- feature

- TECHNOLOGY

What CPAs must do to capitalize on disruption

Accountants should be preparing now for advanced technologies and other factors that are poised to disrupt the profession.

Please note: This item is from our archives and was published in 2019. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

AI tools for finance professionals to prepare and visualize data

6 gear recommendations for home office and business travel

Excel’s Dark Mode: A subtle change that makes a big difference

Over the past few years, use of the word disruption in business discourse has blown up. You come across it in text and on television. You hear it on podcasts and in private conversations. Everywhere you turn, someone seems to be saying that technology will disrupt this industry or that profession — including accounting.

Yet, despite its near constant use, disruption is often misapplied or used in the incorrect context. Disruption is not the same as innovation. It’s not the addition of one cool feature or a beautiful new design. It may include these things, but true disruption is more — much more.

In the accounting profession, we are eager to develop disruptive new ideas that could change the way we do our jobs. To do that, though, we need a clear understanding of what disruption is.

I’ve found the Cambridge Dictionary’s definition of “disruptor” to be the clearest and most concise summation of what disruption truly means. Cambridge describes a disruptor, in business usage, as follows: a company that changes the traditional way an industry operates, especially in a new and effective way.

Disruption, then, isn’t building a better mousetrap; it’s building something that replaces the mousetrap altogether. Innovation may render a competitor obsolete, but disruption can render entire business sectors outmoded. (See the sidebar, “A Classic Example of Disruption,” below, for a discussion of how Netflix upended the home video market — and drove established competitors out of business — by leveraging new technology and a creative business model.)

So what does this mean for accountants? What can they do to capitalize on disruption instead of being victimized by it? This article seeks to answer both questions. Accounting as a valuable service and viable profession isn’t going anywhere, but technology-based disruptions to the fundamental way we do our jobs could radically alter what makes an accounting firm or finance team successful. In a world with the potential for real-time, verifiable data-entry methods — something theoretically possible with blockchain-based technology — clients may soon be clamoring for advisory services and services we haven’t even thought of yet.

POSSIBLE DISRUPTIONS IN ACCOUNTING

As disruption becomes the aim of many ventures in the marketplace, increasing numbers of accountants and their employers are speculating about the ways accounting could be disrupted in the coming years. The use of blockchain-based technologies is one of the mechanisms by which disruption seems eminently possible. Deloitte went so far as to publish a report called Blockchain Technology: A Game-Changer in Accounting?, which details how blockchain could radically transform a profession that has resisted major overhauls.

“The blockchain technology has the potential to shapeshift the nature of today’s accounting,” the report states. “It may constitute a way to vastly automate accounting processes in compliance with regulatory requirements. … A cascade of new applications will likely follow that are built on top of each other, leading [the] way for new, unprecedented services.”

Though blockchain remains in the very early stages of application, we’re already seeing the potential for major disruption when it comes to auditing practices. As innovations begin to stack on top of one another, the rate of change only stands to increase.

The form this disruption will take remains to be seen. In the meantime, large enterprises like the Big Four are investing untold time and resources into disruptive processes. If they do it, the thinking goes, they will be more likely to be the disruptor than the disruptee.

WHAT YOU CAN DO NOW

The time is ripe to discuss with your teams how to implement new and changing technologies, as well as the ramifications of doing so. For instance, if you introduce robotic process automation to fill out individual tax returns, how would that affect your firm or team? What kind of staffing and systems changes would you need to make? How would you adjust your processes, policies, and pricing? And what ramifications might those changes have for other areas of your operation?

Let’s look at a real-life example. Many accounting firms today provide on-the-job training to new staff by having them handle basic tasks such as reconciliations, entering in journal entries, confirming balances, and creating invoices and bills in the accounting system. Currently, these tasks provide value to the firm and a great background of understanding for new employees.

Soon, however, these tasks will be automated or entirely unnecessary. How will that affect firm structure? You won’t need as many lower-level staff members to complete manual tasks, but you will still need higher-level accountants who can review the automated work and also provide analysis and advice to clients. Even if the newly minted CPAs possess more advanced skills, you may need to deliver training and onboarding programs to ensure new employees develop the capabilities they need to contribute to your firm and achieve long-term success in their careers.

