- newsletter

- Extra Credit

Calculating depreciation using the SLN function

Please note: This item is from our archives and was published in 2020. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

Use conditional formatting in Excel to visualize letter grades

Use Excel PivotTables to quickly analyze grades

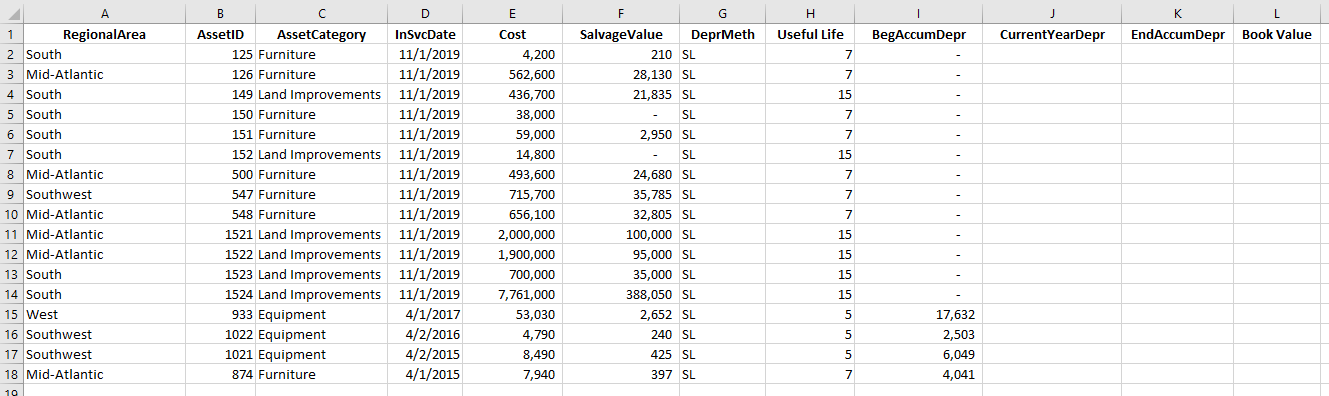

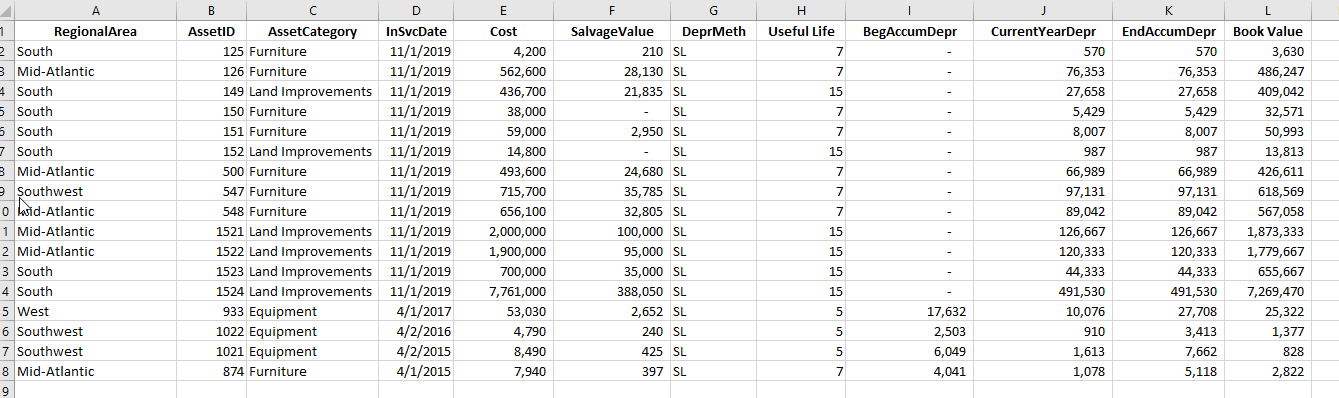

When teaching depreciation in Introduction to Accounting, faculty always cover a variety of different depreciation methods, including straight-line depreciation. Next time you teach this topic, build your students’ Excel skills by showing them how to use the straight-line (SLN) function in Excel. Below you will see an example screenshot of a fixed asset report for a company:

To calculate the current year depreciation, you will use the SLN function. Here’s how:

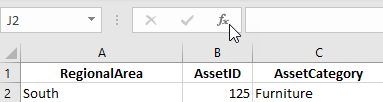

Step 1: Insert Function. Click in the cell where you would like to insert the formula. In this example, I will use cell J2. Click on the function symbol (ƒx) next to the formula bar.

