- feature

- FINANCIAL REPORTING

Accounting for sale and leaseback transactions

New revenue recognition and lease accounting standards have affected the way these transactions are reported.

Please note: This item is from our archives and was published in 2020. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

What CPAs should know about Trump accounts

What to know about engagement quality reviews (SQMS No. 2)

Agentic AI is handling more finance work — but can CFOs trust it?

Sale and leaseback transactions have long been popular because they present benefits to both seller-lessees and buyer-lessors. The accounting for such transactions has changed significantly, though, with FASB’s issuance of new standards for revenue recognition and lease accounting in recent years.

FASB’s new lease accounting standard has made it less challenging to determine whether control has passed from a seller-lessee to a buyer-lessor when assets are under construction. Nonetheless, financial statement preparers for organizations in complicated leasing arrangements may have difficulty applying these provisions.

Issued in 2016, FASB’s lease accounting standard (FASB ASC Topic 842, Leases) requires lessee parties to record right-of-use assets and related obligations in connection with operating leases exceeding 12 months. Under the previous guidance (ASC Topic 840), payments associated with operating leases were treated as expenses, and thus such leases were not reported on the entities’ balance sheets. The new standard has a cosmetic impact on lease transactions previously meeting the Topic 840 criteria for capital leases. The result is a relabeling of such leases as finance leases, which under the current guidance are classified as intangible right-of-use assets subject to amortization. On the lessor side of these transactions, the new standard has the same lease classifications (operating, direct financing, sales-type leases), although the lease classification criteria have changed. In addition, the accounting for these transactions by the lessor parties is affected by the new revenue recognition principles codified in ASC Topic 606, Revenue From Contracts With Customers.

THE NATURE OF LEASEBACKS

A sale and leaseback, or more simply, a leaseback, is a contract between a seller and a buyer where the former sells an asset to the latter and then enters into a second contract to lease the asset back from the buyer. Benefits for the seller-lessee include:

- An immediate inflow of cash that can be deployed in some area of the entity’s business; and

- A cheaper form of financing owing to the ability of the parties to structure the transaction in a manner that reduces the cost of conventional financing (e.g., collateral, violations of loan covenants, closing costs, possible balloon payments, and restrictions).

Benefits for the buyer-lessor from leasebacksinclude:

- Reduced default risk due to the ability to directly investigate the seller-lessee’s credit;

- The ability to more easily terminate the contract than would be the case under conventional financing;

- Important tax advantages — depreciation; and

- Guaranteed residual value at termination.

The benefits obtained from this source of financing will continue to make leasebacks a popular vehicle to both parties notwithstanding the challenge of implementing the detailed reporting and disclosure requirements of Topic 842.

WHAT CONSTITUTES A SUCCESSFUL SALE AND LEASEBACK?

Relevant to the discussion regarding whether the transaction qualifies or fails to qualify as a sale and leaseback transaction centers upon the seller-lessee and whether control has effectively been transferred to the buyer-lessor. In order for control to be achieved, the sale must meet the requirements of Topic 606, specifically Paragraphs 606-10-25-1 through 606-10-25-8. These paragraphs determine whether a contract exists. Paragraph 606-10-25-30 governs whether performance obligations have been satisfied. However, meeting these provisions is not enough to establish transfer of control and attainment of a successful leaseback; the transaction must result in an operating lease classification for the seller-lessee. Here, none of the criteria of Paragraph 842-10-25-2 establishing recognition as a finance lease must be present. If any one of the criteria under this paragraph is met, control over the underlying asset does not qualify as an effective transfer, the seller-lessee must classify the transaction as a finance lease, and the proceeds of the sale must be treated as a financing. The criteria underlying classification of the transaction as a finance lease are:

- There is a transfer of ownership of the asset to the lessee at the termination of the lease;

- The lessee has an option to purchase the asset that is reasonably certain to be exercised;

- The lease term constitutes a major part of the remaining economic life of the asset;

- The present value of the sum of the lease payments and guaranteed residual value by the lessee must equal or exceed substantially all of the fair value of the underlying asset; and

- The underlying asset must be of a specialized nature precluding any alternative use to the lessor at the termination of the lease period.

In addition, under Paragraph 842-40-25-3, virtually any option for the seller-lessee to repurchase the asset precludes sale treatment unless the option is at fair value and the subject asset is essentially a commodity.

