COVID-19 relief measures confront return preparers with novel predicaments. [Updated with tax provisions from the Consolidated Appropriations Act, 2021, the COVID-19 relief package signed into law in late December 2020.]

January 2021 - Journal of Accountancy

- Magazine

- January 2021

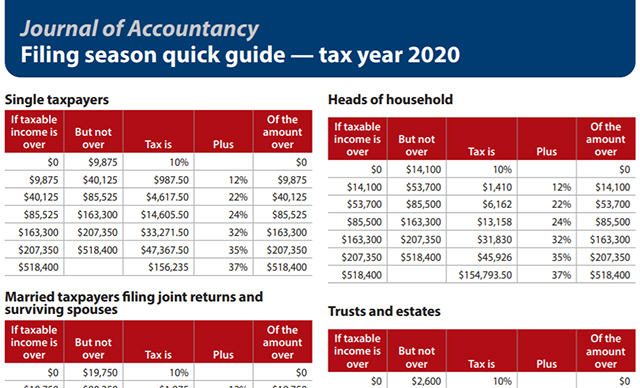

Filing season quick guide — tax year 2020

Download and print our annual quick guide, a tax season reference, highlighting dollar thresholds, tax tables, standard amounts, credits, and deductions.

Building a truly effective D&I initiative

Studies show that a diverse workforce is a more productive, more profitable one. Establishing a strong diversity and inclusion program takes time, effort, and, above all, commitment from top leadership. Use these guidelines when structuring a D&I program.

What anti-bias training can — and can’t — accomplish in the workplace

Carefully chosen, well-implemented anti-bias courses can buttress a company’s diversity and inclusion program when they are part of a clear strategy.

CPA Exam gets refresh after practice analysis

Business processes and data analytics are receiving increased emphasis as a result of an analysis undertaken to maintain the Exam’s relevance.

5 things CPAs need to know about bankruptcy

Examine aspects of bankruptcy, including whether a CPA is likely to get paid and steps that a business can take when dealing with a bankrupt customer.

COLUMNS

CHECKLIST

PROFESSIONAL LIABILITY SPOTLIGHT

From the Tax Adviser

TAX PRACTICE CORNER

TAX MATTERS

TECHNOLOGY Q&A

INSIDE AICPA

THE LAST WORD

Features

FROM THIS MONTH'S ISSUE

AI risks CPAs should know

Are you ready for the AI revolution in accounting? This JofA Technology Q&A article explores the top risks CPAs face—from hallucinations to deepfakes—and ways to mitigate them.