- feature

- AUDITING

Using technology to boost audit quality

With tools such as artificial intelligence, auditors can implement new processes that enhance effectiveness and efficiency.

Related

Differentiating agentic and generative AI — and more with a Tech Q&A author

Change at the top: PCAOB will feature new chair, 3 new board members

How to prevent late-stage engagement quality review surprises

TOPICS

Samantha Bowling, CPA, CGMA, knows a thing or two about how accounting firms can use technology to boost audit quality.

As managing partner at Upper Marlboro, Md.-based Garbelman Winslow CPAs, Bowling spearheaded the firm’s implementation of artificial intelligence (AI) to identify high-risk transactions.

As chair of the AICPA Auditing Standards Board (ASB) Technology Task Force, Bowling leads a group of volunteers dedicated to developing examples of how to use technology to transform audit processes, resulting in higher quality audits.

“It’s about transforming what you do to be more effective and eventually more efficient,” said Bowling, whose firm has been recognized as a leader in AI usage despite having fewer than 20 employees. “You should not adopt technology to do the same process you did last year faster. The efficiency happens when you transform how you audit and elevate your team to a higher level of thinking.”

This article, the first in a four-part series (see the box “Looking Ahead” at the end of this article), identifies the incentives for using technology in an audit. The article also provides findings from an ASB survey on the impediments to technology use in audits, one of many steps the ASB has taken to understand and support technology transformation of the audit.

TRANSFORMING THE AUDIT

In the recent past, the typical delivery of the audit was document-checklist driven. Cloud and other technologies, notably AI and data analytics, have allowed for the audit to be delivered more efficiently and effectively.

Today, auditors are moving into the next stage of audit transformation, as shown in the graphic “AICPA/CPA.com Audit Transformation Maturity Model” (below). There will be further advances — and deeper insight into engagements — as auditors embrace fully integrated, knowledge-driven approaches that are technology-enabled through AI and other technologies.

The AICPA has been promoting the use of technology to transform the audit process for years. As part of that effort, the AICPA has teamed with CPA.com, several large accounting firms, and technology partner Caseware International to develop the Dynamic Audit Solution (DAS), an initiative that brings together data-driven methodology, guided workflow tools, and data analytics into a single, cloud-based platform. Several top 100 firms are using DAS now, and the service is expected to become generally available soon.

At the same time, a recent practice aid from the ASB’s Technology Task Force, “Use of Technology in an Audit of Financial Statements,” helps auditors with tailoring their risk assessment. The practice aid describes and illustrates through examples how technology can improve audit effectiveness and efficiency, with an initial focus on the risk identification and assessment process under Statement on Auditing Standards (SAS) No. 145, Understanding the Entity and Its Environment and Assessing the Risks of Material Misstatement.

IMPROVING PLANNING AND PROCESSES

SAS No. 145 requires firms to gain an understanding of the entity’s use of technology relevant to the preparation of the financial statements, and it has a direct impact on how they plan the audit by tailoring audit programs and designing audit procedures that are responsive to the assessed risk, Bowling said. For example, when a client adopts a new technology, firms can’t just repeat past audit processes because they may no longer be appropriate. Instead, firms need to know technologies well enough to see how they affect client workflow and then adjust audit procedures accordingly. In this way, SAS No. 145 opens opportunities for auditors to use technology to analyze data and transform how they audit.

Bowling, for instance, finds AI to be a valuable tool in the planning and initial risk assessment stage of the audit. Whereas some auditors may plan and conduct initial risk assessments using traditional techniques (checklists and minimal technology use), AI analyzes risk in client data and provides Bowling with insights she uses to refine her audit plan for each client. The ability to more specifically identify risk allows auditors to develop procedures to target those risks rather than perform generic audit procedures that may be more time-consuming and costly and aren’t calibrated for high-risk areas.

AI technology can also improve information-gathering capability, especially in complex audits, according to Patricia Willhite, CPA, senior audit manager at CapinCrouse, a 200-employee firm that specializes in serving not-for-profits.

“A process improvement can make us faster and reduce the time we spend,” Willhite said. With her government clients in particular, technology-driven efficiencies can make it easier to monitor and address new rules as they are added in this highly regulated field.

HOW STAFFING IS AFFECTED

AI technology can help newer staff members develop a keener eye while augmenting their existing knowledge, Bowling said. For example, not only can the technology take over much of the work of choosing sample selections, it can also allow staff to learn from the software by seeing what control points are triggered when the technology highlights a high-risk transaction. “Using the software provides the ‘why’ behind the audit process,” she said.

And when firms support a staff member in their role as the technology-innovation champion with appropriate compensation and the ability to celebrate successes and failure, they will reap the benefits, according to Bowling. “A culture of innovation and fixing what is broken generates a contagious enthusiasm among staff for change,” she said.

At the 220-employee firm Smith and Howard in Atlanta, one audit senior manager with an interest in technology has become the internal IT expert, with the firm supporting her efforts by reducing her billable hours requirement. “Many firms have someone who can take on this role,” said Sean Spitzer, CPA, the firm’s president, “but you have to give them the time and space to do it.”

