- news

- MANAGEMENT ACCOUNTING

Economic confidence recovers to near pre-pandemic levels for finance leaders

Sentiment has risen for three consecutive quarters in a quarterly survey of CPA executives in business and industry. Revenue and profit are projected to increase in the next year.

Please note: This item is from our archives and was published in 2021. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

AI early adopters pull ahead but face rising risk, global report finds

Talent shuffle: Why people want to change jobs and how leaders can adapt

GAO says tax pros helped shape IRS response to ERC issues

TOPICS

The arrival of vaccines and a nascent economic recovery boosted the outlook of finance leaders, whose confidence drew closer to pre-pandemic levels in the first-quarter AICPA Business & Industry Economic Outlook Survey.

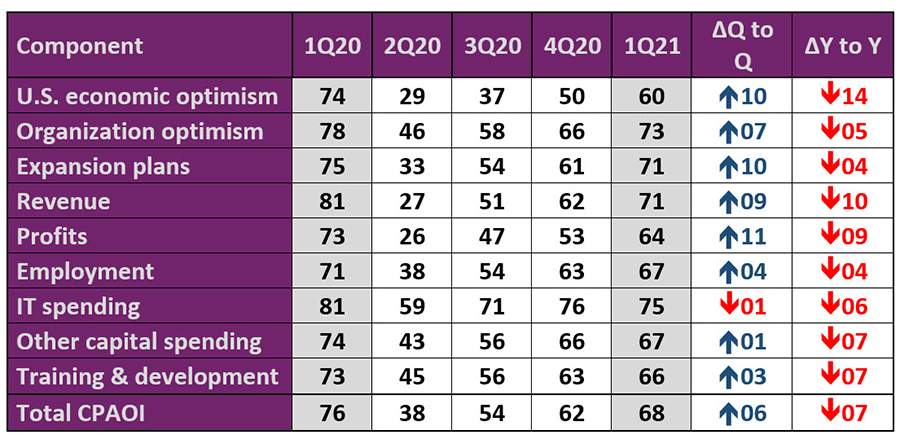

The survey’s CPA Outlook Index (CPAOI) rose six points to 68 out of 100, boosted in part by finance decision-makers’ optimism about revenue and profit for the coming 12 months. The nine-component index peaked at 81 in the first quarter of 2018 and had remained in the 70s until the second quarter of last year, when it dropped from 76 to 38. A reading above 50 reflects positive sentiment.

This quarter’s survey, conducted in February, included 693 responses from CPA decision-makers such as CFOs, CEOs, and controllers. It was the third consecutive quarter in which sentiment rose.

About 47% of respondents were optimistic about the year ahead for the U.S. economy, and 27% said their expectations were neutral. Those were the strongest numbers since a year ago, approaching the figures seen throughout 2018 and 2019.

“I think it’s just going to continue to grow. I have a lot of activity in my pipeline,” said Carolyn Chasteen, CPA, CGMA, the owner of Velosio Denver. The company sells and supports Microsoft enterprise software for residential construction companies.

Velosio Denver has seen “astronomical” growth amid the pandemic housing boom, Chasteen said. The company usually completes a few software implementations per year. It’s now working on nine simultaneously, as clients expand their businesses.

“Everybody wants to move out of the city and into a house,” she said.

Chasteen expects housing markets to stay hot as employees settle into remote work. Indeed, 21% of survey respondents said their business planned to shrink its office footprint, even though 58% expected their business to expand.

But expectations differed greatly across industries as the outbreak continued to limit public activities and travel.

“I guess I’m more pessimistic than anything,” said Holly Maloney, CPA, CGMA, the CFO for an events rental business in Canton, Ohio.

The business, Canton Chair Rental, saw a 50% decline in gross receipts in 2020. With weddings and trade shows cancelled, the company subsisted by renting tents to hospitals and other facilities that needed outdoor facilities, and with a U.S. Paycheck Protection Program loan.

Now, Maloney worries that the pandemic will once again shut down events throughout the upcoming busy season.

