- news

- MANAGEMENT ACCOUNTING

U.S. finance execs hold on to positivity

Please note: This item is from our archives and was published in 2019. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

Report: AI speeds up work but fails to deliver real business value

How a CPA beat burnout after strokes, years of depression

Where CPAs stand on economic sentiment, what’s next for the JofA podcast

TOPICS

U.S. business leaders remained significantly more confident in the domestic economy than the global economy, but the gap narrowed slightly in the second-quarter Business & Industry Economic Outlook Survey released Thursday by the Association of International Certified Professional Accountants.

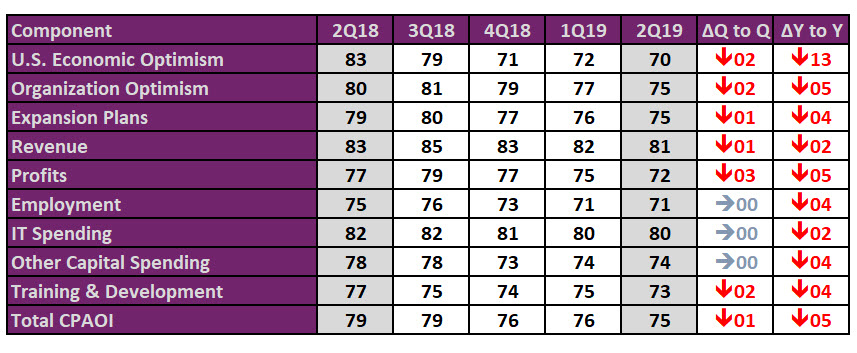

The survey’s CPA Outlook Index (CPAOI) dipped one point to 75 out of 100, reflecting slight easing in expansion, revenue, and profit expectations. The index peaked at 81 in the first quarter of 2018. The most recent survey, conducted in May, included 785 responses from CPA decision-makers such as CFOs, CEOs, and controllers.

Fifty-seven percent of respondents were optimistic about the U.S. economy, consistent with the first quarter. Their views were boosted in part by lower taxes and less regulatory burden.

“In West Michigan, construction just is going at a crazy wildfire pace,” said Michael Steele, controller for Lake Michigan Credit Union. “We have a lot of new businesses coming into the area. I don’t anticipate seeing it slowing down anytime soon.”

In contrast, 35% of respondents held a positive view on the global economy, a slight improvement over the previous quarter but a drop from 63% at this time a year ago.

“Some countries have negative outlooks, some positive, but overall we’ve kind of seen a neutral impact year over year — stagnant,” said Zach Kendro, CPA (inactive), director of finance for Mauser Packaging Solutions, a multibillion-dollar manufacturer that spans 20 countries.

The changing trade relationships between those countries have started to pinch manufacturers. Steel tariffs have been a particular concern for Mauser, which uses the material in some of its rigid packaging products. Domestic manufacturers are raising prices alongside the international tariffs, forcing Mauser to raise prices to protect its margins.

“We lost some customers, and we’re starting to struggle to retain some others,” Kendro said.

Revenue and profit projections for the next 12 months are lower than the previous quarter. Profit is projected to grow 3.1% in the next year, according to the survey, down from 3.6% in the first quarter and 4% a year ago.

Respondents also are dealing with the side effects of the domestic economy’s long boom, especially labor costs. About 44% of respondents said their company had too few employees. To land those elusive hires, the top strategy was more pay, with employers most commonly planning raises of 3% to 5%.

“That’s something that our company is starting to come to grips with: retaining talent and the cost of retaining talent,” said José Levario, CPA, CGMA, controller for MIMCO, a commercial real estate investment firm in Texas.

The company is riding the crest of the development boom in the city of El Paso, and its retail projects have benefited from growing incomes and a surge of young, upwardly mobile workers. But the labor market has grown more competitive, especially for lower-paid administrative and maintenance workers.

“We’ve just seen such turnover there. It’s piqued the interest for sure of our executive team,” Levario said.

Kendro has seen a similar phenomenon in Mauser’s manufacturing plants.

“Not many people want to be in a hot manufacturing plant and put handles on pails. And there’s competition in local markets, especially where we have facilities in industrial complexes,” he said, adding that some employees can literally cross the street to get a new job.

“We’re trying to get as much automation as we can in the plants. It’s hard to flex labor, to a certain degree,” Kendro explained.

The survey also found that inflation concerns are fading from the forefront: 29% of respondents cited inflation concerns, down from 49% in the fourth quarter of 2018. “We expect inflation to keep in check,” Steele said. Labor costs and materials were the biggest expected components of inflation, while interest concerns receded slightly.

Some bankers and economists think that the Federal Reserve might lower rates, Steele said, but his credit union is planning for flat rates.

Levario expects that interest rates will rise again, meaning that now is the time for borrowers to act. “We do leverage a lot of our acquisitions for real estate, so it’s a mad dash right now. We’re trying to refinance as much as we can until rates go up, to kind of lock those rates in,” he said.

Sixty-three percent of respondents said their company had expansion plans, down from 66% in the first quarter. The top four challenges listed by respondents were the availability of skilled personnel, employee and benefits costs, domestic competition, and regulatory requirements/changes.

While sentiment remains positive overall, some respondents have had to ask: How long can this go on, and when will the global pessimism cross into the domestic economy?

“I have to say, I’m very surprised at the length of the expansion,” Steele said. “That would be the only area of angst that I would have. This has been going on for ten years. It’s got to stop at some point. But we don’t see any signs that that’s going to happen.”

Levario is optimistic for now, but he thinks that changes are coming “sooner rather than later.” He said he is most concerned about international trade wars and domestic wealth disparity.

“I hope I’m wrong, I really do,” he said. “But one and one do not equal two right now.”

About the CPAOI

The survey measured the sentiment of finance executives in nine equally weighted components: U.S. economic optimism, organization optimism, expansion plans, revenue, profits, employment, IT spending, training and development, and other capital spending.

Each component of the CPAOI is calculated by taking the percentage of respondents who indicated that their opinion or expectation for the metric is positive or increasing and adding to that half of the percentage of respondents indicating a neutral or no-change response.

For example, if 60% of respondents indicate an optimistic or very optimistic view and 20% express a neutral view, the calculation of the component indicator would be 70 (60% + [0.5 × 20%]).

— Andrew Kenney is a freelance writer based in Colorado. To comment on this article or to suggest an idea for another article, contact Neil Amato, a JofA senior editor, at Neil.Amato@aicpa-cima.com.