- feature

- CORPORATE FINANCE

Using data to optimize marketing and sales strategies

CPAs who want to drive greater profitability and growth must understand customer acquisition costs and customer lifetime value.

Related

AI early adopters pull ahead but face rising risk, global report finds

Talent shuffle: Why people want to change jobs and how leaders can adapt

Looking to land a CFO role? 2025 was a good year

Does your business spend too much or too little on sales and marketing? And is that money spent in the right places? To answer these questions, you need to know how much it costs to acquire and retain customers relative to their purchases.

Understanding customer acquisition cost (CAC), customer lifetime value (LTV), and their interdependent relationship is pivotal for strategic business planning. Accountants and finance professionals willing to access and compute the data can gain actionable insights to optimize marketing and sales strategies and guide the business toward greater profitability and growth.

But common challenges and potential pitfalls lurk along the way.

UNDERSTANDING CUSTOMER ACQUISITION COST

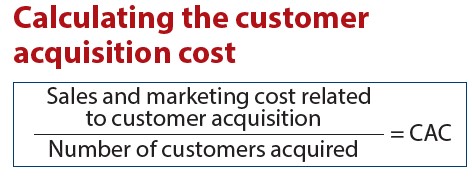

CAC, which is the average cost to acquire a customer, is computed by dividing total sales and marketing costs for a period by the number of customers acquired in that period. (See the box “Calculating the Customer Acquisition Cost,” below.)

Not all marketing expenses directly contribute to customer acquisition. In practice, the CAC tracked is the variable media cost to run specific ads targeting new customers. Digital marketing platforms, such as Google and Facebook, provide tools to compute these metrics based on your spend on their platform.

For forms of traditional marketing like print, radio, or TV, the total cost to develop and run these ads is divided by the total number of customers acquired.

ATTRIBUTION TO A MARKETING CAMPAIGN

Businesses often run multiple marketing campaigns across various media simultaneously. Determining which campaign led to a customer’s acquisition can be complex. The prevailing method is “last touch attribution,” which means you credit the final campaign a customer interacts with before their purchase.

SEGMENTING CAC

More detailed analysis can be achieved through segmentation based on marketing channels, customer types, geographic regions, or demographics such as gender or age. Most of the digital marketing platforms allow you to specifically target these demographics and track the cost to acquire these customers. You are limited only by your imagination and the available data.

Segmentation enables targeted analysis and strategic decision-making, but it requires caution to ensure segments are sufficiently large to yield reliable insights. You could hypothetically narrow your segmentations and find that you acquired two female customers at a low price. But because only two female customers were acquired at this price, you can’t draw the conclusion that all female customers can be acquired at the same price.

Once you start computing CAC by segment, you will learn that certain types of customers are cheaper or more expensive to acquire than others. This information by itself is nice to know but not necessarily actionable. Just because a certain type of customer is cheaper to acquire does not mean you should focus the business on that type of customer. To make CAC useful, you need to move to the next step in the process, which is to understand the lifetime value of customers.

UNDERSTANDING CUSTOMER LIFETIME VALUE

LTV is a projection of the total financial value from a customer relationship lens. It is the present value of the average gross profit a customer relationship will generate over its lifespan.

LTV is computed by looking at specific cohorts of customers’ historical revenue and gross profit data by month to predict how future customers with similar characteristics will behave. Usually, a cohort of customers is tracked based on the month they became a customer along with other segmentation based on marketing channels, customer types, geographic regions, or demographics such as gender and age.

As you dive into LTV segments, as with CAC, ensure your LTV segments are sufficiently large to yield reliable insights.

Also, it is important to note that the cost of acquiring a customer is not considered a cost in computing LTV. This is because there are multiple ways of acquiring a customer and those costs can vary. Ultimately, the LTV-to-CAC ratio will guide these decisions.

THE SIGNIFICANCE OF PRESENT VALUE IN LTV

For customer relationships extending beyond a year, incorporating the time value of money by calculating the present value of future gross profits is crucial. The discount rate typically used is the weighted average cost of capital (WACC), which is a complex measurement that in many cases is not known.

If you have recently had a business valuation done by an actuarial firm, WACC can be found in that valuation report. If a valuation report is unavailable, then you can approximate WACC by using the 10- year U.S. Treasury risk-free interest rate plus an equity risk premium of between 3% and 15%, depending on how the business is capitalized and its lifecycle stage.

