- news

- MANAGEMENT ACCOUNTING

Economic outlook: Not too hot, not too cold

Finance decision-makers remain positive overall heading into 2020, but they continue to have concerns about hiring.

Please note: This item is from our archives and was published in 2019. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

Trade concerns widespread as economic outlook sags

U.S. finance execs hold on to positivity

TOPICS

Finance leaders are feeling slightly better than last quarter about the domestic economy. About 50% said they were optimistic about the U.S. economy’s performance over the next year, and they felt even stronger about their own companies, according to the latest Business and Industry Economic Outlook Survey, released Thursday by the AICPA.

The survey respondents, mainly CFOs and controllers, remain more guarded about the global economy. Only about 28% were optimistic. The strongest plurality, about 44%, were neutral, but those figures still represented a rebound from the previous quarter, when 24% expressed optimism about the global outlook.

For the optimistic finance leaders, the question remains: How long will the good times last?

“It’s almost like the Goldilocks economy. It doesn’t seem to be too hot. It doesn’t seem to be cold,” said Doug Smorag, CPA/PFS, a financial adviser and the COO of CM Wealth Advisors, based near Cleveland.

“There’s no major signs of anything being overpriced. No sector is too crazy. Technology is high, but it’s not like it was in 1999, that’s for sure. … Wages are rising, but there’s no inflation.”

Despite a tepid outlook for continued growth, employers are continuing to invest.

“I’m not seeing people slowing down. I’m seeing people continuing to invest — but I guess I’d be taking the investments that are safe ones,” said John Huitsing, CPA, CGMA, the CFO of Employer Advantage.

His company is moving out of leased space to purchase and renovate a building in southwestern Missouri for its 65 employees. Employer Advantage has grown as more clients have turned to the company for help with outsourcing specialized employment services. It also has seen strong demand for its staffing services.

In the survey, availability of skilled personnel remained a top challenge for companies for the 10th consecutive quarter, followed by domestic economic conditions and domestic competition. Nearly 30% say they don’t have enough employees and are planning to hire.

‘Long in the tooth’

Despite optimism rebounding from the previous quarter, sentiment about the global and domestic economy is down compared with last year at this time. For some finance decision-makers, there is a sense that the good times can’t last.

“We’re pretty long in the tooth on this bull run,” said Jimmy Williams, CPA/PFS, president of Compass Capital Management in Oklahoma. “We’re in a strategic growth mode, but we’re on a protective downside. We want to protect the downside as much as possible.”

He described his company as “still very bullish,” but he’s on the lookout for a change in leading financial indicators such as loan default rates. He hasn’t seen a reversal there yet; in fact, other indicators such as consumer automobile driving statistics are hitting new highs.

“That tells me life’s pretty good in these United States,” he said.

The fast-changing world is bringing challenges for some sectors, though. For example, the oil-and-gas industry is coping with mergers and layoffs, a result of an infusion of private capital and market-changing technologies such as hydraulic fracturing.

“These are not layoffs of teenagers at the mall or at the movie theaters. These are learned professionals with a significant investment in their careers, and most of them are significant contributors to our economy and to our culture,” said Bryan Haws, CPA, CGMA, the controller and director of corporate services for the American Association of Petroleum Geologists.

“When those jobs are being lost by the tens of thousands, that’s a really big concern.”

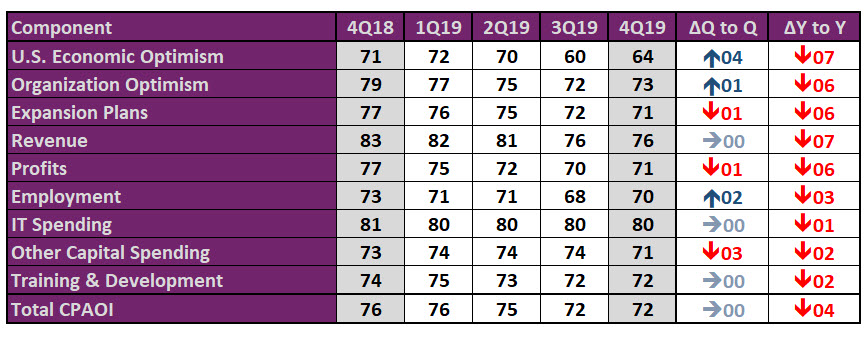

Still, unemployment remains near record lows, and for the economy at large, optimism prevails. The CPA Outlook Index (CPAOI), an equally weighted, nine-sector measure of sentiment, is at 72 this quarter. That’s down from 76 a year ago but still positive.

Mark MacNeill, CPA, the CFO of the real estate developer The Green Company, said his business is highly dependent on economic perceptions. The Massachusetts company’s housing product is designed for retirees and empty nesters, and concerns about the market can quickly damage their confidence.

“And when the market goes the wrong way, as it did the end of last year, you really just see people become a lot more hesitant,” he said. That was driven by fears of a trade war and overall stock volatility.

But as negotiations around the trade war have continued and U.S. markets are rising again, demand has recovered, MacNeill said.

It has also been helped along, he said, by favorable interest rates. And that’s a top concern for Smorag, too.

“If the [Federal Reserve] raises those interest rates too quickly, if they decide things are getting overheated, they can kill it,” he said. “We’ll just keep on keeping on and enjoy how long it lasts.”

About the CPAOI

The survey measured the sentiment of high-ranking finance professionals in business and industry in nine areas: U.S. economic optimism, organization optimism, expansion plans, revenue, profits, employment, IT spending, training and development, and other capital spending.

Each component of the CPAOI is calculated by taking the percentage of respondents who indicated that their opinion or expectation for the metric is positive or increasing and adding to that half of the percentage of respondents indicating a neutral or no-change response.

For example, if 60% of respondents indicate an optimistic or very optimistic view and 20% express a neutral view, the calculation of the component indicator would be 70 (60% + [0.5 × 20%]).

— Andrew Kenney is a freelance writer based in Colorado. To comment on this article or to suggest an idea for another article, contact Neil Amato, a JofA senior editor, at Neil.Amato@aicpa-cima.com.