- feature

- FINANCIAL REPORTING

CECL isn’t just for banks anymore

Revised financial instruments standards that impact all industries and apply to a broad range of financial assets have begun to take effect.

Please note: This item is from our archives and was published in 2019. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

Why stablecoin controls create a solid foundation in an evolving environment

SEC proposes amendments to small entity definitions

Key signals from the SEC-PCAOB conference point to a busy new year

It has been nearly four years since FASB began issuing its revised financial instruments guidance (see the sidebar, “Topic 326 Changes”). The guidance impacts all industries, not just financial institutions in the financial services industry, and applies to a broad range of financial assets.

The underlying principle of FASB ASC Topic 326, Financial Instrument — Credit Losses, is that a reporting entity holding financial assets is exposed to credit risk throughout the holding period. Thus, a credit loss may exist at financial asset purchase or origination, as well as until the financial asset is settled or disposed of. Financial instrument guidance specific to credit losses in Topic 326 changes the recognition, measurement, and presentation of estimated credit losses on existing debt assets involving contractual future cash flows and on off-balance-sheet commitments to extend credit.

Accounting Standards Update (ASU) No. 2016-13, Financial Instruments — Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, applies to all financial instruments carried at amortized cost (including loans held for investment (HFI) and held-to-maturity (HTM) debt securities, as well as trade receivables, reinsurance recoverables, and receivables that relate to repurchase agreements and securities lending agreements), a lessor’s net investments in leases, and off-balance-sheet credit exposures not accounted for as insurance or as derivatives, including loan commitments, standby letters of credit, and financial guarantees.

The new accounting standard does not apply to trading assets, loans held for sale, financial assets for which the fair value option has been elected, or loans and receivables between entities under common control.

In addition to significant changes in accounting, the new guidance implementation will require major changes to the debt asset holder’s operations processes and internal controls over financial reporting. Implementation will also impact information technology and data management because its forward-looking approach means amassing internal and external data to analyze credit losses and forecast future economic expectations.

The effective date for SEC filers is years beginning after Dec. 15, 2019. For all other public entities, the effective date is years beginning after Dec. 15, 2020. Private companies have until years beginning after Dec. 15, 2021. In August 2019, FASB proposed extending the effective dates for SEC smaller reporting companies and for private companies to years beginning after Dec. 15, 2022. The soonest early-adoption date was for years beginning after Dec. 15, 2018. Interim period adoption has the same dates as annual adoption.

If historical experience and future expectations suggest that some debt asset cash flows will not be collected, the debt asset holder must immediately recognize an allowance for credit losses, which reduces the debt asset’s net carrying value with a corresponding impact on earnings.

The biggest change from current guidance is the way to estimate credit losses (uncollectible future cash flows). The magnitude of that change will depend on the debt asset credit quality and terms. The expectation is that uncollectible future cash flow amounts, financial debt asset impairment, and off-balance-sheet losses will now be reflected sooner in the financial statements under the current expected credit loss, or CECL, model.

IN-SCOPE AND OUT-OF-SCOPE DEBT ASSETS

Topic 326 applies to all entities holding debt assets that are not currently measured at fair value with holding gains and losses reflected in earnings. In-scope debt assets include the following:

Financial assets measured at amortized cost

- HTM debt securities exist when the holder has both the intent and ability to hold the debt security to maturity. This is typically the first amortized-cost example that comes to mind.

- Financing receivables, which represent a contractual right to receive cash on demand or at determinable future dates.

- Receivables that meet the definition of a security (which means they are debt securities) that result from revenue transactions within the scope of both revenue recognition standards (Topic 605 or Topic 606) or Topic 610, Other Income.

- Reinsurance receivables that result from insurance transactions within the scope of Topic 944, Financial Services — Insurance. All reinsurance receivables accounted for under Topic 944 are in the scope of Topic 326, including those measured on a discounted basis.

- Receivables from repurchase agreements and security lending agreements within the scope of Topic 860, Transfers and Servicing.

