- feature

- TECHNOLOGY

How BI and analytics enhance management accountants’ partnering role

Business intelligence and analytics tools are no longer optional to deliver real-time insights and support agile business decisions.

Related

AI early adopters pull ahead but face rising risk, global report finds

COSO creates audit-ready guidance for governing generative AI

AI loses ground to pros as taxpayers rethink who should do their taxes

Management accountants stand at a crossroads. The landscape of business is rapidly changing, driven by the explosion of data and the Fourth Industrial Revolution. Business intelligence and analytics (BI&A) offers transformative potential. For management accountants, it’s an opportunity to enhance their role as trusted strategic partners, using new approaches to improve decision-making across the business. But while the road is paved with opportunity, many are still navigating it with little more than a spreadsheet and a wish.

Our CIMA-sponsored study explored how BI&A is reshaping management accountants’ role and what needs to change to realize its full potential. Drawing on original research, the study identifies how BI&A is being used, highlights the key barriers to optimal adoption, and offers practical recommendations for finance professionals and business leaders seeking to unlock greater value from these tools.

The value of BI&A lies in its ability to enhance decision-making processes and outcomes, helping build knowledge for both operational and strategic insights. Internal knowledge can become a unique resource, building capabilities to create a sustainable competitive advantage. However, the knowledge and information that BI&A tools create and identify are not enough. They must be transformed into actionable insights that inform value-creating decisions. Management accountants can play this pivotal role in bridging the gap between data and impactful decisions.

Leveraging modern BI&A tools is no longer optional in the exceedingly complex business world. Without them, companies risk jeopardizing organizational performance and competitive advantage. So, how can management accountants leverage data and harness the full power of BI&A to make value-adding contributions to business decision-making?

