- feature

- PRACTICE MANAGEMENT

7 tips for starting a client advisory services practice

It’s a great time to launch a CAS practice — if you’re willing to make the commitment.

Please note: This item is from our archives and was published in 2021. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

COSO creates audit-ready guidance for governing generative AI

Corporate spending accelerating toward AI in 2026

Tell a story with your documentation

Many CPAs will have heard the compelling reasons why now is an opportune time to offer client advisory services (CAS). The term “client advisory services” refers to a variety of services CPAs can provide, ranging from outsourced business processes (the “virtual back office”) to advisory services to virtual CFO and controller services. Clients also became more accustomed to sharing financial data remotely during the COVID-19 pandemic, making them more amenable to virtual accounting. A 2020 survey by CPA.com revealed that advisory and consulting is clients’ greatest unmet need, with 29% of clients saying they need this service. If price were no issue, 68% of clients would want their CPA firms to give them strategic consulting, the survey found, whereas 41% would want firms to manage some of their financial operations. Adding CAS can also help firms make more money: Clients who do not use advisory services spend an average of $1,108 per month with their CPA firms, but clients who do purchase advisory services spend $1,585 a month, or 43% more.

But starting a CAS practice is a decision that demands commitment. CAS is not a trend to jump on but a different way of relating to clients, one that requires a very different business model than the one traditional CPA firms operate under. Launching a CAS division is almost like creating a new business from the ground up: To do so, firms need to think through everything from the technology they use to how they bill clients, track time, hire and train staff, package and market their services, set goals, and assess their progress.

Though the prospect of starting what’s essentially a new business within your firm can seem daunting, the good news for firms thinking of adopting CAS is that others have paved the way. CAS is a mature enough area now that firms can draw upon the experiences of early adopters and take advantage of the resources organizations have developed to help them succeed. Here, CAS experts, and firms whose CAS divisions are already underway, share what firms should know before taking the CAS plunge.

Be prepared to adopt a whole new mindset

One of the biggest challenges firms face when starting to offer CAS is being open to rethinking the way they do business. To do CAS the right way, “you’ve got to shift the way your communication works,” said Dixie McCurley, principal, digital advisory, CAS leader at Cherry Bekaert, who frequently leads CPA.com’s CAS Roadmap Workshops. “You’ve got to rely on software that does things that you haven’t ever had to do before, like customer support. You may add new roles, such as project manager or client success advocate. And you’ve got to put in processes that help you scale using systems instead of people.”

The staff who work on CAS engagements should be prepared to work much more closely with clients’ organizations than they had previously. Staff will go from meeting with a client once a quarter or year to knowing where clients’ businesses stand on a daily basis and providing them weekly insights, McCurley said.

Firms may also need to reevaluate their mindset around pricing. That was a big change for ACT Services, an 11-employee firm in Indianapolis, said Mark Fuqua, CPA, CGMA, the firm’s manager of client accounting and client advisory services. “We had to step back and look at the value of the services we were providing, not just how many hours we spent” on an engagement, he said. ACT Services now offers CAS clients four packages starting at different price points, with room for customization (see the sidebar “How One Small Firm Packages CAS”).

Before offering CAS, firms need to spend a good deal of time learning about the business model it requires and what changes they need to make, said Kalil Merhib, vice president of sales and marketing at CPA.com, who is located in the Detroit area. He suggests that firms assess their current capabilities and their “ability to execute on building a practice area,” and then create a thorough business plan that covers everything from billing practices to staffing to KPIs.

Expect a slow ramp-up

Firms that start CAS practices generally follow a certain progression, McCurley said. They go through stages she terms “CAS 1.0” through “CAS 3.0” and can expect to spend months to years in each stage before finding themselves ready to take the leap to the next. (See the graphic “Client Accounting and Advisory Services.”)

