- column

- TECHNOLOGY Q&A

2 ways to recover unsaved Excel files

Please note: This item is from our archives and was published in 2021. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

Differentiating agentic and generative AI — and more with a Tech Q&A author

How AI is transforming the audit — and what it means for CPAs

Promises of ‘fast and easy’ threaten SOC credibility

TOPICS

Q. Help! I have been working on a very important Excel file for a client, and suddenly my computer locked up and says, “Excel is not responding.” Is there anything I can do so that I don’t lose all of my work?

A. We have all been there. It’s a terrible feeling when you have put so much work into your file and suddenly you are forced to close it without saving, or the application closes on its own. The best approach to avoid this scenario is to use autosave, but that doesn’t solve the problem posed in the question. The good news is that, most of the time, your file can be recovered. You just have to know where to find it.

Let’s consider two scenarios when you may want to recover your work: (1) You are working on a new file and have never saved the file at all; or (2) your previously saved file closes before you can save the changes made since your last save. Either way, your files may be recoverable but would be recovered in different ways. You can access a video showing the following steps at the bottom of the page.

For the first scenario described above, the way to recover your never-before-saved file is to, first, open Microsoft Excel. Then go to the File tab on your Ribbon and click Open. Click Recent and then scroll to the bottom of the page and click Recover Unsaved Workbooks (see the screenshot below).

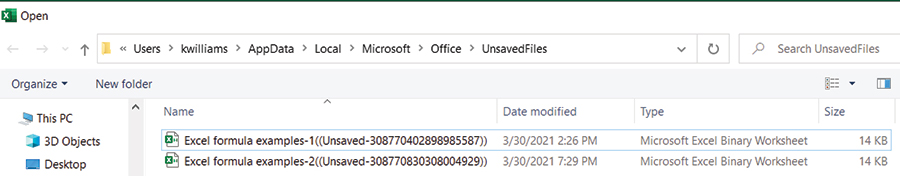

The Open window will appear (see the screenshot below). Select the unsaved file you want to recover.

Another scenario when you may need to recover a file is when your previously saved file closes before you can save the changes made since your last save. To recover the file, open Excel once your computer is working properly. A Document Recovery pane should appear with all unsaved Excel files listed (see the screenshot below). Choose the file that you want to recover.

Note that this content was based on Microsoft Excel 365 for PCs. Other versions of Excel may work differently.

Kelly L. Williams, CPA, Ph.D., MBA, is an associate professor of accounting at the Jones College of Business at Middle Tennessee State University.

Submit a question

Do you have technology questions for this column? Or, after reading an answer, do you have a better solution? Send them to jofatech@aicpa.org. We regret being unable to individually answer all submitted questions.