ILLUSTRATION OF A SUCCESSFUL SALE AND LEASEBACK

Assume the following information:

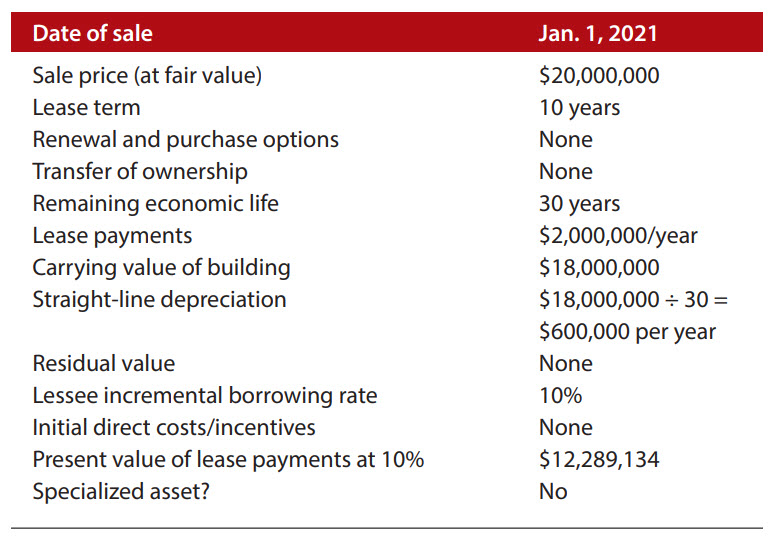

Short on cash, Smith Corp. enters into a contract with Jones Corp. to sell a building used in its operations and then enters into an agreement with Jones to lease back the building from Jones, thereby enabling Smith continued use of the building (see the table “Smith-Jones Sale and Lease Terms”).

Smith-Jones sale and lease terms

The seller-lessee evaluates the sale under Paragraphs 606-10-25-1 through 606-10-25-8, and Paragraph 606-10-25-30, and determines that the transaction qualifies as a sale under Topic 606. Next, based on the information in the table “Smith-Jones Sale and Lease Terms,” the seller-lessee evaluates the lease classification criteria in Paragraph 842-10-25-2. There is no transfer of ownership; that is, ownership will vest with the buyer-lessor after the transfer, and there are no purchase or renewal options available to the seller-lessee. The lease term is only 33% of the building’s remaining economic useful life; the present value of the lease payments is $12,289,134 ÷ $20,000,000, which is a little more than 61% of the fair value of the asset; and the asset is not of a specialized nature. Since none of the criteria from Paragraph 842-10-25-2 are met, the seller-lessee would classify the lease as operating, thereby allowing the transaction to qualify as a sale and leaseback.

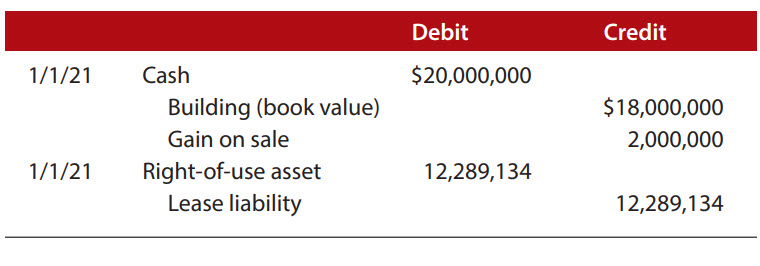

Under these circumstances, the seller-lessee would record cash proceeds of $20,000,000, derecognize the carrying value of the building from his books, and record a gain on sale of $2,000,000. Additionally, the seller-lessee would recognize a right-of-use asset and a related lease liability equal to $12,289,134. As a result of this information, the seller-lessee would make the journal entries shown in the table “Sale and Leaseback Transaction.”

