- feature

- FINANCIAL REPORTING

Initial direct cost and deferred rent under FASB ASC 842

Topic 842 requires that initial direct costs be added to the right-of-use asset and included in its subsequent amortization.

Please note: This item is from our archives and was published in 2023. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

What CPAs should know about Trump accounts

What to know about engagement quality reviews (SQMS No. 2)

Agentic AI is handling more finance work — but can CFOs trust it?

FASB Accounting Standards Codification (ASC) Topic 842, Leases, issued in February 2016, marked a significant overhaul in the financial reporting of long-term leases. Its adoption created many challenges for public and nonpublic entities alike. Where the previous guidance (FASB ASC Topic 840, Leases) was based on a risk-and-reward model, Topic 842 is based on determining whether a contract conveys the right to control the use of an identified asset. In turn, this transition in model formulation underlies a fundamental change in how entities define leases, differentiate lease from nonlease components, determine who are the lessee/lessor parties in complex property transactions, and measure and recognize income statement effects. This article explains the guidance as it relates to accounting for deferred rent and initial direct cost under Topic 842. To provide context for this discussion, we first direct our consideration toward the accounting treatment of these two areas under the previous guidance, Topic 840.

TOPIC 840 TREATMENT OF INITIAL DIRECT COST AND DEFERRED RENT

Consider the following fact pattern:

■ The parties enter a 20-year operating lease.

■ The agreement calls for cash payments of $1,000,000 for the first five years, with a 10% escalation of the payments after the first five years and every five years thereafter.

■ Initial direct costs paid at the beginning amount to $150,000.

■ The implicit lease rate is 5%.

■ The marginal tax rate is 21%.

Topic 840 required total rent expense with escalating payments to be recognized on a straight-line basis over the lease term. In effect, the sum of the payments divided by the number of periods represented the amount of rent expense to be recognized each period. Any difference between the lease payment and the fixed lease expense was treated as deferred rent. In periods during which the fixed lease expense exceeded the lease payment, an entity would have accounted for the difference as deferred rent classified as a liability. In periods during which the lease payment exceeded the lease expense, the difference would be treated as a reduction of this account. By the end of the lease term, this account would be amortized to zero.

