- feature

- FINANCIAL REPORTING

IFRS 18: A fundamental redesign of financial statement presentation

The new international accounting standard is aimed at more consistent reporting that’s better aligned with how businesses are run.

Related

What CPAs should know about Trump accounts

What to know about engagement quality reviews (SQMS No. 2)

Agentic AI is handling more finance work — but can CFOs trust it?

Over the years, companies have relied on alternative performance measures (APMs) such as “adjusted earnings” or “underlying profit” to provide investors additional financial information beyond IFRS or GAAP frameworks.

While useful, these measures are often presented outside audited financial statements, making them difficult to verify or compare. In many cases, APMs presented the data more favorably than the underlying results, leaving investors without a clear, consistent view of performance.

The gaps in transparency and comparability in financial reporting drove the International Accounting Standards Board (IASB) to act by introducing IFRS 18, Presentation and Disclosure in Financial Statements. From January 2027, IFRS 18 will replace IAS 1, Presentation of Financial Statements, transforming how companies present their financial results. The objective is to modernize reporting and make it easier to compare performance across industries and jurisdictions.

IFRS 18 represents more than an incremental update: It is a fundamental redesign of financial statement presentation. The new standard is the result of years of consultation with investors, regulators, accounting bodies, and global companies, all of whom called for clearer, more consistent reporting that better reflects how businesses are run.

This article explores the case for change and why IFRS 18 is such a big change, breaks down its main requirements, and outlines potential audit risks. As well as being about compliance, it’s an opportunity for companies to rethink how financial performance is communicated, strengthen investor trust, and place finance teams at the heart of a fast-moving, data- and AI-driven world.

THE CASE FOR CHANGE: WHY IFRS 18 REPLACES IAS 1

Modern global businesses have become so complex that IAS 1’s broad flexibility simply doesn’t work effectively anymore. The result is a patchwork of reporting practices where companies in different sectors, or even within the same industry, present their results in completely different ways, making comparisons frustratingly difficult.

At the same time, the use of APMs (“adjusted EBITDA,” “underlying profit,” etc.) is a common practice. Sitting outside audited financials, they can distort revenue instead of making things clearer.

And then there’s the digital age. Investors and analysts now expect real-time, data-driven insights of company performance. That only works if the numbers are built on standardized subtotals that can be trusted and that technology platforms can process consistently.

IFRS 18 directly addresses these challenges.

One of the most visible shifts is the newly structured income statement, which separates day-to-day operating activities from investing and financing. With the new structure, readers of financial statements can clearly see where a company is generating revenue and where those resources are being deployed.

Equally significant is the new treatment of management-defined performance measures (MPMs). They must now appear within the financial statements, rather than being buried in unaudited commentary, and be reconciled directly to IFRS-defined figures. For investors, this removes the guesswork in bridging official numbers with management’s own performance narrative.

The standard also reinforces the link between the primary statements and the notes, allowing users to move more easily from the big picture to the finer details without losing context.

CHANGES INTRODUCED IN IFRS 18

The changes IFRS 18 brings reshape not only how companies present their numbers but also how investors interpret them. At the core of the new standard is an overhauled income statement. Under IFRS 18, companies must present income and expenses in the profit and loss (P&L) statement under three main new categories — operating, investing, and financing — as well as the existing categories of income tax and discontinued operations. A company’s main business activities will drive the classification of income and expenses.

Operating activities cover the core business: sales, cost of goods sold, and routine expenses. Investing captures returns generated independently of day-to-day operations, such as income from joint ventures or investment properties. Financing, meanwhile, reflects the cost of raising funds, including interest payments and loan-related charges.

This categorization will apply to most companies. However, for some businesses, such as banks or insurers, financing and investing activities are part of their core operations. In those cases, income and expenses that would typically fall under “investing” or “financing” for other companies are included in the operating category instead.

Alongside these categories come two new mandatory subtotals that every company must disclose. The first is operating profit or loss, which isolates results from core activities before financing and tax. The second is profit or loss before financing and income tax, which allows for easier cross-company comparisons by stripping out the effects of capital structure and tax regimes.

