- feature

- BUSINESS & INDUSTRY

Managing MNE subsidiaries during tariff shocks

Multinational enterprises’ subsidiaries need other incentives to optimize their performance if transfer pricing policies guarantee them a routine profit.

Related

IRS should open Trump accounts for eligible children automatically, AICPA says

AI early adopters pull ahead but face rising risk, global report finds

Talent shuffle: Why people want to change jobs and how leaders can adapt

This article explores how international tax laws and tariff shocks can together demotivate affiliates of a multinational enterprise (MNE) from pursuing operational excellence and continuous improvement because the affiliates are often guaranteed a routine profit by the MNE. Recent shifts in global trade policy have intensified this challenge. MNEs such as Apple and Hyundai have been forced to consider restructuring supply chains across borders to navigate new tariff regimes and reduce dependency on politically volatile trade routes. These shifts affect not only where value is created but also how it is measured and rewarded across organizations.

International tax laws help ensure that intercompany transaction prices (i.e., prices charged in transactions between related entities) are comparable to those between independent parties, in line with the arm’s-length standard. However, these laws can also lead to reduced motivation among subsidiaries to drive operational excellence and continuous improvement because they are guaranteed a routine profit by the MNE. By integrating tailored KPIs with financial incentives, MNEs can motivate subsidiaries to optimize profitability while complying with transfer pricing regulations.

BASICS OF TRANSFER PRICING

Transfer pricing refers to the internal pricing for transactions between related entities within MNEs, companies that operate in multiple countries through subsidiaries, branches, or affiliates, managing production, services, or sales across borders. Tax authorities scrutinize these transactions because transfer pricing is sometimes used to shift profits between jurisdictions and reduce tax liabilities, raising concerns about tax avoidance. (For an example of how transfer prices can shift profits, see “Transfer Pricing: Not Just for the Tax Department,” JofA, March 1, 2025.) To ensure fairness and prevent tax avoidance, tax authorities apply the arm’s-length standard, which requires that transfer prices, or intercompany transaction prices, should be consistent with those that would be charged between uncontrolled (i.e., unrelated) taxpayers in the same transaction under the same circumstances (Regs. Sec. 1.482-1(b)(1)). Generally, pricing between related entities must reflect market conditions and pass a “circumstances-of-sale” test. The circumstances-of-sale test seeks to determine whether the price of imported goods from a related party is influenced by the relationship.

The transfer pricing landscape has recently been unsettled by the new U.S. emphasis on increasing tariffs, also known as customs duties, which is significantly reshaping the global trade environment. For example, Apple has reportedly committed to shifting most U.S.-bound iPhone production from China to India by 2026 to mitigate exposure to growing U.S.-China trade tensions and tariffs (“Apple Moving to Make Most iPhones for US in India Rather Than China, Source Says,” Reuters (April 25, 2025)). Hyundai Motor Group, reacting to large tariffs affecting its vehicles, was relocating production of certain models from Mexico to Alabama and investing over $20 billion in new facilities in the United States (“Hyundai to Invest $21 Billion in U.S. in Bid to Avoid Trump’s Tariffs,” The New York Times (March 24, 2025)).

These kinds of strategic responses to trade policy shifts require updated transfer pricing frameworks that align with both tax compliance and MNEs’ internal performance goals. Before discussing business management challenges that can arise in keeping subsidiaries motivated to optimize operational and financial performance in this trade environment if transfer pricing policies guarantee them a routine profit, some further background on transfer pricing may be helpful.

HOW TRANSFER PRICES ARE SET

Treasury regulations provide several methods for MNEs to determine an arm’s-length price for an intercompany transaction. They generally require that taxpayers choose the method that results in the most reliable measure of an arm’s-length result, known as the best-method rule (Regs. Sec. 1.482-1(c)). While taking these compliance requirements on board, MNEs also aim to establish transfer pricing policies that balance tax compliance and operational efficiency. To achieve this objective, MNEs are conducting detailed analyses of comparability factors, including the characteristics of intercompany transactions as well as the functions performed, assets used, and risks assumed (referred to as a functions, assets, and risks (FAR) analysis). Based on these factors, MNEs select the most appropriate transfer pricing method for each intercompany transaction.

