- newsletter

- Extra Credit

Use the Quick Access Toolbar to increase your efficiency in Excel

Please note: This item is from our archives and was published in 2020. It is provided for historical reference. The content may be out of date and links may no longer function.

When working in Excel, do you find yourself using a set of commands (such as New, Open, and Print) frequently? If so, you can increase your efficiency by customizing the Excel Quick Access Toolbar (QAT) (outlined in red in the image below). This will allow you to have your frequently used commands right at the top of the workbook.

Change the location of the Quick Access Toolbar

The QAT, typically located in the upper-left corner of the Excel window, can also be moved to below the Ribbon. If you want to move the location of the QAT, click on the arrow at the end of the toolbar (outlined in red in the image below) and select either Show Below the Ribbon or Show Above the Ribbon, depending on where the toolbar is currently.

Customize the Quick Access Toolbar

The QAT can be customized to include your most-used commands. To customize the QAT, click on the down arrow located at the end of the toolbar. Select the commands you want to include from the list. You can also remove commands from the QAT by unselecting them from this list.

If you use a command that is not listed, you can add these commands by clicking on More Commands. This will allow you to add almost any Excel command that you use to the QAT.

Change the order of and group commands

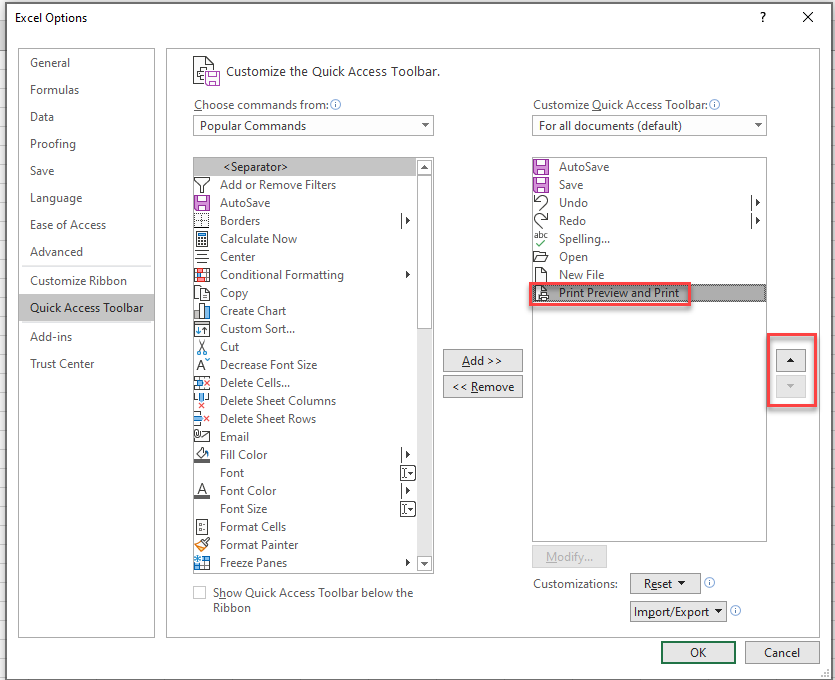

Once you have all your commands added to the QAT, you can change the order they appear in by right-clicking the QAT and then clicking Customize the Quick Access Toolbar. In the Customize QAT area (on the right-hand side), click the command you want to move and the Up or Down arrow and then click OK.

You can also group commands by using a separator. To do this, after clicking Customize the Quick Access Toolbar, select

As you can imagine, having all your frequently used commands in one place can increase your efficiency in Excel. It’s important to note that you can’t increase the size of the buttons on the QAT and you can’t display the QAT on multiple lines. You can, though, customize the QAT for any other Microsoft software products that you use, such as Word, PowerPoint, Outlook, and Access.

— Wendy Tietz, CPA, CGMA, Ph.D., is a professor of accounting at Kent State University in Kent. Ohio; Jennifer Cainas, CPA, DBA, is an instructor of accountancy at the University of South Florida in Tampa; and Tracie Miller-Nobles, CPA, is an associate professor of accounting at Austin Community College in Austin, Texas. See their site AccountingIsAnalytics.com for resources they have developed for teaching data analytics in introductory accounting. To comment on this article or to suggest an idea for another article, contact senior editor Courtney Vien at Courtney.Vien@aicpa-cima.com.