting every industry. When I surveyed the students at the beginning of the semester, I learned that these were their career aspirations, so why not let them practice?

Helping students adjust to learning online

I was surprised at how many of my students, who grew up with smartphones in their hands, were concerned about how they were going to learn online. Online learning is new to them, and I needed to find ways to alleviate their concern and engage them so they would be open and willing to participate in this new approach. I needed to host a video tutorial for my class on the use of Zoom and its breakout rooms feature. (This feature allows me to send my teams into separate video meetings simultaneously and then have them return to the main classroom at the end of an exercise.) I also used the tutorial as an opportunity to connect with students on a more personal level by showing them my home office, my dog, and even a brief appearance from my college-aged daughter.

This class has unexpectedly turned out to be a way to teach students online communication skills. It’s helping them learn how to host effective team meetings with remote teams, growing the online communication skills that they will need to use in a global economy, such as:

- The importance of having effective visuals to support your talking points;

- Using your physical presence on video as a way of keeping the audience engaged;

- Limiting your talking to 6–10 minutes, then engaging the audience with a poll, exercise, or question;

- And the one we dread the most, being comfortable with silence. When someone asks a question in an in-person class, the response time is much quicker because the students can see one another’s body language. On a videoconference this silence can be deafening.

Creative problem-solving and building effective teams

My plans for the class include weaving in some skills on management of team dynamics and problem-solving using design thinking. Traditionally, accountants are taught rules and how to fine-tune our skills to apply those rules to every situation — in essence, how to get to the right answer as quickly as possible. But today, we are faced with new challenges that will not have predefined “rules” we can apply to every situation. As students continue to delve deeper into our COVID-19 case study over the next few weeks, they will be challenged to look at the disruptions in their chosen industry and propose solutions.

I am excited to see how this all plays out. I want my students to emerge from this semester with deeper problem-solving and critical thinking skills, and most importantly, I want them to be the type of finance professionals who approach a problem as an opportunity — a challenge to be solved. I would love to hear thoughts from my friends out there! Please share ideas.

— Rebeka Mazzone, CPA, CGMA, is an adjunct faculty member at Providence College in Providence, R.I., and a strategic finance consultant at FuturED Finance, a consulting firm partnering with CFOs to help college and universities leverage financial management capacity to drive innovation. To comment on this article or to suggest an idea for another article, contact senior editor Courtney Vien at Courtney.Vien@aicpa-cima.com.