Excluded are financial assets measured at fair value through net income, derivatives, available-for-sale debt securities, defined contribution benefit plan employee loans, insurance policy loans receivable, not-for-profit pledges receivable, related-party loans and receivables between entities under common control, and income tax receivable. Subtopic 326-30, not addressed in this article, guides expected credit losses for available-for-sale debt securities.

A lessor’s net investment in leases in accordance with Topic 842, Leases

A lease receivable is a financial asset. Therefore, lessors measure their entire net investment in the lease for credit losses. In late 2018, FASB issued a proposed amendment to Topic 326 clarifying that operating lease receivables are not in-scope.

Off-balance-sheet credit exposures

Off-balance-sheet credit exposure refers to credit exposures on off-balance-sheet loan commitments, standby letters of credit, and financial guarantees not accounted for as insurance.

Also included are financial guarantees for the nonpayment of a financial obligation. Guarantees are recorded as liabilities on the balance sheet initially at fair value. Certain guarantees in the scope of Topic 460, Guarantees, must be assessed for expected credit losses in accordance with Topic 326.

CECL MODEL

Subtopic 326-20 introduced the CECL model for investments in debt assets measured at amortized cost. To define CECL, the “CE” stands for losses currently expected, meaning the credit losses have not yet been actually incurred. CECL will replace the current “incurred loss” method for debt asset holders to recognize credit losses. Under the incurred-loss method, the guidance restricted debt asset holders from recognizing credit losses until it became probable that a credit loss occurred.

This accounting shortcoming became apparent during the financial crisis beginning in 2008. Legacy GAAP delayed loss recognition, as it prohibited debt asset holders from realizing expected credit losses that had not yet met the probable recognition threshold, even if the debt asset holder anticipated a future credit loss. This contributed to the financial crisis because delayed recognition hid the existing bank loan credit problem. As a result, investors in financial institutions, economists and equity analysts that track credit losses as market indicators, and internal management within financial institutions could not see the true deteriorating economic picture.

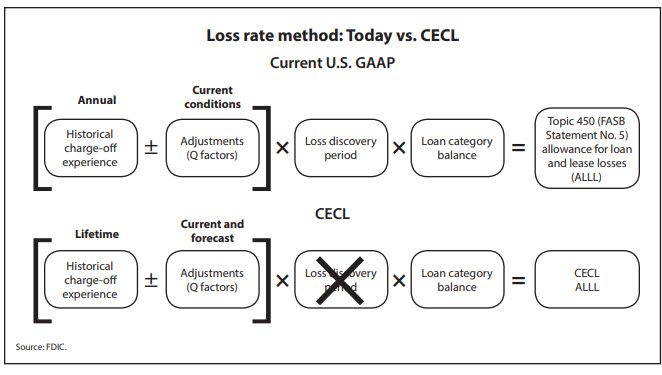

The chart, “Loss Rate Method: Today vs. CECL,” from the FDIC provides a basic comparison between the financial debt asset loss-estimation methodology today versus the CECL approach.

Topic 326’s underlying principle is that a reporting entity holding financial assets is exposed to credit risk throughout the holding period. Thus, a credit loss may exist at the financial asset acquisition or origination and until the financial asset is settled or disposed of.

Financial investment debt holders now will recognize an allowance for credit losses, which is a valuation account for the cash flows that it does not expect to collect. The net amount of the financial assets after subtracting the allowance reflects the amount of cash expected to be collected from the financial asset. Changes in the allowance for credit losses on the balance sheet impact ordinary income.

There is no recognition threshold. Thus, even when credit risk is remote, some credit loss would exist.

CECL requires considering available relevant information about cash flow collectibility. This includes information about past events, current conditions, and reasonable and supportable forecasts of future economic conditions. In the absence of reasonable and supportable forecasts, past events become more influential.

CECL allows great flexibility in choosing the methodology for estimating expected credit losses, as long as the methods are reasonable and supportable, are applied consistently over time, and reflect the net amounts management expects to collect. The methods used may vary by the financial asset type, the debt asset holder’s ability to predict cash flows, and the information available.