Sale and leaseback transaction

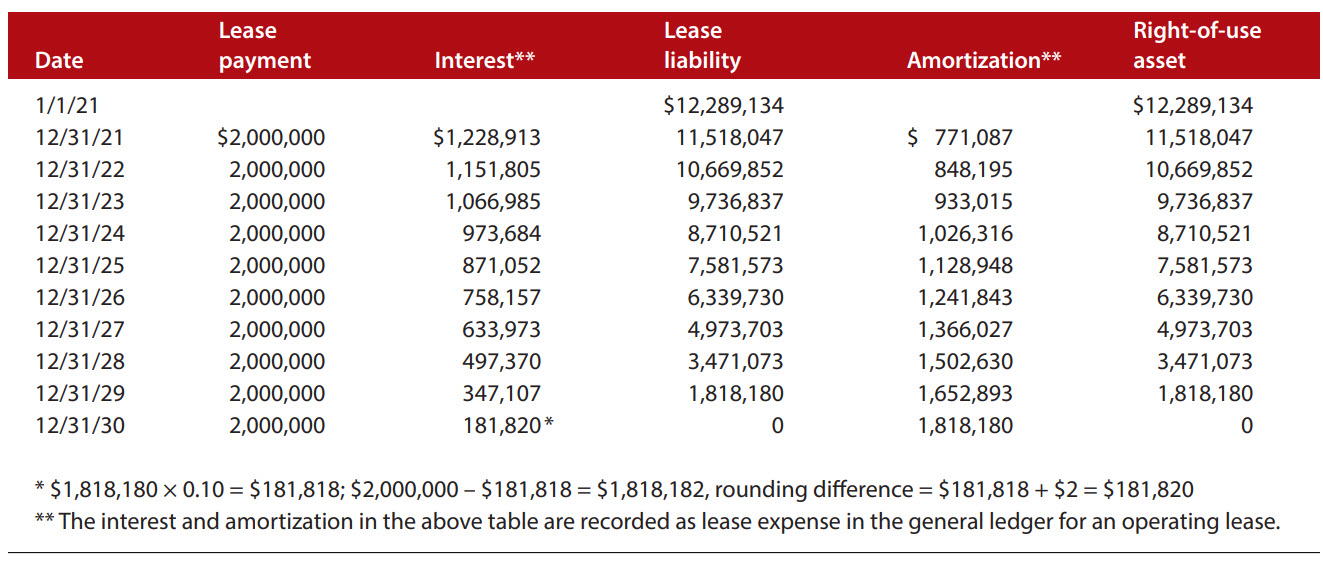

During the remaining lease term, the seller-lessee would recognize lease expense on a straight-line basis. The lease liability would be amortized using the effective interest method, and the right-of-use asset would be reduced by the difference between the straight-line rent expense and the reduction of the lease liability. By the end of the lease term, both the lease liability and the right-of-use asset would be amortized to zero (assuming no initial direct costs and/or incentives) as shown in the table “Amortization Table for Sale and Leaseback Transaction.”

Amortization table for sale and leaseback transaction

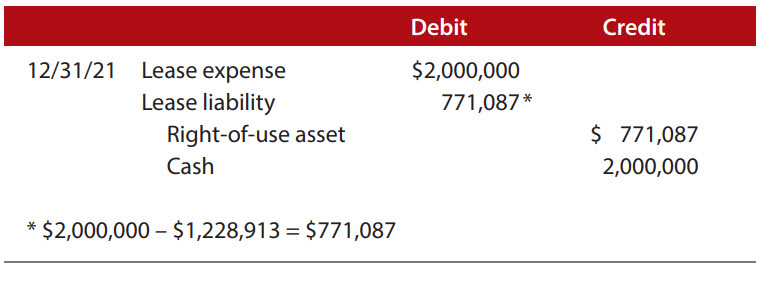

On Dec. 31, 2021, the seller-lessee would record the transaction as shown in the table “Journal Entry Based on Amortization Table.”

The seller-lessee would make similar entries for the remaining nine years. Next, assume the contract provided Smith Corp. with an option to purchase the building on Jan. 1, 2026, for $12,000,000 and that the assets similar to the subject asset are not readily available in the market. In this case, the transaction would not still qualify as a successful sale and leaseback.

Journal entry based on amortization table

ILLUSTRATION OF A FAILED SALE AND LEASEBACK

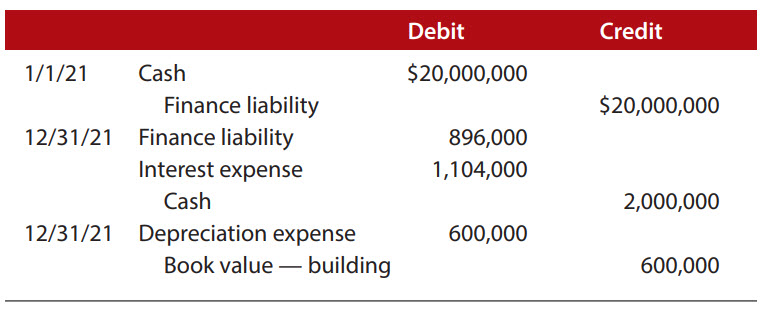

Smith Corp.’s option to purchase the building at the end of year 5 precludes treating the transfer of the asset as a sale under Paragraph 842-40-25-3 (assuming the narrow exception provided by subparagraphs a and b are not met). In this case, the transaction does not qualify as a sale and leaseback, and must instead be treated as a financing pursuant to Paragraph 842-40-25-4. This treatment results in the recognition of a financial liability of the seller-lessee. Further, the seller-lessee may not derecognize the asset and must continue to record depreciation expense on the building.

