- news

- MANAGEMENT ACCOUNTING

Trade concerns widespread as economic outlook sags

Please note: This item is from our archives and was published in 2019. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

Report: AI speeds up work but fails to deliver real business value

How a CPA beat burnout after strokes, years of depression

Where CPAs stand on economic sentiment, what’s next for the JofA podcast

TOPICS

Economic expectations for the United States and the world tumbled in the third quarter amid trade concerns and indications of a possible recession, according to the third-quarter Business & Industry Economic Outlook Survey released Thursday by the AICPA.

Forty-two percent of finance decision-makers are optimistic about the domestic economic outlook, compared with 57% in the second quarter and 69% a year ago. Only 24% were optimistic about the global outlook, a drop from 35% in the previous quarter.

Respondents, mainly CEOs, CFOs, and controllers, are more optimistic about their own organizations than the domestic or global economy, even though that optimism also has declined in the past year. Fifty-eight percent expressed optimism in their own company’s outlook for the next 12 months, compared with 14% who are pessimistic. A year ago, 69% were optimistic about their organizations.

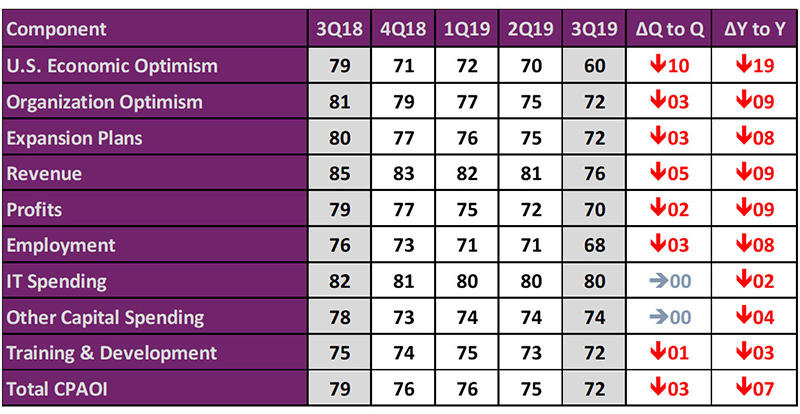

The CPA Outlook Index (CPAOI), an equally weighted nine-component measure, dropped to 72, down two points from last quarter, seven points from last year, and off the post-recession high of 81 in the first quarter of 2018. U.S. economic optimism was the component with the steepest decline, declining to 60, which is 19 points lower than a year ago.

CPA Outlook Index (CPAOI)

The negative effects of the trade war were obvious among survey respondents: About 45% reported some degree of negative impact, and only about 4% saw a positive change, with the rest reporting no impact.

Finance leaders said that tariffs were making business pricier and more complicated.

“To me, it’s a chain reaction,” said Austin Chang, CPA, CGMA, controller for the children’s furniture vendor Million Dollar Baby Co. With each round of new tariffs, the Los Angeles-area company has had to consider additional financing to compensate for increasing import costs, and it has had to negotiate new contracts with suppliers across Asia.

For Chang and others, the prevailing message was “proceed with caution.”

“We skew conservative. A lot of spending is only budgeted when we really need it. And all the business strategies are on a conservative side in case anything happens,” he said. “We don’t sail at full speed. We have more flexibility with it until we see how we’re getting into the next phase of the trade war or the economy.”

For Namasté Solar, a Colorado solar company that designs and installs systems for homes and businesses, tariffs have created chaotic periods of rushes and renegotiations. In 2017, the initial threat of a trade war, followed by steel and aluminum tariffs, contributed to uncertainty in the market and put a freeze on investments, leading to a down solar market in 2018, said Lizette Peña, CPA, director of accounting.

Earlier this year, the 200-employee company had to renegotiate purchase orders because tariffs were retroactively applied to certain solar panels from India, increasing costs on three contracted projects. The company also is dealing with the question of whether federal tax credits will be extended this year.

For industry insiders, it’s jokingly called the “solar coaster.”

“It makes it very difficult when we do projections,” Peña said, adding: “It makes for an interesting bank relationship. The secret is to really bring them along on the ride to avoid surprises.”

Concerns are especially high for manufacturers: 76% of respondents said they had been hurt by tariffs in a July survey by the National Association for Business Economics. But some, like Ohio lock manufacturer The Wilson Bohannan Co., are weathering the storm more easily.

“There are not very many locking companies left in the United States,” said Bruce Valentino, CPA, CGMA, the CFO and treasurer at Wilson Bohannon. “Most of the stuff is imported. We’re 100% American made.”

The company’s brass and stainless-steel locks are in constant demand from electric cooperatives, municipalities, and the trucking and pipeline industries. Those steady sales insulate the company from recessions, Valentino said.

But like many companies, Wilson Bohannan is struggling to keep up with staffing demands amid a long boom. In the survey, 38% of companies said they had too few employees — a drop from 44% in the second quarter.

“The killer for us and a lot of places is benefits, especially on the health insurance side,” Valentino said. The company is comparable to large manufacturers with its benefits for singles, but it’s hard to keep pace with costs for families, he said. Still, the family-owned company has been sustained by a good relationship with multigenerational employees and its union.

More than half of companies expect to expand their business in the next year: 48% of respondents said their businesses would grow “a little,” and 13% predicted “a lot” of growth. Seventeen percent expected to contract, and the rest (22%) predicted stability. The survey data is from 755 qualified responses between July 30 and Aug. 21.

“If we can make it through the next few months, you’ll probably see an uptick into early next year, and after that, my crystal ball doesn’t work,” said Mark MacNicholas, CPA, controller for Canvas Credit Union in Littleton, Colo., referring to the economy in general.

He’s looking at two major factors: Will the trade war be resolved? And will the Federal Reserve lower interest rates, potentially alleviating the inverted yield curve that drove 10-year bond yields below short-term yields?

In the meantime, he said, “We have flexibility. Right now, everything seems to be going along normally. We haven’t seen any major declines in activity.”

Said Peña, of Namasté Solar: “It’s a waiting game.”

About the CPAOI

The survey measured the sentiment of finance executives in nine equally weighted components: U.S. economic optimism, organization optimism, expansion plans, revenue, profits, employment, IT spending, training and development, and other capital spending.

Each component of the CPAOI is calculated by taking the percentage of respondents who indicated that their opinion or expectation for the metric is positive or increasing and adding to that half of the percentage of respondents indicating a neutral or no-change response.

For example, if 60% of respondents indicate an optimistic or very optimistic view and 20% express a neutral view, the calculation of the component indicator would be 70 (60% + [0.5 × 20%]).

— Andrew Kenney is a freelance writer based in Colorado. To comment on this article or to suggest an idea for another article, contact Neil Amato, a JofA senior editor, at Neil.Amato@aicpa-cima.com.