- news

- MANAGEMENT ACCOUNTING

Sustainability assurance’s link to reporting quality

Please note: This item is from our archives and was published in 2019. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

AI early adopters pull ahead but face rising risk, global report finds

Talent shuffle: Why people want to change jobs and how leaders can adapt

Auditing Standards Board proposes changes to attestation standards

The number of companies across the world who issue some form of sustainability report continues to increase. However, even as organizations place more emphasis on improving reporting quality related to the environmental and social impact of their business activities, little is known about whether assurance for these reports improves the quality, and whether accounting firm assurers improve that quality to a greater extent than nonaccounting firm assurers.

“With investor attention on such information higher than ever, corporate sustainability reporting is ripe for the next phase of its evolution,” said a 2018 report posted on the Harvard Law School Forum on Corporate Governance and Financial Regulation.

This article provides a summary of insights on these issues based on an academic study we recently published in the Journal of Accounting and Public Policy (“Corporate Social Responsibility Assurance and Reporting Quality: Evidence From Restatements”).

According to the 2017 KPMG Survey of Corporate Responsibility Reporting, sustainability reports are issued by 93% of the world’s 250 largest companies (Global 250) and 75% of the 100 top revenue-generating companies (N100) in each of the 49 countries surveyed by KPMG. Of those who report, 67% of the Global 250 and 45% of the 4,900 N100 companies studied obtain some level of independent assurance for their sustainability reports. These figures demonstrate sizable growth in the sustainability assurance market since 2011, when KPMG’s survey showed that 46% of the world’s largest companies and 38% of the top 100 revenue-generating companies, obtained some independent sustainability assurance.

Sustainability assurance is typically limited in scope and is performed in accordance with different assurance standards. The most commonly used standards include the Statements on Standards for Attestation Engagements (SSAEs), issued by the AICPA; ISAE 3000, issued by the International Auditing and Assurance Standards Board; and AA1000, issued by the Institute of Social and Ethical Accountability.

The steady growth in assurance of sustainability reports suggests that companies increasingly perceive that there are net benefits of having their sustainability reports assured (e.g., shareholders’ and other stakeholders’ increased confidence in the reports, reduced cost of capital, and lower analyst forecast errors and dispersion, etc.). Further, there has been an increase in the percentage of assured sustainability reports by accounting firms relative to nonaccounting firms. In our study sample, accounting firms provided assurance for 63% of the 848 assured reports.

To examine the effect of obtaining independent assurance on reporting quality, we studied companies’ voluntary restatements of sustainability reporting disclosures. In our sample, approximately 20% of issued sustainability reports are subsequently restated by companies to correct errors (classified as error restatements) and/or revise information as a result of updates of scope, methodology, or definitions (classified as non-error restatements). This seemingly high rate of restatements is consistent with such reporting and assurance being a relatively new phenomenon, compared with financial reporting and assurance, along with added complexity from the wide array of stakeholder issues being reported (many of which are measured with nonfinancial metrics). And because of the evolving process of sustainability reporting, we view both types of restatements as improvements in reporting quality.

As examples of error restatements, in 2015, Givaudan corrected 2014 energy and carbon dioxide loads, one-off waste, groundwater usage, and sulfur dioxide emissions because of calculation and data inaccuracies. Interestingly, the company specifically attributes the identification of these errors to EY’s assurance work. As examples of non-error restatements, in 2018, Dell restated its 2016 Scope 3 emissions and 2017 hazardous waste generated due to improvements in calculation methodologies.

