- news

- FINANCIAL REPORTING & TAX

When a tax cut is a profit hit

Please note: This item is from our archives and was published in 2018. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

Businesses urge Treasury to destroy BOI data and finalize exemption

How to ease taxes on inherited IRAs

Company lacks standing to sue ERTC advisers

P.L. 115-97, known as the Tax Cuts and Jobs Act, which was enacted Dec. 22 and mostly took effect Jan. 1, creates lower effective corporate income tax rates, and, as a result, most companies will report higher future net income in 2018 and beyond.

Companies with net deferred tax assets, however, will report unexpectedly high effective income tax rates in their 2017 calendar fourth quarter compared with their effective income tax rate for the first nine months of 2017 due to the reduction in the income tax rates on the deferred income tax assets. (There is no cash impact because changes in deferred tax balances are noncash items added back to net income in computing cash flows from operating activities.)

Examples of companies recently reporting 2017 fourth-quarter income reductions from the new tax law are Citigroup ($22 billion tax charge), Johnson & Johnson ($13.6 billion tax charge), Goldman Sachs ($4.4 billion tax charge), and BP PLC ($1.5 billion tax charge).

Fundamentals of accounting for income taxes

FASB Accounting Standards Codification (ASC) Topic 740, Income Taxes, guides recognition, measurement, and reporting of taxes based on income. This topic has two objectives:

1. To recognize the amount of taxes payable or refundable in the current year.

2. To recognize deferred tax assets and deferred tax liabilities for the future tax consequences of events that have been or will be recognized in different periods in the reporting entity’s GAAP financial statements versus its IRS tax returns. The total income tax ultimately incurred will be the same; thus, these are timing differences that produce deferred tax items.

Deferred tax assets and deferred tax liabilities are measured using the enacted tax rates expected to apply to taxable income in the future periods in which the deferred tax items are expected to become realized.

This article focuses on the second objective of measuring deferred tax assets and liabilities for federal income tax purposes and does not include a discussion of state income tax effects or deferred tax asset valuation allowances.

A company recognizes a deferred tax asset when timing differences between GAAP and tax reporting result in higher income tax paid in the current period, which will result in lower income tax expected to be paid in future periods. Examples of deferred tax assets would be net-operating-loss (NOL) carryforwards and GAAP depreciation that is greater than tax depreciation in the early years of an asset’s life. Alternatively, a company recognizes a deferred tax liability when timing differences between GAAP and tax reporting result in lower income tax paid in the current period that will result in higher income tax expected to be paid in future periods.

Topic 740 requires the “liability method” that focuses on the balance sheet. When using the liability method, a company calculates GAAP income tax expense (or benefit) comprising two components:

1. Changes in deferred income taxes: Multiply temporary differences between GAAP and tax recognition existing at the balance sheet date by the applicable income tax rate. The resulting amounts are deferred tax assets and deferred tax liabilities, and the net change in deferred tax assets and liabilities equals the deferred tax expense (or benefit) component of GAAP income tax expense.

Thus, the deferred tax balance may change from both (a) new or settled timing differences or (b) changes in anticipated future tax rates.

2. Current-period income taxes payable from the IRS tax return.

The following formula shows the GAAP income tax expense (or benefit) calculation:

Net deferred tax balance at the end of the period

– Net deferred tax balance at the beginning of the period

= Deferred tax expense (benefit)

+ Current-period income taxes payable

= GAAP income tax expense (benefit)

Under ASC Paragraph 740-10-45-15, reporting entities must remeasure and recognize the impact on deferred tax balances due to changes in income tax rates from new laws in the period that the new law is enacted. This remeasurement effect is recorded as a component of GAAP income tax expense (or benefit), as mentioned above in 1(b). For interim reporting, the remeasurement impact of new tax laws occurs in the current interim period and may not be allocated to prior interim periods, even if the change would have impacted prior interim periods.

Example of a company with a net deferred tax asset

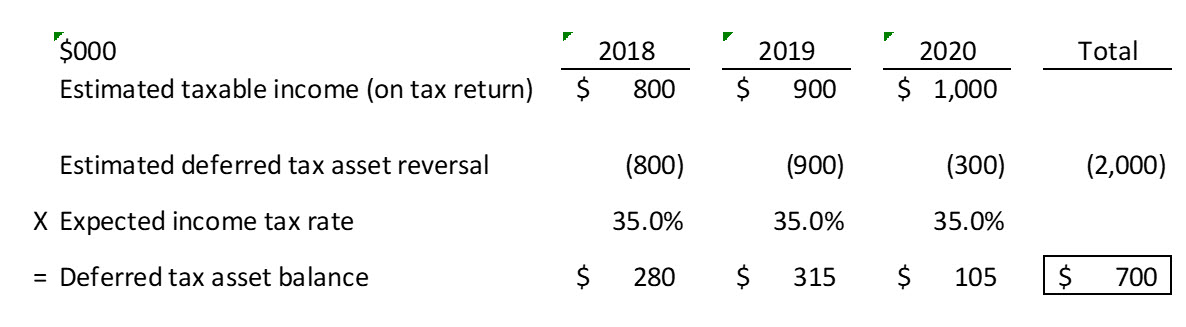

Firm A has a federal NOL carryforward of $2,000,000 at Dec. 31, 2017. This is the only temporary income tax difference, and it is a deferred tax asset. At Sept. 30, 2017, the expected federal income tax rate is 35%, and Firm A’s expected deferred tax asset reversal is forecasted as follows, which is used to measure the deferred tax asset balance:

Based on this forecast, Firm A recognized a $700,000 deferred tax asset balance at Sept. 30, 2017.