WHY GROSS PROFIT MATTERS FOR LTV

Using gross profit for LTV calculations ensures that direct costs are accounted for, providing a more accurate representation of a customer’s value. This highlights the importance of not only generating revenue but doing so efficiently.

Many reputable sources describe the calculation for LTV using only gross revenue without considering the direct costs of that revenue. This is correct for businesses with no direct costs to generate revenue, but, for most businesses, ignoring the costs of revenue leads to erroneous LTV computations.

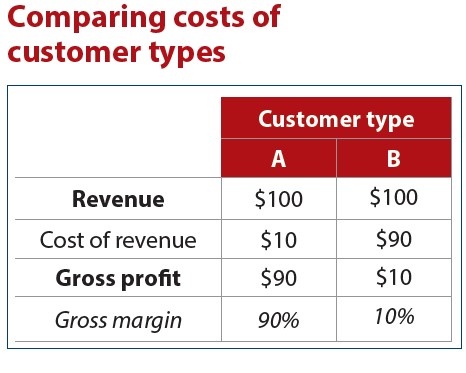

To illustrate this common flaw, let us consider two hypothetical customer types. Both have $100 of lifetime revenue, but customer type A has a gross margin of 90% and customer type B has a gross margin of 10%. If you are spending $30 to acquire these customers, all else being equal, your business will grow if you are acquiring type A customers and will fail if you are acquiring type B customers. (See the table “Comparing Costs of Customer Types,” below.)

A SAMPLE LTV FINANCIAL MODEL

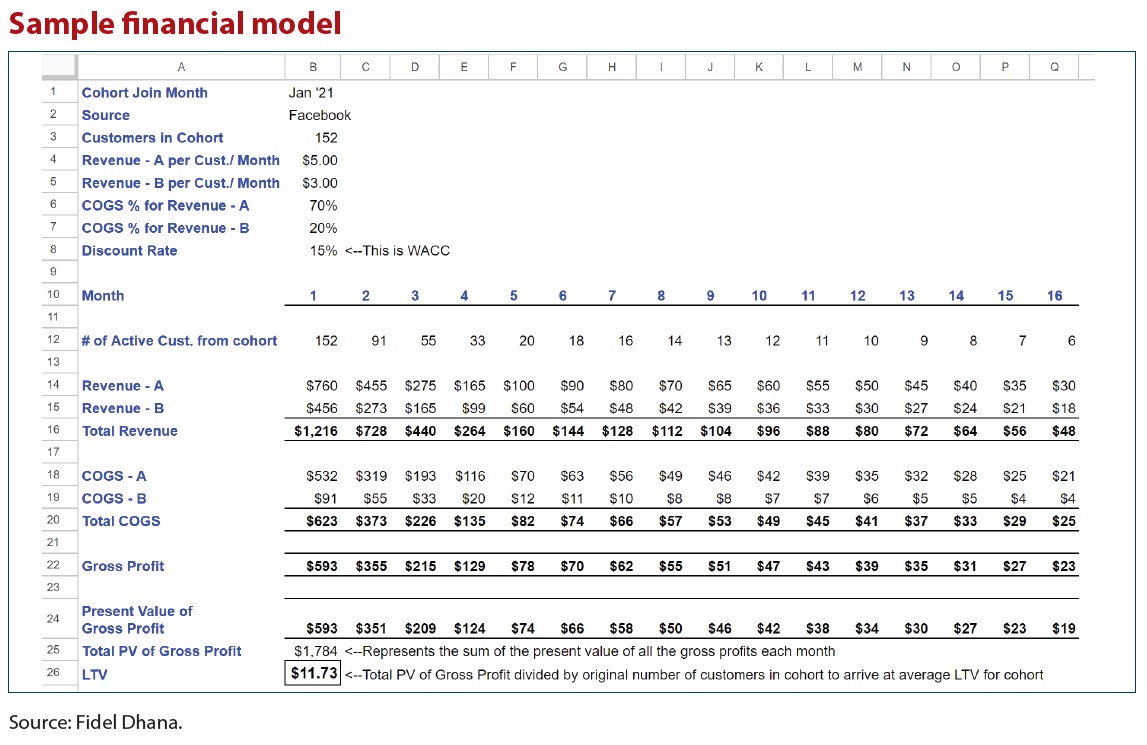

Let’s take a hypothetical financial model that tracks 152 customers acquired on Facebook in January 2021 over the subsequent 15 months. Over time, the number of active customers declined from the original 152 to six. Financial models can be extended out for many months, but with fewer active customers in the cohort and the time value of money, the impact on the average LTV of the cohort is diminished.

