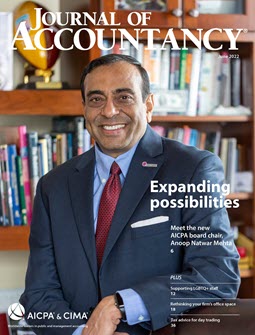

AICPA Chair Anoop Natwar Mehta will focus on diversity, trust, and growing the pipeline.

Advertisement

June 2022 - Journal of Accountancy

- Magazine

- June 2022

PRACTICE MANAGEMENT

Is it time to rethink your firm’s physical footprint?

The rise of remote work is an opportunity to

evaluate where work gets done.

PROFESSIONAL ISSUES

5 ways accounting firms can better support LGBTQ+ employees

Creating a real sense of belonging for LGBTQ+ employees benefits individuals, clients, firms, and the profession.

FINANCIAL REPORTING

Goodwill triggering event alternative provides relief to some companies

Learn how FASB’s goodwill accounting alternative for evaluating triggering events can make financial reporting easier for private companies and not-for-profit entities beyond the pandemic.

ETHICS

Code of conduct changes address NOCLAR, unpaid fees, loans, assisting clients with standards

Learn more about what these changes entail.

TAX

Tax advice for clients who day-trade stocks

Communicate the benefits of the mark-to-market election.

COLUMNS

PROFESSIONAL LIABILITY SPOTLIGHT

TAX MATTERS

TECHNOLOGY Q&A

Features

FROM THIS MONTH'S ISSUE

AI risks CPAs should know

Are you ready for the AI revolution in accounting? This JofA Technology Q&A article explores the top risks CPAs face—from hallucinations to deepfakes—and ways to mitigate them.

From The Tax Adviser

January 31, 2026

Trust distributions in kind and the Sec. 643(e)(3) election

January 31, 2026

Effects of the OBBBA on higher education

December 31, 2025