Step 2: Search and select the SLN function. Type the function abbreviation, in this case SLN, in the box that says, “Search for a function,” and press Enter. Select SLN in the “Select a function” box, then click OK.

If you don’t know the function abbreviation, you can search for it by using the “Search for a function” box. In this case, you would type in “Straight line” and then click Go. Excel then suggests functions that you can select. Select the SLN function and click OK.

Step 3: Identify the function arguments. In the Function Arguments box, click in the Cost box. Either type the cell reference or select the cell with your mouse for the cost (for example, cell E2). Next, click in the Salvage box and type the cell reference or select the cell for the salvage value (cell F2). Follow the same procedure for asset life (cell H2 in this example). Click OK.

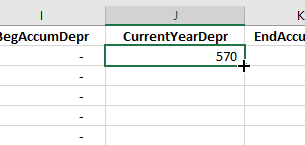

The straight-line depreciation will be calculated.

Step 4: Copy the formula to the remaining cells. To quickly copy the formula to the remaining cells, move your mouse to the lower right-hand corner of the cell until the cursor becomes a black plus sign. Double-click.

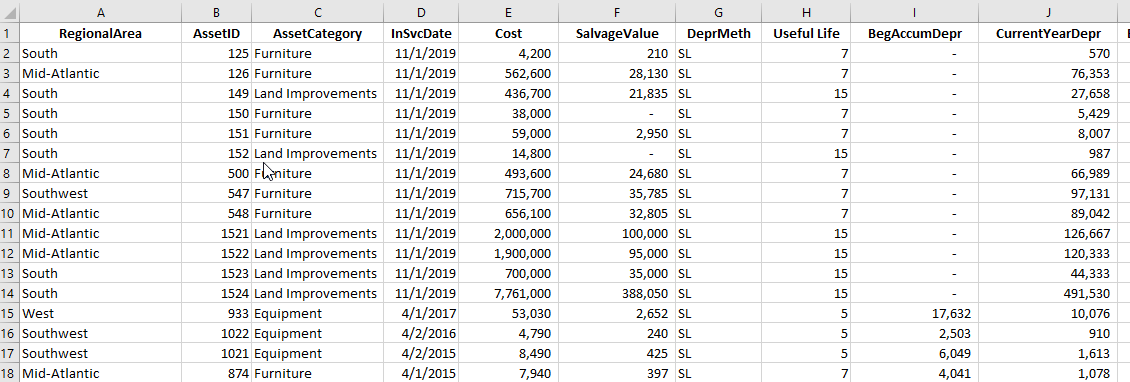

The straight-line depreciation formula will now be copied to the remaining cells.

To complete the fixed asset report, you would then use a formula to calculate Ending Accumulated Depreciation by adding Beginning Accumulated Depreciation plus Current Year Depreciation. You’d also calculate Book Value by subtracting Ending Accumulated Depreciation from Cost.

See this short tutorial video for an overview of how to complete the fixed asset report using the straight-line (SLN) function.

— Wendy Tietz, CPA, CGMA, Ph.D., is a professor of accounting at Kent State University in Kent. Ohio; Jennifer Cainas, CPA, DBA, is an instructor of accountancy at the University of South Florida in Tampa; and Tracie Miller-Nobles, CPA, is an associate professor of accounting at Austin Community College in Austin, Texas. See their site AccountingIsAnalytics.com for resources they have developed for teaching data analytics in introductory accounting. To comment on this article or to suggest an idea for another article, contact senior editor Courtney Vien at Courtney.Vien@aicpa-cima.com.