- column

- TAX PRACTICE CORNER

Vacation home rentals and the TCJA

Please note: This item is from our archives and was published in 2018. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

IRS issues higher 2026 depreciation limits for passenger automobiles

New Schedule 1-A for tips, OT, car loans, and senior deductions published

Senate bill targets preparers who break the law, expands IRS reforms

TOPICS

The law known as the Tax Cuts and Jobs Act (TCJA), P.L. 115-97, may have unforeseen indirect consequences for taxpayers with dwellings used for both short-term rental and personal purposes, often referred to as mixed-use vacation homes. The TCJA’s increase in the standard deduction and limitations on itemized deductions for state and local taxes (SALT) and home mortgage interest may affect the vacation home rental expense allocation under Sec. 280A(c)(5)(B) between personal and rental use, particularly for a dwelling that is unused for significant periods.

ALLOCATION OF EXPENSES

There have been many disputes over the proper allocation under Sec. 280A of certain expenses between personal and rental use. This issue came to a head in Bolton, 77 T.C. 104 (1981), aff’d, 694 F.2d 556 (9th Cir. 1982). The IRS argued (and proposed in Prop. Regs. Sec. 1.280A-3(c)) that the rental portion of real estate taxes and mortgage interest should be allocated by the ratio of total rental days to the total number of days the property was used for any purpose during the year. This has become known as the “IRS method.” However, the taxpayers in Bolton argued, and the Tax Court and Ninth Circuit agreed, that these expenses should be allocated by the ratio of total rental days to the total number of days in the year (subsequently referred to as the “court method” or “Bolton method”). The Tax Court also applied the court method in McKinney, T.C. Memo. 1981-337, aff’d, 732 F.2d 414 (10th Cir. 1983). As a result, taxpayers (particularly those in the Ninth and Tenth circuits) have support for using either method (see the table “IRS and Court Methods” for a comparison). (Note that IRS Publication 527, Residential Rental Property (Including Rental of Vacation Homes), lists only the IRS method, reflecting the IRS’s continuing position that it is the only permissible method.)

A taxpayer’s decision to allocate expenses by the IRS or court method may be affected by the TCJA’s increase in the standard deduction or limits on SALT and mortgage interest deductions.

Example

Married taxpayers file a joint return. In 2017, they rent their vacation home for 60 days and live in it for 30 days. Gross rental income from the home is $10,000. For the entire year, they incur real estate taxes on the home of $8,400, mortgage interest of $3,000, utilities and maintenance expense of $2,000, and depreciation of $7,000. They already have $7,000 in SALT deductions unrelated to their vacation home, and their mortgage is from 2000.

Assume that the taxpayers’ total itemized deductions exceed the standard deduction for 2017 and they elect to claim the itemized deductions.

As shown in the table “Effect on Taxable Income in 2017,” the taxpayers benefit more from the court method, since more of the real estate taxes and mortgage interest are allocated to personal use and thus deducted on Schedule A, Itemized Deductions, where they are not disallowed by exceeding rental income, along with other, direct rental expenses (total deductions are limited to gross rental income under Sec. 280A(c)(5)).

For 2018 through 2025, the TCJA nearly doubles the standard deduction. Assume that all other amounts remain the same, except that the taxpayers do not itemize in 2018 but instead take the standard deduction of $24,000, decreasing their taxable income by that amount under the IRS method and by $21,874 under the court method ($2,126 net rental income minus $24,000).

Here, the IRS method is more advantageous. Therefore, taxpayers may need to reconsider how they calculate expenses for mixed-use vacation homes.

SALT, MORTGAGE INTEREST LIMITS

If the taxpayer itemizes, other considerations will determine whether the IRS or court method is preferable post-TCJA. The itemized deduction for SALT is limited to $10,000 ($5,000 for married couples filing separately) (Sec. 164(b)(6)(B)). The TCJA also limits the deduction for interest paid on home-acquisition indebtedness to mortgages not exceeding $750,000 ($375,000 for married couples filing separately), for mortgages entered into after Dec. 14, 2017. It also eliminated the separate deduction for home-equity loans (Sec. 163(h)(3)(F)).

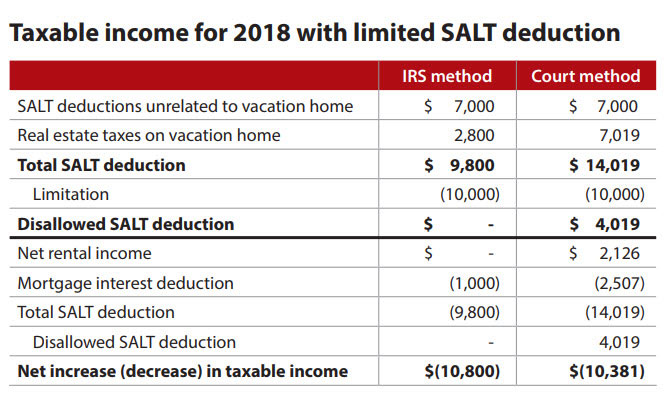

Therefore, the amount of real estate taxes and mortgage interest from a vacation home deducted on Schedule A may be limited. Assume the same amounts as in the example above, except that the taxpayers itemize deductions that, despite the SALT and mortgage interest limitations, total more than their standard deduction amount. The result is shown in the chart “Taxable Income for 2018 With Limited SALT Deduction.”

In this case, the IRS method would be preferable. Therefore, taxpayers need to estimate their net rental income and allowable Schedule A deductions under both methods.

RUN THE NUMBERS

Before the TCJA, it was fairly simple to determine which method was best for allocating expenses for personal/rental vacation homes. If taxpayers itemized deductions, the court method usually was more favorable. If they used the standard deduction, the IRS method was more favorable. Now taxpayers will have to estimate the amount of real estate taxes and mortgage interest allowed and compare that to estimates of net rental income to determine the preferable method.

Conor Gilson, MPS, is a CPA candidate and recent graduate of Cornell University, where John McKinley, CPA, CGMA, J.D., LL.M., is a professor. Matthew Geiszler, Ph.D., is an assistant professor at Ithaca College in Ithaca, N.Y.

To comment on this article or to suggest an idea for another article, contact Paul Bonner, a JofA senior editor, at Paul.Bonner@aicpa-cima.com or 919-402-4434.