Current use of BI&A

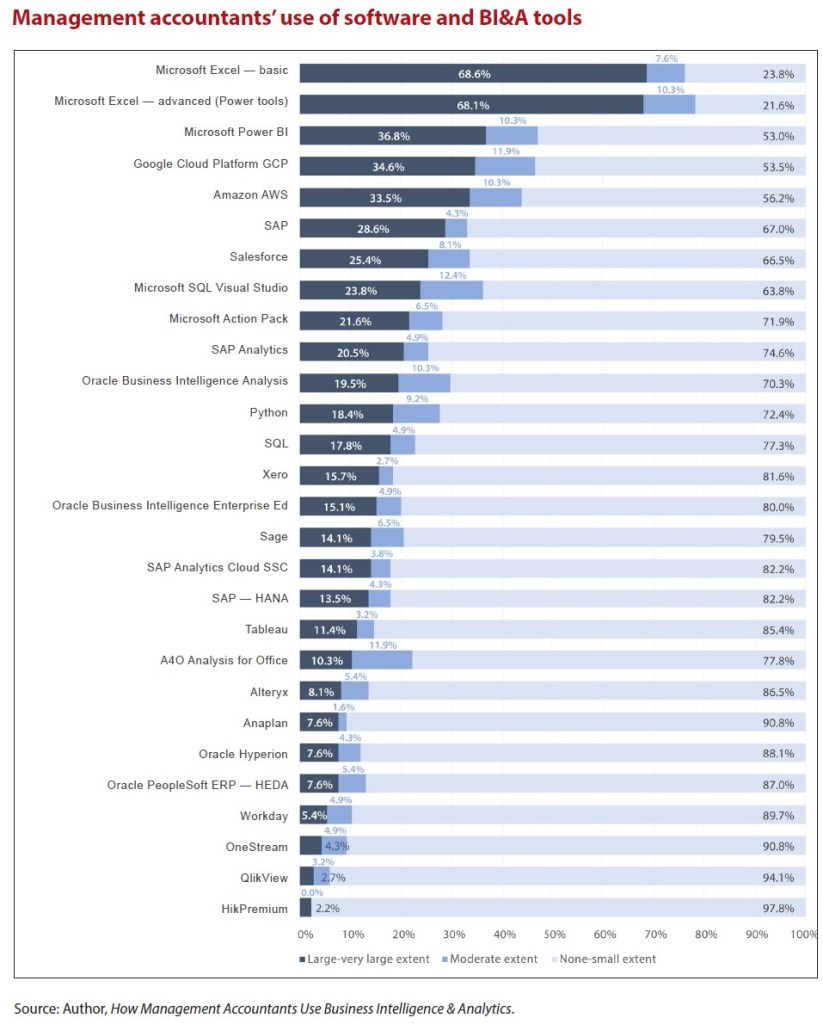

The tools of choice are largely traditional. Microsoft Excel remains the most commonly used tool, with 68% of management accountants using some of its advanced features such as Power Query. While Excel is incredibly versatile and powerful when used effectively, over-reliance on this tool can lead to missed opportunities. Less than 40% of management accountants actively use more advanced platforms like Microsoft Power BI or similar tools (see the chart “Management Accountants’ Use of Software and BI&A Tools,” below).

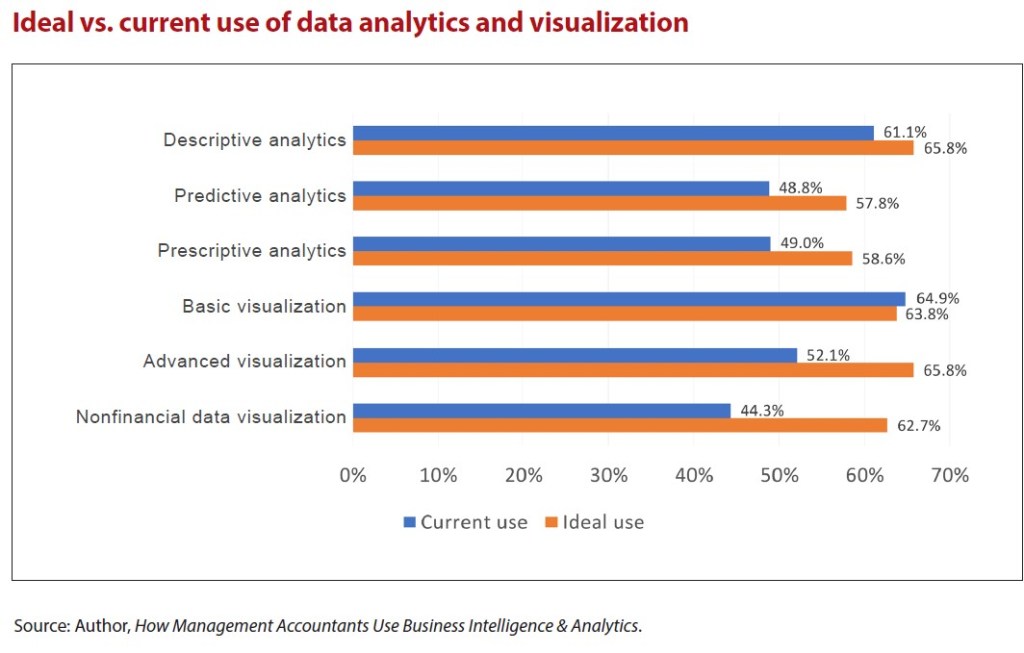

In terms of the level of analytics, the current usage is skewed towards descriptive analytics, focusing on historical data like financial ratios. In terms of data visualization, simple data tables and basic graphs are still the primary formats (see the chart “Ideal vs. Current Use of Data Analytics and Visualization,” below).

The good news is that management accountants are keenly aware of the untapped potential of BI&A. They aspire to move beyond descriptive analytics and limited predictive analytics to more advanced forms. Richer data visualization, especially including advanced and nonfinancial data, is underutilized, but there is a strong interest from management accountants for broader adoption. An interactive dashboard that not only shows financial performance, but also directly links to operational KPIs, customer satisfaction, or employee engagement, can provide a valuable, holistic view of business performance, enabling richer insights.

Practical applications of BI&A

Some organizations and management accountants are actively integrating BI&A into core tasks, predominantly for operational decision-making. BI&A is most frequently applied in fundamental tasks such as budgeting, performance evaluation, and revenue planning. Integrating BI&A in management accounting could, for example, increase the accuracy and speed of the budgeting process.

