- news

- ACCOUNTING EDUCATION

CPA Evolution Model Curriculum FAQs

Please note: This item is from our archives and was published in 2021. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

Talent shuffle: Why people want to change jobs and how leaders can adapt

How CPAs can help close the US financial literacy gap

Apprenticeship program participant aces CGMA case study exam

For the past seven months, the American Institute of CPAs (AICPA), the National Association of State Boards of Accountancy (NASBA), and a group of more than 40 volunteer subject-matter experts have worked to develop a model accounting curriculum for students pursuing the CPA credential. Our goal has been to aid faculty as they seek to transition their programs to reflect the new Core + Disciplines CPA licensure model promoted through the CPA Evolution initiative.

Recently, the AICPA, NASBA, and the American Accounting Association (AAA) announced a joint CPA Evolution Model Curriculum launch event for June 15 and 16. We’ve had more than 1,000 participants already register for this free event with CPE. I would encourage all accounting faculty and any other interested parties to attend.

In the meantime, as we continue our outreach efforts, stakeholders have consistently asked certain questions about the CPA Evolution Model Curriculum. Here are answers to those questions and additional insights on what you can expect from this important project.

What is the CPA Evolution Model Curriculum?

The CPA Evolution Model Curriculum is an aid to assist faculty who want to prepare their students to become CPAs. It aligns with the CPA Evolution initiative and comprises two main components: modules, topics, and learning objectives, and examples of course offerings.

Modules, topics, and learning objectives

The CPA Evolution Model Curriculum is primarily an extensive listing of educational modules, topics, and learning objectives for faculty to consider in order to align their curriculum with the needs of practicing CPAs.

CPA Evolution Model Curriculum Task Forces developed these materials based on what they are seeing in the practice environment.

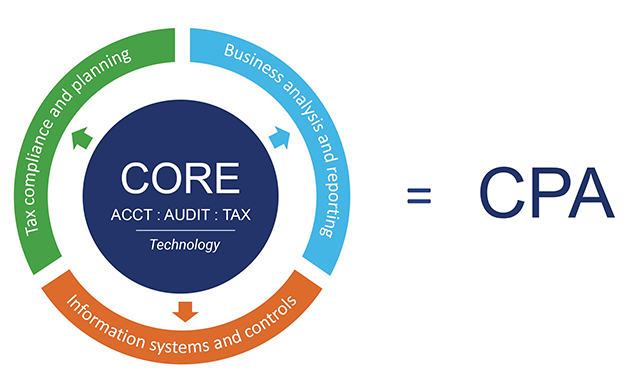

In keeping with the new CPA licensure model, each module is linked either to the Core or one of three Disciplines: Business Analysis and Reporting, Information Systems and Controls, or Tax Compliance and Planning. The modules are also designed to provide material alignment with Uniform Accountancy Act Model Rules (Model Rules), which serve as the baseline standard for use by boards of accountancy in state rules and laws, and current directional thinking relative to future updates to the Uniform CPA Examination in 2024.

The CPA Evolution Model Curriculum will include a recommended range for how much time faculty should spend teaching each topic, learning objectives to consider, and suggested courses where the topic might be addressed. For example, an accounting program may elect to cover IT governance in its Accounting Information Systems course or an IT Audit course. We hope these recommendations will help faculty as they determine how best to incorporate topics, and the related learning objectives, into their curricula.

Examples of course offerings

The CPA Evolution Model Curriculum also provides sample accounting program structures that committees and program chairs might consider adopting. One example demonstrates how an undergraduate program might be structured to cover all three Disciplines, while another shows how a university with both an undergraduate and master’s program might approach its course offerings.

Only boards of accountancy can prescribe the courses and subject matter required for CPA licensure. But many faculty members have asked for guidance on how they might arrange their course offerings to introduce the changes called for by CPA Evolution. Our goal here is to provide illustrations that will support that effort.

Can the CPA Evolution Model Curriculum be implemented in an undergraduate accounting program?

The CPA Evolution Model Curriculum does not specify whether material should be covered at an undergraduate or graduate level, as this decision will differ based on the circumstances of the program. That said, we developed a curriculum that faculty at programs of all sizes will be able to use.

The Model Rules indicate every CPA candidate should complete 24 credit hours of accounting education in addition to the credits they earn through principles of accounting courses (e.g., financial or managerial accounting).

We’ve ensured that a program that covers every topic at the lower end of the range of recommended classroom time can address all the material in the CPA Evolution Model Curriculum in 24 credit hours. For universities able to devote more classroom time to topics, such as those with master’s programs, we’ve provided sufficient detail to inform a deeper dive into each area.

Does the CPA Evolution Model Curriculum cover all 150 semester hours required for licensure?

The short answer is no, it does not. The educational requirements in the Model Rules indicate CPA candidates are required to complete a bachelor’s degree, an accounting curriculum, a business curriculum, and 150 total semester hours of education. When targeting our efforts, we elected to focus on the accounting curriculum, except for principles of accounting courses, which are often prerequisite courses most accounting majors would be expected to have taken. We presumed that, independent of the content recommended through the CPA Evolution Model Curriculum, students will complete coursework in principles of financial accounting, principles of managerial accounting, economics, finance, business law, and other areas. While the CPA Evolution Model Curriculum does not address these courses, they remain vitally important to future CPAs preparing to meet the needs of the marketplace.

Is the CPA Evolution Model Curriculum designed for all accounting students?

The CPA Evolution Model Curriculum is specifically designed with CPAs in mind. We sought to build a curriculum that provides a student with the skills and competencies required of a newly licensed CPA to meet the needs of the marketplace and protect the public interest. It should be viewed as a road map for faculty seeking to prepare future CPAs, not as a one-size-fits-all approach to accounting education.

When reviewing recommendations within the CPA Evolution Model Curriculum, each university should consider its unique circumstances and the needs of employers hiring its students.

For instance, at Sam Houston State University in Huntsville, Texas, only an hour from downtown Houston, our program offers a course on oil and gas accounting. This topic is not addressed in the CPA Evolution Model Curriculum but is based on the unique circumstances at our school, and I fully anticipate the course will continue to be offered.

Another example is cost accounting. In the CPA Evolution Model Curriculum, some topics related to this subject are a part of the Business Analysis and Reporting Discipline. However, we expect that some accounting programs, such as those with many graduates who go on to work in the manufacturing industry or are based in a state that mandates cost accounting coursework for CPA licensure, will conclude that all topics relevant to cost accounting should remain a part of their Core.

Final thoughts

We appreciate all the thoughtful questions and feedback we’ve received and encourage you to keep it coming. You can reach us at feedback@evolutionofcpa.org — we read and respond to every email.

As we get closer to unveiling the CPA Evolution Model Curriculum next month, we aim to provide faculty with the support and insight they need to prepare future CPAs. We look forward to seeing you at our launch event on June 15 and 16.

— Jan Taylor-Morris, CPA, CGMA, Ph.D., is academic in residence and senior director–Academic & Student Engagement at the Association of International Certified Professional Accountants, representing AICPA & CIMA, and associate professor of accounting at Sam Houston State University in Huntsville, Texas. To comment on this article, contact Courtney Vien, a JofA senior editor, at Courtney.Vien@aicpa-cima.com.