MNEs often seek to determine an arm’s-length price for an intercompany transaction by researching how much was charged in comparable transactions between unrelated parties. The inclusion or exclusion of loss-making comparables in transfer pricing benchmarking is a long-standing and contentious issue — and may be relevant to tariff shocks. Historically, loss-makers have been excluded, especially for routine entities expected to earn stable, low profits, on the rationale that persistent losses suggest poor management or strategic risk. However, some MNEs have challenged this policy and argued that economic shocks (e.g., COVID-19) and strategic business phases (e.g., market entry) better reflect actual market conditions. Some recent court rulings have held that loss-making comparables cannot be excluded solely due to losses and need to reflect strategic and market context (Italy v. Convergys Italy S.R.L., No. 19512/2024, Supreme Court of Italy (7/16/24); Panama v. AC S.A., No. TAT-RF-002, Administrative Tribunal of Panama (1/10/20)). Tariff shocks may also be considered in the future.

Among the available transfer pricing methods, the Organisation for Economic Co-operation and Development’s transactional-net-margin method (TNMM), similar to the United States’ comparable-profits method, is commonly adopted by MNEs due to its practicality, data availability, and flexibility, and it will be useful here for illustrative purposes. Some background in how the TNMM works will be helpful to understand the motivation challenges involving subsidiaries that will be discussed next. The TNMM evaluates the arm’s-length nature of an intercompany transaction based on the net profit margin, such as the operating margin (operating profit as a percentage of sales) or full cost-plus markup (operating profit as a percentage of total costs) achieved by the selected tested party.

APPLYING THE TNMM

The TNMM requires a detailed FAR analysis of both transacting parties. The entity with the simpler FAR profile — typically, performing routine functions, assuming limited risks, and using minimal intangible assets — is selected as the tested party. Its profit margin serves as the basis for evaluating whether the transaction meets the arm’s-length standard.

For instance, if a parent company handles significant value-adding functions, assumes entrepreneurial risks, and uses valuable intangible assets, while its subsidiary performs relatively simple distribution or assembly functions, the subsidiary is generally selected as the tested party.

After identifying the tested party, a benchmarking analysis is conducted to find comparable companies with similar FAR profiles. These comparable companies help determine an arm’s-length margin, often using financial indicators such as operating margin, depending on the nature of the tested party’s activities.

MNEs typically conduct annual benchmarking to set target profit margins and maintain tax compliance. To meet these targets, they may also perform year-end transfer pricing adjustments to align the actual margin with the predetermined target:

- Excessive margin: If the tested party’s margin is above the target margin, the tested party reimburses the excess to the other party.

- Deficient margin: If the tested party’s margin is below the target, the tested party is compensated for the shortfall.

These adjustments help MNEs manage cross-border tax risks, although tax authorities may still challenge the reasonableness of the target margin itself during audits. Having robust documentation is crucial.

MOTIVATION CHALLENGES

While the TNMM helps MNEs manage tax compliance, it can lead to unintended consequences in business performance and employee motivation. Subsidiaries performing routine functions — such as distribution or resale — are assured a fixed profit margin through year-end transfer pricing adjustments, which can reduce the incentive to optimize performance. Some of the key challenges include:

- Moral hazard: Guaranteed profits may shield entities from the full impact of their decisions. Employees might deprioritize revenue growth or cost control, knowing that margins will be adjusted to meet predetermined targets.

- Reduced motivation: Surpassing the target margin yields no direct benefits, as excess profits are reallocated within the MNE group. This can discourage innovation and efficiency efforts, as employees feel their contributions do not lead to proportional rewards.