To prepare for the future, you must step back from the way you do things today and look at your business from a new perspective. You will need to brainstorm new ideas. A key step in this process is to bring in people from all levels of the organization, as well as outside the business, to contribute new ideas. The more diversity you can bring to this process in terms of age, race, ethnicity, gender, etc., the more likely you are to craft an onboarding experience that succeeds in efficiently and effectively developing new hires into valuable contributors to your organization.

The reimagining of staff onboarding and skill development is just one of many possible scenarios accountants will have to consider. For example, if clients are able to estimate potential tax at any time during the year, what impact would that have on their business decisions and your interaction with them? If your time is freed up by automation, what would you do with it? When an implementation of technology goes wrong in your firm, is there a risk of not trying again?

HOW TO VISUALIZE DISRUPTION’S CONSEQUENCES

Not every firm or accountant can be a disruptor, but you don’t need to be among the earliest adopters to survive and thrive. However, you do need to see disruption coming and prepare yourself for how to create value in a changing environment.

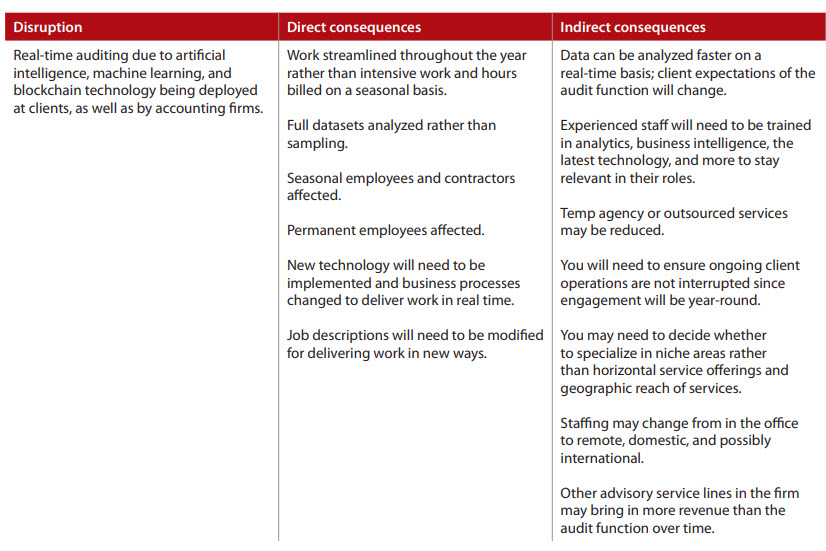

It’s important to dedicate some off-site time with your teams and create an open environment to answer this one question: What new service could you launch to make an old service obsolete? Assume in this question that your existing skills and processes are no longer relevant in three to five years. Visualize direct and indirect consequences as you solve for this question. The chart, “Visualizing the Consequences of Disruption,” provides an example of what that might look like.

This type of exercise is one that good startups perform, and it will help get you into the right mindset to build something new and create space for change. As you do it, keep in mind that it’s unlikely you’ll see any plans you develop come to fruition in the next year or two. The answers you are seeking need to be long-term plays for the future of your firm (or business), all the professionals who work there, their families, and your clients’ (or customers’) well-being.

Automation techniques are a great example in this regard. Today, many of your team members probably view automation with vague skepticism, worried it may one day eliminate their jobs. If you begin to experiment with artificial intelligence and other advanced automation tools, they become less scary — the monsters in the movies are always scarier when they’re off-screen. You start to reveal real, actionable potential and how application may look in practice. Undertaking experiments like these, even when they don’t result in services brought to market, makes your entire organization more agile.

Disruption is happening all around us when we open our eyes to it. We can’t control it, it’s hard to go through it, and it’s complex because of all the implications. However, when we start the process of jumping on board and playing with disruption, we can remove the fear of it and be open to all its possibilities. Once we begin to understand and embrace disruption, that could be the inspiration we need to find a better future.