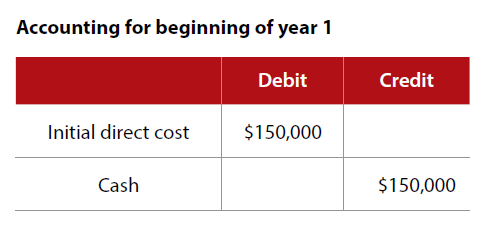

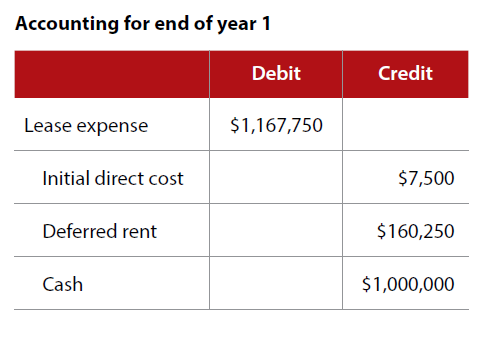

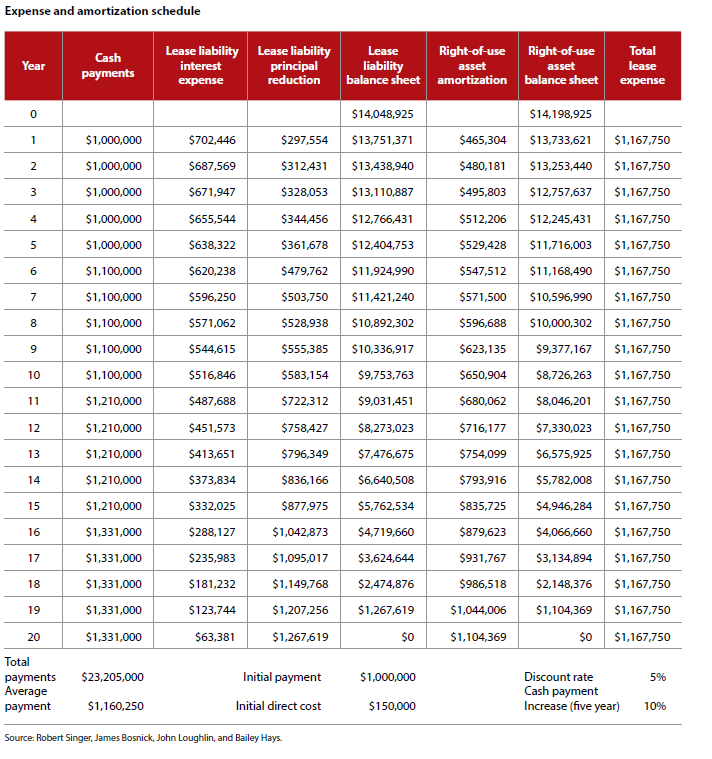

Under Topic 840, the initial direct cost is capitalized and amortized on a straight-line basis over the duration of the lease. In the example above, for instance, total payments for the 20 years would be $23,205,000 ÷ 20, equaling $1,160,250 for straight-line amortization over the life of the contract. Initial direct costs of $150,000 would be amortized on a straight-line basis over the 20-year period, amounting to $7,500 per year ($150,000 ÷ 20). Topic 840 required this expense to be added to rent expense to compute the total lease expense for each period. Thus, the total lease expense would be equal to $1,160,250 + $7,500, or $1,167,750. The deferred rent would be calculated as the difference between $1,160,250 and $1,000,000, or $160,250. Based on this information, entries for year 1 under Topic 840 would be as shown in the chart “Accounting for Beginning of Year 1” (below). This chart records the initial direct cost paid at the inception of the lease. The entry in the chart “Accounting for End of Year 1” (also below) records the first year’s lease expense (under Topic 840).

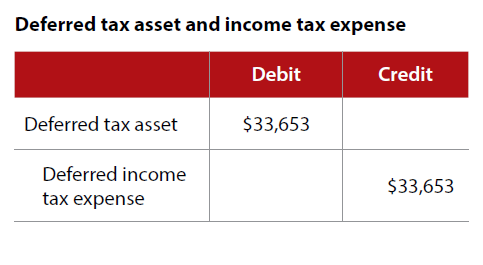

A future deductible amount arises from the difference between the portion of fixed lease expense related to the average lease payments of $1,160,250 and the lease payment of $1,000,000, or $160,250. Given a marginal tax rate of 21%, a deferred tax asset results in the amount of $160,250 × 0.21= $33,653. The entry in the chart “Deferred Tax Asset and Income Tax Expense” (below) accounts for tax effects related to benefits associated with future deductible amounts.

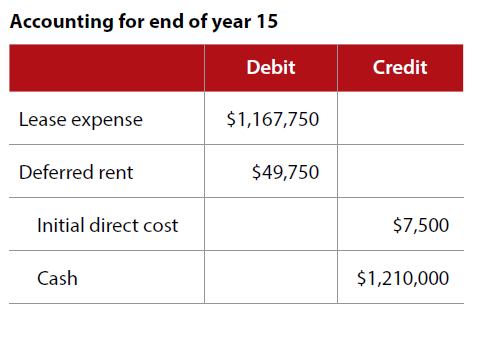

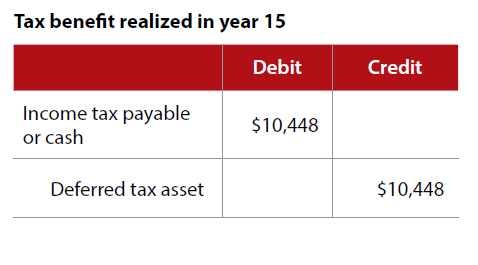

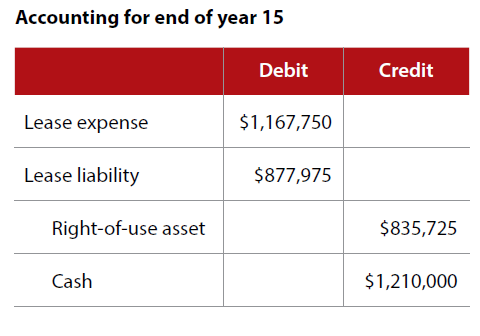

In a year when a lease payment exceeds lease expense (for example, year 15 in the table “Expense and Amortization Schedule,” below), the entry in the chart “Accounting for End of Year 15” (also below) records lease expense for year 15.