When using an integrated BI&A system, there is no need for manual-based budget spreadsheets, endless emails between business managers and finance, version-control headaches, or the risk of incorrect formulas or spreadsheet malfunctions. BI&A can not only be used effectively to prepare budgets but also to apply budgetary control and variance analysis. This enables organizations to revise planning and pricing decisions more often and not, for example, only once a year.

The results of our research indicate a strong reliance on traditional tools and descriptive analytics (see the sidebar, “Data Analytics Levels”). However, the future of management accounting is inherently linked to the broader adoption of advanced technologies such as automation and artificial intelligence (AI), including machine learning. Although many may feel that these are buzzwords, these technologies may enable the management accountant’s role to transform from a historical reporter and controller to a forward-looking strategic adviser.

In our research, time constraints were highlighted as one of the most significant barriers preventing finance professionals from leveraging BI&A tools to their full potential. Their time is consumed by manual and mundane tasks such as collating and compiling spreadsheet reports, cleaning and transforming data, and completing month-end tasks.

This is where automation can be critical. By automating these manual tasks, management accountants can use the saved hours to explore business possibilities through advanced scenario analysis or investigate variances and develop corrective actions for the root causes, rather than just reporting on the variances. The time for strategic advisory can be unlocked so that finance can provide insights that directly influence business strategy and decision-making.

Beyond automation, AI offers more potential to create deeper insights. Machine-learning algorithms can be leveraged in predictive analytics to analyze vast datasets to identify patterns and create forecasts with greater accuracy. For example, a more accurate revenue forecast can be created based on economic indicators, marketing spending, consumer tracking on social media, and historical sales data, all in a relatively short period of time.

The pinnacle of analytics, prescriptive analytics, can also be powered by AI and machine learning. For example, based on the revenue forecast, an AI-driven system could suggest optimal pricing strategies, inventory levels, and resource allocations, allowing management accountants to move from answering the question “What happened?” to “What should we do?”

However, it is critical to keep in mind that while automation and AI can be powerful enablers, replacing human decision-making with automated algorithms does not inherently create value. While these technologies can replace structured, repetitive tasks, humans bring tacit knowledge, context, creativity, and insight. The goal is not to replace the management accountant, but rather to augment and apply their capabilities and expertise, finding a balance between automation and human judgment to achieve optimal outcomes. By embracing these technologies as part of BI&A tools, management accountants have more precise, timely, and comprehensive information to make superior decisions.

Unfortunately, many research participants admit that the implementation and use of BI&A in accounting tasks are still at low levels due to various enabling factors and common challenges.

Removing barriers

While the benefits of advanced adoption of BI&A in management accounting are clear, there are challenges and requirements to implementing it successfully. Organizations and management accountants should both proactively cultivate BI&A capabilities.

Organizations need to create a data-driven ecosystem in the following way:

- Cultivate a data-driven culture: This is a foundational requirement. Company systems and processes must be aligned with managers’ expectations and ingrained into the company culture, all to actively support data-driven decision-making.

- Recognize the value of high-quality data: Organizations must invest in robust data collection and management systems to ensure reliable, timely, and accurate data. Systems should be integrated to create one source of truth; otherwise, the age-old saying of “garbage in, garbage out” will apply to the BI&A outputs.

- Promote advanced visualization: Encourage the use of interactive and information risk dashboards, not just in finance, but across the entire organization.

- Invest in automation and AI: Develop automation and AI capabilities to reduce time pressure on the finance team, enabling it to focus on value-adding strategic activities.

- Invest in training to amplify BI&A use: Our study shows that only half of the management accountants received BI&A training during formal education. While most management accountants self-rate their BI&A skills as above average, this may reflect overconfidence in their own skills rather than actual proficiency. Organizations should invest in tailored training to enhance these skills. Formal company training is especially impactful for those with below-average descriptive analytics skills and can often lead to increased BI&A use for those who previously did not understand the tools well.

