- news

- MANAGEMENT ACCOUNTING

U.S. economic enthusiasm remains high

Please note: This item is from our archives and was published in 2018. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

Top takeaways from the latest Economic Outlook Survey

4 issues for CFOs to ponder

How to recruit the best job candidates

TOPICS

Potential economic headwinds are giving U.S. finance decision-makers some reason for concern, but those issues are not enough to lower most measures of optimism about the year ahead.

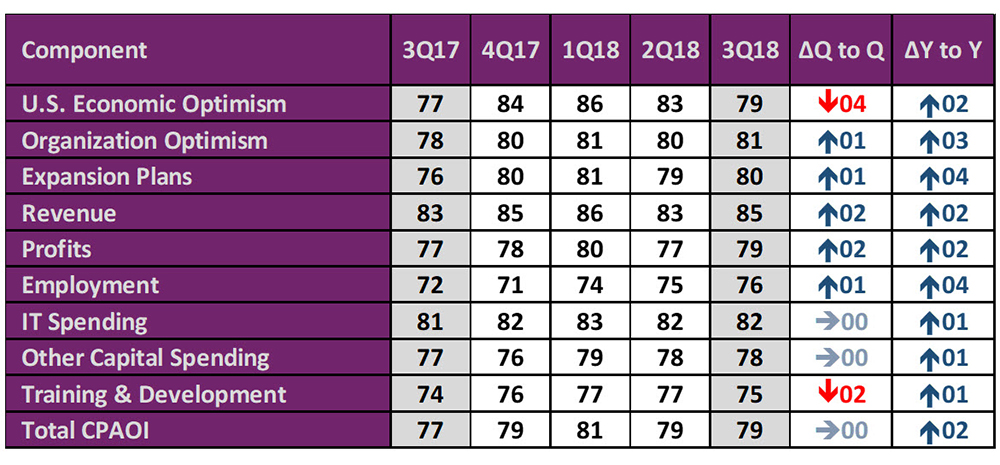

The third-quarter Business & Industry Economic Outlook released Thursday by the Association of International Certified Professional Accountants shows gains in all nine components of the CPA Outlook Index (CPAOI) year over year. That includes optimism about the U.S. economy, their own organizations, expansion plans, and staffing growth. Respondents’ optimism about the U.S. economy, however, declined from the second quarter.

The overall CPAOI is 79, close to the post-recession high of 81 set in the first quarter of the year. A reading above 50 indicates a generally positive outlook. The CPAOI is up 10 points from this time two years ago, before tax legislation changes. The index has risen or remained steady in eight of the previous 10 quarters since dropping five consecutive quarters in 2015 and early 2016.

Yet reasons exist for concern, including a rise in interest rates, the waning availability of talent, and the potential effects of trade discord. About half of respondents are concerned about tariffs on goods from other countries or retaliatory actions by U.S. trading partners: 49% say tariffs would have an unfavorable effect on their companies, and 48% said the impact of retaliatory tariffs would be unfavorable.

The most recent minutes from the Federal Reserve’s Federal Open Market Committee (FOMC) mentioned trade disputes as a risk to economic growth.

“All participants pointed to ongoing trade disagreements and proposed trade measures as an important source of uncertainty and risks,” the FOMC minutes from the July 31–Aug. 1 meeting said. “Participants observed that if a large-scale and prolonged dispute over trade policies developed, there would likely be adverse effects on business sentiment, investment spending, and employment. Moreover, wide-ranging tariff increases would also reduce the purchasing power of U.S. households.”

Close to 60% of finance decision-makers — mainly CEOs, CFOs, and controllers — said the impact of potential interest rate increases would be unfavorable. The FOMC has increased the federal funds rate twice this year, in March and June, and its meeting minutes said the probability for an increase at the Sept. 25–26 meeting was “about 90%.”

Sixty-eight percent said tax law changes would have a favorable impact on their business over the next 12 months. Nineteen percent said the impact would be neutral or minimal, and 12% said the impact of the legislation would be unfavorable.

A bigger concern than interest rates and tariffs is finding workers. For the fifth consecutive quarter, availability of skilled personnel is the top challenge in the survey, followed by regulatory requirements and changes. A rising percentage of organizations plan to hire in the next 12 months, according to the survey: 32% say they don’t have enough workers and plan to add staff — the seventh consecutive quarter in which that percentage has risen or remained steady and up from 20% in the fourth quarter of 2016.

The outlook for the global economy is positive but less so than the sentiment about the U.S. economy or finance decision-makers’ organizations: 54% are optimistic and 33% are neutral about the global economy for the next 12 months. For the U.S. economy, 69% are optimistic and 20% are neutral.

The survey also showed that:

- Revenue for the coming 12 months is projected to increase 5%, up from 4.3% a year ago. Profit is projected to rise 4.3%, up from 3.5% a year ago.

- Information technology, training, and other capital spending is projected to decrease slightly compared with the previous quarter, but projections for all three categories are up year over year.

- Health care costs are projected to increase by 5.7% in the next year, down from the projection of 6.3% a year ago.

- Organization optimism by industry shows manufacturing sentiment on the rise, from 63% a year ago to 78% this quarter. Professional service optimism has increased from 50% to 84% in the past year. Real estate optimism dropped from 78% in the third quarter of 2017 to 66% now.

- Businesses with annual revenue between $100 million and $1 billion are most likely to say they need employees: 37% say they have too few employees and plan to hire. Small businesses (less than $10 million in annual revenue) are the least likely to hire.

About the CPAOI

The survey measured the sentiment of 1,242 high-ranking finance professionals in business and industry in nine areas: U.S. economic optimism, organization optimism, expansion plans, revenue, profits, employment, IT spending, training and development, and other capital spending.

Each component of the CPAOI is calculated by taking the percentage of respondents who indicated that their opinion or expectation for the metric is positive or increasing and adding to that half of the percentage of respondents indicating a neutral or no-change response.

For example, if 60% of respondents indicate an optimistic or very optimistic view and 20% express a neutral view, the calculation of the component indicator would be 70 (60% + [0.5 × 20%]).

CPA Outlook Index (CPAOI)

— Neil Amato (Neil.Amato@aicpa-cima.com) is a JofA senior editor.