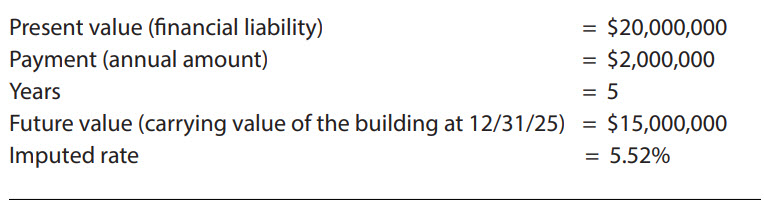

Under this circumstance, Paragraph 842-40-30-6b requires that the book value of the asset cannot exceed the carrying value of the liability at the earlier of the lease termination date or the date at which control over the asset is transferred to the buyer-lessor. Here, the seller-lessee must determine an interest rate that will equate the carrying value of the financial liability to the carrying value of the building at the exercise date of the option. Based on the above fact pattern, that date would coincide with Dec. 31, 2025. At this date, the book value of the building would be $18,000,000 ‒ ($600,000 × 5) = $15,000,000. The imputed rate would be calculated using the figures in the table “Factors for Calculating Imputed Rate.”

Factors for calculating imputed rate

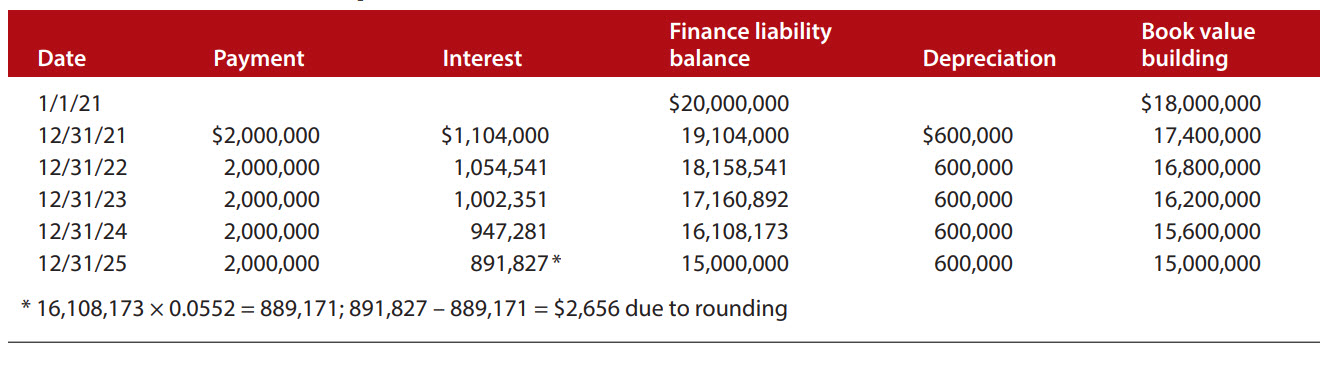

Using the imputed rate of 5.52% results in the amortization table “Amortization at the Imputed Rate.”

Amortization at the imputed rate

In connection with this financing, Smith Corp. would record the transaction as shown in the table “Journal Entries Related to Failed Leaseback 2021—2025.”

Journal entries related to failed leaseback 2021—2025

Similar entries would be made through Dec. 31, 2025.