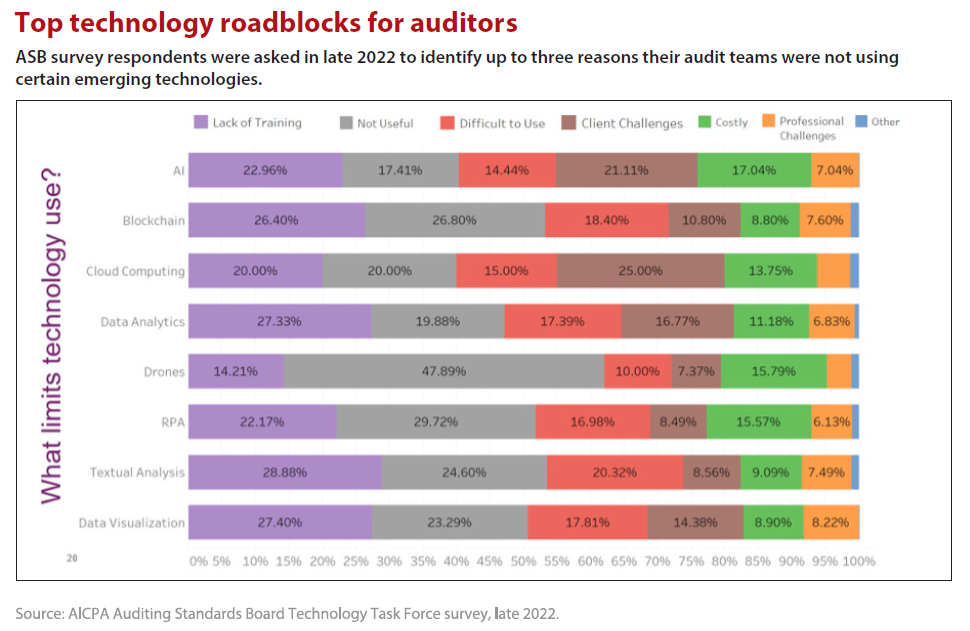

SURVEY: BARRIERS TO TECHNOLOGY USE

The ASB survey conducted late last year sought to identify barriers that prevent auditors from making use of IT, including emerging technologies. Nearly 60% of respondents came from firms with 50 or fewer professionals; of these, almost half came from firms with fewer than 10.

In designing the survey, a key question for the ASB was whether auditors believed that U.S. generally accepted auditing standards (GAAS) hindered their use of technology in an audit. As the chart “What Limits Technology Use?” (below) shows, few respondents identified GAAS as a stumbling block. While impediments varied by technology type, respondents named the following as the most common hurdles:

- A lack of training and infrastructure within the firm. This was the top reason given for not using textual analysis (29%), data analytics and data visualization (27% each), and AI (23%).

- Doubts about the usefulness of a particular technology in the engagement. This was the reason auditors most often cited for not using drones (48%), robotic process automation or RPA (30%), and blockchain (27%).

- The cost of the technology. AI (17%), drones and RPA (16% each), in particular, were seen as too expensive.

WHAT TECHNOLOGIES FIRMS ARE USING

The survey revealed several tiers of technology use. Most respondents were using cloud technology, mainly for planning, audit documentation, journal-entry testing, confirmations, and tests of details as well as collaboration and information-sharing.

Data analytics and data visualization were the next most often used technologies, with data analytics put to work in journal-entry testing and data visualization used mostly for planning, risk assessment, audit documentation, and substantive analytical procedures. AI and textual analysis were employed generally for journal-entry testing and audit documentation, respectively, but they were (like some other technologies) infrequently used.

A total of 17% of respondents reported using no emerging technology included in the survey.

Overall, the survey results suggest there are opportunities for firms to use emerging technologies on audit engagements and strategies that firms can implement to overcome barriers in technology use.

As the profession embraces emerging technology and technology transformation, CPAs are adapting new ways to conduct their audits.

Looking ahead

Forthcoming articles in this four-part series will cover the following topics:

- February: Artificial intelligence

- March: Data analytics and data visualization

- April: Change management

About the authors

Anita Dennis is a New Jersey-based freelance writer. J. Gregory Jenkins, CPA, Ph.D., is the Ingwersen Professor in the School of Accountancy in the Harbert College of Business at Auburn University. To comment on this article or to suggest an idea for another article, contact Jeff Drew at Jeff.Drew@aicpa-cima.com.

AICPA & CIMA RESOURCES

Articles

“How 3 Firms Tackle the Audit Talent Crunch,” JofA, Sept. 1, 2023

“An Updated Practice Aid and How It Can Assist in Audits of Digital Assets,” JofA, Aug. 31, 2023

“AICPA Debuts New Practice Aid for Tech-Enabled Auditing,” JofA, July 27, 2023

“5 Ways Firms Can Use Technology to Transform Audits,” JofA, Dec. 20, 2022

Tool

Enhance your risk assessment procedures with the use of automated tools and techniques in the auditor’s risk assessment.

CPA.com insights and research

Leverage cutting-edge tools and technology to modernize your A&A practice.

For more information or to make a purchase, go to aicpa-cima.com/cpe-learning or call 888-777-7077.