CAS 1.0 involves offering outsourced accounting: accounts payable/bill paying, accounts receivable/collections, and cash management and reconciliation. Taking this step first “puts you in the daily heartbeat of clients’ transactions,” McCurley said. “Firms should come into [CAS] knowing they are going to be doing CAS 1.0 for a year or two.”

After becoming comfortable with outsourced accounting, firms often move on to what she terms “CAS 2.0,” or offering outsourced CFO services. In this stage, “they’ll be getting their cadence down and then scaling it,” she said. It’s after this point many firms transition to CAS 3.0, or assisting clients with business strategy and decisions.

Many firms do some form of bookkeeping for clients. Bookkeeping isn’t considered “true” CAS, McCurley said, as it happens after the fact and does not provide clients with timely data they can use to improve their businesses. That said, she observed, quality bookkeeping is still the foundation on which CAS rests. Or, as Merhib put it, “You need to have the books in good order to advise your clients on what they can be doing with their businesses.”

Find a niche

Most firms that offer CAS serve either one or a small number of niches — and for good reason. “Clients want specialists, not generalists,” McCurley said. “They want their CPAs to speak the ‘language’ of their industry almost as well as they do.”

Without deep knowledge of an industry, CPAs won’t be able to provide the types of business insights CAS demands. But acquiring this knowledge takes time, effort, and experience. To be an effective adviser, a CPA might need to become intimately familiar with a given sector’s processes, risk factors, customer types, KPIs, regulatory environment, and so on. CPAs who work with doctors, for instance, need to know about billing and Medicare, while those who work with restaurants need to know about food trends, delivery costs, and state laws regarding tipping. Concentrating on a niche allows staff to gain this expertise.

Having a niche can also help firms focus their marketing efforts and choose the right software. It can also help a firm streamline its processes, something ACT Services realized when it chose to specialize. The firm started out as generalists, recalled Tina Moe, CPA, CGMA, the owner and CEO of ACT Services. “We worked with anyone who came in the door,” she said. “I joked that our clients just had to be nice, be compliant, and pay our bill.”

Now that they focus on three sectors, Fuqua said, “we’re able to standardize and automate and do things more quickly.”

Make a strong commitment to CAS

Because starting a CAS practice is such a complex undertaking, firms need to fully commit to it for it to thrive (see the sidebar “Making Pizza Profit”). “If you’re going to do it, you’ve got to go all in,” Fuqua said.

That means dedicating money, staff, and hours to the CAS endeavor. Ideally, have someone devoted to CAS full time, Merhib said. Though you may start off having a staff member from a different area working part time on your CAS initiative, that’s not sustainable in the long run, he said.

“You should have a plan to eventually have that person transition to CAS full time,” Merhib said. Otherwise, he said, they’ll struggle to succeed at balancing both aspects of the role.

Don’t reinvent the wheel

Many resources now exist to help firms that are starting to offer CAS. Organizations including the AICPA have created materials firms can use to learn about CAS and offer training programs that cover everything from pricing to staffing to how to talk to clients about the value of CAS.

Getting formal training in CAS can save firms time and effort, Moe said. After her firm took some steps toward CAS on its own, she took a CAS workshop she found very helpful.

“We were trying to take bits and pieces of information from different resources to try and create our own CAS division, but it was like reinventing the wheel. It was very time-consuming,” she said. “Investing in a proven program, I think, is the fast track to getting a CAS practice set up and on solid ground.”

Partnering with a firm with more CAS experience, but that serves a different niche than you do, can also reap benefits. “As you start growing, it might not all be internal resources that makes your CAS practice successful,” she pointed out. “You’ve got to rely on some other firms sometimes to be that partner to help you grow.”

Stay on top of tech

Have someone in your firm be responsible for keeping up with new technologies in the CAS space, suggested Hugh Hermanek, CPA/CITP, a partner at Hancock Dana, a 55-employee firm in Omaha, Neb. New apps and software emerge rapidly, he said, and when you’re knowledgeable about them, you can choose the right ones to help your clients’ businesses run more smoothly. For example, Hermanek and his team were able to significantly improve a client’s cash flow by getting them to adopt automated accounts receivable software. By doing so, the client’s accounts receivable dropped from an average of 50 days down to 30 days.