MANDATORY AND CONSISTENT LINE ITEMS

IFRS 18 also focuses on consistency. All reports must use standardized labels and line items, reducing ambiguity and improving comparability.

As such, companies face a practical but important choice in how they present operating expenses: by function (such as cost of sales or administrative costs); by nature (e.g., salaries, depreciation, or utilities); or a mix of the two. Whichever method is adopted, it must be explained clearly and applied consistently year after year.

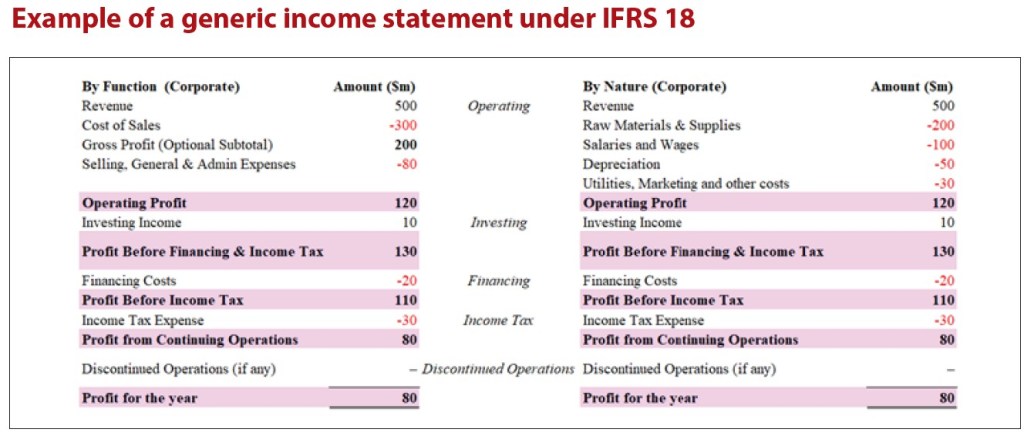

The chart “Example of a Generic Income Statement Under IFRS 18” shows a P&L statement for a generic company and shows expenses presented by function and by nature.

This side-by-side view of the two individual approaches shows how the same company’s results can look very different depending on the approach. While the end results are the same, an $80 million profit for the year, the route to get there breaks it down differently.

The by-function format draws attention to cost of sales and gross profit, spotlighting performance indicators that analysts and investors rely on to judge operational efficiency in manufacturing and retail sectors.

The by-nature format, in contrast, highlights the underlying cost drivers of salaries, depreciation, and raw materials, which often provide more relevant insights for service or technology-based companies.

FUNCTION VS. NATURE: CHOOSING THE RIGHT APPROACH

The way a company presents expenses directly impacts how the company’s financial performance is understood, and under IFRS 18, that choice carries even greater weight.

IFRS 18 does not dictate which method to use. What it does require is that companies explain their choice and apply it consistently. The decision should reflect the underlying business model and ensure the financial statements tell the clearest possible story to investors.

Guidance from the IASB also recognizes that, in some circumstances, using a mixed approach by presenting some expenses by function and others by nature may give the most useful summary of a company’s cost drivers and profitability.

If a company chooses to disclose expenses by function or mixed presentation, then IFRS 18 has some additional disclosure requirements in the notes to the financial statements.

Ultimately, the guiding principle is usefulness for investors — expenses should be classified in the way that best helps them understand what drives profitability and forecasts future performance.

MANAGEMENT-DEFINED PERFORMANCE MEASURES (MPMs)

As noted earlier, historically, companies have shown their performance using APMs, which are difficult to verify and compare across companies. IFRS 18 brings MPMs into the audited financial statements for the first time. MPMs are defined as subtotals of income and expenses not required or specifically exempted by IFRS, which are included in public communications outside of financial statements and are measures that communicate management’s view of a company’s financial performance.

The standard requires companies to reconcile each MPM to the nearest IFRS-defined subtotal and to explain any adjustments, such as restructuring costs, in clear, accessible language. In addition, companies must disclose the related tax effects and the impact on noncontrolling interests for each adjustment. Crucially, because these measures now form part of the financial statements, they are subject to audit procedures, which enhances their credibility and gives investors greater confidence in the numbers they rely on (see the sidebar “MPM Disclosures Under IFRS 18 — Do’s and Don’ts”).