“Our events may not come back totally. There’s revenue gone that we need to get through next winter,” she said.

Even a fast reopening might not solve the problem, she added. Labor markets have been surprisingly tight for in-person and relatively low-wage jobs like the ones that Canton Chair Rental relies on to manage and deliver its huge inventory of event supplies.

“If they do come back and people just go crazy [with events],” Maloney said, “am I going to be able to get the people I need to hire to provide those services?”

Forty-four percent of respondents were worried about inflation, a sharp increase from the fourth quarter of 2020, when 24% had that concern. Labor costs were the most common inflation risk factor. The possibility of a minimum wage increase could make that even more complicated, Maloney added.

Meanwhile, some organizations are wondering how the pandemic has altered their trajectory in the years to come. Nearly half of respondents reported a moderate or severe negative impact from the pandemic.

Jill Berkemeier, CPA, CGMA, is the CFO and vice president of administration for the Cincinnati Museum Center. The not-for-profit traces its roots back more than 200 years, and Berkemeier is confident that the cultural institution will survive the pandemic — but the question is how long the hangover will last.

“We have a long legacy,” she said. “We’re doing everything we can to minimize the long-term impact.”

Like other venues, the center faced an extreme drop-off in revenue due to public health restrictions. Berkemeier said the museum reduced staffing costs 40% by eliminating 175 positions and cutting pay across the organization.

“We eliminated any nonessential spending, and we’re still losing millions,” Berkemeier said. “We’re doing everything we can to minimize the blood loss.”

The museum has been buoyed by a PPP loan. Donors have stepped up, and Berkemeier is hoping for a Shuttered Venue Operators grant from the recent federal stimulus package, which was passed by the U.S. House of Representatives but must still pass the Senate. She’s still expecting a $3 million loss for this fiscal year and a loss of perhaps $20 million in earned revenue overall.

Before the pandemic hit, the not-for-profit was celebrating the recent completion of a $244 million restoration of its campus, the historic Cincinnati Union Terminal. Now, Berkemeier’s biggest concerns are about how much debt and how much money from the endowment it will take to survive.

She expects the rebound could take up to three years.

“The fact that there’s a vaccine and we have some target dates to plan for the future is helpful,” Berkemeier said. “That’s something that we haven’t had for a year. There’s been so many unknowns.”

Across the country, the profound shifts caused by the pandemic and the U.S. election have made it hard to predict what’s next.

In Washington, D.C., Carolyn Mollen, CPA, is vice president for finance and administration for the not-for-profit Resources for the Future, which conducts nonpartisan research on the environment and energy. President Joe Biden’s administration is likely to bring new money and support for renewable energy and climate change mitigation, but Mollen isn’t counting on that yet.

“It’s a really interesting conundrum. We’re having to do a lot more scenario planning. We feel this optimism and this potential, especially for our organization and our industry. But it’s not realized potential yet,” she said, adding that she was not speaking on behalf of her employer.

Mollen hopes the pandemic has led to a new realization: Its unprecedented nature has forced people to think about other global threats, such as climate change.

“It put a renewed focus on why we need to focus on these things ahead of time,” she said. “The disruption of COVID caused us all to realize that things can really shift.”

Other survey highlights:

- Optimism about the global economy is also rising. Last quarter, 26.9% of respondents said they were optimistic about the global economy. This quarter, 36.5% were optimistic.

- Revenue and profit expectations each rose for the third consecutive quarter. Specifically, respondents expect a revenue increase of 3% for the next 12 months and a profit increase of 1.9%. Respondents predicted declines in revenue and profit in the second and third quarters last year.

- 53% of organizations say they have the right number of employees, which is two percentage points higher than the previous quarter. Just 7% say they have too many workers, a decline from 11% in the previous quarter.

— Andrew Kenney is a freelance writer based in Colorado. To comment on this article or to suggest an idea for another article, contact Neil Amato, a JofA senior editor, at Neil.Amato@aicpa-cima.com.