- feature

- TAX

Understanding the new kiddie tax: Additional examples

Please note: This item is from our archives and was published in 2018. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

Understanding the new kiddie tax

TOPICS

This page features additional examples from “Understanding the new kiddie tax,” Nov. 2018.

Example 1

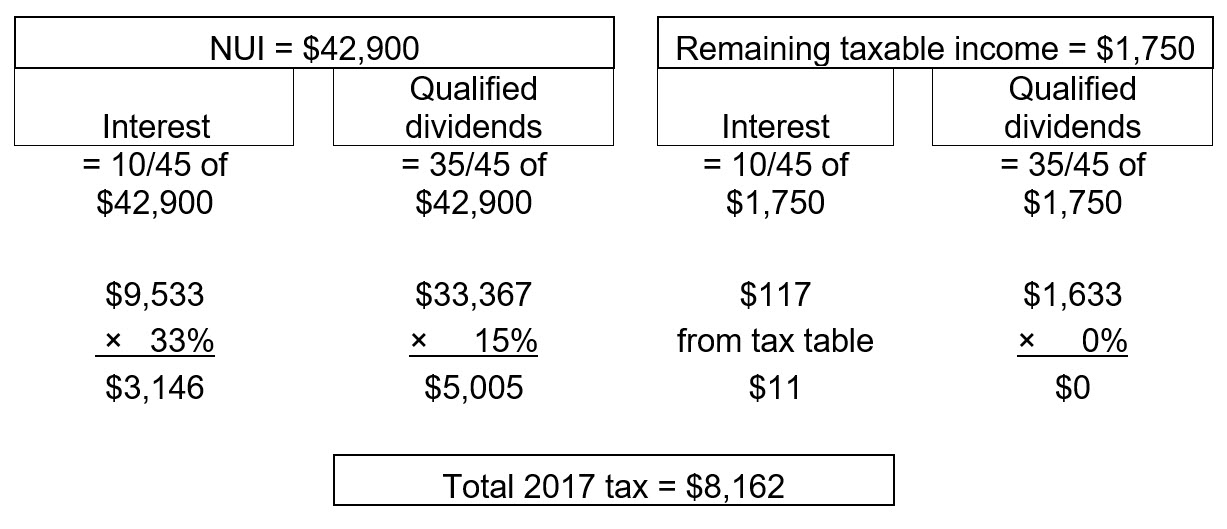

If A, from the example in the article, had the same amount and type of taxable income in 2017 under the old kiddie tax rules and her parents had taxable income of $250,000 and they did not owe alternative minimum tax (AMT), A’s total tax for 2017 would have been $8,162. Under the old kiddie tax rules, her taxable income of $44,650 is bifurcated between net unearned income (NUI) of $42,900 that is taxed at her parents’ tax rates and the remaining taxable income of $1,750 that would be taxed at her tax rates. Since A’s earned income is completely offset by her standard deduction under the old rules, her taxable income is composed completely of unearned income.

To apply the appropriate tax rates to compute tax, both the NUI and the remaining taxable income must be split between interest income to be taxed at ordinary tax rates and qualified dividends to be taxed at preferential rates, prorating the income to reflect the mix of unearned income in the taxable income calculation — specifically the ratio 10/45 for the interest and 35/45 for the qualified dividends.

Since A’s parents have taxable income of $250,000, the relevant tax rates for the NUI are 33% for the interest and 15% for the qualified dividends. Tax on the remaining taxable income is computed based on A’s tax rates: Interest income is taxed using the 2017 tax table for single individuals, and the tax on the qualified dividends is computed at A’s preferential tax rate of 0%, given the low level of income subject to tax at her rates.

The following table summarizes these calculations.

Example 2

C, who is 15 years old, has gross income made up of wages and interest income for 2018. He earns $3,000 from a part-time summer job and also has some money invested in U.S. Treasury obligations that generate $14,000 of interest each year. His filing status is single, and he must pay federal income tax on both his earned and unearned income. Because he does not use his earnings for his support, he is considered his parents’ dependent subject to the kiddie tax. C’s state taxes are less than his standard deduction, so he will not itemize deductions. (C’s state tax liability is beyond the scope of this article.)

