- feature

- AUDITING

What AI can do for auditors

Firm leaders explain why they are using artificial intelligence to transform audits and how they are handling barriers to AI adoption.

Related

AI early adopters pull ahead but face rising risk, global report finds

COSO creates audit-ready guidance for governing generative AI

Auditing Standards Board proposes changes to attestation standards

Artificial intelligence (AI) is a technology that auditors are exploring, but they may not yet be reaping all the benefits it can offer

In an audit, AI can be used in a variety of ways, including performing journal entry testing by identifying unusual transactions among a large pool of unstructured data and analyzing those transactions for patterns and anomalies. AI can also be used in the audit’s planning phase and when performing risk identification and assessment procedures. AI can process large amounts of data (such as reading bank statements and legal contracts) and reconcile accounts many times faster than a human auditor can — and with fewer errors. Using AI-powered technology tools, the auditor can move beyond traditional practices to more efficiently analyze client information and more easily identify risk, thereby enhancing audit quality.

The AI technologies referenced in this article should not be confused with generative AI tools such as ChatGPT (see the sidebar “What Is AI?” at the bottom of this article).

WHY FIRMS USE AI IN AUDITS

Although many firms, particularly smaller ones, have not yet put AI to work in audits, there are numerous reasons to do so.

Overall efficiency is among the benefits. Efficiency can have a negative connotation in audits, according to Danielle Supkis Cheek, CPA, vice president of strategy and industry relations, MindBridge Analytics Corp., because it can be misunderstood to mean that the audit process may have been substandard or poorly performed. However, Cheek believes that an efficient audit is based on enhanced planning and better use of finite resources. “It means that you haven’t spent time on areas that don’t merit it,” she said.

That’s possible in part because AI can minimize the risks of over-testing. In performing anomaly detection using traditional audit methods, “you’re trying to find a needle in a haystack when you perform sampling,” said Alan Anderson, CPA, founder and president of ACCOUNTability Plus LLC, which consults on accounting and assurance advancement. “AI can give you 100% of the population, which makes anomaly detection extremely reliable when it’s based on proper parameters set by the auditors.”

AI can change the paradigm of the auditor’s approach to gathering and testing data from an IT system. Data may come from the audit client’s ERP systems and ancillary accounting systems (such as point-of-sales systems, expense report systems, and payment approval systems). The auditor usually requests components and, in some cases, all of the data from these systems. However, with AI technology, auditors can now request a full dataset and derive many of the needed sub-datasets and not worry about the inability to analyze the full dataset, said Cheek, who is also a member of the AICPA Auditing Standards Board (ASB). AI can also analyze the data, which helps the auditor more appropriately refine the scope and planning of the audit to focus on procedures that are more responsive to actual risk, she said.

For example, AI can completely transform journal entry testing, according to Cheek. An idea could be to change the order of operations of the audit to find the high-risk items first. Using AI and looking at full population testing, it’s possible to perform journal entry testing very early in the audit, such as when the initial risk assessment is performed, Cheek said. This may allow auditors to look at the highest-risk transactions first. In some cases, with the higher-risk transactions that were already subjected to some journal entry testing procedures, there may be potential to reassess some significant balances or classes of transactions to tailor the nature, timing, and extent of procedures to be more responsive to the actual residual risk for some parts of the audit.

