- feature

- BUSINESS VALUATION

Business valuation for multi-tiered entities

A high-level overview helps CPAs navigate the maze of complex ownership structures found in MTEs.

Related

Lessons in career and business development during times of disruption

NFTs come with big valuation challenges

New standard addresses investments, specialist matters

Multi-tiered entities (MTEs) offer businesses a sophisticated organizational structure with multiple layers of ownership and control. But the complex ownership structures and intercompany relationships present unique challenges when valuing MTEs.

With subsidiaries or holding companies spanning different legal jurisdictions and levels of control, MTEs require a thorough understanding of their specific characteristics and the application of appropriate valuation methodologies. Industry-specific regulations and tax implications further complicate the process.

Many considerations go into valuing MTEs, including key challenges, application of traditional valuation methods, discounts and premiums, and emerging trends, which are crucial to deliver precise tax planning strategies and sound business guidance.

UNDERSTANDING MTEs

MTEs are organizational structures in which a parent company owns multiple subsidiaries, which may, in turn, control additional entities, creating a layered ownership hierarchy. Common models include conglomerates, where a parent company oversees diverse businesses; holding companies that primarily manage equity in subsidiaries; and investment firms that manage structured asset portfolios through multiple subsidiary layers. Spanning various industries and regions, these entities offer a strategic framework for risk management and growth.

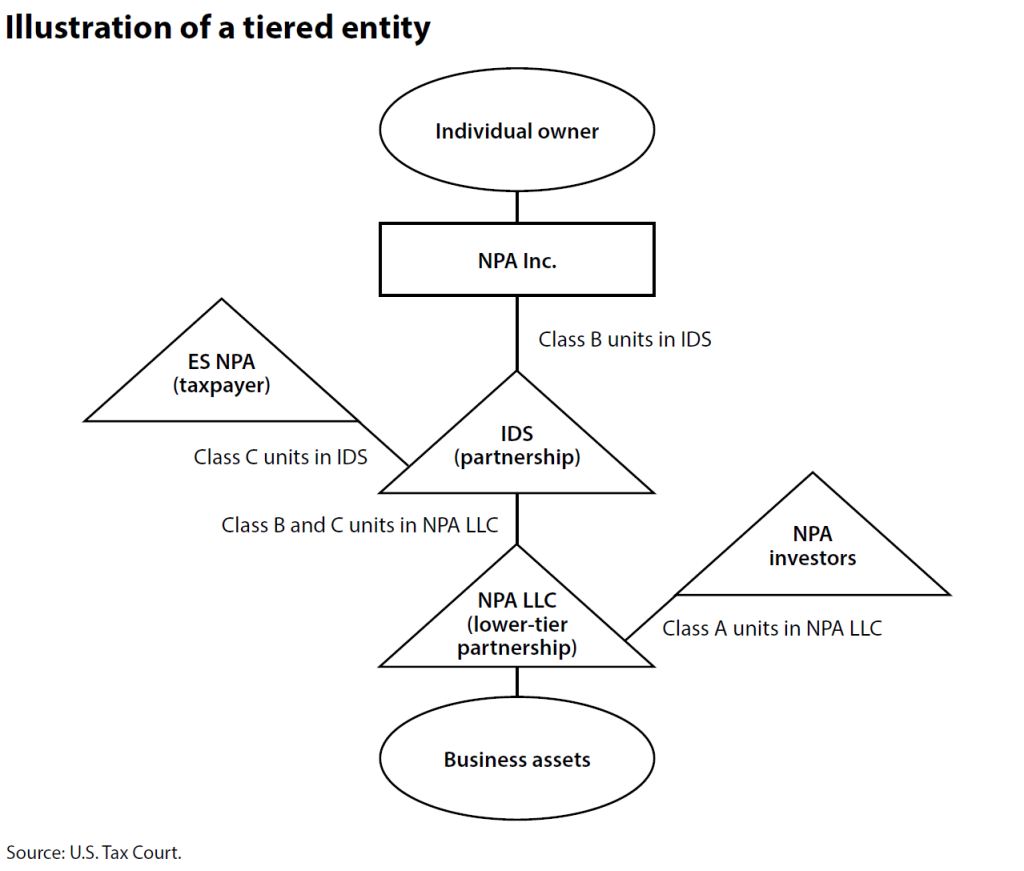

The chart, “Illustration of a Tiered Entity,” shows an example of an organizational structure of an MTE whose valuation was contested in court.

These complex structures consist of multiple ownership layers, with each subsidiary potentially holding stakes in additional entities, creating an interconnected business network. Determining the true value of the parent company or a subsidiary requires a detailed assessment of the financial health and performance of each subsidiary.

