CPA firms venture into the new decade of serving taxpayers.

January 2020 - Journal of Accountancy

- Magazine

- January 2020

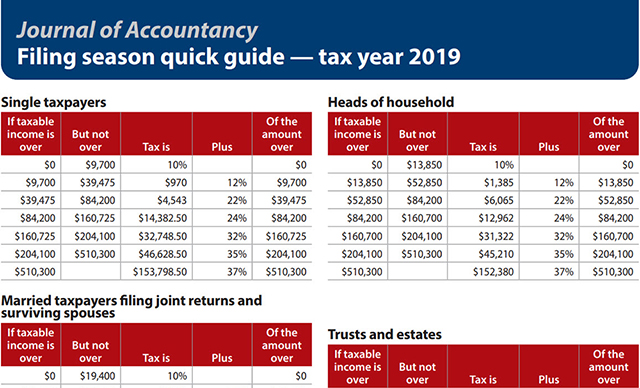

Filing season quick guide — tax year 2019

Download and print this tax season reference highlighting dollar thresholds, tax tables, standard amounts, credits, and deductions.

4 ways CPAs can manage their stress

Busy season is here, bringing with it compressed deadlines and rising pressure. What can accountants do to deal with stress? This article offers some ideas.

2020s vision: Tech transformation on tap

Data analytics, blockchain, artificial intelligence, and other technologies will drive big changes in the accounting profession over the next 10 years. Are you ready for what’s next?

How to guard client finances against dementia

Cognitive impairment adds a difficult layer of complexity to a client’s financial plans. Here are steps CPAs can take to protect clients with dementia against fraud.

10 steps for getting practice growth right

When firms experience growth, it can be a challenge figuring out how to respond to the demands that come along with it.

Writing to win tax appeals

If taxpayers disagree with an IRS audit, they have 30 days to prepare an IRS protest. Find out how to win at IRS Appeals.

COLUMNS

CHECKLIST

PROFESSIONAL LIABILITY SPOTLIGHT

From the Tax Adviser

TAX PRACTICE CORNER

TAX MATTERS

TECHNOLOGY Q&A

INSIDE AICPA

THE LAST WORD

Features

FROM THIS MONTH'S ISSUE

AI risks CPAs should know

Are you ready for the AI revolution in accounting? This JofA Technology Q&A article explores the top risks CPAs face—from hallucinations to deepfakes—and ways to mitigate them.