Many CECL loss-estimation methodologies exist. Debt asset holders must balance competing concerns of data availability and accuracy with method auditability, reasonability, and cost. Reporting entities must convince insiders (management and the board of directors) and external stakeholders (auditors, lenders, and shareholders) that their methodology choices are appropriate and reasonable. Subtopic 326-20 allows grouping debt assets into pools, and each pool may have a different CECL estimation method.

Topic 326 mentions different CECL estimation methods and allows other methods. Management often applies qualitative adjustments for macroeconomic, business cycle, and other factors to the quantitative calculation. Following are some estimation methods:

- Discounted cash flow estimates expected credit losses by projecting future principal and interest cash flows and by discounting these cash flows at the financial asset’s effective interest rate. The allowance for credit losses is the difference between the carrying value and the present value of the expected cash flows.

- Loss rate, also called the cumulative loss rate method or weighted-average remaining maturity (WARM) method, measures loan losses over the life of a loan pool and compares loan losses to the outstanding remaining loan pool balance. It is generally considered the simplest method for calculating estimated credit losses. In January, FASB issued a staff Q&A reiterating that the WARM method is an acceptable method.

- Vintage, also called an aging method, considers historical losses by origination year and by age. This is similar to the method most companies use for estimating allowances on trade accounts receivable today.

Estimating expected credit losses is highly subjective and requires significant management judgment. Due to this subjectivity, Topic 326 does not require specific approaches when estimating expected credit losses. Rather, management should use judgment to develop estimation techniques that are applied consistently over time to faithfully estimate financial asset collectibility. Furthermore, these estimation techniques should be reasonable and supportable, grounded in relevant data, and adjustments should be relevant factors to the circumstances. The methods used to estimate expected credit losses may vary based on the type of financial asset, the entity’s ability to forecast the cash flow’s timing, and the information available to the entity. (The sidebar, “An Example of Accounts Receivable Under CECL,” illustrates how a company could apply the CECL method to estimate credit losses using an aging methodology.)

Nonexhaustive examples of management judgment may include:

- The default definition;

- The measurement approach of historical credit loss amounts;

- The appropriate historical period for estimating expected credit loss statistics and the utilization methods of historical experience;

- The approach to adjusting historical credit loss information to reflect current economic conditions and reasonable and supportable forecasts that are different from conditions existing in the historical period;

- The method of adjusting loss statistics for recoveries;

- How expected prepayments affect the expected credit loss estimate;

- How to revert to historical credit loss information for future periods beyond which the entity can make reasonable and supportable forecasts of expected credit losses; and

- Assessment of whether a financial debt asset exhibits risk characteristics similar to other financial debt assets.

In summary, CECL implementation is a significant endeavor. Management should develop an action plan, or road map, for its implementation process to make the transition smoother, less timely, and less costly. Such a plan might include these steps:

- Identify and provide bandwidth to people resources, which may need to include outside help;

- Identify appropriate loan pools;

- Identify the ideal CECL methodology for each loan pool;

- Determine the “as is” of the current allowance for loan losses process and assess the “should be” new process;

- Accumulate necessary data, such as historical debt asset charge-offs; and

- Identify attributes of charged-off debt assets (type, origination year, and term) and macroeconomic factors.

Topic 326 changes

Accounting Standards Update (ASU) No. 2016-13, Financial Instruments — Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, codified into FASB ASC Topic 326, Financial Instruments — Credit Losses, changes accounting for financial debt assets and other instruments that are not measured at fair value through net income.

This guidance applies to all entities; it does not just impact financial institutions. Instead, it impacts any entity that has financial debt assets not measured at fair value. Subtopic 326-20 guides accounting for credit losses on financial debt assets not measured at fair value and is referred to as the current expected credit loss (CECL) model.

The effective date for public companies is years beginning after Dec. 15, 2019. Thanks to ASU No. 2018-19, Codification Improvements to Topic 326, Financial Instruments — Credit Losses, issued in November 2018, private companies now have two years longer for implementation — for years beginning after Dec. 15, 2021. The soonest early-adoption date was for years beginning after Dec. 15, 2018.

