Many resources are now available to help firms launch CAS practices. CAS experts and firm leaders who’ve taken the plunge share their best advice for getting started.

August 2021 - Journal of Accountancy

- Magazine

- August 2021

How CPAs helped save businesses during COVID-19

Many small businesses were forced to reinvent themselves to survive the COVID-19 pandemic. Learn how CPAs who offer client advisory services helped business-owner clients explore new options for creating revenue.

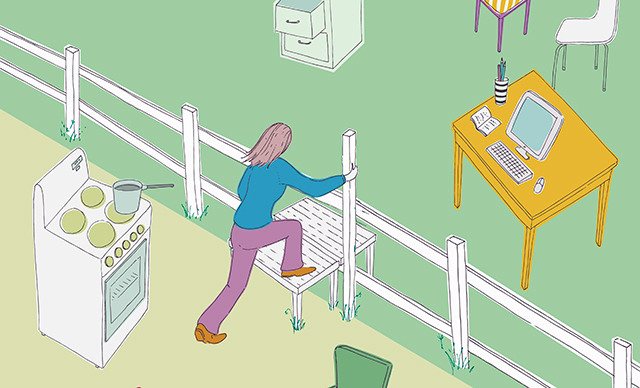

How to effectively support working parents during a crisis

Helping employees maintain health and efficiency during a crisis requires flexibility, empathy, and consistent communication. Employers can follow these tips to help employees during a crisis.

Energize your practice with a tax innovation challenge

The skills and ingenuity the accounting profession showed in reacting to the pandemic can be applied proactively with a new type of competition.

Export tax incentives: The effect of potentially rising tax rates

U.S. exporters are evaluating how to best use IC-DISC and FDII incentives if tax rules change.

Ask the expert: What is an API?

Calvin Leong helps firms understand what APIs are available at Thomson Reuters and how to use them.

COLUMNS

PROFESSIONAL LIABILITY SPOTLIGHT

TAX MATTERS

TECHNOLOGY Q&A

INSIDE AICPA

THE LAST WORD

Features

FROM THIS MONTH'S ISSUE

AI risks CPAs should know

Are you ready for the AI revolution in accounting? This JofA Technology Q&A article explores the top risks CPAs face—from hallucinations to deepfakes—and ways to mitigate them.