NEW DISCLOSURE REQUIREMENTS UNDER IFRS 18

IFRS 18 introduces significant enhancements to disclosure requirements aimed at improving the clarity and usefulness of financial information:

Detailed aggregation/disaggregation: Companies now need to explain clearly in the notes how they’ve grouped or broken out items in the accounts. This helps investors see why certain costs are shown together and why others are split out, giving a clearer picture of what really drives performance.

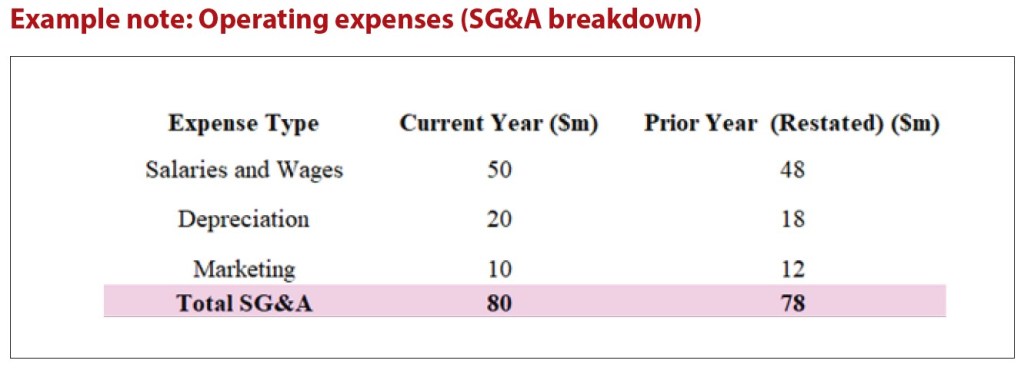

Reconciliation across statements: The selling, general, and administrative expenses (SG&A) total of $80 million shown in the chart “Example Note: Operating Expenses (SG&A Breakdown)” must line up with both the income statement and the cash flow statement, so readers get a consistent picture.

In addition, each line item in the primary statements must now link directly to its corresponding note, making it easier to move from headline figures to supporting detail.

Materiality: If costs are very different in nature or risk, they need to be shown separately.

Change from prior year: What used to sit under “other expenses” is now broken out in more detail.

Mandatory reconciliations: Companies now need to show how subtotals like operating profit link to other performance metrics, including cash flow and segment data.

MPM-specific disclosure: If management wants to present adjusted figures, those must now be reconciled to IFRS-defined subtotals, with the tax and ownership effects of each adjustment made explicit. For investors, that removes the ambiguity that once came with unaudited commentary and places these measures firmly within the scope of audit scrutiny.

TOP AUDIT RISKS UNDER IFRS 18: WHERE IMPLEMENTATION CAN GO WRONG

With IFRS 18, the biggest risks lie in how companies put it into practice. If management’s adjusted measures don’t reconcile clearly to audited numbers, investor confidence will fade. And when firms flip between expense classifications, it doesn’t just confuse the accountants, it frustrates analysts and investors who are trying to make like-for-like comparisons.

Many finance systems just weren’t built with this level of granularity in mind. So, what happens? Teams often end up putting disclosures together at the last minute, usually against tight deadlines, which can leave the numbers looking more like patchwork than a clear financial story. Add to that notes that don’t properly point back to the primary statements, and you’ve got investors trying to make sense of limited information.

And then there’s the classic mistake: waiting too long to bring auditors or regulators into the conversation. By the time you do, time pressures rise and judgment calls become rushed, a rush that could have been avoided with a few early conversations.

EPS AND SEGMENT REPORTING IMPACTS

IFRS 18 impacts related standards, notably IAS 33, Earnings Per Share, and IFRS 8, Operating Segments.

For earnings per share (EPS), the calculation under IAS 33 continues to use profit or loss attributable to ordinary shareholders. What changes is the need to align this with the new IFRS 18 subtotals, such as profit before financing and income tax. Companies must reconcile EPS back to these figures, and if they present alternative measures such as adjusted EPS, these will either need to reconcile directly to audited subtotals or be disclosed as MPMs. The result is greater consistency and clarity.