Additionally, these entities often hold a mix of tangible assets, such as real estate and machinery, and intangible assets, including intellectual property and goodwill. Each ownership tier adds complexity to the valuation process, requiring a deep understanding of the interrelationships among the entities. Intercompany transactions, where subsidiaries within the MTE engage in business with each other, can further complicate valuation by potentially distorting financial performance at different levels.

Adjustments may be needed to ensure an accurate reflection of arm’s-length pricing.

The geographical distribution of these assets and operations adds further complexity, as different jurisdictions impose varying regulations, tax implications, and economic conditions. This necessitates a comprehensive valuation approach that accounts for regional differences and their impact on an MTE’s overall financial stability.

Consolidated financial statements, while useful for overall reporting, may mask the individual performance and risks of specific subsidiaries, especially those operating under different accounting standards or in different tax jurisdictions. Accurate MTE valuation requires careful analysis and potential disaggregation of these statements.

FRAMEWORK FOR MTE VALUATION

Valuing interests in MTEs presents unique challenges, particularly when applying discounts for lack of control (DLOC) and lack of marketability (DLOM). These discounts reflect the fact that a fractional interest in an entity is worth less than a proportionate share of its underlying assets.

Given the complexities of tiered discounts, a structured approach is essential. Key steps include:

- Defining the purpose: Determine the reason for the valuation, whether for estate planning, a legal issue, or a transaction. The purpose dictates the valuation methodology. For instance, fair market value (FMV) is commonly used for tax assessments.

- Analyzing the ownership structure: Identify each entity within the tiered structure and map out their interrelationships. A clear understanding of this hierarchy is crucial for assessing applicable discounts and ensuring an accurate valuation.

- Valuing assets at each tier: Conduct independent valuations for each tier using appropriate methods: the asset-based approach for asset-holding entities, adjusting historical costs to market values; the income approach, projecting future cash flows and considering specific risks and opportunities; the market approach, identifying comparable transactions with necessary adjustments; and considering intangible assets like customer lists and goodwill that may impact valuation.

- Determine level of ownership: Classify the interest being valued at each tier. Is it a controlling or noncontrolling interest? Marketable or nonmarketable? These distinctions guide the application of appropriate discounts.

- Apply discounts thoughtfully: DLOC and DLOM adjustments are often necessary when valuing interests in MTEs. Factors that should be considered include:

- Company-specific information: The magnitude of discounts is influenced by several factors, including asset risk, governance structure, management quality, and liquidity.

- Case law guidance: Court holdings on tiered discounts provide valuable precedents, reinforcing the justification for their application.

- Avoid double-discounting: Be cautious not to apply multiple discounts for the same risk factor across different tiers. For example, if a lower tier is discounted for lack of marketability, avoid applying the same discount at higher levels.

- Pyramid discounting strategy: To mitigate double-discounting, use a pyramid discounting approach — applying progressively smaller discounts at higher tiers to reflect the diminishing impact of risk factors as you move up the ownership structure.

- Arriving at the final valuation: After applying appropriate discounts at each tier, determine the FMV of the subject interest, ensuring that all relevant factors are considered.

- Documentation for defensibility: Maintain thorough documentation of the valuation process, clearly justifying applied discounts and citing supporting market data. Well-documented methodologies enhance the credibility and defensibility of the valuation.

While the steps outlined above provide a general framework, each valuation is unique. The choice of methods and the application of discounts depend on the specific facts and circumstances of each case.

KEY FACTORS INFLUENCING MTE VALUATION

A comprehensive valuation of MTEs requires addressing key factors that influence financial health and stability.

Applying multilevel valuation discounts involves independent assessments at each ownership tier, with considerations such as lack of control, marketability, voting rights, operational limitations, geographical spread, and cumulative discounting.

- Lack of control: Minority interests in subsidiaries and sub-subsidiaries often lack decision-making authority, reducing their value. Limited influence over strategic and operational decisions warrants discounts in valuation.

- Marketability: Ownership stakes in MTEs are typically illiquid, as minority interests are difficult to sell. The lack of a readily available market decreases their attractiveness to potential investors, leading to discounts.

- Voting rights: Complex voting structures can further diminish value. When decision-making power is fragmented across multiple tiers, additional discounts may be applied for reduced governance influence.

- Operational constraints: Restrictions from operating agreements, such as covenants or mandatory approvals, can limit flexibility and profitability. These constraints necessitate adjustments in valuation.