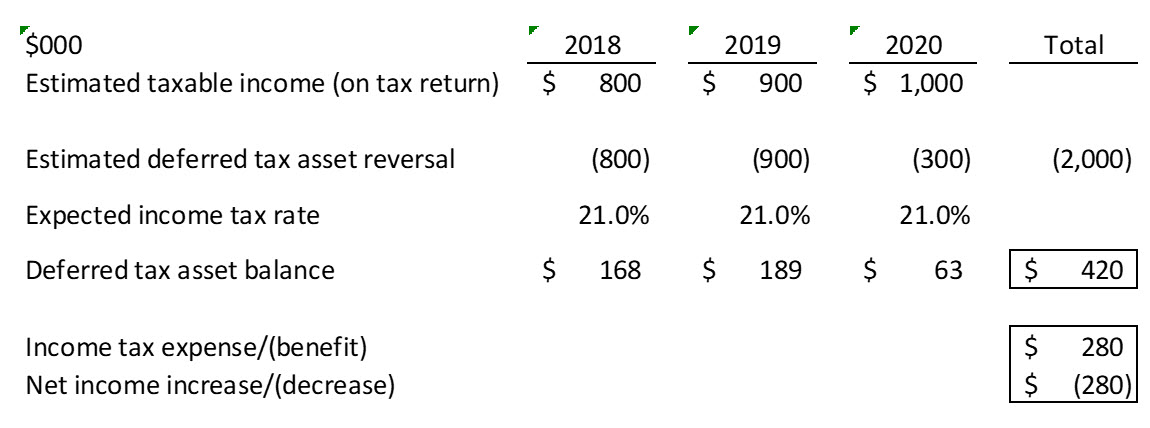

On Dec. 22, 2017, the new tax law changed the corporate tax rate from 35% to 21%. Firm A’s deferred tax asset remeasurement calculation follows:

After remeasuring the deferred tax asset, Firm A would report $280,000 of additional income tax expense in its interim quarter ended Dec. 30, 2017. This amount reflects the $280,000 decrease in the deferred tax asset balance from $700,000 at Sept. 30, 2017, to $420,000 at Dec. 31, 2017. As a result, Firm A would report $280,000 lower net income in 2017.

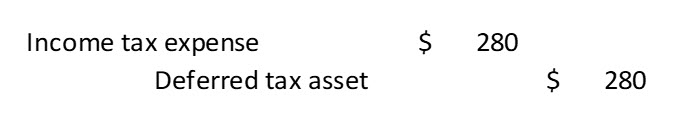

The journal entry would be:

Companies with a net deferred tax liability would show the opposite impact, generally resulting in a lower tax expense and higher net income in 2017. The deferred tax liability remeasurement for a lower income tax rate would reduce the carrying value of the deferred tax liability that would be recognized as a lower income tax expense or as an income tax benefit.

SEC Staff Accounting Bulletin No. 118

The SEC issued Staff Accounting Bulletin (SAB) No. 118 in response to the new tax law because SEC registrants’ accounting for the law’s income tax effects may be incomplete by the time financial statements are issued. The law’s late enactment date of Dec. 22, 2017, may result in a registrant’s not having all the necessary information available, prepared, computed, or analyzed to complete the accounting under Topic 740.

The SEC will not object to a registrant’s including in its financial statements a reasonable estimate, or provisional amount, of the income tax effects of the new law. For any specific income tax effects for which a reasonable estimate cannot be determined, the reporting entity would not report a provisional amount, and would instead continue to report using the tax laws in effect immediately prior to the newly enacted tax law.

For a reporting entity that avails itself of SAB No. 118, the SEC requires additional qualitative disclosures of which items are incomplete, the reasons the items are incomplete, and what additional information is needed. In subsequent periods when measurement is completed, the SEC requires disclosure about the nature and amount of any measurement-period adjustments, the quantitative effect of the adjustments, and notification when measurement is complete.

The author believes this is similar to the SEC’s position and disclosure requirements on accounting for business combinations where the measurement period according to ASC Topic 805, Business Combinations, may be up to one year from the acquisition closing date. The SEC guidance is available to nonissuers, too, as a FASB staff Q&A posted to the board’s website said FASB would not object if private companies and not-for-profits voluntarily apply SAB No. 118.

— Mark D. Mishler (mishler@umich.edu) is a principal at CFO Resource Management in Morristown, N.J., and an adjunct professor of international business, management, finance, and accounting at Seton Hall University in South Orange, N.J., and at Rutgers University in New Brunswick, N.J. To comment on this article or to suggest an idea for another article, contact Sabine Vollmer, a JofA senior editor, at Sabine.Vollmer@aicpa-cima.com or 919-402-2304.