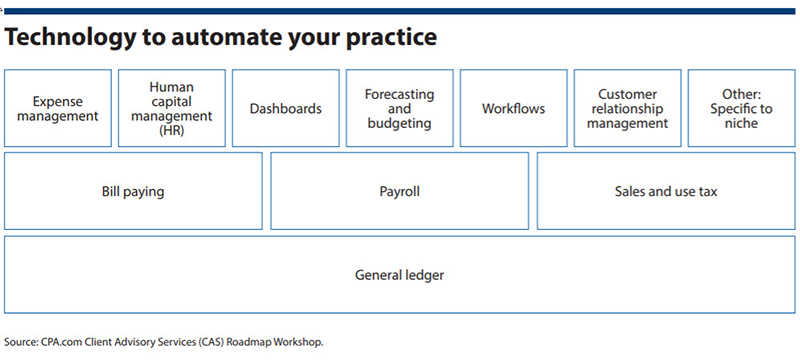

Be sure to give your CAS staff sufficient time to train on technology, Hermanek said. “It’s the only way to know what all the options are for clients.” (See the graphic “Technology to Automate Your Practice.”)

Choose the right clients to start with

To pick the first clients to offer your CAS services to, Merhib said, look over your client roster and identify “the ones who could benefit from more advice and insights, not to mention the clients who are willing to pay and invest in that added value.” Clients who are already comfortable with cloud technology will be easier to transition to CAS, he said.

Your first CAS clients shouldn’t be your top clients, McCurley said. She recommended starting with “two to five beta clients” first. It helps to “get your feet wet and your processes right when working with a smaller-level client,” she explained. “Once you’ve got some practice, and some experience in creating processes and systems, that’s when it’s nice to go after those ideal clients.”

An avenue worth exploring

Starting a new CAS practice is not a decision to be taken lightly. That said, CAS is an exciting area of accounting and one well worth pursuing. For firms that are willing to make the commitment, now is an opportune time to get started with CAS, Merhib said. “We’re seeing an increasingly complex business environment where clients of all sizes are now needing to make decisions more quickly,” he said. “It’s a perfect opportunity for firms to take a proven business model, use those resources, and really start delivering on the strategic advisory role for clients.”

How one small firm packages CAS

ACT Services, an 11-employee firm in Indianapolis, had been offering client advisory services (CAS) on an occasional basis before launching a formal CAS division in 2020. Its CAS clients are mainly in three sectors: logistics, construction, and health care.

With new CAS clients, the firm first undertakes an operational assessment. This assessment “gives us a deep dive into the people, processes, and systems of the organization and allows us to map where they are currently,” said Tina Moe, CPA, CGMA, the CEO and owner of the firm. “We get a deeper understanding of who they are and how resources and data flow through their organization. We spend a great deal of time with leadership, understanding what their needs are and what their pain points are.” The assessment is followed by a multiphase implementation in which the firm helps to “redesign the client’s systems and processes to solve those problems,” Moe said.

The firm offers this assessment as both a stand-alone service and as a foundation for the firm’s other four accounting and CAS packages. The first package, according to Mark Fuqua, CPA, CGMA, manager of client accounting and advisory services, consists of “traditional tax and bookkeeping, the after-the-fact stuff.” The second is a “virtual back office” package, which takes place “in much more real time.” At this stage, the firm’s data is synced with the client’s bank and credit card accounting, and the firm does financial reporting for the client and creates dashboards for them. The third and fourth packages involve controller and CFO services and involve more in-depth reporting, dashboard creation, and consulting.

