- feature

- HUMAN RESOURCES

Challenges continue for African-American accountants

Survey shows mixed results despite a big effort to increase opportunities.

Please note: This item is from our archives and was published in 2019. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

Luxury liabilities: Serving high-net-worth clients

AI early adopters pull ahead but face rising risk, global report finds

COSO creates audit-ready guidance for governing generative AI

During the past decade, the accounting profession has made a significant effort to increase opportunities for minority employees, but more progress needs to be made.

To explore how African-American accountants view their treatment in the work environment, and how to improve it, the Center for Accounting Education (CAE) at Howard University surveyed African-Americans in the accounting profession in 2017 and compared results with findings from a similar survey in 2006. Broadly speaking, we observe improvements, but the need for significant advancements remains.

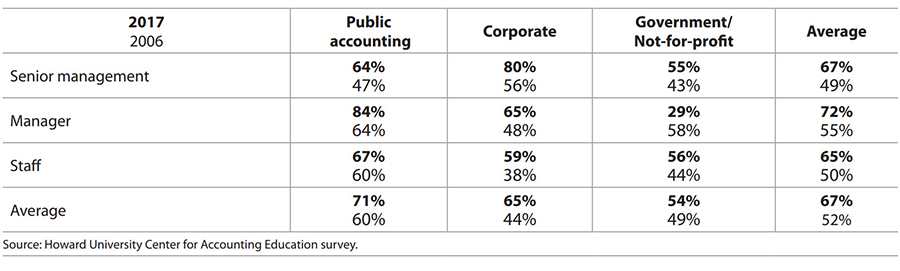

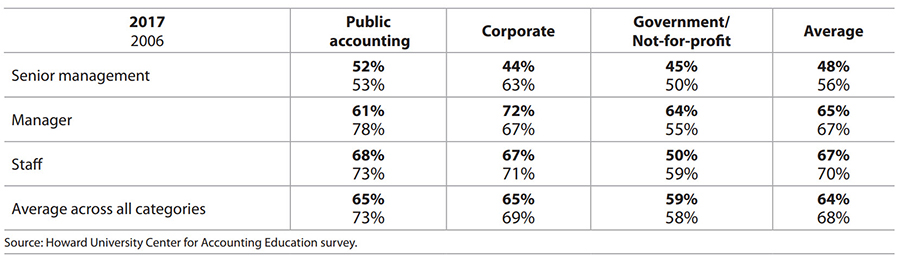

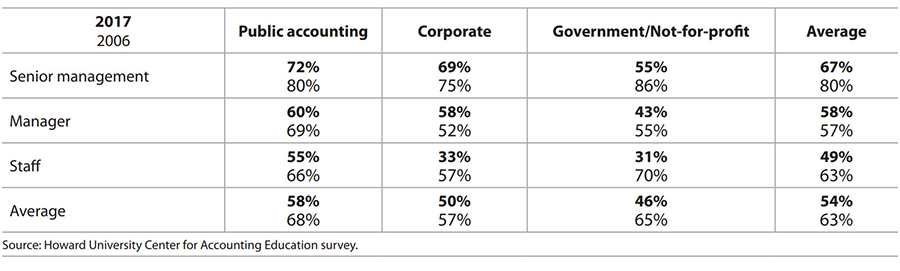

The survey showed that mentoring relationships have benefited the careers of more African-American accountants, with 67% saying in 2017 that mentoring has helped them, compared with 52% in 2006. However, while formal mentoring and networking programs have expanded opportunities (see the chart “Formal Mentoring on the Rise”), African-Americans are still not welcomed to informal networks where opportunities arise for members. Specifically, we note a decrease in success in establishing strong social networks in the workplace to 54% (2017) from 63% (2006). A contributing factor to the eroding success of establishing strong social networks is that access to these networks in the workplace is also deteriorating, as 53% reported access in 2017 compared with 63% in 2006. Meanwhile, more than six in 10 respondents in 2017 (64%) and 2006 (68%) said they had challenges navigating corporate politics. Thus, while we observe the positive impacts from formal mentoring relationships, we find that limited access to informal networks hinders the ability to navigate corporate politics, which limits or slows career advancement.