- Financial insulation: A critical aspect of MTE valuation is assessment of the degree of financial insulation present within the organizational structure. Well-designed financial insulation, which involves strategically separating business units to contain financial risks, can significantly enhance the overall stability and attractiveness of the company to investors, thereby influencing its valuation.

- Ringfencing: This refers to how effectively business units are designed to function as bankruptcy-remote entities or special-purpose vehicles (SPVs), essentially extending the protections offered by the corporate veil. SPVs, with their specific and limited purposes, often exhibit a high degree of isolation from broader economic risks, requiring thorough and distinct consideration in MTE valuation processes.

- Geographical dispersion: Assets and operations spread across different jurisdictions may involve variations in regulations, tax implications, and economic conditions. These regional differences must be factored into the valuation process.

- Cumulative discounting: Each ownership layer compounds valuation discounts, making it critical to ensure an accurate reflection of the parent company’s true economic interest.

CHALLENGES IN APPLYING DISCOUNTS

In MTEs, the value of a parent company’s interest in its subsidiaries is often subject to multiple layers of discounts. Multilevel valuation discounts account for factors such as lack of control, lack of marketability, and the compounded effect of these limitations across different ownership layers.

These discounts reflect the reality that minority interests in subsidiaries typically: (1) lack decision-making authority, reducing their intrinsic value; (2) face liquidity challenges due to limited marketability; and (3) are further constrained by complex voting rights and operational restrictions.

Applying multilevel valuation discounts requires a step-by-step approach:

- Determine the FMV of assets held by the sub-subsidiary.

- Apply discounts for lack of control and marketability to derive the subsidiary’s adjusted value.

- Further discount the parent company’s interest in the subsidiary to reflect the compounded effect of ownership constraints across tiers.

The systematic application of discounts ensures an accurate representation of the true economic value of the parent company’s stake within the MTE structure, acknowledging the constraints inherent in these complex arrangements. However, these technical and financial adjustments are significantly complicated by differences in regulatory regimes and legal jurisdictions across the various entities within the MTE.

Variations in corporate law, securities regulations, and even tax codes can substantially impact how these discounts are calculated and applied. Furthermore, court precedents and case law within these differing jurisdictions play a crucial role, influencing the interpretation of valuation principles, the acceptance of specific discount methodologies, and the overall legal and financial risk assessment associated with the MTE structure.

A comprehensive valuation must therefore consider not only the financial factors, but also the potential impact of the legal landscape and varying regulatory environments on the perceived value and applicable discounts within the MTE.

THE ROLE OF JURISDICTION

Legal jurisdictions play a pivotal role in the valuation of MTEs. Courts function as a bridge between the legal system and economic development, influencing firm value through case resolution efficiency and resource allocation.

Regulatory changes, including industry-specific regulations and tax policies, can significantly impact a company’s valuation.

Different jurisdictions often interpret valuation methodologies differently, leading to inconsistencies. For example, conflicting tribunal rulings on the same valuation issue (dissents) can create challenges in standardizing valuation approaches. These discrepancies highlight the importance of appraisers being well versed in legal precedents and case law applicable to each jurisdiction where an MTE operates. Often, different entities within the group operate in different jurisdictions, further complicating the application of premiums and discounts.

The valuation of MTEs is a nuanced financial assessment shaped significantly by various legal precedents. Courts have addressed key issues, including:

- The application of discounts across different ownership tiers.

- The marketability of minority interests.

- The valuation of intangible assets within tiered structures.

Several landmark decisions provide valuable guidance on how courts assess tiered valuations, offering practitioners insights into navigating these complexities. These decisions establish critical principles that help refine valuation methodologies and ensure compliance with legal standards.

INDUSTRY-SPECIFIC CONSIDERATIONS IN MTE VALUATION

MTE valuation varies across industries due to differences in regulations, tax implications, and business models. Appraisers need to possess industry-specific expertise to ensure accurate assessments.

Real estate

Real estate MTEs often involve intricate ownership structures, encompassing multiple properties and entities. Valuation factors include market rents, operating expenses, and capitalization rates. Regulatory changes, such as broadband access in multiple-tenant environments, can impact property values by influencing rental income and operating expenses.

Technology

Technology companies present unique valuation challenges due to complex financial instruments and a heavy reliance on intangible assets. Trends such as generative AI and clean energy influence investment decisions and valuations. Additionally, regulations governing broadband in MTEs can affect technology companies by altering service availability and costs, impacting operations and customer acquisition.

A primary challenge in valuing technology MTEs is quantifying intangible assets — intellectual property, brand recognition, and customer relationships — given their intangible nature and lack of standardized valuation metrics.

