A CPA who lives with mental illness explains how getting help can make a difference — and how the support of colleagues can help, too.

February 2020 - Journal of Accountancy

- Magazine

- February 2020

Flexible work strategies for public accounting

Worker-friendly policies — when executed correctly — can assist CPA firms in retaining valuable people.

Housing costs and the talent crunch

Many of the world’s biggest cities have become unaffordable for workers, creating deep labor shortages. Some companies are beginning to invest in employee housing to lure talent and bolster retention.

What’s your fraud IQ?

Are you effectively preparing your employees to guard against cyberfraud? Take this month’s quiz and find out.

Finance priorities for post-merger integration

Management accountants can take a lead role in post-merger integration with the right planning and execution of key steps.

Boardroom advice for handling disruptive risk

Unforeseen, fast-moving risks call for new models of risk management.

Start or review an accountable plan

Employees’ business expense reimbursements are excluded from gross income.

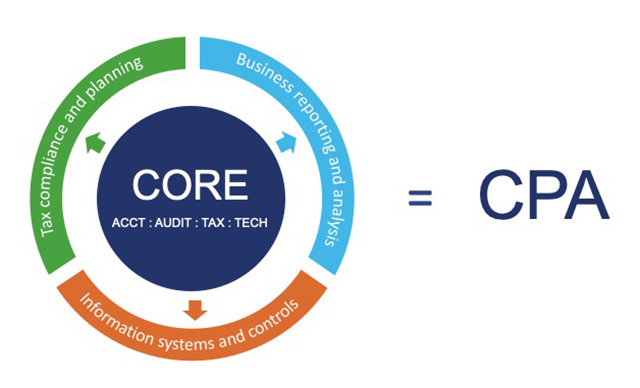

A future-focused path for CPA licensure

A model proposed by the National Association of State Boards of Accountancy and the AICPA would require candidates to display core skills plus deeper knowledge in one of three disciplines.

COLUMNS

CHECKLIST

PROFESSIONAL LIABILITY SPOTLIGHT

From the Tax Adviser

TAX PRACTICE CORNER

TAX MATTERS

TECHNOLOGY Q&A

TECH TOOLS

INSIDE AICPA

THE LAST WORD

Features

FROM THIS MONTH'S ISSUE

AI risks CPAs should know

Are you ready for the AI revolution in accounting? This JofA Technology Q&A article explores the top risks CPAs face—from hallucinations to deepfakes—and ways to mitigate them.