Summary of research methodology and results

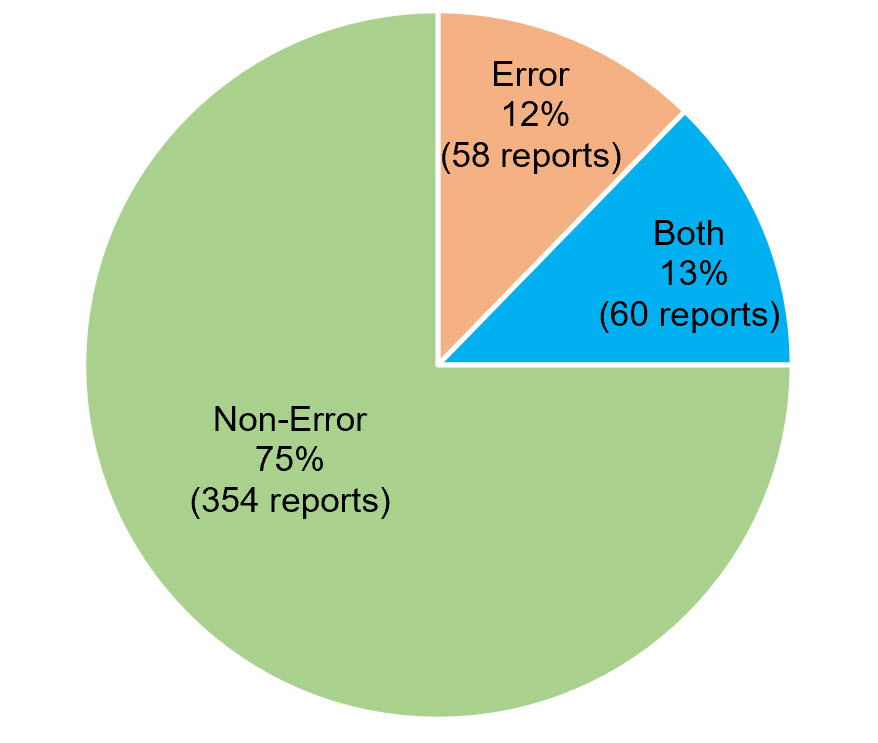

Our sample contains 2,339 sustainability reports issued by companies in 42 countries included in the consecutive international surveys by KPMG of sustainability reporting that captured restatement information (2011 and 2013). Slightly more than 20% (472 reports) included restatements due to error or omissions (error restatements) or updated or improved methodology, definitions, scope, or unspecified reasons (non-error restatements). As shown in the chart, “CSR Restatements by Type,” error corrections account for approximately 25% [Error (12%) plus Error + Non-Error (13%)] of restatements, and pure non-error reasons account for 75% of the 472 restatements. Slightly more than 36% of reports (848 reports) were independently assured either by public accounting firms (530 reports; 62.5% of the assured reports) or other assurance providers (318 reports; 37.5% of the assured reports).

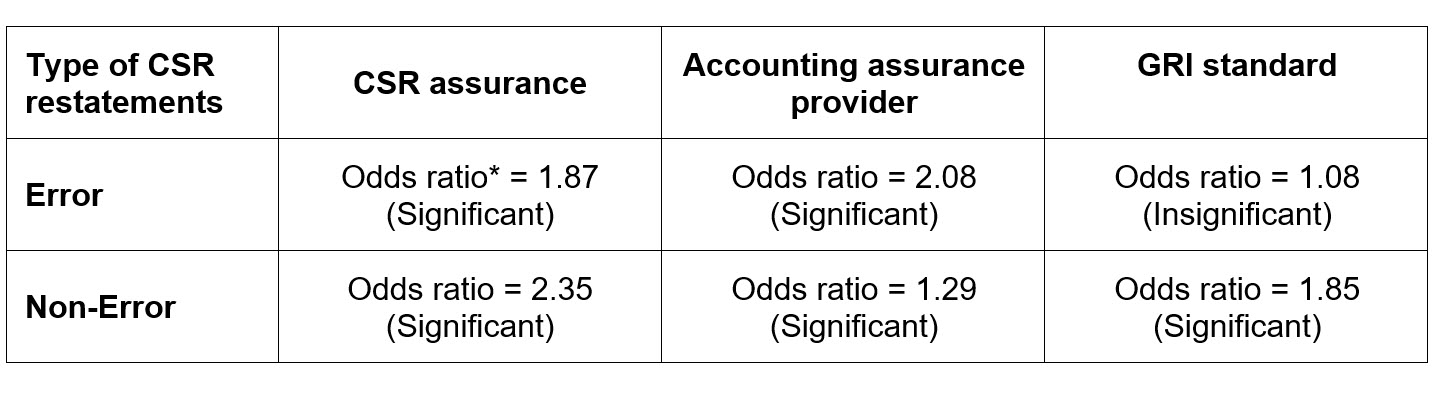

The data shows the following findings (see the table, “The Effect of CSR Assurance/Assurance Provider on CSR Restatements,” for more information):

Accounting firm assurance providers help detect and prevent errors in sustainability reports. We find a positive relationship between the likelihood of error restatements and CSR assurance. Specifically, companies having CSR assurance versus no assurance are nearly twice as likely (1.87 times) to detect and correct errors contained in their sustainability reports. Notably, this error detection effect of CSR assurance is more pronounced when accounting firms provide the assurance. The odds of accounting assurers detecting errors in sustainability reports are more than double (2.08 times) that of nonaccounting assurers. Our analysis further reveals that accounting firm assurance providers not only detect inaccuracies in the current period but also prevent errors from reoccurring in future periods. By contrast, nonaccounting firm assurers do not appear to deter future occurrences of sustainability reporting inaccuracies.