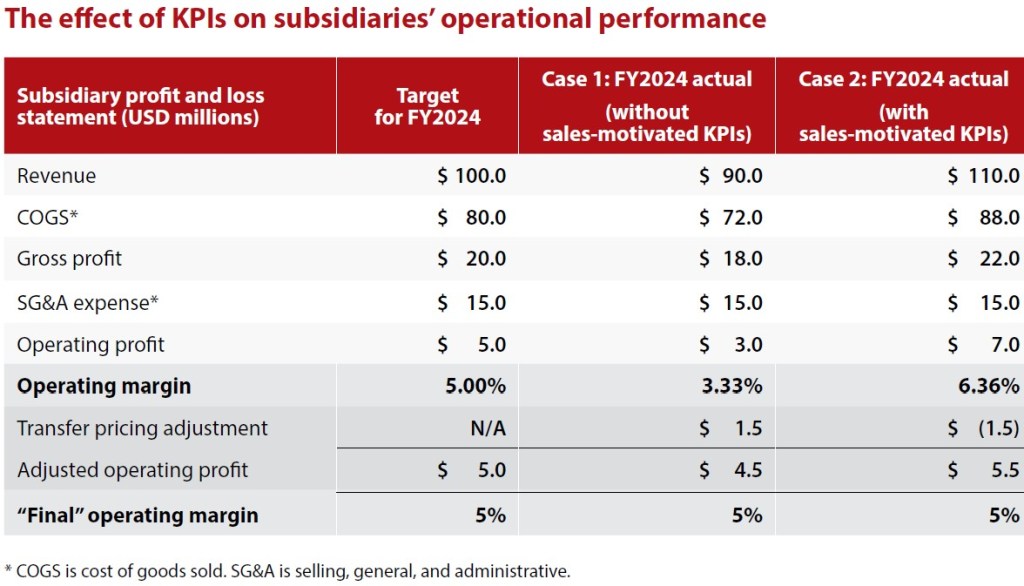

For example, suppose a subsidiary’s tax jurisdiction accepts a 5% operating profit margin for fiscal year (FY) 2025. TNMM-based transfer pricing policies may result in various outcomes, regardless of actual performance. The table “The Effect of KPIs on Subsidiaries’ Operational Performance” illustrates how a sales-driven subsidiary can have different performance outcomes depending on how well it is incentivized through effective KPIs. In this example, the subsidiary can increase its revenues through external sales. The target revenue for the year is $100 million with an operating profit of $5 million, yielding a 5% profit margin. In the table’s column for Case 1, the sales staff do not have effective KPI incentives to motivate them. As a result, they generate an operating profit of only $3 million initially. The MNE would need to make an upward transfer pricing adjustment of $1.5 million to achieve a reported margin of 5%.

In Case 2, with effective KPI incentives, such as a bonus based on sales growth, the sales staff are more motivated and generate $7 million in profit, which would require a downward transfer pricing adjustment of $1.5 million from the MNE to achieve the target 5% operating margin. As a result, although the subsidiary would still report a 5% operating margin for tax purposes, it generates more revenues and profits at the MNE level.

This example highlights the need for carefully designed KPIs to mitigate the adverse organizational effects of TNMM-based transfer pricing policies. When implemented effectively, KPIs can motivate subsidiaries to pursue more profit, operational excellence, and continuous improvement and still comply with TNMM regulations.

IMPACT OF TARIFF SHOCKS

Focusing now on tariffs, sudden tariff increases of substantial size can disrupt transfer pricing policies, especially for those affiliates guaranteed a fixed profit margin. These affiliates will probably struggle to offset the added costs, creating the need for revised KPIs that reflect tariff exposure and motivate operational improvements.

