- news

- AUDIT

Save money by having your sustainability report assured

Please note: This item is from our archives and was published in 2018. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

Guidance for sustainability attestation engagements

CFOs and sustainability—a growing relationship

TOPICS

Sustainability reporting has become a common business practice in the United States, and now research shows that sustainability assurance efforts more than pay for themselves in a majority of companies. Independent assurance of sustainability reports is growing but remains uncommon in the United States, according to a survey conducted by KPMG in 2017.

Organizations such as the AICPA are helping accounting firms provide sustainability assurance to their clients in many ways, including the publication of a recent attestation guide. However, the lower rate of adoption of sustainability assurance in the United States, compared with other countries, indicates that many companies need to be convinced of the merits of having their sustainability reports assured.

A recent academic study that we published in Auditing: A Journal of Practice & Theory finds significant capital market benefits in having sustainability reporting assured, including reduced cost of capital and lower analyst forecast errors and dispersion (see “Understanding and Contributing to the Enigma of Corporate Social Responsibility (CSR) Assurance in the United States,” Auditing: A Journal of Practice & Theory, Vol. 34, No. 1, pages 97–130 (February 2015)). In fact, our research estimates that the cost of capital reduction likely exceeded the sustainability assurance fee for over half of the U.S. companies that obtained sustainability assurance. These benefits of sustainability assurance are more pronounced when a public accounting firm provides the assurance. In this article, we update these previous findings with an additional four years of data and discuss the implications of the results for companies and public accounting firms.

Empirical method and results

Our sample contains 4,164 sustainability reports from 1993 to 2014, of which 8.7% were assured. Nonaccounting providers (e.g., environmental consulting firms) assured 77.4%, and the accounting profession assured 22.6%. However, accounting firms’ market share has grown, as they assured 35.2% in the last 10 years of the sample and, as of 2014, 60% of the largest U.S. companies’ sustainability reports.

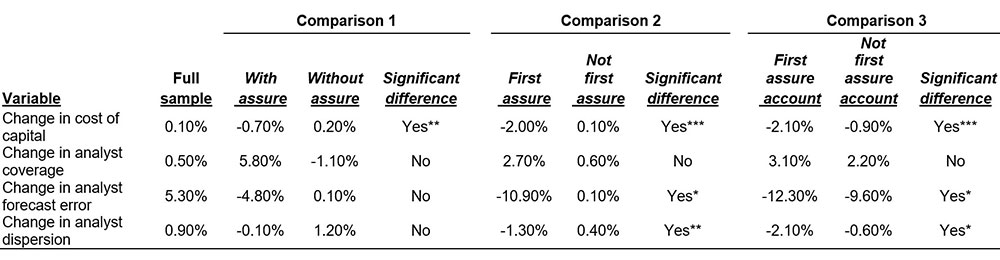

Here are four potential capital market benefits of obtaining sustainability assurance and what our comparison found (for more comparison statistics, see the table “Post-Assurance Changes in Cost of Equity Capital and Analyst Variables”):

Cost of capital: Companies that obtain sustainability assurance enjoy a reduction in their cost of capital of 0.7% while companies that do not obtain assurance have essentially no change in their cost of capital.

Analyst coverage: Companies that obtain sustainability assurance saw 12-month analyst coverage rise 5.8%, and companies that do not obtain assurance had analyst coverage drop 1.1%.

Analyst forecast errors: First-time sustainability assurance from accounting providers is associated with fewer forecast errors relative to first-time sustainability assurance from a nonaccounting provider (-12.30% vs. -9.60%, respectively).

Analyst forecast dispersion: First-time sustainability assurance from accounting providers is associated with less analyst dispersion relative to first-time sustainability assurance from a nonaccounting provider (-2.10% vs. -0.60%, respectively).

Cumulatively, these results demonstrate that there is a benefit to assurance of sustainability, and that benefit is amplified for the first-time assurance reports, and amplified again if the first-time assurance is from an accounting provider.

We also compared the benefits of sustainability assurance to the costs by comparing the reduction in cost of capital to an estimate of the assurance fee of either 5% or 10% of the firm’s financial statement audit fee (range obtained from a Big Four partner). Of the 74 first-time sustainability assurance engagements, the assurance would have more than paid for itself for 52 firms (70%) assuming a 5% sustainability assurance fee or for 41 firms (55%) using a 10% fee.

Why assurance can benefit companies

Potential for market gains. Companies that issue unassured sustainability reports could be missing out on the capital market benefits of having those reports independently assured. Determining whether sustainability assurance could reduce your company’s cost of capital requires you to consider any residual concern that capital providers have with your company’s environmental and social risks after reading your sustainability report. This improved information environment could also manifest in terms of higher stock prices and lower borrowing rates.

Elimination or reduction of shareholder questions. If questions still arise at shareholder meetings (or with other capital providers) about environmental and social risks, the shareholders are probably not convinced that your company is appropriately managing these risks based on your sustainability report. Also, even if questions do not arise, but you feel your cost of capital is unreasonably high, it could be that capital providers remain concerned about your management of environmental and social risks.

