- feature

- TAX

2019 tax software survey: Shares of respondents and product and company information

Please note: This item is from our archives and was published in 2019. It is provided for historical reference. The content may be out of date and links may no longer function.

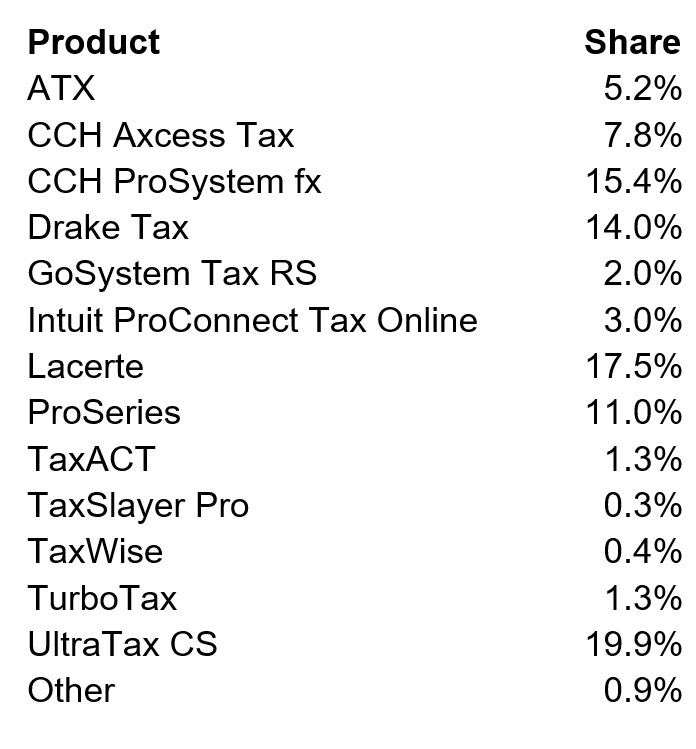

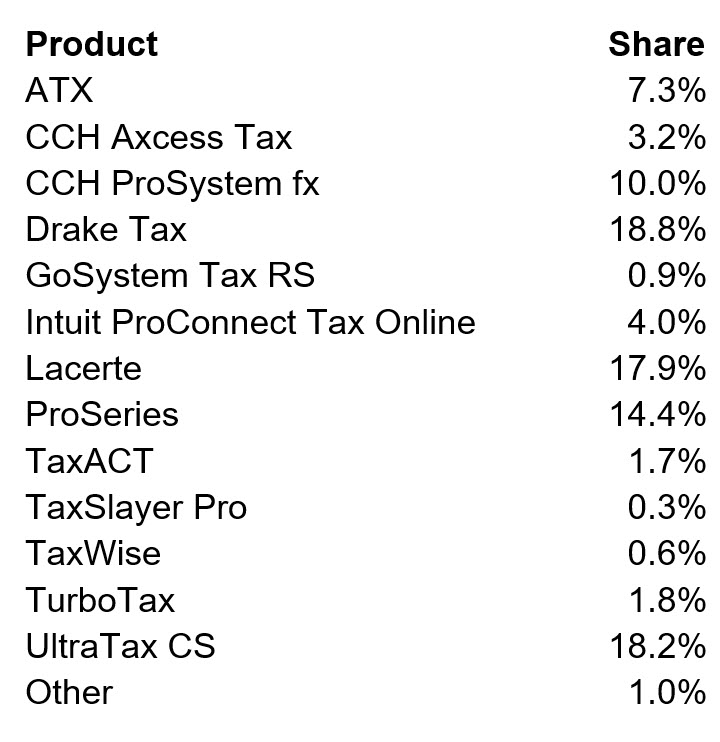

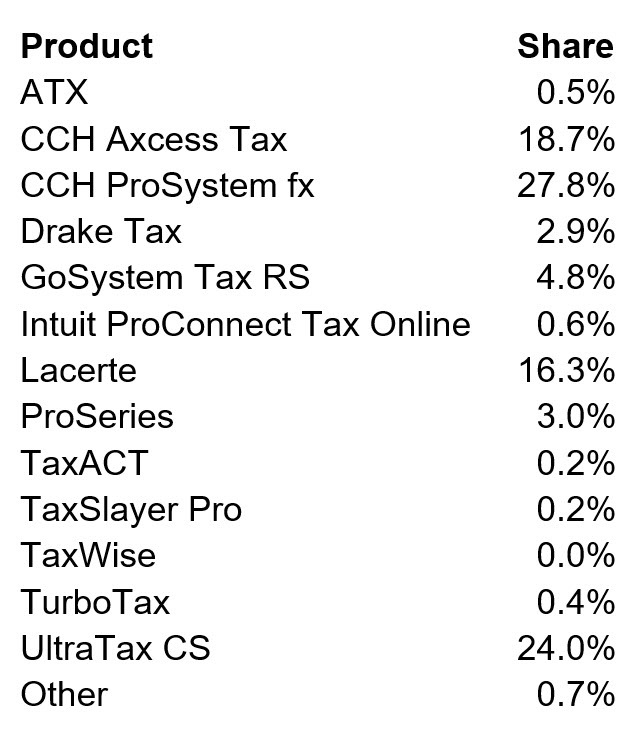

In this year’s tax software survey by the JofA and The Tax Adviser, 3,422 CPAs assessed the software they used to prepare 2018 tax returns for a fee. The survey was conducted May 20–June 4, 2019. Overall, respondents rated their software an average of 4.2 out of 5. Users of three products, Lacerte, CCH ProSystem fx, and UltraTax CS, formed a majority of respondents. Their share of respondents, in total and by firm size, are shown below with others of the 13 products the survey asked about. Additional survey analysis, including charts of major likes and dislikes of users of the top seven products, are available in the September 2019 issues of the Journal of Accountancy and The Tax Adviser.

What tax preparation software did you predominantly use to prepare 2018 tax returns for clients?

Market share among firms with five or fewer preparers

Market share among firms with six or more preparers

Contact information and basic packages and their features are shown below for the seven most-used products. More detailed product information is available at the software vendors’ websites and product pages.

- Wolters Kluwer Tax & Accounting

- Packages: 1040 (individual returns, includes three states, 75 e-filed returns); 1040 Office (preceding features plus all states, e-filing included, tax research); MAX (preceding features plus federal and state business returns, sales and use forms, payroll compliance reporting, unlimited e-file returns); Total Tax Office (preceding features plus integrated document management and expanded research capabilities); ATX Advantage (preceding features plus six concurrent user licenses, enhanced asset management, practice management integration).