A portion of the tax benefits from prior years’ deferred tax assets are realized because deductions for tax purposes of $1,217,500 exceed the income tax expense of $1,167,750 for financial reporting purposes. This realization is due to a reduction of deferred rent, the difference between the lease payments of $1,210,000 and the portion of the lease expense attributable to the lease payments of $1,160,250, or $49,750. The tax benefit associated with this amount is equal to $49,750 × 0.21 = $10,448 and gives rise to the entry shown in the chart “Tax Benefit Realized in Year 15” (below). This entry records a portion of the benefits from the deferred tax asset realized in year 15.

TOPIC 842 TREATMENT OF INITIAL DIRECT COST AND DEFERRED RENT

In contrast to previous GAAP, Topic 842 requires operating leases greater than one year to be recognized on the balance sheet as right-of-use assets and related lease obligations. There is no change in substance to the treatment of capital leases under Topic 840. Assuming the lease arrangements meet contract specifications and any one of the five criteria underlying the financing lease classification, the lessee should recognize on the balance sheet a right-of-use asset and at the same time recognize a related lease liability.

Of course, complications could arise at transition if leases previously classified as operating under Topic 840 now meet the criteria of financing leases under Topic 842. Under Topic 842, income statement effects for operating leases differ from those of financing leases. The latter classification requires the lessee to amortize the right-of-use asset over the lease term, while it requires the lessee to amortize the related lease obligation using the effective interest method. In contrast, for operating leases a single lease cost is recognized.

Based on comment letters received from various stakeholders in the new guidance that emerged, FASB provided lessees with an option to apply a package of practical expedients (per FASB ASC Paragraph 842-10-65-1) to ease the transition. Paragraph 842-10-65-1, subparagraph f, provides the leasing parties with the following transition guidance:

1. An entity need not have to “reassess whether any expired or existing contracts” at transition “are or contain leases.”

2.“An entity need not reassess the lease classification for any expired or existing leases.” Thus, leases classified as operating leases under Topic 840 may continue as operating leases under Topic 842.

3.“An entity need not reassess initial direct costs for any existing leases” at transition.

Topic 842 defines initial direct costs as “[i]ncremental costs of a lease that would not have been incurred if the lease had not been obtained.” Under the previous guidance, initial direct costs included allocated overhead. Finally, Topic 842 requires that initial direct costs be added to the right-of-use asset and be included in its subsequent amortization.

Aside from Topic 842’s requirement that operating leases greater than a year recognize right-of-use assets and lease liabilities, its effects on the income statement (putting aside the difference in how initial direct costs are defined) are similar to Topic 840’s. As under Topic 840, the lease payments (including any escalations) are totaled and amortized on a straight-line basis (see FASB ASC Paragraph 842-20-25-6) and include amortization of initial direct cost.

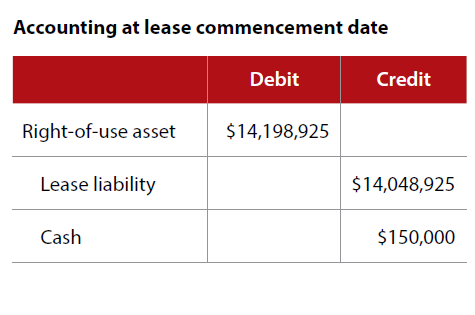

The following example illustrates the treatment of initial direct cost and deferred rent, the latter of which is no longer recognized for balance sheet purposes. The chart “Accounting at Lease Commencement Date” (below) illustrates amortization of the right-of-use asset and the lease liability, as well as related journal entries. Using the data in the table “Expense and Amortization Schedule,” a lessee would make the journal entries shown in that chart. This entry records the operating lease and payment of initial direct cost at the commencement date.

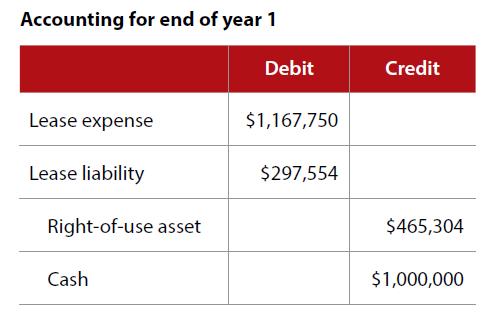

The lease liability of $14,048,925 is the present value of lease payments discounted at 5%; the $150,000 of initial direct cost is added to $14,048,925 (see column 5, “Lease Liability Balance Sheet,” in the table “Expense and Amortization Schedule”) in arriving at a right-of-use asset amount of $14,198,925 (column 7, “Right of Use Asset Balance Sheet,” in the table “Expense and Amortization Schedule”). See the chart “Accounting for End of Year 1” (below). This entry records lease expense, payment, and amortization of lease liability and right-of-use asset.