Formal mentoring on the rise

The continued struggles of African-American accountants in these areas — even after leaders of the profession have made substantial efforts to improve diversity and inclusion in the profession — may be evidence that additional factors need to be considered. While our survey does not address unconscious biases, it is an explanation that is being offered in the profession. Unconscious biases are judgments that people hold outside their awareness that can affect how they treat others in the workplace and elsewhere. Recognizing and overcoming these biases may be a key to making further progress toward diversity and inclusion in the profession and helping African-American accountants establish strong social networks and navigate corporate politics.

In the survey, the CAE received 420 usable responses from 2017 and 427 from 2006. Of the 420 participants, 263 work in public accounting, 101 in corporate, and 56 in government/not-for-profit. The responses represent workers from a cross-section of the major segments of the accounting labor market: 221 staff, 132 managers, 52 in senior management, and 15 in other roles.

After analyzing the survey responses, CAE and the authors conducted three focus groups consisting of a total of 10 participants. The focus groups were partitioned by senior management in public accounting, managers in public accounting, and staff in both public and corporate accounting.

A CHANCE FOR IMPROVEMENT

Overall participation of African-Americans in the accounting profession continues to be low. According to the U.S. Bureau of Labor Statistics (BLS), African-Americans represent 12.1% of the employed workforce but only 8.2% of the accountant and auditor workforce. The coming years are an especially opportune time to improve representation because accounting jobs are expected to expand, amplifying the potential impacts of diversity initiatives. The BLS forecasts that over the 2016—2026 period, the number of accountant and auditor jobs will grow by 10%, a rate faster than overall employment.

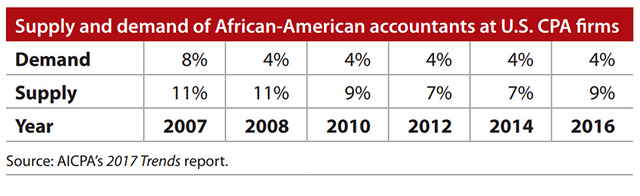

Yet the pipeline figures do not point to a forthcoming improvement. The AICPA’s 2017 Trends report provides data on the supply of and demand for African-American accountants. The most recent data show that representation is not uniformly distributed across segments of the profession, with under-representation worse at higher career levels. For instance, at U.S. CPA firms, only 3% of professional staff are African-American and a paltry 0.3% are partners. Those results are not likely to improve (see the chart “Stagnant Demand”). The demand numbers indicate the percentage of bachelor’s and master’s accounting graduate hires who were African-American in each year. The supply numbers indicate the percentage of bachelor’s and master’s accounting enrollees who were African-American in each year.

Stagnant demand

GREATEST CHALLENGES

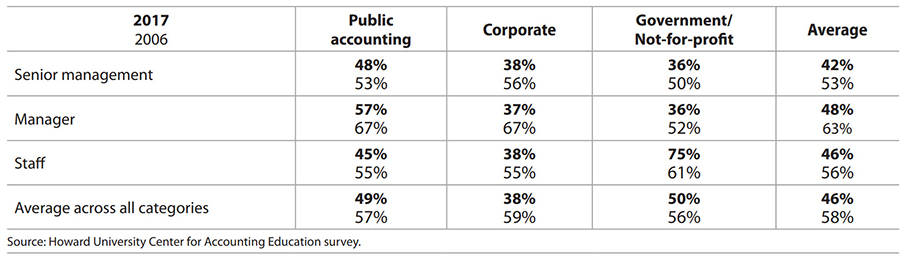

In our survey, we asked respondents about their greatest challenges in the work environment. Navigating corporate politics remains one of the greatest challenges, with more than six in 10 respondents feeling this challenge in 2017 (64%) as well as in 2006 (68%). Navigating corporate politics affects staff at a much higher rate than senior management (see the chart, “Navigating Corporate Politics”). Establishing credibility is another challenge for almost half of African-American accountants, even with improvements in 2017 (46%) from 2006 (58%). The chart “Establishing Credibility” shows that establishing credibility is more of an issue in public accounting than with other employers. The results are surprising when one considers that the public accounting firms hire many highly qualified new graduates. Finally, assimilating into corporate culture continues to be a challenge for approximately four out of 10 respondents, even with a slight improvement in 2017 (38%) from 2006 (46%).

