- feature

- TAX

Cafeteria plan compliance

The choices for employees can be many, but the recipes for employers are exact.

Please note: This item is from our archives and was published in 2020. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

District court dismisses taxpayer’s refund claim

Nondeductible W-2 wages not included in Sec. 199A deduction computation

Court determines taxpayer lacked profit motive

TOPICS

Employees of businesses that offer health care plans have come to expect that their employer will deduct their employee contributions for premiums on a pretax basis and properly manage other benefits under a Sec. 125 cafeteria plan, also known as a flexible benefit plan. Cafeteria plans are so commonplace that the origins of this treatment and the attendant requirements are often ignored, particularly among small businesses. Payroll service providers, which typically don’t offer payroll or income tax advice and are not tasked with monitoring Sec. 125 compliance, will set up pretax salary reductions for the employees of a business as requested but typically do not require the business to produce a Sec. 125 plan document to show that a plan exists, or make other inquiries to be sure the client understands the law.

As a consequence, many small businesses are out of compliance with Sec. 125. While the chance of audit is probably low, the risk is high if noncompliance unexpectedly results in years of past salary reductions suddenly becoming subject to taxation. The disconnect in many small businesses creates a practice opportunity for CPAs to inform and educate clients about compliance and guide them toward it.

ORIGINS OF SEC. 125 PLANS

In 1970, dual-earner households made up 31% of two-parent households; that figure has increased steadily and today is 46% (Pew Research Center). As increasing numbers of dual earners had no need for duplicate health care, effective pay inequities resulted for the employees who joined their spouse’s benefit plan and received no benefits from their own employer. Cafeteria plans, allowing employees to choose between cash or benefits, became popular, but the benefits were taxable. Disproportionate numbers of lower-paid participants chose cash over benefits, leading to uninsured or underinsured employees.

Sec. 125 was passed in 1978 to allow employers to offer cafeteria plans in which certain qualified benefits are not taxable. Employees can pay for benefits with pretax wages, saving the employees both income and payroll taxes and encouraging participation among lower-paid employees. (See the sidebar “Reasons Clients Should Have a Sec. 125 Plan.”) The section also requires employers to pass discrimination tests to discourage favoring highly compensated or key employees.

CODE PROVISIONS

Under Sec. 125, employers with a qualified written plan are permitted to offer employees a choice between at least one permitted taxable benefit and at least one qualified nontaxable benefit, without the choice itself triggering taxation.

The permitted taxable benefit can include cash, various types of paid time off, and/or severance pay. Qualified benefits are those that, under the application of Sec. 125(a), are excludable from gross income by express provision of Chapter 1 of the Code, except for Sec. 106(b) Archer medical savings accounts, Sec. 117 qualified scholarships, Sec. 127 educational assistance, and certain fringe benefits under Sec. 132, which are specifically excluded. Therefore, qualified benefits can include such popular items as accident and health plans, group term life insurance, and dependent care assistance programs. Deferred compensation, except for certain exceptions such as Sec. 401(k) contributions, is not allowed. In some cafeteria plans, employers offer their employees “flex credits” expressed as a dollar amount, which can be applied to purchase any of a variety of benefits offered. If the cost of the benefits chosen exceeds the credits, the employee can use salary reduction to pay the difference; if the credits exceed the cost, the employee can take the difference in taxable cash in lieu of the benefit.

All participants in the plan must be current or former employees. Though only employees may participate, spouses and dependents may benefit from the plan. Individuals who are self-employed, such as sole proprietors or partners in a partnership, and individuals who are 2% shareholders in an S corporation, are not employees for this purpose. Detailed rules cover the types of changes in status relating to employment, marital status, dependents, etc., that may be permitted in the plan documents.

Sec. 125 plan document preparation, guidance, and administration are offered by many professionals in benefits administration services throughout the country. Employers may choose to offer premium-only plans, flexible spending arrangements, and an array of other benefits.

PREMIUM-ONLY PLANS

A premium-only plan (POP, also known as a premium conversion plan), defined in Prop. Regs. Sec. 1.125-1(a)(5), offers only a single choice consisting of either cash or accident and health insurance coverage. Cash is defined in Prop. Regs. Sec. 1.125-1(a)(2) to include salary reduction, in which the employee elects to decline to receive a portion of his or her pay and directs the employer to use the money to pay the employee’s contribution toward a specified benefit. Under the Code, the money, if used by the employer to pay premiums for a POP, is not constructively received by the employee and is not subject to tax. Employers who offer a POP are not required to offer employees any other form of cash, including cash in lieu of benefits, so employees who opt out of coverage receive no benefit, taxable or nontaxable. However, employers may offer cash in lieu if they choose, and if the employee accepts it, it is a taxable benefit (see the sidebar “A Closer Look at POPs”).

