- news

- PERSONAL FINANCIAL PLANNING

Which benefits do employees find most financially beneficial?

Please note: This item is from our archives and was published in 2018. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

How to ease taxes on inherited IRAs

Cost-of-living increases could hurt 2026 financial goals, poll says

Tax-efficient drawdown strategies in retirement

Eighty percent of Americans would rather accept a job with benefits such as health insurance and a retirement plan than take a job without benefits, even if it paid 30% more, according to a new poll conducted in April for the AICPA by Harris Poll.

Though respondents valued benefits highly, the majority reported that they were not optimizing their benefits. Almost 90% of the 1,115 employed adults surveyed said they understood all of the benefits their employers offered them. However, less than one-third (28%) said they were very confident they were taking full advantage of those opportunities.

Tracie Miller-Nobles, CPA, a member of the AICPA’s National CPA Financial Literacy Commission, described this finding as “concerning.”

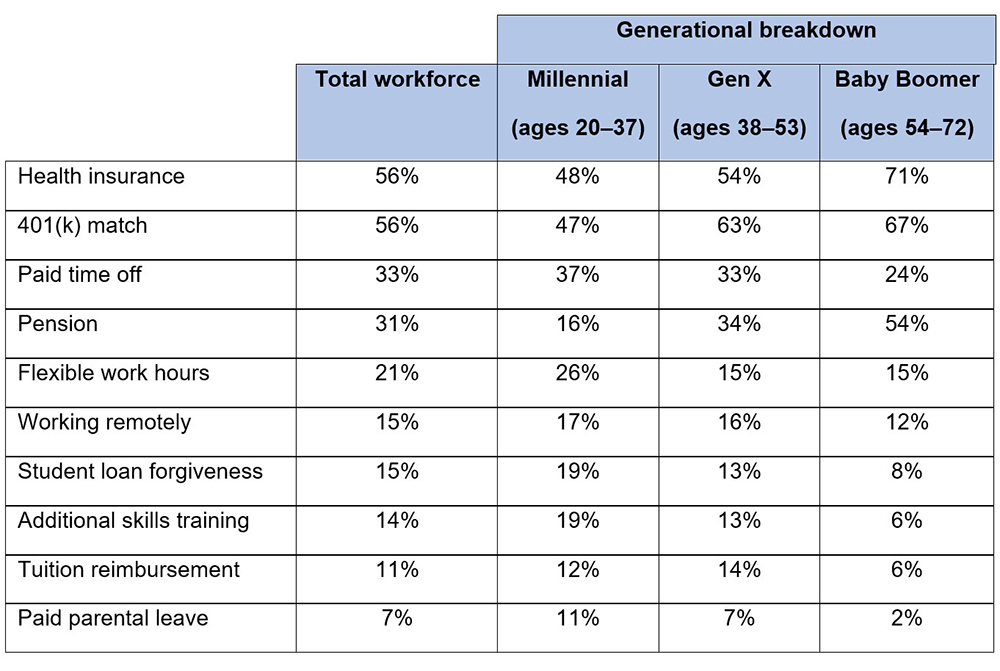

“Understanding what type of benefits are available, what is the best benefit mix, and how to utilize benefits to the fullest potential can help employees navigate unforeseen circumstances (such as medical emergencies) and adequately prepare for retirement,” she said. More than half of employed people said that health insurance (56%) and a 401(k) match from their employer (56%) were the benefits that would most help them save money or increase their income. (Respondents could pick up to three answers to this question.)

Other benefits that respondents said would most help them reach their financial goals included:

- Paid time off (33%)

- A pension (31%)

- Flexible work hours (21%)

- Working remotely (15%)

- Student loan forgiveness (15%)

- Additional skills training (14%)

- Tuition reimbursement (11%)

- Paid parental leave (7%)

Members of three generations — Baby Boomers, Generation Xers, and Millennials — all chose health insurance and 401(k) matches most frequently as the benefits that would most improve their financial standing.

However, Millennials (37%) and Gen Xers (33%) were more likely than Boomers (24%) to choose paid time off as a benefit that would help them financially, and Millennials (26%) were more likely than either Gen Xers (15%) or Boomers (15%) to say that flexible working hours would improve their finances.

Boomers (54%) were also far more likely than either Gen Xers (34%) or Millennials (16%) to say a pension would improve their financial standing.

The chart below presents a detailed breakdown of how each generation responded:

The survey also suggested that many employed Americans are overestimating the value of their benefits, Respondents said their benefits made up about 40% of their total compensation, on average, whereas benefits only made up 31.7% of average annual compensation in 2018, according to the U.S. Bureau of Labor Statistics.

Nearly one-third of employed respondents said they planned to change jobs in the next year. Before doing so, they should take time first to understand how their benefits work and which will serve their financial situations best, said David Almonte, CPA, a member of the AICPA’s National CPA Financial Literacy Commission.

Not understanding their benefits could put them at a disadvantage when negotiating for a job offer, Almonte said. “It is extremely hard to get what you want when you are not even sure what cards you hold,” he said. “You may be putting too much or too little weight on one piece of the puzzle, when really, your focus should be elsewhere (whether it be salary dollars or a specific benefit).”

When considering a job change, employees should carefully consider the benefits they may be leaving behind, Almonte said.

“A slight difference in an employer match percentage, investment offerings, or more importantly, the fees associated with such offerings could cost you big time when it comes to your retirement nest egg 20, 30, or 40 years down the road,” he said. “Always be aware of the long-term impact that both salary and benefits can have on your financial outlook both in the short term, but more importantly, in the long term.”

— Samiha Khanna is a freelance writer based in Durham, N.C. To comment on this article or to suggest an idea for another article, contact Ken Tysiac, the JofA’s editorial director, at Kenneth.Tysiac@aicpa-cima.com.