Segment reporting under IFRS 8, Operating Segments, is also tightened. Segment profit or loss must now be presented using the same operating, investing, and financing categories that appear in the primary financial statements. This means that margins such as operating margin or EBITDA will need to reconcile directly to audited subtotals. For analysts, this alignment reduces confusion and makes it simpler to connect segment-level performance with overall company results.

OTHER STANDARDS AFFECTED BY IFRS 18

IAS 7, Statement of Cash Flows

One of the most important changes affects the starting point for entities using the indirect method of cash flow. Instead of the vague “profit or loss,” companies must now begin with operating profit as defined under IFRS 18. This anchors cash flow reporting more directly to the income statement.

The classification of interest and dividends is also more prescriptive. For most entities, interest and dividends paid is presented within financing activities, while interest and dividends received falls under investing activities. However, for banks, insurers, and other entities whose business model centers on investing or lending, classification must follow the treatment in the income statement with each type of cash flow presented consistently in a single category. These refinements strengthen both clarity and comparability, giving investors a clearer bridge between income and cash flows.

IAS 8, Basis of Preparation of Financial Statements

Another structural shift is the relocation of core presentation principles from IAS 1 into IAS 8. These include fair presentation and compliance with IFRS, the going concern assumption, the accrual basis of accounting, and accounting policy disclosures. While the principles themselves remain unchanged, this move, accompanied by a retitling of IAS 8 to Basis of Preparation of Financial Statements, is intended to improve clarity, reduce duplication, and align presentation requirements with IFRS 18’s revised structure.

IAS 34, Interim Financial Reporting

IFRS 18 also extends its influence into interim reporting. Companies must now include MPMs within interim financial statements, not just annual reports. This ensures that investors have consistent, audited insights into management’s key performance metrics throughout the year, rather than waiting until year end.

STRATEGIC BENEFITS OF EARLY IFRS 18 ADOPTION

IFRS 18 is not just another accounting update — it’s a chance to reset how companies communicate performance. Those who start early will find themselves with cleaner reporting and stronger comparability and have deeper trust with investors.

Yes, the transition will take effort: Systems must be updated, disclosures reworked, and comparatives restated. But the upside is clear. Done well, IFRS 18 delivers greater transparency, sharper insights, and a finance function equipped to guide decision-making in a constantly changing environment.

This is about more than compliance. It’s an opportunity to modernize reporting, reinforce credibility, and place finance at the heart of corporate value creation.

MPM disclosures under IFRS 18 — Do’s and don’ts

Do:

- Provide clear reconciliations and show your work: Link each MPM (e.g., adjusted operating profit) directly to the nearest IFRS-defined subtotal.

- Be upfront and explain adjustments transparently: Keep explanations clear and simple.

- Show the knock-on effects: Don’t forget to disclose the impact on tax and noncontrolling interests, if material.

- Include within audited statements: Make sure MPMs appear within the audited statements, not just in a presentation.

- Maintain consistency: Use the same definitions year after year and clearly explain if something changes.

Don’t:

- Dress up regular costs as “nonrecurring”: Investors will spot it, and it undermines trust.

- Bury MPMs in press releases: They belong in audited financial statements.

- Play with multiple definitions: Stick to one calculation per measure and flag any methodology tweaks.

- Leave out the links: Always cross-reference reconciliations back to subtotals and relevant notes.

About the authors

Daniel Prendergast, FCMA, CGMA, is technical director—Professional Qualification, and Christian Gagiano, ACMA, CGMA, is associate technical director—Professional Qualification, both at the Association of International Certified Professional Accountants. To comment on this article or to suggest an idea for another article, contact Jeff Drew at Jeff.Drew@aicpa-cima.com.

LEARNING RESOURCES

Seasoned CFOs from across the country will gather at the Fontainebleau in Miami Beach to provide the latest innovations and anticipated trends to keep you on the cutting edge.

April 13–15

CONFERENCE

The biggest event in the accounting profession will celebrate its 10th anniversary at the ARIA in Las Vegas. Don’t miss it!

June 8–11

CONFERENCE

For more information or to make a purchase, go to aicpa-cima.com/cpe-learning or call 888-777-7077.