- feature

- MANAGEMENT ACCOUNTING

Capex risk management during the coronavirus pandemic

Use these five steps to identify company vulnerabilities as well as capital expenditure opportunities during a global crisis.

Please note: This item is from our archives and was published in 2020. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

Company lacks standing to sue ERTC advisers

Report: AI speeds up work but fails to deliver real business value

How a CPA beat burnout after strokes, years of depression

The coronavirus pandemic has disrupted companies’ capital project plans, not only this year but most likely for the foreseeable future. This is likely to have consequences beyond the pandemic, because the way companies allocate capital and make investment decisions affects long-term shareholder value creation.

One CFO role in leading organizational sustainability is capital planning. Successfully fulfilling this key role requires risk management and performing analytical processes that predict capital decision implications.

The practical business approach builds advance capabilities to respond to negative-surprise events and protect business operations. In a crisis, preserving cash and cash flow, as well as sustaining or obtaining capital, becomes the highest priority.

Major capital investments such as acquisitions and stock buybacks generally cease soon after a crisis begins. However, capital expenditure (capex) momentum often continues unabated. Worse, capex can increase. Like death by a thousand cuts, uncurtailed capex can result in a major impending cash flow squeeze that threatens liquidity and may ultimately threaten a company’s existence.

Much of the reason is structural. Acquisitions and stock buybacks are easy to end quickly because they are generally centralized at the corporate level, are more likely to be at the board of directors’ authority level, and have higher visibility. Capex, however, often has a life of its own.

Expenditures are generally approved during the annual budgeting process. Even for a large, single expenditure, spending often occurs in smaller amounts over a long period. In addition, capex can consist of many projects, making expenditures harder to capture. Also, smaller capex generally falls under lower spending authority levels. Lastly, capex is frequently less visible because it is buried in subsidiary operations.

While deferring capex is a way to conserve cash, CFOs frequently struggle to identify which capital projects to cut or where to allocate capital. Risk modeling can aid this decision-making process.

5-STEP RISK MODEL

Few CFOs would admit to not possessing dynamic risk-modeling capabilities for ongoing operations and for crisis and risk management. Fortunately, companies with ineffective or nonexistent risk-modeling capabilities can quickly implement the following approach. Beyond today’s crisis, this approach will also improve their capital allocation decision process. Capital allocation means distributing and investing financial resources in ways that fulfill strategic objectives as well as meet tactical goals of increasing operational efficiency and profitability. Capex is operationally investing in a specific asset. (See the sidebar, “Managing Capex Risk Step-by-Step,” for a specific example.)

The five-step risk model sequence follows:

- Identify the issues;

- Conduct risk identification and scenarioanalysis;

- Analyze identified risks;

- Develop risk mitigation alternative solutions; and

- Select and implement the best solution.

1. Identify the issues

Identify and prioritize the crisis’s key issues that are affecting business operations. Pinpoint the disrupters and prioritize the most important impacts to the business. These issues have the largest financial effects on the company’s capital and cash flow.

These financial impacts are not just internal, such as having enough cash to fund working capital needs. They are also external factors affecting cash, such as the supply chain functionality encompassing suppliers and customers. Less tangible issues are impacts on employee morale, stakeholders, reputation, and the company’s mission. It is important to identify these hard-to-measure costs of investing in external business drivers because the impact of external forces on cash is less obvious.

2. Conduct risk identification and scenario analysis

Business threats that were either nonexistent or irrelevant before the crisis now need to be identified. Monitoring and ongoing assessment of emerging risks should occur more frequently than once a year. At this time, the risk assessment process should identify “what can go wrong and how it can go wrong.” Identifying how something can go wrong allows management to initiate preventive steps now instead of taking corrective actions after a mishap that could result in significant harm.

Scenario analysis is a good approach for identifying risks because it focuses on what might go wrong in the future. Scenario analysis identifies potential events and their possible outcomes and implications to cash and capital requirements.

Risk convergence is the process of looking across the entire company and combining common risks affecting the business. Functional interdependencies necessitate a cross-functional risk-identification approach. A best practice for identifying and combining common risks affecting the business is to include multiple internal functional leaders and external stakeholders. This shortens information silos and enhances the efficiency and quality of risk identification.

