- column

- PROFESSIONAL LIABILITY SPOTLIGHT

Shore up your data breach detection skills

A lapse in cybersecurity can be costly in terms of money, time, and reputation. Swift detection can head off worse problems.

Please note: This item is from our archives and was published in 2018. It is provided for historical reference. The content may be out of date and links may no longer function.

Click here to download the full infographic PDF

Costs in time and money

- 191: Average days to identify a data breach

- 66: Average days to contain a data breach

- $225: Average cost per record of a data breach in the United States – $225 per capita

Source: Ponemon Institute Research Report, 2017 Cost of Data Breach Study.

Professionals at risk

- 58% of victims of data breaches were categorized as small businesses.

- 68% of breaches took months or longer to discover.

- 60% of breaches for the Professional Services industry were discovered by an external party.

- The Professional Services industry is the 4th most common industry to be targeted by social breaches (phishing/pretexting).

Source: Verizon, 2018 Data Breach Investigations Report.

Top 3 factors that help reduce the cost of a data breach:

- Having an incident response team.

- Extensive use of encryption.

- Employee training.

Source: Ponemon Institute Research Report, 2017 Cost of Data Breach Study.

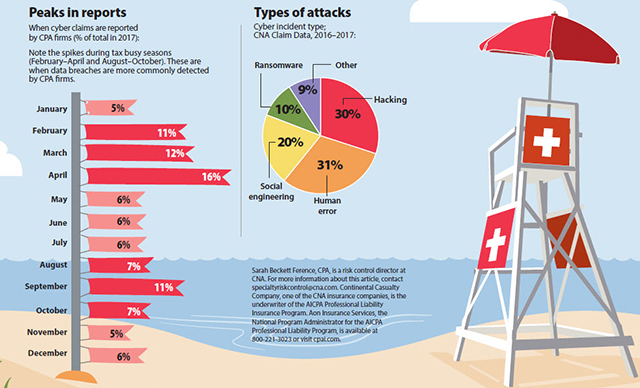

Sarah Beckett Ference, CPA, is a risk control director at CNA. For more information about this article, contact specialtyriskcontrol@cna.com. Continental Casualty Company, one of the CNA insurance companies, is the underwriter of the AICPA Professional Liability Insurance Program. Aon Insurance Services, the National Program Administrator for the AICPA Professional Liability Program, is available at 800-221-3023 or visit cpai.com.