- feature

- PROFESSIONAL DEVELOPMENT

CPA engagement boosts student interest in Exam, public accounting

Practitioner participation in college capstone class teaches relevant workforce skills and increases desire to pursue licensure.

Related

How will accountants learn new skills when AI does the work?

AICPA asks Department of Education to list accounting as a professional degree

Talent shuffle: Why people want to change jobs and how leaders can adapt

To combat the continued decrease in new CPA candidates — a recent AICPA study revealed the number of candidates has fallen more than 32% since 2016 — practitioners and accounting faculty need to work together to solve the problem. One way to strengthen student commitment to the CPA Exam and increase their professional identity is for practitioners, faculty, and students to collaborate on an accounting course project.

Students transition to the workforce successfully by learning to communicate and work effectively in a team, prepare client communications on complex accounting issues, manage up, and understand the economics of a professional services firm. The senior capstone course at Ohio Northern University reinforces these skills by involving current practitioners in a simulated client engagement. The program, which is entering its third year, has had between 12 and 19 students working with three practitioners each semester. The semester-long project is built on continuous interaction between students and practitioners.

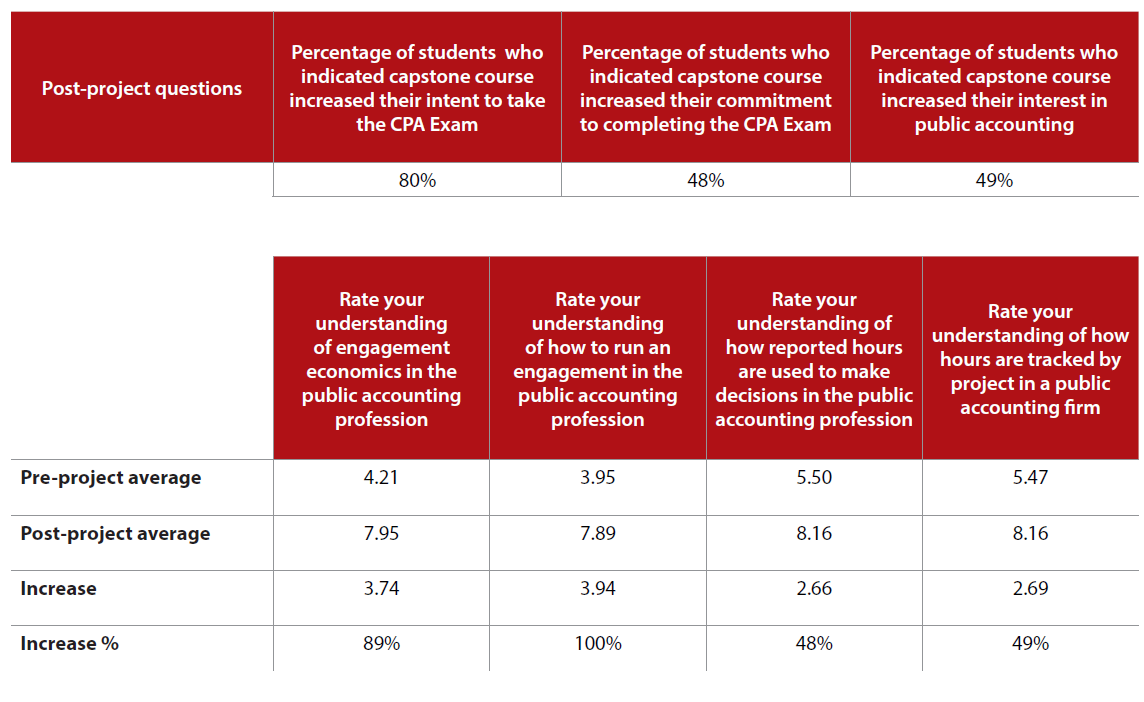

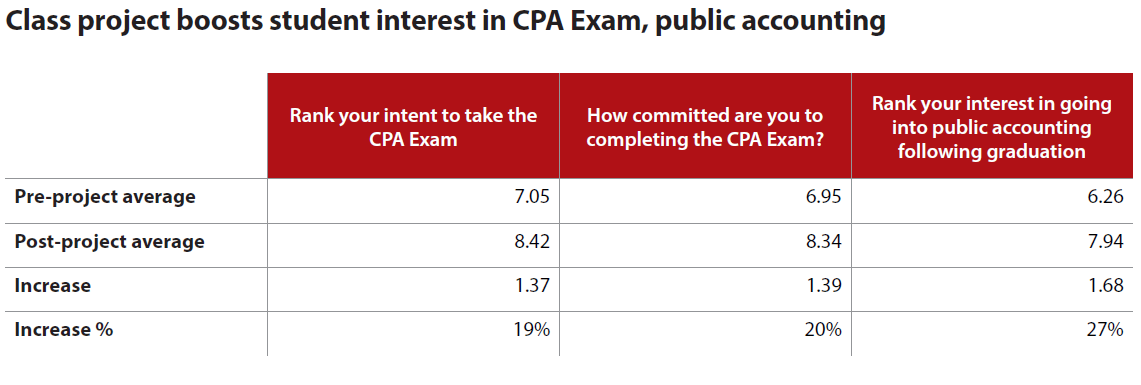

As a result of successful practitioner involvement in the classroom, students who completed the project indicated an increased likelihood of taking the CPA Exam, while those already planning to take the exam indicated a greater commitment to obtaining their CPA license, as shown in the table “Class Project Boosts Student Interest in CPA Exam, Public Accounting.”

HOW WE DID IT

We worked with practitioners to modify a standard case study to represent a consulting engagement in an emerging topic (e.g., cryptocurrency, ESG reporting). Students were divided into teams with a partner (practitioner) and senior manager (faculty member) assigned to their team. There were multiple client deliverables, and each student served as the senior for one deliverable and as staff for all others.

Students researched, developed, and prepared recommendations for the client in the form of professional memos and presentations. Practitioners provided the “partner review” as well as guidance on technical accounting research and interpretation.

Students had to learn how to communicate with staff, seniors, managers, and partners.

Practitioners and faculty provided feedback on communication style and interactions to help students develop their soft skills. This also allowed practitioners to show their firm culture and how different levels of experience interact to deliver a quality product.

Additionally, students tracked their time and the time and expenses of their practitioner and faculty members. Each level of employee was assigned a billable rate. Students accumulated the billable hours and expenses and analyzed engagement economics. Discussion topics with the partner included profitability by client problem, utilization rates, blended rates, engagement gross margin, drivers behind profitability, and recommendations for efficiency in future engagements.

Overall, students engaged in the creation, review, and delivery of:

- An engagement letter.

- A project plan.

- Client deliverables.