FLEXIBLE SPENDING ARRANGEMENTS

Flexible spending arrangements (FSAs) permit employees to set aside pretax wages to pay for certain qualified benefits, subject to limits on the amounts set aside. FSAs can be offered alongside POPs. Benefits covered by FSAs include dependent care assistance, adoption assistance, and medical care reimbursements (health FSAs). For employees covered by a high-deductible health plan, employer contributions to a health savings account (HSA) can be included in a cafeteria plan as a qualified benefit, along with a limited-purpose and/or post-deductible health FSA. FSAs require adherence to two rules: Under the “use or lose” rule, costs payable under all three types of FSAs are required to be incurred during the plan year. However, under proposed regulations issued in 2007, the plan may adopt an optional grace period allowing costs to be incurred during a predetermined period after the end of the plan year. The grace period may not exceed 2½ months, and it may cover some benefits and not others, as specified in the plan.

Under the uniform coverage rule, the full amount of reimbursement available under a health FSA (less amounts previously reimbursed for the plan year) must be available throughout the plan year. This rule does not apply to dependent care or adoption-assistance benefits.

DISCRIMINATION RULES

To encourage participation by lower-paid employees, Sec. 125 plans may not discriminate in favor of highly compensated or key employees, and the regulations include tests required with respect to eligibility, contributions, and individual and total benefits. If, under testing, a plan is found to be discriminatory with respect to a plan year, the discriminatory benefits are included in the gross income of the highly compensated or key participants who received them.

Highly compensated employees are any employees, or spouses or dependents of employees, who are:

- An officer;

- A 5% shareholder;

- An employee with annual compensation in the preceding year exceeding the amount in Sec. 414(q)(1)(B) ($125,000 for plan years beginning in 2019 and $130,000 for plan years beginning in 2020); or

- If the employer elects under Sec. 414(q)(3), an employee whose salary is in the top 20% of all employees.

Key employees are any employees, or spouses or dependents of employees, who are:

- An officer of the company with annual compensation, per Sec. 416(i)(1), of $180,000 for plan year 2019 and $185,000 for plan year 2020;

- A 1% owner with annual compensation of $150,000 or more in the plan year; or

- A 5% owner, without regard to compensation.

SPECIAL RULES FOR BUSINESSES WITH FEWER THAN 100 EMPLOYEES

Businesses with fewer than 100 employees on average on business days during either of the two preceding years may be eligible to adopt a simple cafeteria plan under Sec. 125(j). Provisions for simple cafeteria plans were included in the Patient Protection and Affordable Care Act, P.L. 111-148, and became available in 2011. Under a simple plan, eligible employees include those with 1,000 hours of service in the preceding plan year. Discrimination testing is simplified: Employers can meet nondiscrimination requirements if the plan requires the employer to provide to qualified employees (those who are neither highly compensated nor key employees and are eligible to participate in the plan) qualified benefits that equal either:

- A uniform percentage of each employee’s compensation, not less than 2%; or

- The lesser of 6% of each employee’s compensation for the plan year or twice his or her salary-reduction contribution.

However, the nondiscrimination requirement will not be met if the rate of contribution with respect to the salary-reduction contribution of a highly compensated or key employee is greater than the rate for an employee who is not a highly compensated or key employee.

SEC. 125 DOCUMENTS

Employers must have written plan documents, to include a master plan document, an adoption agreement (which can be included in the master plan document), and a summary plan description that must be provided to all eligible employees within 90 days of their becoming covered by the plan. The plan documents must be furnished to all plan participants every 10 years, if the plan has not been updated, or every five years, if the plan has been updated.

The plan documents must specify the plan year, and the plan year may be changed only for a valid business purpose, such as to align with the health care provider’s benefit year. Other requirements for written plans are at Prop. Regs. Sec. 1.125-1(c). The plan must require employee elections to be made annually. Elections are irrevocable during the plan year; however, Regs. Sec. 1.125-4 allows employers to permit certain midyear changes due to changes in employee status. Permitted status changes must be listed in the employer’s plan documents.