Private equity

Private-equity firms frequently invest in MTEs with layered ownership structures. Common valuation approaches include public-company-comparable, transaction-comparable, and discounted-cash-flow models. Market volatility and economic conditions significantly affect valuations, leading to more conservative estimates during downturns.

Regulatory changes, such as tax law modifications, can reshape the investment landscape and significantly impact private-equity valuations.

Additionally, industry regulations influence the “recovery period” for MTEs, impacting long-term value. High compliance costs or regulatory hurdles can prolong recovery and negatively affect valuations, particularly for small firms within MTEs, which may struggle to absorb these costs.

INTANGIBLE ASSETS AND COMPLEX FINANCIAL INSTRUMENTS

The increasing prevalence of intangible assets and sophisticated financial instruments introduces new complexities for MTE valuation.

Intangible assets and intellectual property

Intangible assets — including patents, trademarks, customer relationships, and brand recognition — are challenging to measure due to their lack of physical substance and standardized accounting practices. Appraisers must develop specialized methodologies to accurately quantify and monetize these key intangible assets, while also developing other methods to assess the contribution of other assets (i.e., the “supporting players”) to overall value. For example, intellectual property valuations, such as patents or trademarks, may require estimating future revenue streams or analyzing market prices for similar assets. For brand valuation, the relief-from-royalty method is often employed. This method estimates the hypothetical royalty payments a company would have to pay to license its own brand if it did not own it, providing a value for the brand based on these avoided costs.

Complex financial instruments

MTEs often utilize complex financial instruments, such as warrants, options, and convertible debt, which introduce additional valuation complexities. These instruments can contain embedded options or contingent payments that necessitate sophisticated modeling techniques, such as option-pricing models for warrants or debt-equity allocation models for convertible securities.

For example, consider a parent company that holds convertible preferred stock in a subsidiary, granting the option to convert these shares into common stock at a predetermined ratio. Valuing this instrument requires assessing the subsidiary’s underlying value, applying an option-pricing model to capture the conversion option’s worth, and incorporating tiered discounts that reflect the parent company’s ownership level and the stock’s liquidity. This multifaceted approach ensures that the valuation accurately captures the complexities of both the financial instrument and the tiered ownership structure.

ACCURATE MTE VALUATIONS ARE CRITICAL

Unique characteristics, legal and regulatory frameworks, and appropriate valuation methodologies play into valuing MTEs. While traditional valuation techniques remain applicable, appraisers must carefully navigate challenges such as intercompany transactions, consolidated financial statements, and varying levels of control.

Accurate MTE valuations are critical for investors, business owners, and taxing authorities, influencing investment decisions, mergers and acquisitions, and regulatory compliance.

As MTE structures evolve, valuation professionals must continually adapt to new challenges, ensuring clarity in assessing the true economic value of these entities.

About the authors

Nainesh Shah, MBA, CFA, CVA, is co-founder and director of valuation, and Evan Levine is founding partner and head of valuation engagements, both at Complete Advisors. To comment on this article or to suggest an idea for another article, contact Jeff Drew at Jeff.Drew@aicpa-cima.com.

LEARNING RESOURCES

AICPA Business Valuation School

Broaden your skills and learn to confidently assess and maximize the value of a client’s business. This intensive five-day program in Durham, N.C., immerses you in new theories, applications, best practices, and current controversies in business valuation. For more information or to register, click on the headline above.

Sept. 8-12

CONFERENCE

AICPA Forensic & Valuation Services Conference

Get timely updates, cutting-edge information on new technology, and quality networking with other forensic accounting and valuation professionals at the AICPA Forensic & Valuation Services Conference, to be held at the Gaylord Rockies Resort & Convention Center in Aurora, Colo. For more information or to register, click on the headline above.

Oct. 27-29

CONFERENCE

The Forensic and Valuation Services (FVS) Section is an add-on membership section that offers comprehensive professional guidance and tools, exceptional learning initiatives, advocacy, and community for forensic accounting and business valuation practitioners. For more information, click on the FVS Section membership headline above.

SECTION

Accredited in Business Valuation credential

The Accredited in Business Valuation (ABV) credential positions you as a premier valuation provider with expertise in the valuation of businesses and intangible assets for transactional purposes, succession planning, mergers and acquisitions, litigation and disputes, and other consulting purposes. For more information, click on the headline above.

CREDENTIAL

For more information or to make a purchase, go to aicpa-cima.com/cpe-learning or call 888-777-7077.

AICPA & CIMA MEMBER RESOURCES

Article

- “Attracting Students to Accounting With Business Valuation Courses,” Academic Update, Dec. 4, 2024

Website