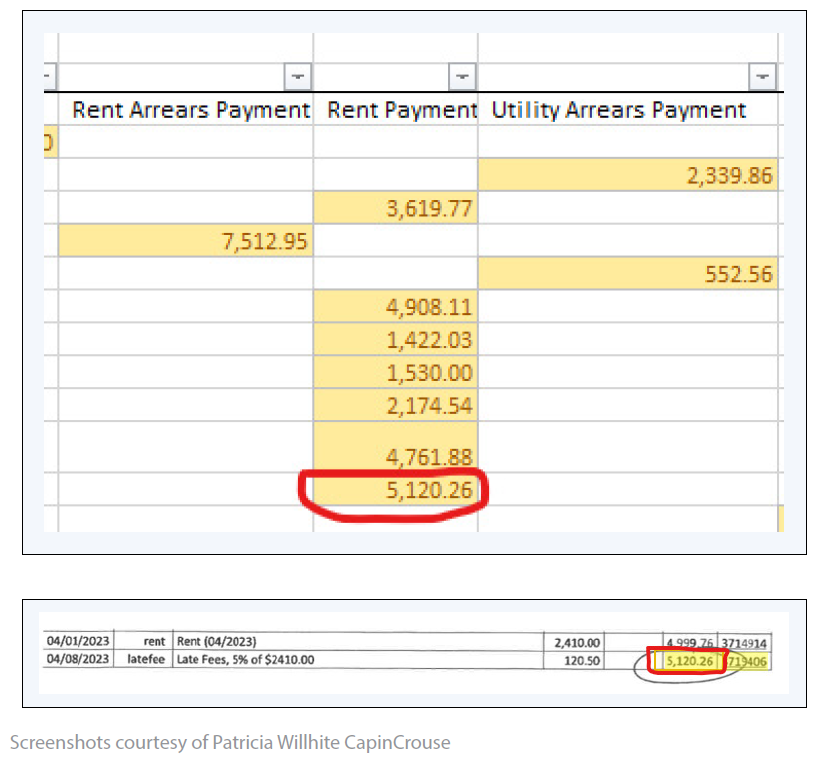

AI can also perform more targeted information gathering. In her audits, Patricia Willhite, CPA, senior audit manager at 200-employee firm CapinCrouse, uses DataSnipper, an intelligent automation platform that uses Excel, to link significant volumes of data from distinct PDFs from a client workbook into one testing workbook. Auditors can then use automated formulas to identify an irregularity. Clicking on a cell takes the reviewer to the underlying source document, where they can check data accuracy, and any user can easily see where the data came from (see the image “Hyperlinking to Underlying Source Documents,” below). In using it, “we’ve reduced testing and training time and improved quality, all quite substantially,” Willhite said.

At the 220-employee firm Smith and Howard in Atlanta, auditors use AI in their 401(k) audits to quickly gather information from a third-party administrator’s site and upload it to the firm’s network so that staff can easily access it in one place, said Sean Spitzer, CPA, the firm’s president. Previously, they had to get passwords to the site, log in, and find the data.

OVERCOMING BARRIERS

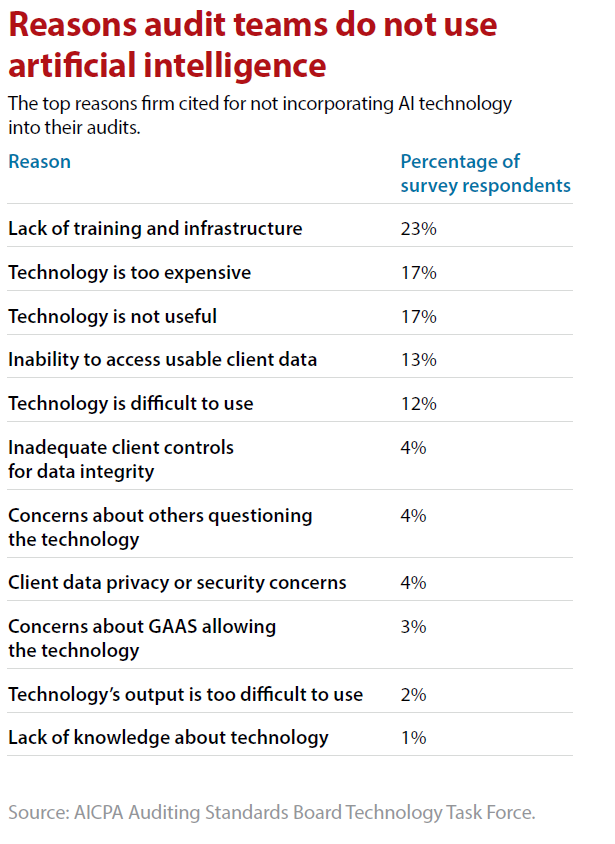

The ASB — which issues standards; guidance; and auditing, attestation, and quality control statements to CPAs — surveyed small and midsize firms in late 2022 to understand any barriers to technology use in the audit.

The results can be seen in the table, “Reasons Audit Teams Do Not Use Artificial Intelligence,” below.

How can firms clear barriers to incorporating AI into their audit processes? Here are some suggestions, starting at the top.

Get leaders on board; test with R&D audits

Firm leadership — regardless of firm composition and size — must understand the value of AI technology, including the opportunity costs of not adopting it, and make a commitment to transformation.

It is essential that firm leadership be strategically aligned on the need to invest significant financial resources into digital transformation. That type of commitment will help clarify the technology’s usefulness and the value of making necessary changes in training and infrastructure.

In evaluating the value of a transformative technology, one of the biggest barriers for firms is not knowing what they don’t know, according to ACCOUNTability Plus’ Anderson, who led the Rutgers AICPA Data Analytics Research Initiative and advised the AICPA on audit transformation. The current audit approach is a transaction-based orientation. AI technology, on the other hand, offers a data-driven approach that makes it possible for firms to understand client processes from transaction initiation right through to the general ledger.