SEC. 125 AND ERISA

Sec. 125 plans are covered by the Employee Retirement Income Security Act (ERISA), which includes requirements for written plan documents, a trust fund to hold the assets, proper recordkeeping, and periodic notices to the participants and the government. If a Sec. 125 plan uses an insurance contract, a trust fund may not be needed, but employees’ salary-reduction contributions should be deposited with the insurer on a timely basis in accordance with U.S. Department of Labor (DOL) regulations.

Annual summary plan descriptions and employee eligibility notices and election forms should be provided to eligible employees on a timely basis before the beginning of each plan year. The DOL does not require Form 5500, Annual Return/Report of Employee Benefit Plan, from most welfare benefit plans that have fewer than 100 participants as of the beginning of the year, including Sec. 125 plans, and IRS Notice 2002-24 suspended the requirement to file information returns with the IRS. Annual discrimination test results do not need to be submitted to the government, but evidence of testing should be retained with other plan documents.

COMMON ERRORS IN SEC. 125 PLANS OF SMALL BUSINESSES

Many small businesses expect their payroll service provider to guide them through the laws and regulations that govern payroll, but payroll service providers typically don’t offer payroll or income tax advice and are not tasked with monitoring Sec. 125 compliance. As a result, many small businesses may not be compliant with the requirements of Sec. 125. While discrimination issues can subject highly compensated or key participants to taxation, the lack of a written plan or operational errors can subject all participants to taxation, in accordance with Prop. Regs. Secs. 1.125-1(c)(6) and (7). Common errors include:

No plan documents

Some small businesses don’t realize that plan documents are required. Plan documents can be prepared and updated annually by professionals in benefits administration services. The client should thoroughly discuss with the benefits administration personnel the details of Sec. 125 requirements, to be sure the client understands them, and read the documents carefully to be sure their process conforms to the plan.

Misunderstanding employee eligibility

Nondiscrimination rules for eligibility require plans to allow employees who have completed three years of service to participate, providing they satisfy other conditions not related to length of service (Prop. Regs. Sec. 1.125-7(b)(2)). Small employers might confuse that rule with the shorter eligibility testing rule under a simple cafeteria plan described above, which requires eligibility for employees who worked 1,000 hours in the preceding plan year.

Not retaining evidence of a status change

Employees should be required to authorize their elections and any midyear status changes that they are permitted to make under the terms of the plan documents, and evidence of their authorizations should be retained. Both written and electronic elections are permitted by Sec. 125, and employers should maintain systems for retaining employee authorizations and proof-of-eligibility documents required for status changes.

Not taking required parameters into account when calculating salary reductions or flex credits

Sec. 125 parameters for employer contributions should be examined when calculating salary reductions or flex credits. These parameters include the cost of health plan coverage for cafeteria plans and the employee’s compensation and salary reductions for simple plans. Employers should be sure that they have met the requirements for contributions to the plan and the benefits offered.

Not testing for discrimination, or not testing on a timely basis

Tests for discrimination involve eligibility, contributions, and benefits. Tests should be made annually as of the last day of the plan year (Prop. Regs. Sec. 1.125-7(j)). If midyear status changes are permitted by the terms of the plan documents, interim testing might be advisable to watch for any developing issues.

HOW CPAs CAN HELP

Some small business clients may not be aware that they can offer a Sec. 125 plan. Others may not be aware that their plans are not in compliance, risking adverse tax consequences.

CPAs can ask their clients how their benefits programs are handled and initiate a conversation. If a client does not offer a Sec. 125 plan, or if it has a plan and the CPA identifies a concern, the client will appreciate being informed.

Knowledgeable tax practitioners, together with a professional in benefits administration services, can advise the client on creating the required documents and preparing and implementing procedures to establish compliance within the human resources, payroll, tax, and accounting processes of the client’s business. Successfully aiding the client in offering a useful, compliant Sec. 125 plan will be a win for the client — especially for its employees.

Reasons clients should have a Sec. 125 plan

Income tax savings for the employee: A Sec. 125 plan is required for employers who want to allow employees to choose the qualified benefits they want and avoid paying income taxes on the amount of wages they contribute to obtain those benefits.

Payroll tax savings for the employee and employer: Since employees’ wages contributed to obtain qualified benefits aren’t subject to income taxes, both the employee and the employer save on payroll taxes.

Flexible spending account (FSA) benefits for the employee: FSAs can only be offered through a Sec. 125 plan.

Minimal administration: For a premium-only plan (POP), setup and ongoing fees of administration are minimal, no IRS forms are required, and no U.S. Department of Labor forms are required for plans with fewer than 100 participants.