Navigating corporate politics

Establishing credibility

These results show that the greatest challenges in African-American accountants’ current work environment in 2006 remain significant challenges today. We had expected those challenges to decrease significantly because of African-American diversity program goals. Initiatives started between 2006 and 2017 include mentoring, access to key experiences, career advising and sponsorship, and promotion of retention and advancement. Each program’s materials outline how it meets its goals, such as:

- The program “focuses on the development of our partner/principal pipeline by providing our high-potential ethnic minorities with access to key experiences and opportunities” (EY’s Career Watch program).

- The “mission is to develop next generation leaders by supporting African-American partners and employees in their pursuit of professional excellence through career advising and sponsorship, leadership development, and credentialing that promotes retention and advancement” (KPMG’s African-American Network program).

- “African-Americans at Grant Thornton & Allies promotes the recruitment, development, advancement and retention of African-American professionals through collaboration with allies and firm leadership.”

To explore these results further, and to validate them, we asked our focus groups about the challenges in the work environment, sharing with them the survey findings on this question. Their responses centered on two interrelated themes that had to do with how African-Americans navigated the informal norms of their organizations: (1) the importance of soft skills to complement technical proficiency as one progresses up the ladder; and (2) the importance of informal networks to complement formal ones. There was some disagreement between senior management and staff about these themes, which we explore below.

Soft skills vs. technical proficiency

Our first focus group consisted of African-American senior management from public accounting, i.e., a Big Four partner. Instead of focusing on their own experiences, they discussed the difficulties facing African-American accounting staff. Those in senior management experienced what it takes to move up the career ladder and therefore possess insight into what might hold junior colleagues back. They immediately noted that a key challenge for staff is “developing soft skills while demonstrating technical proficiency.” We defined technical proficiency as understanding accounting standards, auditing standards, GAAP, and their appropriate application. Generally, from the perspective of senior management, technical proficiency is not a problem among African-American staff, but soft skills are. Soft skills are defined as the social skills that allow one to build familiarity, comfort, and trust with colleagues. Senior management’s advice to junior staff for developing soft skills is:

Allow yourself to share yourself with others. You will get more broad support if [you are] willing to share and connect with others. [One] cannot overemphasize how important the social aspect of sharing lunch, attending happy hour, playing softball, and attending sporting events is. Find out about people who you work with or who you want to work with.

Although senior management told us junior staff must develop their soft skills because “technical proficiency was considered not an issue,” junior staff disagreed. They relayed one encounter after another that signaled the importance of technical proficiency, especially since it is the main criterion in their performance evaluation. Staff emphasized that their challenges involved proving technical proficiency and not soft skills. We heard examples of minority staff having to work twice as hard because they perceived that their errors were amplified or received a different level of reinforcement compared to errors made by white counterparts. Even with a CPA, a minority interviewee believed that colleagues perceived that “you were not smart enough to perform the work,” thus leading African-American accountants to work even harder to demonstrate their technical proficiency. These examples serve to reinforce to staff that technical proficiency rather than soft skills were key to career advancement, contradicting the views of senior management.

Formal networks vs. informal networks

To understand the progress that diversity initiatives have accomplished and what areas can be improved upon, we examine two survey questions related to professional networks. First, we asked about the benefits associated with formal networks. The survey results on the next page indicate that respondents believe they have benefited from a fruitful mentoring relationship. This could be attributable to the formal programs created by employers. The overall average has increased to 67% in 2017 from 52% in 2006. The greatest improvements, per our survey, are in public accounting (see, “Seeking Acceptance, High-Profile Assignments,” below) and in the corporate sector. Interviewed African-American accountants believe that formal coaching, mentoring, and sponsoring programs have benefited their careers.

Survey results, however, indicate that minorities feel increasingly isolated from social networks in the workplace. We find that agreement to the statement “I have succeeded in establishing strong social networks in the workplace” has decreased from 63% in 2006 to 54% in 2017 (see the chart “Informal Networking Shrinking). This response contradicted our expectation that diversity programs would lead to stronger networks.

Informal networking shrinking

The focus group participants noted that public accounting firms and corporations provide formal coaching, mentoring, and sponsoring and company events such as happy hours to attend. However, focus group respondents felt excluded from informal networks and believed that this exclusion constrained their opportunities. Many said minorities are often not invited to “informal get-togethers,” e.g., home parties, cookouts, golf outings, etc. Interviewees believed key information is shared and bonds created during those gatherings. Because they are not invited to those gatherings, they believe their access to an inner circle of power is restricted.