In the chart “Accounting for End of Year 1,” 5% is multiplied by the lease liability of $14,048,925 to obtain the interest portion of the lease obligation ($702,446) and subtracted from the lease payments ($1,000,000) to obtain the reduction in the principal amount of the lease obligation ($1,000,000 – $702,446 = $297,554).

The lease liability at the end of year 1 is equal to the lease obligation at the beginning of the period minus the principal reduction, or $14,048,925 – $297,554 = $13,751,371. The adjustment of $465,304 to the right-of-use asset represents the difference between the cash payment and the single lease cost ($1,000,000 – $1,167,750 = ($167,750)) plus a decrease of $297,554, consistent with the change in the lease liability. Calculation of the deferred tax asset is the same as under Topic 840, or $1,160,250 – $1,000,000 = $160,250 × 0.21 = $33,653, necessitating the same journal entry.

At the end of year 15, the lessee would make the entry shown in the chart “Accounting for End of Year 15,” under the new guidance (see the table “Expense and Amortization Schedule”).

The adjustment to the right-of-use asset represents the difference between the cash payment and single lease cost ($1,210,000 – $1,167,750 = $42,250) and a decrease of $877,975, consistent with the change in the lease liability.

CONCLUDING COMMENTS

Many of these entities continue to struggle with developing information systems designed to capture and track changes to thousands of lease transactions. Nonpublic entities, despite the availability of several practical expedients, are expected to be challenged as well. For these entities, the new lease guidance becomes effective for fiscal years beginning after Dec. 15, 2021, and for interim periods within fiscal years beginning after Dec. 15, 2022, although they have been afforded more time to transition and implement the new guidance.

It is important to note that the changes to reporting areas discussed in this article relate solely to operating leases. Because deferred rent is no longer recognized as a liability, the change in reporting does not affect transactions classified as financing leases.

Moreover, while deferred rent is not explicitly recognized under Topic 842, it is implicitly recognized in the amortization of the right-of-use asset under Topic 842 because it represents the portion of the straight-line expense associated with the difference between the lease payments and fixed expense without regard to the initial direct costs. Again, Topic 842 requires initial direct costs paid at the inception of the lease to be added to the right-of-use asset. Under Topic 840, these costs included the cost associated with many activities including some overhead. In contrast, the initial direct costs are more narrowly defined under Topic 842. Specifically, such costs include only the incremental costs that would not have been incurred had the lessee not entered into the agreement.

While nonpublic entities may have initially had more time to prepare for implementation of Topic 842, it is important for them to be keenly aware of its nuances — such as those addressed in the example we supplied — and to learn from the issues faced by those public entities that transitioned earlier.

Although public entities transitioned to Topic 842 in 2019, their managers continue to grapple with implementing many of its complex provisions.

About the authors

Robert Singer, Ph.D., is a professor of accounting; James Bosnick, J.D., is an associate professor of accounting; John Loughlin, Ph.D., is an associate professor of finance, and Bailey Hays, M.Acc., is a career strategist at the Center for Engaged Learning, all at Lindenwood University in St. Charles, Mo.

LEARNING RESOURCES

The Bottom Line on the New Lease Accounting Requirements

Learn the core principles of FASB ASC 842, Leases, including identification, recognition, measurement, presentation, and disclosure requirements.

Leases: Mastering the New FASB Requirements

This course offers hands-on learning with journal entry examples that demonstrate how to apply the new standard.

For more information or to make a purchase, go to aicpa.org/cpe-learning or call the Institute at 888-777-7077.

AICPA RESOURCES

Articles

“Accounting for Sale and Leaseback Transactions,” JofA, July 1, 2020

“Lease Accounting Standard Requires New Auditor Judgments,” JofA, March 1, 2020

“Lease Accounting: A Private Company Perspective,” JofA, July 1, 2019

Online resource

Exploring ASC 842: Leases Standard

Reports

ASC 842: Unanticipated Costs and Complexities in Adoption

CPEA ACS 842 Implementation Series, Parts I–IV