- Weekly status-update meetings.

- Tracked hours.

- An engagement economics analysis and presentation.

This interactive experience can be adapted for any type of practitioner or scaled down for shorter-term situations. You could, for example, plan a simulation that is internal to a company, where students work in the financial accounting/ controller group and write a report to the board or audit committee. The practitioner could perform the role of accounting manager, controller, or CFO. You could also structure a project requiring a report or memo from an internal audit team. For tax practitioners, you could simulate a client situation and help students work through the tax preparation and client meeting process.

BENEFITS

Overall, 83% of students said their intent to take the CPA Exam increased, and 70% of students said their commitment to passing the exam also increased. Eighty-nine percent of students expressed an increased interest in public accounting as a career option. Students also indicated an overall increase in understanding some of the nuances of the professional services industry, such as engagement economics, engagement management, workpaper review, and professional communication.

This increased commitment is likely because students also reported they felt more comfortable interacting and communicating professionally and more confident in their technical abilities. Student comments included:

“I feel this experience helped prepare me for communicating with and working alongside other professionals, which will make my transition to the accounting workforce easier.”

“I feel more confident in accounting research, which will allow me to understand new topics and interpret things to make decisions when I start public accounting.”

“Following the capstone course, I started my career at a firm and immediately realized how much better prepared I was than some of my peers in terms of understanding the importance of tracking hours, discussing and problem-solving with my peers and management team, and my overall understanding of how the team structure and a firm operates.”

During this project, students recognized that high profitability at the expense of quality is not a good long-term business strategy. Understanding when and how to reach out for support from firm management can be a learning curve for new employees. Students stated that having an opportunity to learn these skills in a safe environment fostered (1) more thinking outside the box; (2) seeking constructive feedback; and (3) performing in a leadership role.

Practitioners discovered unexpected benefits besides the opportunity to demonstrate their firm’s culture and recruit students. They stated it helped them develop their skills leading a team of inexperienced professionals.

“[This university’s] senior capstone is cutting-edge in that they have effectively integrated engagement management and engagement economics into their course in a real-world environment. [A Big Four firm] invests a lot of time and resources into educating our professionals on these topics, and I’m excited to see the students reap the benefits from this project in their professional career, whether in public accounting or industry. Additionally, it helped me develop my skills as a professional in my ability to teach, oversee, and manage a team.” — Audit manager, Big Four firm

About the authors

Jacob Crowley and Jill Cadotte are assistant professors of accounting at Ohio Northern University. To comment on this article or to suggest an idea for another article, email joaed@aicpa.org.