Typically, a financial model like this is built for each cohort month, and then an overall average for customers from the marketing channel is computed. In the sample shown in the table “Sample Financial Model,” below, the LTV for a customer sourced on Facebook is $11.73.

COMPUTING THE LTV-TO-CAC RATIO

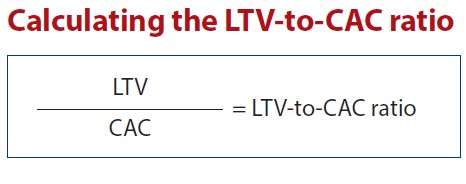

Once you have computed the LTV and the CAC, you can compute the LTV-to-CAC ratio, which is considered the holy grail of metrics for managing a company’s growth. (See the table “Calculating the LTV-to- CAC Ratio,” below.)

Theoretically, as long as your LTV is greater than your CAC, you should spend every incremental dollar to acquire customers. In practice, most companies target an LTV-to-CAC ratio of 3, which means spending about a third of their LTV on acquiring customers. The rule of thumb is if your LTV-to-CAC ratio is above 3, then you should be spending more to acquire additional customers. And if your LTV-to-CAC ratio is below 3, you need to adjust your marketing campaigns and/or spend less to bring the ratio in line.

Startups with products that are not well known in the marketplace may have to endure LTV-to-CAC ratios of below 3 for some time until their products become more widely known. Also, new marketing campaigns on digital platforms like Facebook and Google can take a while to optimize. During this time, your LTV-to-CAC ratio could be much lower than 3.

CONSIDER MARKET POTENTIAL

Once you know your LTV-to-CAC ratio, the next thing to consider is market size potential. Assessing the market potential of various customer segments can reveal opportunities for significant growth, even if some segments have lower ratios but larger market sizes.

Based on your segmentations, you may find a niche group of customers with a high LTV-to-CAC ratio, but with a small total market potential that is insufficient to materially change your business. A group with a lower LTV-to-CAC ratio but a larger market size may offer the potential to dramatically change the business’s growth trajectory.

Optimization of your marketing efforts will leverage many of the familiar management accounting concepts. For starters, resources should be allocated first to marketing campaigns that focus on the segments with the highest LTV-to-CAC ratios and high-market potential. This will ensure the highest rate of return for marketing dollars.

Additionally, you may choose to focus on improving the LTV of a customer segment. This can include increasing revenue per customer, introducing new revenue streams to existing customers, increasing gross profit per customer, retaining customers longer, and figuring ways to lower the discount factor (WACC), such as shifting the capital structure from equity to debt.

About the author

Fidel Dhana, CPA, MBA, is CFO at Zumba Fitness LLC. To comment on this article or to suggest an idea for another article, contact Jeff Drew at Jeff.Drew@aicpa-cima.com.

LEARNING RESOURCES

ENGAGE 25

Don’t miss out on the biggest event in the accounting profession, AICPA & CIMA ENGAGE 25, to be held at the ARIA in Las Vegas.

June 9–12

CONFERENCE

MBAexpress: Masterful Marketing — V 2.0

This course discusses various methods of lead generation, investing in your people, the importance of branding, and the use of social media.

CPE SELF-STUDY

The Most Essential Growth Strategies [BLI / Boomer Firm Success Series]

In this course, you will learn how to develop clear messaging about your firm’s services, the essential ingredients you need for effective digital marketing, and how to turn leads into clients.

CPE SELF-STUDY

Value Analysis

Understand how to create higher value for customers at a lower cost.

CPE SELF-STUDY

For more information or to make a purchase, go to aicpa-cima.com/cpe-learning or call 888-777-7077.

AICPA & CIMA MEMBERS RESOURCES

Articles

“Valuing Customers: Part 1 — Profitability Based on Past Performance,” FM magazine, Oct. 19, 2022

“Valuing Customers: Part 2 — Predicting Customer Lifetime Value,” FM magazine, Oct. 20, 2022