Accuracy of analyst earnings forecasts. You should consider the accuracy and dispersion of analyst earnings forecasts. If errors and dispersion are significant, analysts could have residual concern about your management of environmental and social risks. Consequently, it may be wise to ask your capital providers about their level of concern with these risks in light of the actions described in your sustainability report. Sustainability assurance could enhance the credibility of how your company is identifying and managing these risks, giving shareholders and analysts more confidence that the risks are being properly managed.

Companies should also strongly consider using an accounting provider, as we find that such providers amplify these benefits, consistent with their strong reputation for integrity, independence, professional skepticism, and assurance expertise. As shown in Comparison 3 in the table “Post-Assurance Changes in Cost of Equity Capital and Analyst Variables,” the reductions in cost of capital, analyst forecast errors, and analyst forecast dispersion are all amplified when an accounting firm provides the assurance.

Assurance recommendations and opportunities for public accountants

A new way to advertise. Our research can help public accounting firms in marketing sustainability assurance services. Public accounting firms, through advertising, can emphasize the capital market benefits and how they are more pronounced when using accounting firms. Such efforts could be very successful, especially in the United States, as the low demand level indicates that many prospective clients are likely not aware of the capital market benefits of obtaining sustainability assurance. Emphasizing that capital market benefits are amplified when public accounting firms are the assurance provider could help win business when an accounting firm is in competition with nonaccounting providers.

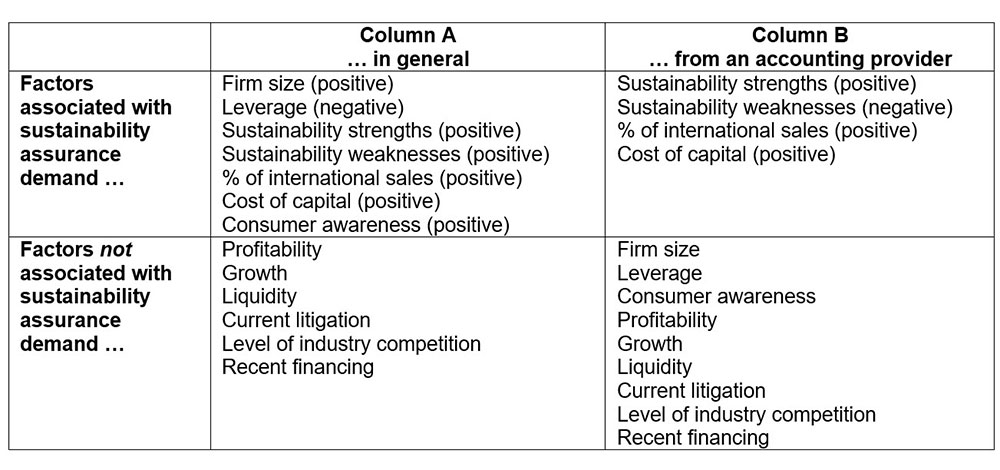

How to target potential clients. Clients with certain characteristics are more likely to be interested in sustainability assurance (see the table “Sustainability Assurance Demand” for these factors). Column A displays the factors associated with sustainability assurance from any provider. Column B lists factors associated with the decision to employ an accounting firm provider. Based on Column A, firms should target large companies, companies with significant international operations, companies with strong customer awareness (via advertising), and companies that are recognized for having strong sustainability performance. Further, firms could target companies that seem to have an unnecessarily high cost of capital. Although companies with poor sustainability performance are positively associated with general sustainability assurance demand, public accounting firms likely do not want to be associated with companies that obtain sustainability assurance, primarily for this reason. These firms tend to choose nonaccounting providers, as evidenced by the negative association in Column B.

Data show that there is likely little benefit in targeting profitable or growing firms or trying to convince a company that they should purchase sustainability assurance to differentiate themselves from competitors or minimize litigation. Companies and public accounting firms should rely on their professional judgment, based on a company’s unique characteristics, to determine if sustainability assurance will be beneficial in light of our research.

— Ryan J. Casey is an associate professor of accounting at the University of Denver’s Daniels College of Business. Jonathan H. Grenier is an associate professor of accounting at Miami University’s Farmer School of Business. To comment on this article or to suggest an idea for another article, contact Neil Amato, a JofA senior editor, at Neil.Amato@aicpa-cima.com.

Post-assurance changes in cost of equity capital and analyst variables

Cost of capital is derived using three well-accepted models that utilize analysts’ forecasted earnings to arrive at an implied cost of capital. Analyst coverage is the 12-month average of the number of analysts who issued annual earnings forecasts. Analyst forecast error is the absolute value of the 12-month average of analyst forecast errors. Analyst forecast dispersion is the 12-month average of the standard deviation of analyst forecasts, divided by stock price. “Assure” refers to the existence of sustainability assurance during the year of measurement for the particular firm. “First assure” signifies the first instance of assurance for the given firm. “First assure account” refers to the circumstance where the first instance of assurance originates from an accounting firm. *** Denotes significance at the 1% level; ** denotes significance at the 5% level; and * denotes significance at the 10% level, all two-sided.

Sustainability assurance demand