- news

- MANAGEMENT ACCOUNTING

Hiring on the minds of optimistic U.S. finance execs

Please note: This item is from our archives and was published in 2017. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

Report: AI speeds up work but fails to deliver real business value

How a CPA beat burnout after strokes, years of depression

Where CPAs stand on economic sentiment, what’s next for the JofA podcast

More U.S. organizations want to hire, and almost half have begun to offer higher pay or other financial incentives to bring candidates on board.

U.S. finance decision-makers exhibit rarely seen levels of optimism in the third-quarter Business & Industry Economic Outlook Survey, released Thursday by the Association of International Certified Professional Accountants. The projected change in employees during the next 12 months is at its second-highest post-recession percentage and fifth-highest in the past 10 years of the survey

The current projection of 1.9% growth in staffing is the highest since 2.1% was projected in the fourth quarter of 2014, when the overall CPA Outlook Index, a nine-component measurement of economic sentiment, was at its highest point, 78.

The CPAOI in the third quarter is just below that mark, at 77. A reading above 50 indicates positive sentiment.

A pro-business stance in Washington, including a potential lowering of the corporate income tax, is one reason for a rising outlook among CPA decision-makers. U.S. economic optimism, one component of the CPAOI, is at 77, 19 points higher than in the third quarter of 2016.

One optimist is Mick Armstrong, CPA, CGMA, the CFO of Micro 100 Tool Corp. in Meridian, Idaho. His company expects to increase revenue between 3% and 6% during the next year due in part to steady business in providing tools and other parts to manufacturers in industries such as aerospace and automotive.

More benefits

Micro 100 is in the process of updating training programs, in part to compete with other companies in the Treasure Valley of Idaho. The area in and around Idaho’s capital, Boise, has an unemployment rate below 3%.

“We’re revamping our whole focus on training across the company, to build skill sets,” Armstrong said. “As you make a more focused investment in training, people see value in working here.”

The company is raising pay for both existing and new workers and is considering giving employees faster entry into its retirement savings plan. Previously, employees had to work at Micro 100 a year before being eligible for its 401(K) plan. Now, the company is considering giving eligibility after 60 days. Also, Armstrong said, the company plans to offer earlier vacation eligibility. Previously, employees got one week of paid time off after a year with the company. Micro 100 is now planning to have accrual periods begin after two months.

One example of the enhanced training involves customer service. Armstrong said those employees can no longer be order-takers only. They must make recommendations for which tools are right for the customer. “We’ve got 9,000 different tool sizes and nearly 300 types of tools,” he said. “Our engineering team is training our customer service team to help them understand the products and the applications. Our distributors have less of that type of expertise, so we have to provide it.”

In the survey, projections for training budgets have either risen or remained steady for six consecutive quarters.

More confidence in hiring

Nearly one-quarter of U.S. companies plan to hire new employees, continuing a small but sustained increase that now represents the highest percentage of companies with hiring plans since the recession.

In the third quarter of 2010, for example, 31% of companies said they had too few employees. But that breakdown included a majority who remained hesitant to hire. Just 9% had too few workers and planned to hire.

In the current survey, 24% have too few workers and plan to hire, compared with 15% who have too few employees but are hesitating to hire.

One company that plans to grow in several ways is Big G Express, a trucking firm in Shelbyville, Tenn. Stephen Voorhees, CPA, vice president of finance and accounting, said the company increased its revenue about 10% after acquiring a smaller company. It plans to seek more potential acquisitions in the next six months to two years and expand its operation into western states such as Colorado, Utah, and Nevada.

Big G hires eight to 10 drivers a week, Voorhees said, offering perks such as an employee stock ownership plan and new equipment. He said the average age of the company’s fleet of trucks is 2½ years.

He is optimistic about Big G’s business as well as the U.S. economy because he has seen an increase in the flatbed segment, which is generally hauling raw materials. The company’s recent acquisition grew its flatbed fleet from 38 trucks to 55.

“It’s a great leading economic indicator for us,” Voorhees said. “It’s raw materials, whereas most of the truckload [segment] is finished product. So, as the flatbed [segment] remains strong, it gives us a six-month preview of how our truckload business will do.”

Top challenges

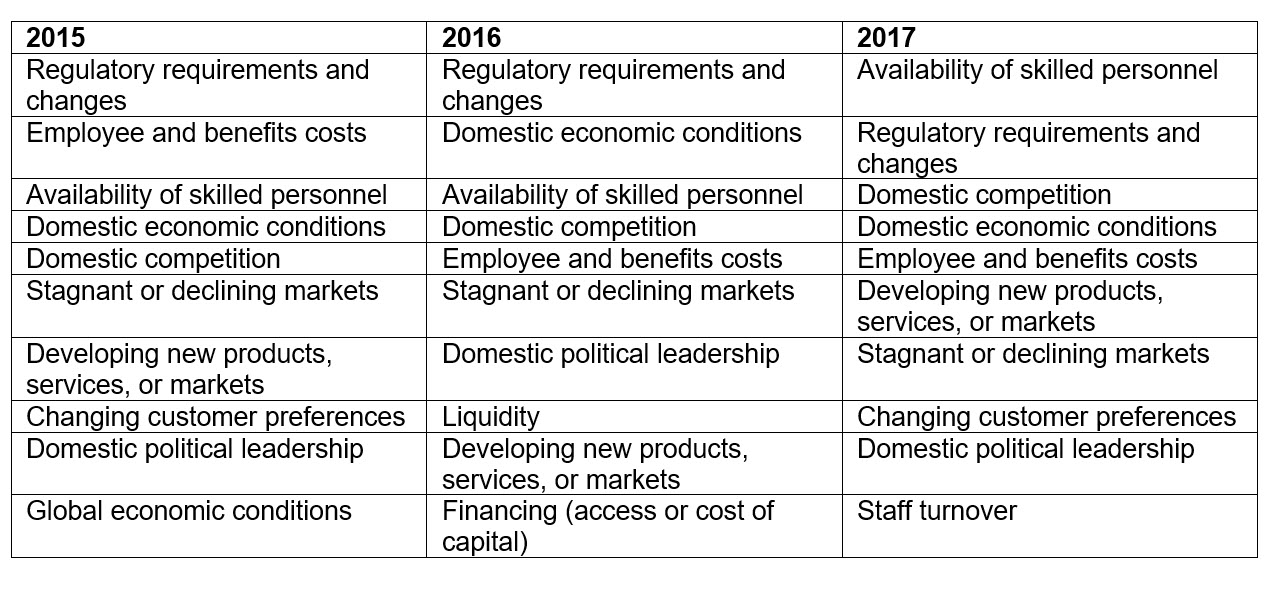

Availability of skilled personnel moved to the top of the list, ahead of regulatory requirements, often a top challenge listed by finance executives. Employee and benefits costs, the top challenge in each of the first two quarters of the year, fell to fifth on the list. The chart below shows the top 10 challenges and their ranking in the three most recent third quarters.

—Neil Amato (Neil.Amato@aicpa-cima.com) is a JofA senior editor.