- newsletter

- Academic Update

Best way to teach adults? Scenario-based learning

Related

Adapting teaching methods for Gen Z learners

Preparing accounting students for professional success

Expand the accounting pipeline with a mentorship circle

Scenario-based learning is in line with strategies for teaching adults known as andragogy, a term popularized in contemporary higher education by Malcolm Knowles (1913–1997), a central figure in U.S. adult education.

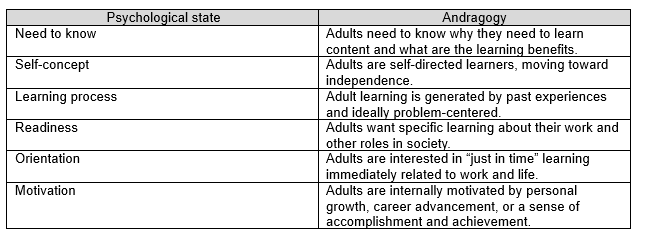

Knowles professed that teaching adults is fundamentally different from teaching children due to adults’ life experiences that formed their experiences, minds, and brains. His work is based on six principles or psychological states of adult learners. (See the chart, “Knowles’ 6 Psychological States of Andragogy.”)

Knowles’ 6 psychological states of andragogy

Source: Author.

The main premise of Knowles’ andragogy theory is that adults are “self-directed” in their learning of material. They apply content to their work and life and want immediate relevancy. The instructor’s role is to lead and engage the learner toward understanding and applying the content and solving problems rather than transmitting facts.

Scenario-based learning strategies

In a business learning environment, scenario-based learning (SBL) teaches content within an environment of solving problems in real-life situations. Students learn content by engaging with the entire problem-solving process in a scaffolded or incremental fashion, with appropriate feedback and guidance from the instructor.

As a result of the COVID-19 pandemic and an explosion of e-learning, SBL became a mainstream tool in online business programs.

SBL example: A 3-week accounting course lesson

In week one, the instructor provides the “big picture” of the course to help students understand and analyze a firm’s financial performance by examining the financial statements of a publicly traded company. Students are taught, with examples, the purpose of the “big three financial statements”: the income statement, the balance sheet, and the cash flow statement.

In the first lesson, students are shown how the statements are linked to one another and how they are used in a typical business financial model. Assessments for this week include a quiz on the content, along with a discussion board where the learners discuss the definitions and purpose of the statements based on their research of the reports of a publicly traded company.

The quiz is a tool to reinforce learning and memory for students, and the discussion board provides a vehicle to display their knowledge and share ideas with other learners. The instructor’s role is to reinforce what the learners did well and where they need to improve, with suggestions on how to improve their work products. The learning objective of this work is to prepare students to understand the big picture of a publicly traded firm’s financial performance.

In week two, students examine a case study of that publicly traded company and then evaluate financial success by understanding the company’s key financial performance indicators (KFPIs). Examples of KFPIs may include gross profit margin, net profit margin, and working capital. The assessments for this week include a quiz on the content, along with a presentation to a management team, with recommendations on improving one or two KFPIs.

Again, the quiz reinforces the need to learn definitions and commit KFPI terms to memory, and the presentation provides an outlet for critical and creative thinking for the learners. A presentation to management is a typical task of leaders in real life. The instructor’s feedback on the assessments follows the path of explaining what the learners did well and advising on areas for improvement, with guidance for how to improve their work. This week’s lesson builds on the first week, leading students to a final assessment regarding the big picture of financial performance.

In week three, adult students employ the information they learned in the previous weeks. Students are introduced to new content about how to apply the learning of strategic business tools like the Balanced Scorecard (BSC) or Michael Porter’s Five Forces to a firm’s strategic and financial reporting. The BSC focuses on reporting metrics of financial, customer service, internal processes, and organizational capacity. Porter’s Five Forces is a framework for understanding competitive forces in business that drive economic value. The learning of new content (known as novelty), along with material from the prior two lessons, will assist learners in combining financial reporting with organizational effectiveness.

Introducing new material, blended with current content, is an excellent way to improve adults’ learning and memory.

Final assessments

For the final assessment of the three-week lesson, students apply this new strategic content with previously learned tactical and operational information in a report and presentation to the leaders of their organization. The report should use the financial statements, financial benchmarks, and KFPIs applied to one of the strategic business tools. Students use simple technology, such as Microsoft Word, Excel, and PowerPoint, in this assessment. The learners also display their knowledge of the definition of terms and how the material is applied and explained in the report.

In addition to the report, students participate in a discussion board to share and explain the highlights of their work with other learners to elicit an exchange of ideas and peer feedback. These two assessments — the discussion board and the report — capture the learning objective of the three-week lesson. The assessments will also provide an opportunity for the instructor to supply feedback to the students on how well they learned the objective.

— Mark F. Hobson, Ph.D., CAGS, is a retired senior associate dean of Southern New Hampshire University who now teaches part time in business for Great Bay Community College in Portsmouth, N.H. He will speak on this topic at the AICPA Faculty Hour on Jan. 31, 2025. Register here.

To comment on this article or to suggest an idea for another article, contact Jeff Drew at Jeff.Drew@aicpa-cima.com.