Both types of assurance providers help prompt updates of definitions, scopes, and methodologies in sustainability reports; however, the effect appears to be more pronounced with accounting firm assurers. We find a positive relationship between restatements due to updates of definitions, scopes, or methodologies and the use of sustainability reporting assurance regardless of type of provider. This relationship is stronger when accounting firms — rather than nonaccounting firms — provide assurance. According to our data estimation, companies are more than twice as likely (2.35 times) to implement updates in their sustainability reports when having assurance versus no assurance. Further, having accounting firm assurance providers increases the odds of implementing updates by slightly more than 25% (1.29 times). These findings suggest that obtaining sustainability report assurance can help enhance sustainability report quality by identifying areas of improvements or in need of updates. Additional tests find that this effect persists over time (i.e., the positive relationship is found in the recurring years of obtaining sustainability assurance).

Applying formal reporting standards is not a substitute for obtaining sustainability assurance in terms of enhancing reporting quality. The evolution of sustainability reporting has been driven in part by increased use of reporting standards, e.g., the 2017 KPMG study reports that 89% of the Global 250 and 74% of the top 100 in its 49-country survey have adopted some guidance or framework for their reporting. The Global Reporting Initiative’s (GRI’s) framework (i.e., the GRI Guidelines or the GRI Standards) is the most commonly used, according to the study. Two interesting results related to a company’s adoption of the GRI framework and the likelihood of sustainability report restatements are:

- Use of the GRI framework helps prompt updates of definitions, scopes, or methodologies in sustainability reports. Companies using sustainability reporting standards, such as the GRI reporting standards, are almost twice as likely (1.85 times) as non-standards adopters to have sustainability restatements related to updates of definitions, scopes, or methodologies in sustainability reports.

- Use of the GRI framework does not help detect or prevent errors in sustainability reporting. This finding suggests that assurance, especially when provided by accounting firms, is particularly important for establishing credibility in sustainability reporting based on its relationship for enhancing the accuracy of information over time. Further, this role cannot be replaced by implementing reporting standards like those of the GRI. In other words, sustainability reporting assurance and formal reporting standards like those of the GRI likely complement rather than substitute for one another.

Implications for public accountants

Offering assurance for sustainability reports should provide significant value-adding benefits to clients. Given the ongoing maturation of sustainability reporting and sustainability reporting standards, clients likely will benefit from having independent assurance providers with expertise in interpreting standards and helping to improve reporting quality over time.

Obtaining assurance for sustainability reports enables clients to convey to stakeholders their commitment to developing trusting relationships with stakeholders. Given the level of distrust in the current business and political environment across many contexts, demonstrating to clients the benefits of enhancing stakeholder trust is likely a worthwhile pursuit for public accounting firms. Issuing sustainability reports with a commitment to reporting quality, including assurance provided by independent assurance experts, likely enhances client trust with key stakeholders.

Accounting firms appear to have a competitive advantage over nonaccounting firm assurance providers. While nonaccounting assurance providers can help improve reporting quality in the area of enhancements or updates of information included in sustainability reports, our findings suggest the improvements resulting from accounting firm assurance providers are more pronounced, and they also are capable of detecting and preventing reporting errors for their clients. In contrast, our findings do not find a relationship between restatements related to the detection or prevention of errors and using nonaccounting firm assurance providers. This competitive advantage can be better leveraged in light of these research findings. Further, the sustained positive effect of assurance on reporting quality can help accounting firms convince their clients of the merits of repeat sustainability assurance engagements.

CSR restatements by type

The effect of CSR assurance/assurance provider on CSR restatements

* Odds ratio is defined as the odds of having an Error CSR restatement for CSR assurance over the odds of having a restatement for no CSR assurance. Similar interpretations can be made for other tests and variables of interest.

In this table, we use pure errors (i.e., CSR restatements due to error corrections only) as our proxy for Error to draw clearer inferences of the effects of CSR assurance, assurance providers, and GRI standards on different types of CSR restatements.

Resources

Please visit aicpa.org/sustainability for additional resources. These resources include a Sustainability Toolkit with extensive background information for CPAs looking to enter the sustainability assurance market.

— Po-Chang Chen, Ph.D., is an associate professor of accounting at Miami University’s Farmer School of Business. Brian Ballou, Ph.D., is the EY Professor of Accounting and faculty fellow of the William Isaac & Michael Oxley Center for Business Leadership at Miami University’s Farmer School of Business. Jonathan H. Grenier, Ph.D., is the Endres Associate Professor Fellow of Accounting at Miami University’s Farmer School of Business. Dan L. Heitger, Ph.D., is the Deloitte Professor of Accounting and co-director of the William Isaac & Michael Oxley Center for Business Leadership at Miami University’s Farmer School of Business. To comment on this article or to suggest an idea for another article, contact Neil Amato, a JofA senior editor, at Neil.Amato@aicpa-cima.com.