- feature

- AUDIT & ASSURANCE

Managing change in audit technology transformation

Constant change can be exhausting. To transform their audit technology despite change fatigue, firms can follow these tried-and-true suggestions.

Related

AI tools for finance professionals to prepare and visualize data

6 gear recommendations for home office and business travel

Excel’s Dark Mode: A subtle change that makes a big difference

TOPICS

Editor’s note: This is the fourth article in a four-part series that is part of a larger initiative the AICPA Auditing Standards Board (ASB) has undertaken to understand and support technology use in the audit.

A number of impediments can stand in the way of audit technology transformation, including issues with innate complexity; training and infrastructure; uncertainty about usefulness; and finding the capital necessary to run and maintain a firm’s “tech stack.” Those are some of the findings of a survey that is part of a larger project the AICPA Auditing Standards Board (ASB) undertook to understand and support technology use in the audit.

Transformation means change, and change can be unsettling. After several years of disruption in their work lives, many employees seem to be suffering from change fatigue. When Gartner surveyed workers in 2016, 74% were willing to support organizational change. By late 2022, that number had plummeted to 38%.

Firms need to carefully plan and execute changes in their audit technology if they want to effectively implement transformational change. Here’s what to pay attention to in change management.

CREATE AND COMMUNICATE A CLEAR VISION

Audit technology transformation is about making a significant difference not only in what software a firm uses but also in how audits are performed. Creating and communicating a clear vision for such a significant transformation is critical to success. This vision will inform the firm’s strategic plans and clarify what change will mean to all firm members.

“There is a lot to consider when implementing new technology, and change needs to be a big part of that,” said Ericka Racca, CPA, director of Audit Professional Services at CPA.com, the business and technology subsidiary of the AICPA, who works with firms of all sizes to guide them through their audit transformation initiatives. According to Racca, to lead successful change, firms must answer five key questions to help individuals understand why change is needed, not just that it is happening:

- What is changing?

- What is not changing?

- Why are we changing?

- Why is the way we do things today no longer good enough?

- What is the risk of not changing?

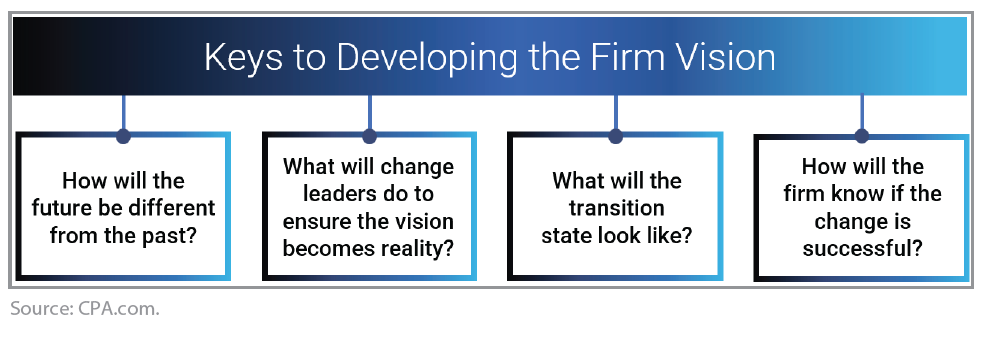

Keep in mind that a firm may have to revisit its vision based on its experiences during the change process. Setting a clear plan and revising it as needed is crucial. (See the chart “Keys to Developing the Firm Vision,” below.)

HIGHLIGHT THE BENEFITS THAT CHANGE OFFERS

Communication is important before, during, and after any change process, according to Sara Watson, CPA, director, A&A Professional Standards Group, FORVIS LLP, which has about 5,500 employees nationwide. That’s especially true because both staff and firm leaders may drag their feet on implementing change if they don’t fully understand how it will benefit them or their work.

As a result, in introducing the idea of audit technology transformation, it’s important to articulate “what’s in it for me,” Watson said. For example, while firm leaders may worry about upfront costs, they may be more accepting if they understand technology can offer advantages that include:

- Higher audit quality and effectiveness.

- The ability to take on clients seeking an auditor that uses advanced technologies. Prospective clients are now asking about the technologies auditors use, Watson said.

- Efficiencies that can reduce the time it takes staff to get work done.

Staff members may be excited about the chance to gain skills in cutting-edge technology, win new clients, and spend time on more complex areas while avoiding repetitive manual tasks. “If it provides better quality or makes the engagement more profitable, people will want to be involved,” said Doug De- Boer, CPA, principal at 90-employee Grimbleby Coleman. These benefits for staff will also be a great advantage for firms in their recruiting and retention efforts.

DETERMINE WHICH TECHNOLOGY SUITS THE FIRM BEST

CPAs can gain some perspective by reaching out to fellow practitioners whom they know through their state societies or networking groups for insights on the tools they use and their experiences with them.

Software vendors can also provide information, answer questions, and offer demonstrations of their products, which can help firms quickly narrow the field. “A vendor should allow you to test a platform on a client before you buy it,” said Samantha Bowling, CPA, CGMA, managing partner at 20-employee GW CPA LLP. “If they stand by their product and it is going to be transformational, they should let you use it.”

She recommended that firms do a dry run with a client whose system is already in the cloud to see how it integrates with the platform the firm is considering. If that works well, consider whether adoption will work well for most other clients. The firm’s assessment of the vendor must also include understanding how the software protects client data, through a review of their security or their SOC audit, Bowling said, as well as quality management considerations.