Visualizing the consequences of disruption

A brainstorming exercise can help your firm imagine direct and indirect consequences of various disruptions. Here’s an example.

A classic example of disruption

Perhaps the most illustrative and easiest-to-understand example of disruption is the way Netflix displaced in-store movie rentals and the cable TV industry. At its outset, Netflix sought only to innovate the video rental market. Rather than having to drive to your local Blockbuster or Hollywood Video in search of a movie, you’d have it mailed to your door, and you wouldn’t have to pay late fees. This made Netflix an interesting company, but it didn’t present much of a threat to established industry players. In fact, Blockbuster turned down the chance to acquire the company for $50 million back in 2000. That decision turned out to be as regrettable a move as any in recent business history.

It wasn’t the mail-order service with no late fees that finished off Blockbuster, which eventually implemented both policies. As internet speeds grew faster, Netflix realized it could stream video directly to consumers, who jumped at the chance to access movies (and television shows) without the need to go to a store or even have physical media delivered. This is what finally spelled doom for Blockbuster, which shuttered its last company-owned stores in 2013. And streaming video is one of the factors that has contributed to the steady decline of cable TV subscriptions in recent years.

What’s important to note here isn’t just Netflix’s creative ingenuity, but also its ability to leverage technology to see the future before others did. As Eran Gilad, managing partner at Scopus Ventures, wrote in Medium, “True disruptors are thinking miles and years ahead — passionate about finding ways to solve tomorrow’s problems before many of us have had the chance to tackle the most pressing issues of today.”

The most pressing issue for Netflix today is increasing competition. With the company already battling for viewers with the likes of Amazon Prime and Hulu, Disney plans to launch its Disney+ streaming service in November, and Apple intends the join the fray with its own streaming service, perhaps also in November.

About the author

Amy Vetter, CPA/CITP, CGMA, is the CEO of The B3 Method Institute, a keynote speaker and adviser, Technology Innovations Taskforce leader for the AICPA Information Management Technology Assurance (IMTA) Executive Committee, and author of the book Integrative Advisory Services: Expanding Your Accounting Services Beyond the Cloud.

To comment on this article or to suggest an idea for another article, contact Jeff Drew, a JofA senior editor, at Jeff.Drew@aicpa-cima.com or 919-402-4056.

AICPA resources

Articles

- “How Firms of Any Size Can Innovate,” CPA Insider, July 15, 2019

- “5 Ways Firms Can Solidify Their Business Foundation,” CPA Insider, July 15, 2019

Publication

Certificate programs

For a complete list of available technology programs — including blockchain, robotic process automation, cybersecurity, and more — visit certificates.aicpastore.com/Technology.

Webpages

- Tax Technology Resource Center, aicpa.org

- Gramm-Leach-Bliley Act Information Security Plan, aicpa.org (Tax Section member login required)

Conferences

- AICPA/CPA.com Digital CPA Conference 2019, Dec. 9—11, Seattle

- Practitioners Symposium and Tech+ Conference at AICPA ENGAGE, June 7—11, Las Vegas

For more information or to make a purchase or register, go to aicpastore.com or call the Institute at 888-777-7077.

IMTA Section and CITP credential

The Information Management and Technology Assurance (IMTA) Section supports AICPA members who provide services in the areas of information security and cyber risk, privacy and IT risk management, business intelligence, and emerging technologies. CPAs may also pursue the Certified Information Technology Professional (CITP) credential, which demonstrates an individual has the expertise to advise organizations on how to maximize information technology to manage their business. Access to the IMTA’s tools and resources is included with AICPA membership. To learn more, visit aicpa.org/IMTA and aicpa.org/CITP.

CGMA Finance Leadership Program

The CGMA Finance Leadership Program is an online, personalized learning program designed for finance professionals to develop technical, business, people, and leadership skills that are critical in today’s business environment. The program is the pathway to the CGMA designation. With more than 150,000 designees, the CGMA is the world’s most widely held management accounting designation. Learn more at CGMA.org/FinanceLeadershipProgram.

OTHER RESOURCE

Publication

Deloitte report Blockchain Technology: A Game-Changer in Accounting?