Finance professionals need to take ownership of their BI&A journey by taking these actions:

- Seek strategic business alignment: Do not just generate reports because your predecessor generated them. Understand why the information is needed and engage with business managers and leadership to grasp the strategic goals and priorities. Management accountants who understand business strategy deliver greater value through their analyses and can better support decision-making.

- Tell a story: Information overload is not helpful. Develop communication skills to effectively convey insights in a clear and compelling manner. BI&A can help to transition from presenting data to telling meaningful stories, highlighting actionable recommendations and business impacts.

- Use advanced visualizations: Evolve beyond basic tables and graphs. Champion interactive dashboards that include both financial and nonfinancial data to help information users quickly grasp complex information.

- Embrace technology change: Do not resist the implementation of automation and AI technologies. Actively collaborate with IT to automate mundane tasks to free up time to make yourself invaluable in the decision-making process.

- Have a continuous learning mindset: The modern world is constantly evolving. Dedicate time to professional development to stay updated on emerging tools. This does not necessarily imply investing in new software or technologies: Existing tools like Microsoft Excel and Power BI regularly release new functions. Value can be unlocked by learning to use existing software to its full potential, with low additional costs.

- Be a BI&A champion: Advocate and encourage your organization to not only implement BI&A technologies but also to provide BI&A-related training. Offer to mentor team members who may need guidance in using BI&A effectively.

As finance functions face growing pressure to deliver real-time insights and support agile business decisions, BI&A is no longer optional. The journey from data to valuable insights is not always a straight path, but management accountants are uniquely positioned to navigate it. In turn, BI&A has the transformative potential to position management accountants as vital business partners in the decision-making process. Management accountants can move beyond spreadsheets and become influential business partners — if given the right tools, training, and strategic alignment.

Data analytics levels

Within BI&A, data analytics provide a structured approach for understanding the past, predicting the future, and determining the course of action. Typically, there are four levels of data analytics:

Descriptive analytics: What happened?

This is the starting point of data analytics. Descriptive analytics focus on understanding historical data and summarizing trends and performance over time to identify patterns. This level provides a retrospective view, using tools such as financial ratio analysis and KPIs.

Diagnostic analytics: Why did it happen?

This level of analytics builds on descriptive analytics to uncover the reasons behind the observed outcomes. It mainly aims to understand the root cause of the results and contextualize the past.

Predictive analytics: What is likely to happen?

This next level uses historical data, statistical techniques, probability models, and forecasts to predict future outcomes. These predictions can help the organization to be better prepared by evaluating probable scenarios.

Prescriptive analytics: What should be done?

The most advanced form of analytics provides actionable recommendations based on the insights from the previous levels of analytics. It often includes simulations of different strategies, as well as evaluation of the potential outcomes of various options to help decision-makers choose the best course of action.

About the author

Elize Kirsten, ACMA, CGMA, is a senior lecturer and researcher with a focus on digital transformation in management accounting at the University of Pretoria in South Africa. To comment on this article or to suggest an idea for another article, contact Jeff Drew at Jeff.Drew@aicpa-cima.com.

LEARNING RESOURCES

Microsoft Power BI: Power BI Series

This nine-part, self-study online series will help you develop the skills necessary to use Microsoft Power BI tools, which will allow you to perform enhanced data analysis.

CPE SELF-STUDY

Data Management & Analytics Certificate

Critical knowledge in business intelligence, data management, and data analytics will be gained to help you augment your accounting expertise, acquire a new skill, or complete the CITP credential.

CPE SELF-STUDY

For more information or to make a purchase, go to aicpa-cima.com/cpe-learning or call 888-777-7077.

MEMBER RESOURCES

Research

“How Management Accountants Use Business Intelligence & Analytics: The Road to Improved Decision-Making,” AICPA & CIMA, June 2, 2025

Articles

“Using the AI in Power BI to Do Root Cause Analyses,” JofA, Oct. 1, 2024

“Tips for Using the Power BI Suite of Tools,” FM magazine, Feb. 22, 2024

“BI Tools: Power Query, Power Pivot, and Power BI,” FM magazine, Jan. 4, 2024