MAKING POSITIVE STRIDES

Our study provides managers and employers insight into devising better strategies for recruitment, development, and retention of African-American accountants. Additional steps that the profession and individuals can take to make positive strides in this area include:

- Ensuring that opportunities that are created through informal networks are available to African-Americans.

- Making efforts to increase African-American accountants’ participation in lunch, happy hour, softball, and other company events. The relationship between employers and employees is a two-way street, and both sides can pursue these opportunities to share of themselves and build trust and familiarity with colleagues.

- Overcoming unconscious bias may be one avenue toward making improvements in these areas. Formal training in unconscious bias can help employees identify how unconscious bias affects the exclusion of African-Americans in their informal networks.

- Providing guidance to staff on gaining all the necessary skill sets, including soft skills, from online courses or external training classes.

- Continuing requests by African-American accountants to be placed on high-profile and challenging assignments — and sincere efforts on the part of the profession’s leaders to accommodate those requests.

As illustrated by the numerous affinity programs at companies and accounting firms, diversity and inclusion is an issue that leaders and members of the profession are taking seriously. Putting these additional steps into action may help reduce the problems caused by unconscious bias and help African-American accountants overcome the challenges that continue to be reflected in our survey.

Seeking acceptance, high-profile assignments

Survey finds fewer African-Americans felt welcome at work in 2017 than in 2006.

The Howard University Center for Accounting Education survey in 2017 included 263 accountants in public accounting, and our focus groups included employees of public accounting firms.

Here is what African-American public accountants said:

They feel less welcome and accepted

The portion of respondents who said they feel accepted and welcomed by colleagues dropped to 75% in 2017 from 89% in 2006.

To understand the decrease, we queried the focus groups. One participant narrowed in on what our findings seemed to convey about the impact of accounting firms’ diversity initiatives by stating the following:

In our commercial audit practice, it’s commonly known and discussed that there’s only one black partner (1 of 28) and one black manager/senior manager (I think 1 of 64). This is certainly something staff take into consideration.

To understand if our focus group participants’ comments were unique or a general characterization of the industry, we reviewed national-level data. The AICPA’s 2017 Trends report notes that only 3% of professional staff are African-American and 0.3% are partners at U.S. CPA firms. These percentages are not likely to improve because recruitment of African-American accountants by U.S. CPA firms has not improved since its peak rate of 8% in 2007.

They are less inclined to believe they are given high-profile and challenging assignments

Respondents’ belief that they are being given high-profile and challenging job assignments dropped to 52% in 2017 from 69% in 2006.

One focus group participant noted that she was “up for promotion with five other colleagues; needed to check certain boxes such as supervisory skills; (she) asked managers for opportunities to get those skills but (was) personally denied.” Another focus group participant noted that he had strong formal relationships with his managers and partner, and he attended social functions such as happy hours and lunch, yet he often learned of his specific partner or manager having social events that excluded, perhaps unintentionally, African-Americans. These experiences left our participant wondering if lucrative and promising engagement opportunities were not afforded to him because he was not a part of the informal network.

They remain concerned about biased evaluations

Almost half (45%) of respondents said that because of their race, they believe they have not always received unbiased or objective evaluations from a supervisor. That percentage is unchanged from 2006.

About the authors

Mithu Dey, CPA, Ph.D., is an associate professor, Lucy Lim, Ph.D., is an associate professor, Carroll Little, DPA, is an instructor, and Frank Ross, CPA, is the director of the Center for Accounting Education, all at Howard University in Washington, D.C.

To comment on this article or to suggest an idea for another article, contact Ken Tysiac, the JofA’s editorial director, at Kenneth.Tysiac@aicpa-cima.com or 919-402-2112.

AICPA resources

Articles

- “Have You Embraced Innovation, Diversity, and Inclusion?” CPA Insider, April 30, 2018

- “Why Your CQ Is Just as Important as Your IQ (and EQ),” JofA, Feb. 1, 2018

- “How to Develop a Global Mindset,” JofA, Jan. 16, 2018

- “CPA Firms Find That Advancement Programs Boost Recruiting, Retention,” JofA, Nov. 9, 2017

- “How Firms Can Overcome Challenges and Develop a Diverse Workforce,” CPA Insider, April 17, 2017

Webpage

AICPA Diversity and Inclusion resources page, aicpa.org/diversity