To gain buy-in from firm leadership, which may be unsure of how a seemingly complicated and costly technology will help, as well as from clients, Anderson recommended that firms perform R&D audits so they can try out an AI option to see how it works, scaling it to their needs. A firm might test out an AI tool on an already completed prior-year audit or perhaps use it on an audit that’s just beginning, with the understanding that some of the time used will be nonbillable as team members learn new technologies and approaches.

The benefits should be clear immediately. With an R&D audit, “firms learn so much about what’s happening at clients,” Anderson said. R&D audits are also a great way to show clients the tremendous value they can gain, because the firm can be a better adviser based on the enhanced insights and efficiencies the audit can offer.

Communicate with clients on costs, scope

AI tools can be expensive, but firms don’t have to eat the cost. Samantha Bowling, CPA, CGMA, managing partner at 20-person Upper Marlboro, Md.-based GW CPA LLP (formerly Garbelman Winslow CPAs), said her firm typically passes on technology charges in its engagement fee, explaining to clients that AI tools are essential to performing a quality audit.

Sometimes, firms may have to scale the technology based on client situations. AI can be used in a dizzying array of applications in a firm, but it may not be appropriate for all audit clients in all situations. For example, Bowling has one client that includes job costing in accounts receivable (AR), and the application her firm uses didn’t work well with batch transactions or subaccounts under AR, making it too much work to manipulate the data into a useful, readable format. Her firm ended up using AI for some, but not all, aspects of this audit.

Be prepared for bumpy waters with client data streams

Firms looking to incorporate AI tools into their audit processes would be wise to anticipate the unexpected when it comes to the quality of client data.

Doug DeBoer, CPA, principal at 90-employee, California-based firm Grimbleby Coleman, said that when his firm enhanced its audit technology, “more clients than we anticipated were not a good fit,” due in part to challenges in extracting usable data from their accounting software. He expects that to change, however, as the firm standardizes its data ingestion process and can better stipulate what it needs to gather useful data.

With the potential of data difficulties in mind, firms should consider the value of some clients and clarify their requirements for AI-powered audits. “You have to tell clients you expect them to operate at a certain level,” Logan said, or the client will face cost overruns.

CREATE YOUR OWN ANSWER

How can firms begin to incorporate AI into their audits? Focusing on the problems it solves can help immediately demonstrate the value. “We asked ourselves what really drove us crazy, what took too much time, then we looked for a tool that would solve those problems,” Willhite said.

Anderson urged firms to get started sooner rather than later. “Don’t wait for the answer, create your own answer,” he said. “You will end up with a high-quality audit when you’re done.”

What is AI?

Artificial intelligence (AI) technology simulates human intelligence. Some of its capabilities include automating tasks previously performed by humans, such as accounting, tax, and audit data gathering. In carrying out the tasks, the technology learns from the information it has analyzed and applies those lessons in future tasks to make reasoned judgments and solve problems. This capability is called machine learning, and it is key to the AI applications described in this article.

Machine learning is one of several types of AI and is used in many applications, often in conjunction with other AI technologies. For example, digital assistants such as Apple’s Siri and Amazon’s Alexa use natural language processing and machine learning to respond to voice commands. Generative AI, a more advanced type of machine learning, has received a great deal of attention during the past year. It is expected to be increasingly used in auditing as its reliability and accuracy are enhanced, and proper controls and other safeguards related to data security and confidentiality are implemented.

About the author

Anita Dennis is a New Jersey-based freelance writer. To comment on this article or to suggest an idea for another article, contact Jeff Drew at Jeff.Drew@aicpa-cima.com.

Articles in this series

The four articles in this JofA series cover the following topics:

- January: “Using Technology to Boost Audit Quality”

- February: “What AI Can Do for Auditors”

- March: Data analytics and visualization

- April: Change management

LEARNING RESOURCE

Use of Technology in an Audit of Financial Statements – Risk Assessment

Learn to increase the efficiency, effectiveness, and quality of your risk assessment procedures as required under SAS No. 145 by using technology and automated tools and techniques.

WEBCAST

For more information or to make a purchase, go to aicpa-cima.com/cpe-learning or call 888-777-7077.

AICPA & CIMA RESOURCE

Publication

CPA.com Generative AI Toolkit: A road map for accounting and finance professionals to understand and leverage the transformative impact of GenAI.