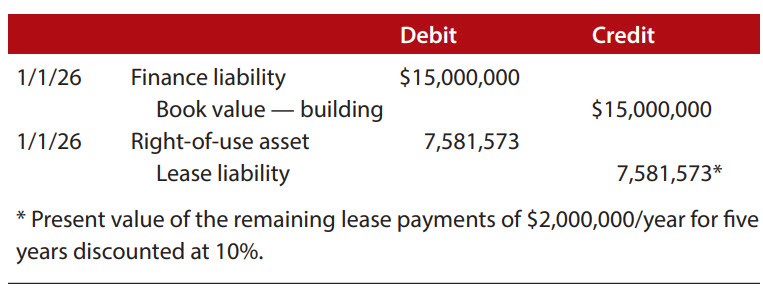

Assume that Smith Corp. does not exercise the option. The leasing arrangement now qualifies for classification as an operating lease and treatment as a leaseback. In this instance, Smith Corp. would eliminate the carrying value of the building and finance liability. In essence, such elimination would be equivalent to a sale, as the seller-lessee has effectively transferred control of the underlying asset (i.e., the building) to the buyer-lessor. The seller-lessee would also record a right-of-use asset and related lease liability equal to the present value of the remaining lease payments (2026—2030). On Jan. 1, 2026, the seller-lessee would make the entries shown in the table “Option to Purchase Not Exercised: Successful Leaseback Established at End of 2025.”

Option to purchase not exercised: Successful leaseback established at end of 2025

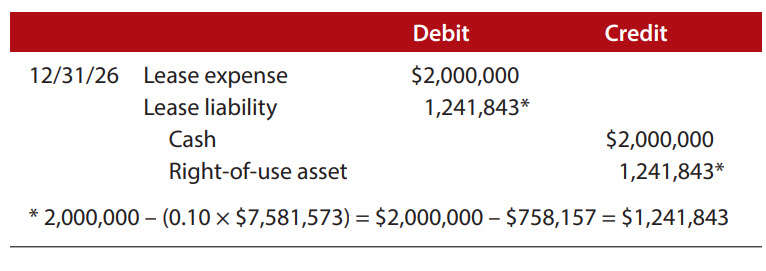

On Dec. 31, 2026, the seller-lessee would make the entries shown in the table “Journal Entries for Seller-Lessee.”

Based on the first amortization table, similar entries will be made for the remainder of the lease term.

Journal entries for seller-lessee

CHALLENGES REMAIN

The examples of successful and failed sale and leasebacks make application of the relevant paragraphs of Topic 842 seem relatively straightforward. However, in many leaseback examples, it is difficult to determine when control transfers, particularly in the case of real estate transactions where one party owns buildings sold on land owned by another party. Under the previous guidance, Topic 840, application of its extensive provisions and related disclosures were difficult to implement for many entities. Here, FASB in Paragraphs 842-40-55-40 through 842-40-55-44 has streamlined the onerous provisions of the preceding guidance with respect to criteria underlying whether control is deemed to have passed from a seller-lessee to a buyer-lessor in transactions involving assets under construction. Despite the new guidance, application of these provisions in more complicated leasing arrangements will continue to pose challenges to many entities.

Effective date delayed

As a result of the coronavirus pandemic, FASB has voted to delay by one year the effective dates of its lease accounting standard for certain entities. The delay makes FASB ASC Topic 842, Leases, effective for private companies and private not-for-profits for fiscal years starting after Dec. 15, 2021. The effective date for public not-for-profits, which have issued or are conduit bond obligors for securities that are traded, listed, or quoted on an exchange or an over-the-counter market and that have not yet issued financial statements, would be fiscal years starting after Dec. 15, 2019.

About the authors

Robert Singer is a professor of accounting, and Steven Coleman is an associate professor of accounting, both at the Robert W. Plaster School of Business and Entrepreneurship at Lindenwood University in Saint Charles, Mo. Heather Winiarski, CPA, CGMA, is a shareholder of Mayer Hoffman McCann PC in Kansas City, Mo.

To comment on this article or to suggest an idea for another article, contact Ken Tysiac, the JofA‘s editorial director, at Kenneth.Tysiac@aicpa-cima.com.

AICPA resources

Articles

- “Lease Accounting Standard Requires New Auditor Judgments,” March 2020

- “Lease Accounting: A Private Company Perspective,” July 2019

- “Lease Accounting Tips for Public and Private Companies,” April 4, 2019

CPE self-study

- Annual Accounting and Auditing Workshop (#736195, text; #156565, online access)

- Leases: Mastering the New FASB Requirements (#164933, online access)

Conference

- National Advanced Accounting and Auditing Technical Symposium (July 20—22) at ENGAGE Digital (July 20—24), aicpaengage.com

For more information or to make a purchase or register, go to aicpastore.com or call the Institute at 888-777-7077.

Online resource