An example of accounts receivable under CECL

Current expected credit losses, or CECL, are applied to trade accounts receivable in a similar fashion as legacy GAAP. In applying FASB ASC Topic 606, Revenue From Contracts With Customers, if a selling entity transfers goods or services to a customer and determines collection is not probable, then the selling entity neither recognizes revenue nor records an account receivable. If, however, the selling entity determines collection is probable, the credit loss risk is not zero. The selling entity would apply Subtopic 326- 20 to estimate CECL on the trade accounts receivable. CECL is different (and thus is accounted for differently) from losses due to other factors, such as the seller’s nonperformance, volume rebates, trade allowances, or customer contract modifications.

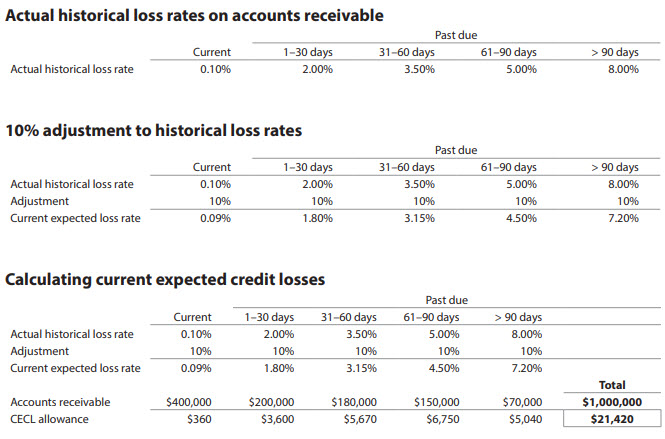

The following example uses an aging methodology to estimate CECL, much like the methodology in legacy GAAP. Some of the terminology may be different.

Example

Mark Company sells products to consumer customers on net 60-day terms. Mark’s historical credit loss information for its trade accounts receivable on an amortized-cost basis is shown in the table “Actual Historical Loss Rates on Accounts Receivable.” Mark evaluates the following qualitative factors:

- Its customer mix is consistent over the last several years. Thus, its customer base’s overall credit risk characteristics are consistent.

- The economic indicator that best correlates with its past credit loss (bad debt) expense is the unemployment rate, which has improved recently. As a result, Mark determined that economic conditions are more favorable than when its historical credit loss experience occurred. Furthermore, Mark expects the unemployment rate to continue to drop (economic conditions will continue to improve).

Mark concludes that it is reasonable and supportable that its current expected loss rate on trade accounts receivable will improve over the life of its accounts receivable. As a result, Mark adjusts its historical accounts receivable credit loss rate by reducing (improving) it by 10% for each age category, as shown in the table “10% Adjustment to Historical Loss Rates.”

Mark estimates its CECL on its $1 million trade accounts receivable to be $21,420, as shown in the table “Calculating Current Expected Credit Losses.”

About the author

Mark D. Mishler, CPA, CMA, is a principal at CFO Resource Management in Morristown, N.J., and an adjunct professor of international business, management, finance, and accounting at Seton Hall University in South Orange, N.J., and at Rutgers University in New Brunswick, N.J.

To comment on this article or to suggest an idea for another article, contact Sabine Vollmer, a JofA senior editor, at Sabine.Vollmer@aicpa-cima.com or 919-402-2304.

AICPA resources

Articles

- “Tips for a Smooth CECL Implementation,” JofA, June 10, 2019

- “Credit Losses Standard Tips for Audit Committees,” JofA, May 7, 2019

- “Credit Loss Standard Implementation Tips,” JofA, March 16, 2017

Publications

- AICPA Audit and Accounting Guide: Credit Losses (#AAGCECLO, online access)

- Allowance for Credit Losses — Audit Considerations, aicpa.org (free access)

CPE self-study

- Credit Impairment — Financial Instruments: Mastering the New FASB Requirements for the Allowance for Credit Loss (#164923, online access)

Webcast

- “Credit Impairment — Mastering FASB Requirements for Current Expected Credit Loss” (#VFIIN19110, Nov. 7; #VFIIN19120, Dec. 4)

For more information or to make a purchase, go to aicpastore.com or call the Institute at 888-777-7077.

Webpage

- Accounting for Credit Losses, aicpa.org