- newsletter

- Cpa Insider

4 technology gift ideas for CPAs

There’s no accounting for taste, but these suggestions are timely, remarkable, and something to write home about.

Please note: This item is from our archives and was published in 2020. It is provided for historical reference. The content may be out of date and links may no longer function.

As someone who adores presents and technology, I love the holidays. There’s just something satisfying about ripping off wrapping paper to reveal a gadget or gizmo that makes life just a little bit better — or at least more fun.

With that in mind, I have put together a quartet of technology-related gift ideas for CPAs. If you like one or more of these suggestions, you might consider leaving this article “accidentally” open on the coffee table, counter, or anywhere else it might catch a loved one’s eye. Hint, hint.

PHILIPS SMARTSLEEP ALARM CLOCK

Store link: https://amzn.to/3lpFib2

As a CPA, you work hard. If you are like me, you also play hard. You can’t go hard if you don’t get enough sleep. The Philips SmartSleep alarm clock simulates a sunset and sunrise. This natural light therapy leverages your body’s natural hormones to put you to bed and wake you up as nature intended. The Philips SmartSleep alarms range from $50 to $200 on Amazon.

GOOGLE PIXEL BUDS

Store link: https://store.google.com/us/product/pixel_buds

Google is a late entry to the earbud game, but the search giant’s Pixel Buds are a standout in a competitive market.

The Pixel Buds include the standard traits you would expect of a quality earbud, including excellent audio, decent battery life, and a charging case. Where Google begins to pull away from the pack is with adaptive sound technology, which adjusts earbud volume based on surrounding noise, and clear voice functionality, which isolates your voice and eliminates the background noise.

Finally, what sets Pixel Buds apart from the rest is the integration with an Android phone and Google Assistant. This provides an endless list of features and functionality, including having Google Translate built directly into your ears. The Pixel Buds retail for $179.

REMARKABLE 2 TABLET

Website: https://remarkable.com/

I remember the first time I took handwritten notes digitally on my Palm V personal digital assistant. It was amazing and awful at the same time. The screen felt miserable, the stylus was too thin for my fingers, and the graphics were hardly a reflection of my chicken scratch.

Starting with the Palm V in 1999, I have made many attempts to ditch pen and paper, but every attempt has fallen flat. Until now.

The reMarkable 2 tablet provides digital notetaking that feels like writing with pen and paper, with the functionality you would expect of a cloud-connected device. The tablet retails for $399, plus you need to buy a pen, which will cost either $49 or $99. This isn’t a cheap gift, but it’s one that will be used for years.

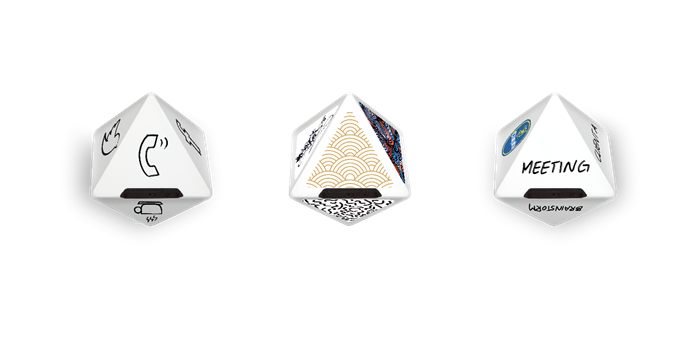

TIMEULAR TRACKER

Website: https://timeular.com/product/tracker/

If you are an accountant who has worked in public practice, you almost certainly know what a pain it is to track time. And it’s a shame, really, because knowing how you have spent your time can be far more valuable to you than calculating how many of the hours you worked are billable.

An accurate record of what you do with your time can show you where you can be more efficient and effective. If only there was an efficient and effective way to track time.

That’s where this gift comes in. The Timeular Tracker is an eight-sided die that uses a Bluetooth connection to provide time tracking that’s accurate to the minute. You simply assign a different task to each of the object’s eight sides and assign them in the Tracker app, as suggested in the photo below.

Once you have the die customized, you simply place it on your desk and flip it when you change tasks, as shown in the photo below.

The app automatically recognizes the change through its Bluetooth connection. The Tracker can connect to Windows, Mac, Linux, iOS, and Android operating systems, and it also can automatically populate time sheets and even generate invoices via the app. But the greatest value, to me at least, is the ability to see where your time goes (see photo below) and use that information to recover time that is lost on a regular basis.

The Basic option is $89, but there are advanced options that include monthly subscriptions or a single lifetime fee of $249.

— Byron Patrick, CPA/CITP, CGMA, is vice president of growth and success at Botkeeper. To comment on this article of to suggest an idea for another article, contact Jeff Drew, a JofA senior editor, at Jeff.Drew@aicpa-cima.com.