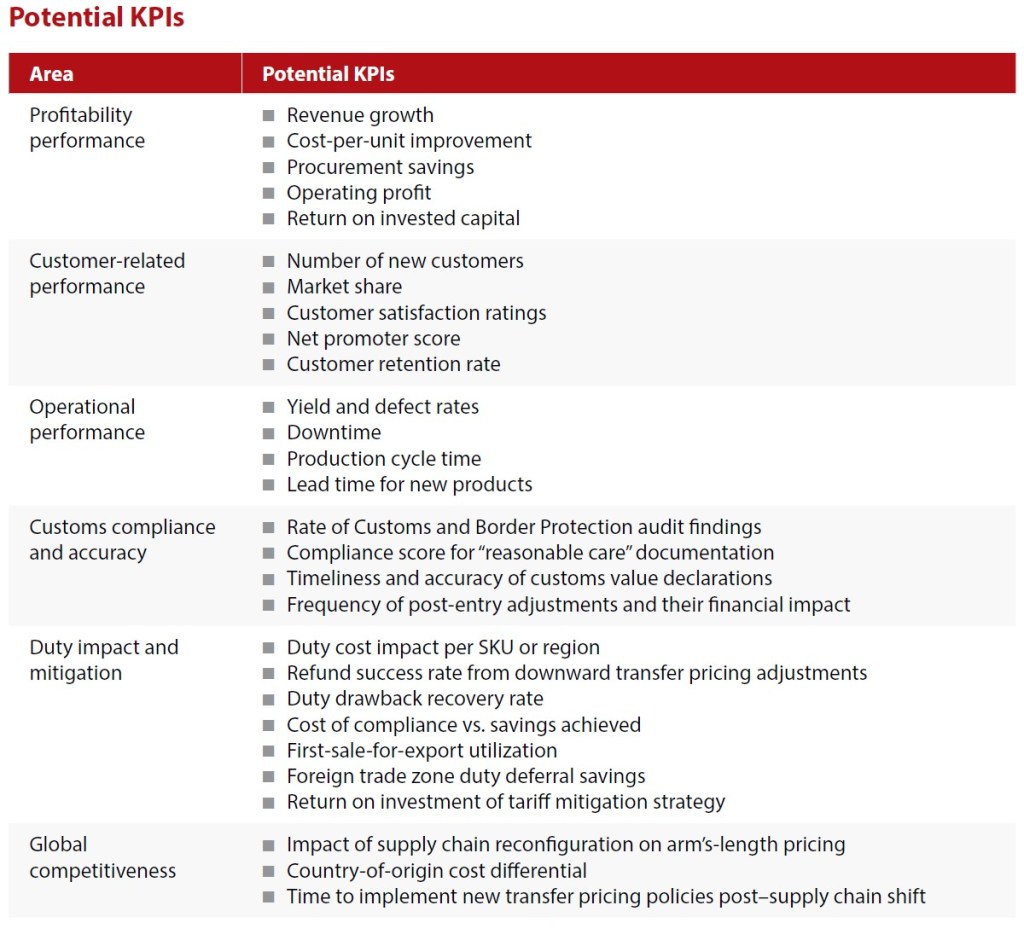

To mitigate tariff impacts, MNEs can:

- Integrate tariff sensitivity into KPIs by tracking such things as duty costs per stock keeping unit (SKU), refund rates, and customs declaration accuracy;

- Enhance customs compliance metrics, monitoring audit findings, documentation quality, and post-entry adjustments (updates to customs values after importation due to pricing changes, which may result in duty refunds or liabilities);

- Link supply chain shifts to transfer pricing adjustments, evaluating cost differences by origin and implementation speed of new transfer pricing policies; and

- Model return on investment of mitigation strategies, such as first-sale-for-export, duty drawback (a refund of duties paid on imported goods that are later exported), and foreign trade zones, using KPIs to assess cost savings and compliance costs and provide leading indicators of duty exposure. Use simulations to predict transfer pricing margins under various scenarios.

Adjusting transfer pricing to absorb part, but not all, of the added tariff burden can incentivize the subsidiaries to find operational improvements or new revenue opportunities. Incorporating KPIs relating to compliance, performance, duty mitigation, and global competitiveness with financial incentives can help achieve these goals.

DEVELOPING EFFECTIVE KPIs

Well-designed KPIs tied to compliance, performance, and competitiveness can help drive pre-transfer-pricing-adjustment profitability. Financial KPIs such as revenue growth, operating profit, and cost per unit should be linked to management incentives. Understanding what drives buying decisions — better quality, lower price, or faster delivery — can help guide KPI selection. Aligning these metrics with broader strategic objectives increases their effectiveness.

The table “Potential KPIs” offers examples of KPIs aligned with profitability goals, tariff-driven supply chain changes, and transfer pricing considerations.

There have been international cases involving using KPIs to justify profit levels for routine entities, often within broader transfer pricing benchmarking discussions. In Skechers USA Inc. II v. Wisconsin, No. 10-I-173, Wisconsin Tax Appeals Commission (7/31/15), financial KPIs such as operating margin and return on assets were central in evaluating whether the entity’s profits aligned with independent comparables. Although not a court case, China’s Bulletin 6, Administrative Measures of Special Tax Investigation and Adjustment and Mutual Agreement Procedure, in 2017 and Circular 2, Implementation Measures of Special Tax Adjustment, in 2009 emphasize that routine entities must earn reasonable profits, with KPIs commonly used to support or challenge compliance.

Example

As a hypothetical example, a foreign company relies on transfer pricing for its foreign semiconductor subsidiary that transfers components to the U.S. subsidiary for distribution. Due to the adverse effects of the TNMM-based transfer pricing policy, the subsidiaries are less motivated to optimize pre-adjustment profitability. By tailoring KPIs to each entity’s role and aligning them with transfer pricing policy, the company could drive both compliance and performance across its subsidiaries.