The assessment alone can bring clients considerable value, Moe said. For one client, a construction company with about 124 employees and revenue of $24 million a year, the firm spent around eight weeks interviewing leadership and key employees and mapping out and redesigning processes. They estimate the changes they made saved the client 91 employee-hours per week, or $136,000 a year in expenses. “The employer can now scale and grow without significantly adding to the headcount,” Moe said.

The firm also discovered an error in the client’s calculations on the profitability of a project. With revised data, the client’s leadership determined that the project wasn’t actually bringing in money. “We never put a value on that insight, but that’s just one example of how we bring our knowledge to the table,” Moe said.

Making pizza profit

MAK Financial CPA, a firm located in San Diego with five U.S.-based and five offshore employees, started doing CAS because it saw a need for it, said owner Michael Khalil, CPA. Most of the accountants in its area who served small businesses focused on taxes and didn’t provide the kind of sophisticated advice business owners needed, Khalil said. He chose to focus on quick-service restaurants as one of his niches, in part because he handled accounting for several of his family members who own franchise pizza restaurants.

Khalil found himself becoming frustrated with the software his restaurant clients were using. It “didn’t have very robust reporting capability,” he said, and couldn’t customize data to the extent that he wanted. When his firm picked up a larger client with more data, he knew it was time for an upgrade.

In 2018 the firm “committed to CAS,” Khalil said, and hired a staff member with CAS experience to help develop the firm’s CAS capabilities. The firm invested in more powerful software and hired a developer to create a tool that would help its clients automate invoices.

Now, the firm can give clients financial data within 10 days of closing, he said. “It’s timely enough information so that they can make proactive decisions,” he said. For instance, clients can see if their food costs were high during a given period, or, if they own multiple stores, they can get “unit-level analysis” and see which stores are struggling and which are doing well.

During the COVID-19 pandemic, MAK Financial helped restaurant clients with the accounting for third-party delivery services such as Uber Eats and Postmates. This type of accounting “is actually somewhat complex,” Khalil said, as delivery companies can have different agreements with individual franchisors and charge them different rates. MAK analyzed how much a client’s actual gross profit changed when it shifted revenue between carryout sales and third-party sales, and some clients changed their pricing as a result. The firm would then analyze the results of these new pricing decisions, and the client would adjust if necessary. “That allowed us to add a lot of value and make sure clients were going to be profitable by the end of the year,” he said.

About the author

Courtney L. Vien is a JofA senior editor. To comment on this article or to suggest an idea for another article, contact her at Courtney.Vien@aicpa-cima.com or 919-402-4125.

AICPA RESOURCES

Articles

- “Remove Roadblocks to CAS Practice Growth,” JofA, July 28, 2020

- “Professional Liability Spotlight: Minding the Expectation Gap in a CAS Engagement,” JofA, Aug. 2018

- “Client Accounting Services Driving Revenue Growth,” JofA, Feb. 2017

- “Build Your Tech Stack With CAS Purpose,” AICPA.org

Podcast episode

- “What to Know Before Offering Client Accounting Services,” JofA, April 21, 2020

Online resources

White papers

- Accelerate Into Advisory (member login or registration required)

- Setting the Stage for CAS Success (member login or registration required)

LEARNING RESOURCES

Client Accounting Advisory Services Certificate

CPE SELF-STUDY: The Client Accounting Advisory Services Certificate helps firms demonstrate their expertise in the fundamental client accounting service deliverables.

CPA.com Virtual Client Advisory Services (CAS) Roadmap Workshop

CONFERENCE: The CAS Roadmap Workshop helps firms develop a plan to build a CAS practice or expand an existing client accounting service line, using a proven and tested practice development approach to help your firm achieve success in client advisory and accounting services. Offered once a month.

Dec. 5—8, Nashville, Tenn.

CONFERENCE: Digital CPA is for practitioners curious about technology and its impact on the accounting landscape. Together we’re challenging business models, transforming practice areas, and driving innovation across the profession.

For more information or to make a purchase, go to future.aicpa.org/cpe-learning or call the Institute at 888-777-7077.