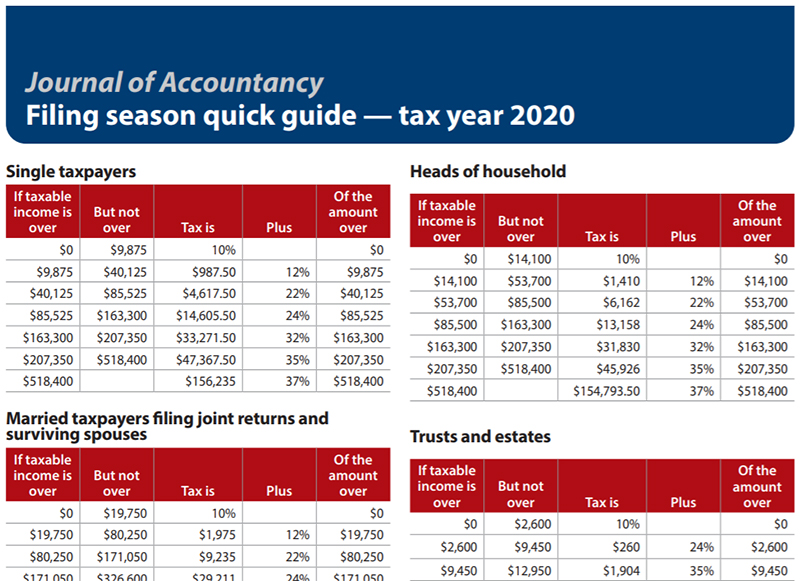

Filing season quick guide — tax year 2020

Please note: This item is from our archives and was published in 2021. It is provided for historical reference. The content may be out of date and links may no longer function.

Download and print this quick guide for use during tax season, highlighting dollar thresholds, tax tables, standard amounts, credits, and deductions.

The key to success with CAS is selecting the best clients. Tools like ideal client profiles (ICPs), buyer personas, and even artificial intelligence can help identify the businesses that best fit each CAS practice.