- news

- FIRM PRACTICE MANAGEMENT

Finding qualified staff tops ranking of CPA firm top issues

Related

Luxury liabilities: Serving high-net-worth clients

COSO creates audit-ready guidance for governing generative AI

Corporate spending accelerating toward AI in 2026

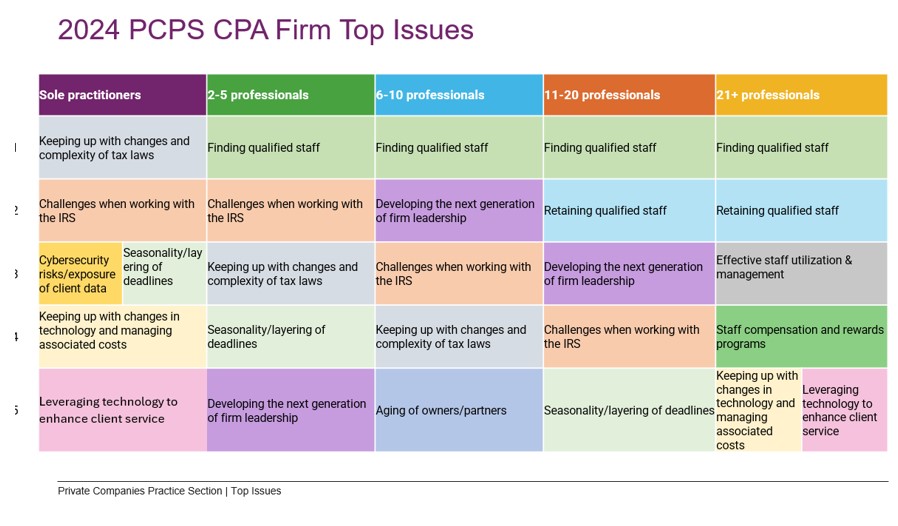

Finding qualified staff is the most pressing concern of accounting firms except sole practitioners, according to survey results released by the AICPA’s firm practice management section. Sole practitioners who participated in the biennial Private Companies Practice Section (PCPS) CPA Firm Top Issues Survey chose “keeping up with the changes and complexity of tax laws” as their top challenge.

Another tax-related concern, “challenges when working with the IRS,” was the only issue to rank in the top four for most categories of firms tracked in the survey, failing to crack the top issues list only among the largest firms (those with 21 or more professionals).

IRS challenges were the top issue reported by firms surveyed in 2022, when the IRS dealt with backlogs due to the COVID-19 pandemic. While the Service has gone back to “business as usual” levels of service (in the words of National Taxpayer Advocate Erin Collins) since the 2022 survey, challenges in working with the IRS remain acute enough to rank as the No. 2 issue for firms with five or fewer professionals, No. 3 among firms with 6–10 professionals, and No. 4 among firms with 11–20 professionals.

Finding qualified staff was far from the only staffing-related issue that’s top of mind for accounting firms (see graphic below), the survey found:

- The two largest firm categories (11–20 professionals and 21 or more professionals) listed “retaining qualified staff” as their No. 2 issue.

- Small to midsize firms listed “developing the next generation of firm leaders” as a top five concern or higher.

- The largest firms named “effective staff utilization and management” and “staff compensation and reward programs” among their top five concerns.

- Firms with 6–10 professionals also recognized the aging of owners/partners as a top five concern, a ranking that also reflects the need for firms to focus on leadership development.

Results of the survey are segmented by firm size because the perspectives of small firm CPAs are often substantially different from those of CPAs at larger firms. Even so, the survey results often reveal trends across categories. Survey respondents are asked to rank the impact of a host of issues on a 1–5 scale, with one being “minimal” and five being “extreme.”

Other findings in the survey included:

- In addition to being the No. 1 issue for sole practitioners, “keeping up with changes and complexity of tax laws” was the top concern for firms with 10 or fewer professionals. Those practices often lack the research resources of their larger counterparts.

- Interestingly, technology-related issues ranked highly among firms at the opposite ends of the size spectrum. Sole practitioners and the largest firms named “keeping up with changes in technology and managing associated costs” and “leveraging technology to enhance client service” among their top five concerns.

Survey respondents were asked to rank the issues expected to have the greatest impact on firm practice operations over the next five years. Staffing, contending with emerging technologies, and changes in the regulatory environment were the most common issues across categories.

“The interplay between talent and technology is interesting, since we know that using technology effectively can have a significant impact on a firm’s ability to leverage staff to provide higher-value services to clients,” Lisa Simpson, CPA, CGMA, vice president–Firm Services for AICPA & CIMA, said in a news release. “As firms look to recruit, retain, and develop staff, being a technology-forward firm is attractive to professionals who are looking for innovation in how work gets done.”

— To comment on this article or to suggest an idea for another article, contact Jeff Drew at Jeff.Drew@aicpa-cima.com.