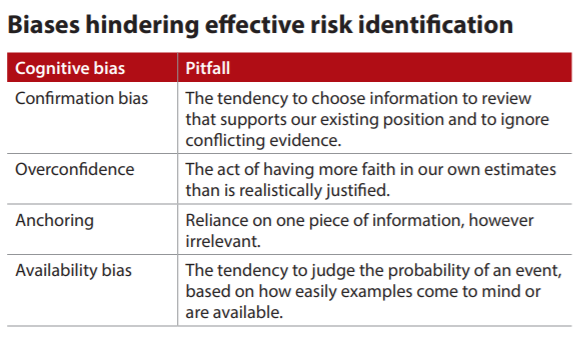

An advantage to including external stakeholders in the risk-identification process is to lessen the chance of falling prey to common cognitive biases. Some relevant biases and their pitfalls are shown in the chart, “Biases Hindering Effective Risk Identification.”

3. Analyze identified risks

Based on the cash and capital risks identified, evaluate their financial impact on the business. Risk analysis can be both quantitative and qualitative. The quantitative approach is employed less frequently and uses actual dollar impact amounts to produce a financial risk value.

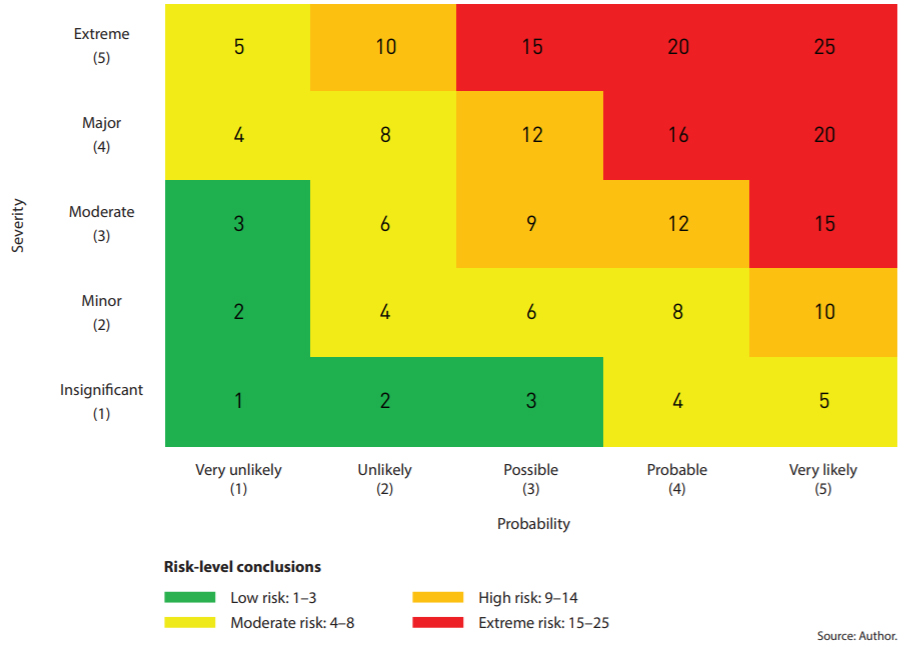

Most CFOs employ the qualitative approach, which produces a risk score based on scoring methods. One tool is a risk heat map combining risk significance with its occurrence probability. An example format is shown in the “Risk Heat Map” graphic.

To mitigate risks, companies need to prioritize risk mitigation actions from the highest level (red) to the lowest level (green).

Risk heat map

4. Develop risk mitigation alternative solutions

Risk mitigation is the act of taking actions to reduce the financial impact of risks or the probability of their occurrence. Action examples include improving process efficiency, increasing reliability, improving data quality, lowering operational costs, and eliminating capital investment. CFOs and business leaders determine the best solution from the alternatives developed, which may result in capex if achieving objectives will not come from process improvement alone.

The outcome is a revised cash and capital investment allocation strategy based on risk analysis and tactical priorities. Examples are supplying needed working capital for operations and reconsidering or postponing capex until the crisis improves.

This last alternative contains a trade-off that requires evaluating how much capex reductions could hurt a company’s competitive position in the marketplace. CFOs must be strategic about cutting capex, and they need to carefully evaluate opportunity costs from canceling, postponing, or scaling down capital projects. These opportunity costs quantify the impact of such capex changes, recognizing marketplace dynamics and company product and process interdependencies.