The process should certainly include a realistic consideration of the firm’s existing technology infrastructure and expertise and what level of initial transformation it can support. That assessment will affect the initial steps and the project time frame.

“Don’t run before you can walk,” DeBoer said.

Any platform should be able to integrate well with the firm’s existing technology, whether the firm will be using an add-on service or tool from an existing provider or a new tool that plugs into that technology, Watson said. Her firm uses Caseware Working Papers as its audit platform and has implemented a standardized taxonomy structure for mapping of trial balances. When the firm added MindBridge AI for risk assessment, journal entry testing, and data analytics, “we created a mapping structure in MindBridge AI that mirrored what was done in Caseware,” Watson said. “Audit teams map accounts once, and that carries over to the other platforms we use.”

GIVE EMPLOYEES A SAY IN CHANGE MANAGEMENT

Two of the most important choices firms can make in the change management process are appointing a champion for the project and giving employees a say in key decisions related to the project. Important issues to consider are:

Inclusion

Involving employees in decision-making during a change management process can improve the chance of success by 15%, according to Gartner.

Remember, too, to include input from the firm’s technology team or outside technology consultant because of the expertise and perspective they can add.

Accountability going forward

The technology road map should include a reasonable timeline that sets goals and assigns responsibility for achieving them, and determines key milestones, project phases, and outcomes for each phase. If a firm has appointed champions for the new technology early in the process, it might ask these champions to play a part in helping to maintain success after a system is implemented, Watson said.

Looking ahead, firms will have to monitor software updates and keep an eye out for the next best product, as well as provide training for new features or new programs and maintain scheduled evaluations around data security and quality management standards. (See the sidebar “Technology and Quality Management Standards”).

PREPARE FOR OBSTACLES

There are typically inefficiencies involved in adopting new software, so firms should prepare their people for the inevitable bumps in the road. Firms will be positioned to gain support for change (and overcome opposition to it) if they start with committed management buy-in, clear communication on the timeline and goals, and a solid case for change based on the benefits for all involved.

Part of the conversation should include the risk of not changing, so that firm members fully understand that there are consequences of sticking with the “same as last year.”

“As firms transition to a new way to doing things, it’s understandable that many employees will experience a lot of uncertainty around whether the new way will be too difficult or time-consuming, whether they’ll be able to adapt quickly enough, and how challenging it will be to learn something new,” Racca said. “The leading cause of change failure is employee resistance and ineffective management on the people side. Leaders often focus more on the technical implementation or process redesign because it’s more straightforward, but shifting mindsets and cultures is critical for success.” She recommended beginning with a group of people who are eager to move the process forward.

For the next stage, Watson suggested that, as part of the attempt to be inclusive, the firm should include in the planning those who are least likely to appreciate the change. “If you get those naysayers involved, they will feel they have a stake in the plan,” she said, and the firm can identify and address pain points early.

In some cases, what seems like resistance may happen simply because employees don’t fully understand how to put the new technology to work. Training on how to use the technology and on the value it can add for the people using it are critical.

Firms may also want to be proactive and add change agility to their list of desired attributes in prospective new hires to ensure that their people can adapt well to new developments, as Watson said her firm is doing. “The pace of change is not going to slow down,” she said.

FIRMS ALREADY KNOW THE DRILL

Technology change may sound daunting, but firms have a great deal of experience in adapting to new approaches, noted Danielle Supkis Cheek, CPA, vice president and head of Analytics & AI for Caseware. They should recognize and leverage their existing strong expertise in dealing with the unknown, given the uncertainty they regularly face when there are last-minute tax code changes or a significant new standard or regulation takes effect.

She recommended doing a postmortem of the firm’s past planning strengths and weaknesses in adjusting to new laws and regulations, then applying the lessons learned to the firm’s approach to technology transformation. “They’re the same conversations with different subject matter,” Cheek said.

Technology and Quality Management Standards

Firms should be aware that AICPA Statement on Quality Management Standards No. 1, A Firm’s System of Quality Management, and related guidance in AICPA Statement on Auditing Standards No. 146, Quality Management for an Engagement Conducted in Accordance With Generally Accepted Auditing Standards, and AICPA Statement on Standards for Accounting and Review Services No. 26, Quality Management for an Engagement Conducted in Accordance With Statements on Standards for Accounting and Review Services, cover the use of software tools and technologies in assurance engagements.

Although the standards are not effective until Dec. 15, 2025, firms are urged to begin planning ahead by contacting vendors now to understand how they address information security considerations or by discussing the issue with prospective vendors.

Technology and audit transformation

Articles in the four-part series:

- “Using Technology to Boost Audit Quality,” JofA, Jan. 1, 2024

- “What AI Can Do for Auditors,” JofA, Feb. 1, 2024

- “Data Analytics and Visualization in the Audit,” JofA, March 1, 2024

- “Managing Change in Audit Technology Transformation,” JofA, April 1, 2024

About the author

Anita Dennis is a New Jersey-based freelance writer. To comment on this article or to suggest an idea for another article, contact Jeff Drew at Jeff.Drew@aicpa-cima.com.

AICPA & CIMA RESOURCE

Article

“Harnessing Collaboration for Workplace Transformation,” JofA, Oct. 5, 2023