- Per-return pricing available: Yes

- Integrated tax research available: Yes

- Integrated accounting software available: Yes

- Wolters Kluwer Tax & Accounting

- Packages: Multiple bundles, with cloud-based suite modules including practice management, document management, project management, and client portal.

- Per-return pricing available: Yes

- Integrated tax research available: Yes

- Integrated accounting software available: Yes

- Wolters Kluwer Tax & Accounting

- Packages: Multiple bundles based on firm needs.

- Per-return pricing available: Yes

- Integrated tax research available: Yes

- Integrated accounting software available: Yes

- Drake Software

- Packages: DrakeZero (for stand-alone sites), Web1040 (for multiple sites).

- Per-return pricing available: Yes

- Integrated tax research available: Yes

- Integrated accounting software available: Yes

- Intuit Inc.

- Packages: Lacerte Unlimited, Lacerte 200, Lacerte Pay-Per-Return (Fast Path).

- Per-return pricing available: Yes

- Integrated tax research available: No

- Integrated accounting software available: Yes

- Intuit Inc.

- Packages: Basic (20, 50, or unlimited 1040 returns + 2–4 states); Professional (Pay-Per-Return, Choice 200, 1040 Complete, Power Tax Library).

- Per-return pricing available: Yes

- Integrated tax research available: No

- Integrates with accounting software: Yes

- Thomson Reuters

- Packages: CS Professional Suite.

- Per-return pricing available: Yes

- Integrated tax research available: Yes

- Integrated accounting software available: Yes