Depending on company management’s (and the board’s) risk appetite, in a high-risk-tolerant company or industry, a bold CFO may become the champion of certain capex.

An aggressive alternative could be financing capex to position the company to rebound or to increase its competitive advantage in the marketplace. Of course, companies need capital availability and courage to make opportunistic investments.

5. Select and implement the best solution

The last step is to select the best solution among the alternatives and implement this solution.

STRONG LEADERSHIP DURING A CRISIS

Effective leaders possess several characteristics that are important during a crisis. An essential leadership capability in a crisis is recognizing uncertainty’s impact on the internal people (employees) and the external people (supply chain and other stakeholders such as creditors, investors, and communities) who affect the company’s performance.

Strong leadership actions include prioritizing speed over perfection. During a crisis, prompt action outweighs perfection. Strong leaders are comfortable with imperfect information, and people value quick decisions and communication.

Also, staying on message is important when organizations encounter a crisis. Strong leaders identify, prioritize, and focus on the most critical issues. Investors, the board of directors, and other stakeholders look to the CFO to protect company financial performance relating to cash flow, liquidity, and solvency, especially during a crisis.

Financial leadership during a severely disruptive event, such as the global coronavirus pandemic, necessitates preserving cash and cash flow, as well as sustaining or obtaining capital. While deferring capex can help conserve cash, CFOs frequently struggle to identify which capital projects to cut or where to allocate capital. One approach for doing this comes from developing advance capabilities to respond to negative-surprise events and protect business operations by implementing dynamic risk modeling so that company management prioritizes risk vulnerability and capex opportunity.

By effectively managing hard and soft assets, and capital and people, respectively, business leaders can optimize organization performance during a global crisis like the coronavirus pandemic.

It will be apparent the risk management modeling is superior when, during a global crisis, the company suffers fewer immediate financial constraints and improves its long-term competitive position.

Managing capex risk step-by-step

A simple example of this five-step risk management tool starts with an occurrence that is likely during a crisis:

1. Identify the issues: The company is losing customers in the Northeast Region. A root-cause analysis determines the reason is slow product delivery.

2. Conduct risk identification and scenario analysis: The Northeast Region accounts for 20% of the company’s sales, and the Northeast is a strategic priority for future sales growth. Scenario analysis suggests a 10% revenue reduction could occur, which would result in employee layoffs and a dangerous liquidity situation for the company.

3. Analyze identified risks: Based on the risk assessment table, the conclusion is that this is a high-risk event.

4. Develop risk mitigation alternative solutions: Open a warehouse in the Northeast to have product closer to the customer. This will result in faster product delivery and a visible presence in a strategically important region. The company’s strategic plan is to develop a greater presence in the Northeast Region. Opening a warehouse accelerates the strategic plan timetable and preserves operating cash flow.

5. Select and implement the best solution: The company defers spending on less critical capital projects to fund the opening of the warehouse in the Northeast.

About the author

Mark D. Mishler, CPA, CMA, is a principal at CFO Resource Management in Morristown, N.J., and an adjunct professor of accounting, finance, and management at Seton Hall University in South Orange, N.J., and Rutgers University in New Brunswick, N.J.

To comment on this article or to suggest an idea for another article, contact Sabine Vollmer, a JofA senior editor, at Sabine.Vollmer@aicpa-cima.com or 919-402-2304.

AICPA resources

Articles

- “Companies Use Full Array of Tools to Navigate the Pandemic,” JofA, Sept. 28, 2020

- “Crisis Basics: Managing Cash,” FM magazine, June 17, 2020

- “A Playbook to Manage Cash in a Crisis,” FM magazine, June 2020

- “Boardroom Advice for Handling Disruptive Risk,” JofA, Feb. 2020

Publication

- Enterprise Risk Management: Guidance for Practical Implementation and Assessment (#APAERMO, online access)

CPE self-study

For more information or to make a purchase, go to future.aicpa.org/cpe-learning or call the Institute at 888-777-7077.

Reports

- 2020: The State of Risk Oversight: An Overview of Enterprise Risk Management Practices

- Risk Heat Map

OTHER RESOURCES

IFAC report