A closer look at POPs

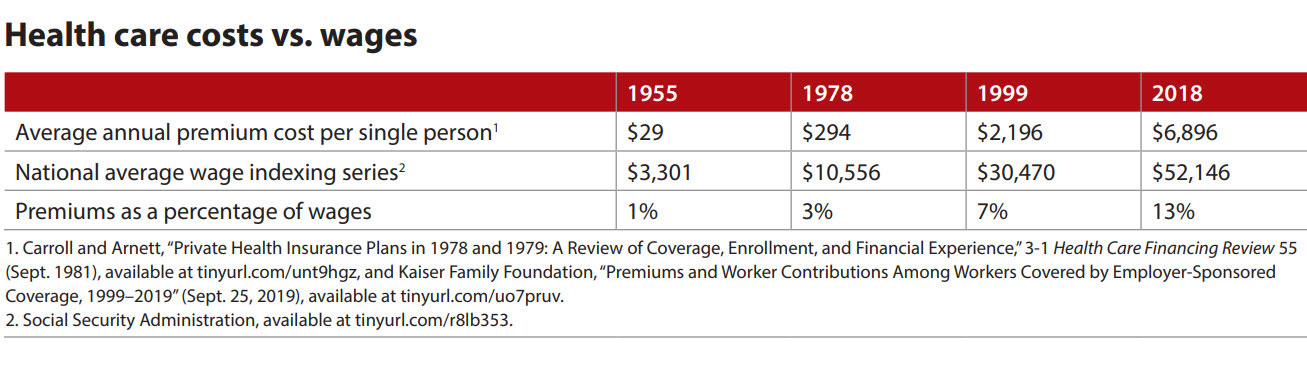

The cost of care has risen precipitously, as shown in the chart “Health Care Costs vs. Wages.” Employers have walked a fine line between the needs to offer health care coverage to recruit employees and to control the cost of health care by requiring employees to shoulder more of the cost. Especially among small employers, a premium-only plan (POP) may seem the perfect way to strike that balance — except for employees who opt out.

A POP, as defined in Prop. Regs. Sec. 1.125-1(a)(5), allows employers to offer only a choice between pay and health care benefits (under a salary reduction). Employees who opt in pay no taxes on the portion of their salary used for their share of the health care premium. If the employer does not offer cash in lieu of benefits, however, employees who opt out of the health care benefits get nothing beyond their usual rate of pay and are no better off than if the employer had no Sec. 125 plan or did not offer health care. Employees who opt out might do so because they have coverage through a spouse or partner; they may also need the additional pay, even though it is taxed.

Two possible solutions present themselves: The first, requiring employers with a POP to offer cash in lieu of benefits, burdens employers with the cost of the additional cash in lieu and payroll taxes and would be especially difficult for small businesses to afford. The second, to permit employees who opt out to receive the amount of their salary reduction in the form of nontaxable pay just as opt-in employees do, shifts the burden to the governments that lose payroll taxes on the salary-reduction amounts of opt-out employees. It might also result in more employees opting out of employer health care coverage, a negative social effect. So neither solution is optimal.

It’s unlikely that the 95th Congress, which carefully outlined guidelines to discourage discrimination toward highly compensated employees, envisioned that two employees with the same rate of pay could receive widely differing values for their services. Dramatically increasing health care costs have made this scenario a reality.

About the author

Linda Franks, CPA, is controller at B&Z Manufacturing Co. Inc. in San José, Calif.

To comment on this article or to suggest an idea for another article, contact Paul Bonner, a JofA senior editor, at Paul.Bonner@aicpa-cima.com or 919-402-4434.

AICPA resources

Article

- “Flexible Benefits for Small Employers,” JofA, March 2001

CPE self-study

- AICPA’s Annual Federal Tax Update (#746512, text; #163745, online access)

- Auditing Employee Benefit Plans (#733843, text; #153008, online access)

Conference

- Employee Benefit Plans, May 4—6, Las Vegas

For more information or to make a purchase or register, go to aicpastore.com or call the Institute at 888-777-7077.

The Tax Adviser and Tax Section

Subscribe to the award-winning magazine The Tax Adviser. AICPA Tax Section members receive a subscription in addition to access to a tax resource library, member-only newsletter, and four free webcasts. The Tax Section is leading tax forward with the latest news, tools, webcasts, client support, and more. Learn more at aicpastore.com/taxsection. The current issue of The Tax Adviser and many other resources are available at thetaxadviser.com.