If the foreign semiconductor subsidiary is the tested party, the company could use KPIs to drive quality and efficiency and optimize its profitability, even in the face of uncertain U.S. tariffs. Because the semiconductor subsidiary produces semiconductors with extremely high standards for quality, good KPIs might include defect-free delivery and on-time delivery rates. Defects would be based on the specific performance characteristics needed for each type of semiconductor, such as power consumption and signal amplification. Incentive compensation tied to defects and on-time delivery would help motivate the semiconductor subsidiary to strive for continuous improvement to eliminate defective work. To help achieve this goal, the subsidiary would need to develop action plans to continuously improve its internal processes.

If the U.S. distribution subsidiary is the tested party, KPIs would focus on profitability and sales growth. Potential financial KPIs might include revenue growth, operating profit, and return on investment. Customer-focused KPIs might include market share, net promoter score, and retention rate.

Compliance and duty mitigation KPIs might include customs compliance score (e.g., audit findings and documentation accuracy), duty cost per SKU to monitor tariff exposure, refund success rate, and customs value declaration accuracy.

ACTION PLANS

To address motivational challenges of transfer pricing policies and tariff shocks, MNEs should implement targeted KPIs with built-in incentives to promote operational excellence, profitability, and compliance. Ideally, KPIs should align with the strategic priorities of the parties involved and reflect financial, operational, and customer-related performance goals.

Tax authorities may challenge KPIs that appear inconsistent with the tested party’s FAR profile. For example, sales-driven KPIs (e.g., revenue growth and/or number of new customers) for a limited-risk distributor could raise questions about whether higher profits reflect arm’s-length pricing. To mitigate the risk, MNEs should maintain legitimate documentation in advance that clearly distinguishes between KPIs for managing business performance versus transfer pricing compliance metrics.

Here are some actionable best practices in this regard:

- Proactively plan and document transfer pricing and tariff mitigation strategies, policies, and objectives.

- Differentiate between related-party and unrelated-party pricing. For related parties, the circumstances-of-sale test is required to ensure pricing is not influenced by the relationship.

- Document valuation methods in an annual reasonable-care study to confirm that transactions are at arm’s length.

- Accurately declare customs values, including off-invoice payments, royalties, assists, and selling commissions.

- Review post-entry adjustments for duty implications.

- Monitor compliance with country-specific laws, policies, and penalties.

FINAL THOUGHTS

In today’s environment of shifting tariffs and heightened scrutiny of transfer pricing practices, MNEs cannot rely on routine profit guarantees to sustain performance. Well-designed KPIs, when integrated with transfer pricing policies, can serve as both a compliance safeguard and a management tool that drives continuous improvement and innovation.

By linking financial, operational, and compliance metrics to incentives, subsidiaries remain motivated to optimize outcomes even when year-end transfer pricing adjustments equalize margins. At the same time, incorporating tariff sensitivity and customs compliance into KPI design helps MNEs anticipate shocks and respond with greater agility. Taken together, these approaches provide a practical framework for aligning tax compliance with business objectives, strengthening resilience, and ensuring that transfer pricing policies contribute not only to regulatory conformity but also to long-term enterprise profitability.

About the authors

Kip R. Krumwiede, CPA, Ph.D., CMA, CSCA, is an accounting instructor at Virginia Commonwealth University in Richmond, Va. Tae Hyoung Kim, Esq., CPA, EA, CMA, is a tax partner at Yulchon LLC, based in Korea, specializing in transfer pricing. To comment on this article or to suggest an idea for another article, contact Jeff Drew at Jeff.Drew@aicpa-cima.com.

LEARNING RESOURCE

U.S. International Tax Certificate

Get updated with the most recent international tax guidance and developments, including regulations, notices, and OECD projects.

CPE SELF-STUDY

For more information or to make a purchase, go to aicpa-cima.com/cpe-learning or call 888-777-7077.

MEMBER RESOURCES

Articles

“Strategic Trade Management in 2025: Navigating and Mitigating Tariffs,” The Tax Adviser, June 30, 2025

“Using Transfer Pricing to Blunt the Effects of Tariffs,” Tax Insider, June 10, 2025

Tax Section resources