C’s 2018 taxable income is:

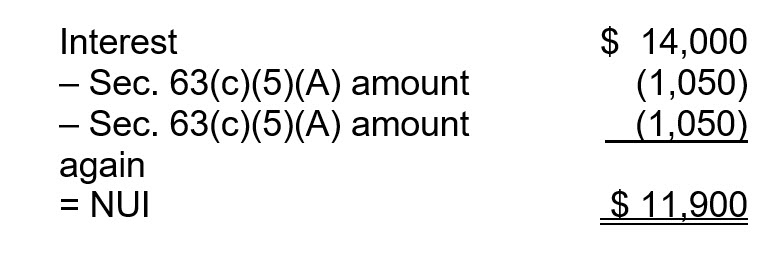

C’s net unearned income is computed as follows:

Finally, C’s earned taxable income is computed as follows:

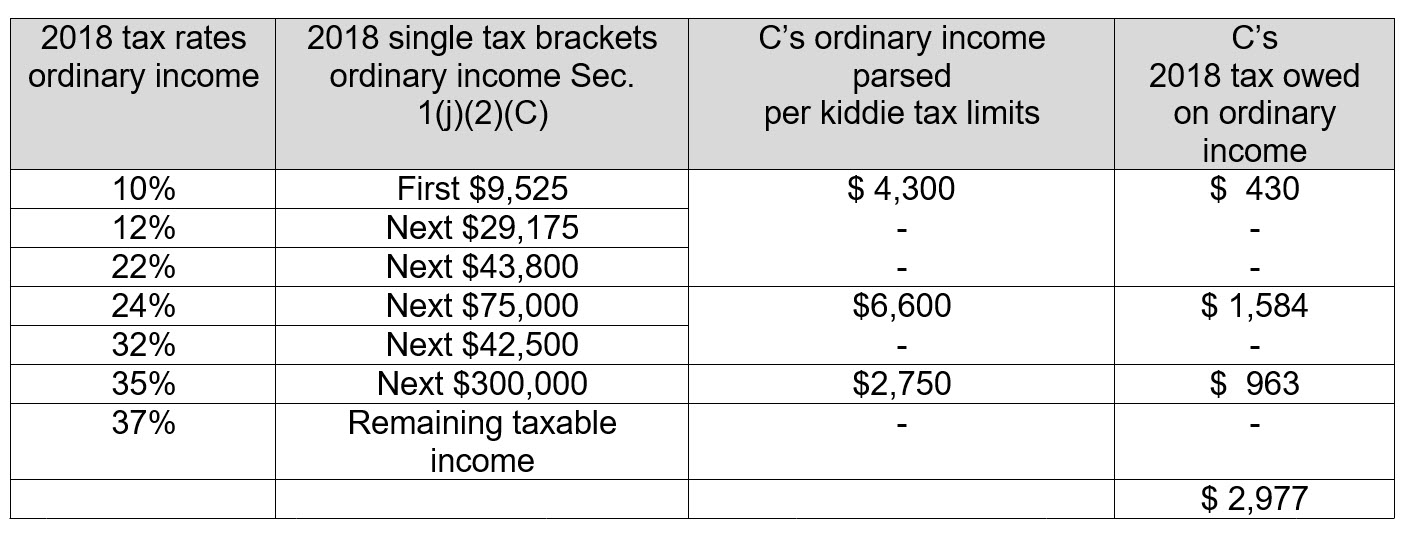

Tax on C’s taxable income is computed using a modified single tax rate table that applies for kiddie tax purposes. The maximum amount of C’s taxable income that can be taxed at single rates below 24% is $4,300, which is the sum of $1,750 earned taxable income (ETI) plus $2,550. C will owe tax of $430 on this $4,300 since the entire amount fits within the 10% single tax bracket amount of $9,525. He will not be able to take advantage of the 12% and 22% single tax brackets because the law forces his remaining ordinary income into higher tax brackets.

The maximum amount of C’s taxable income that can be taxed at single rates below 35% is $10,900, the sum of $1,750 ETI plus $9,150. Since $4,300 has already been taxed at 10%, the difference of $6,600 will be taxed in the 24% tax bracket. C will owe tax of $1,584 on this $6,600 since the entire amount fits within the 24% single tax bracket amount of $75,000.

C’s remaining taxable income of $2,750 will be taxed at 35% since the new kiddie tax won’t allow him to take advantage of the 32% tax bracket. He will owe tax of $963 on this $2,750 of income. C’s total tax liability for 2018 is summarized below.

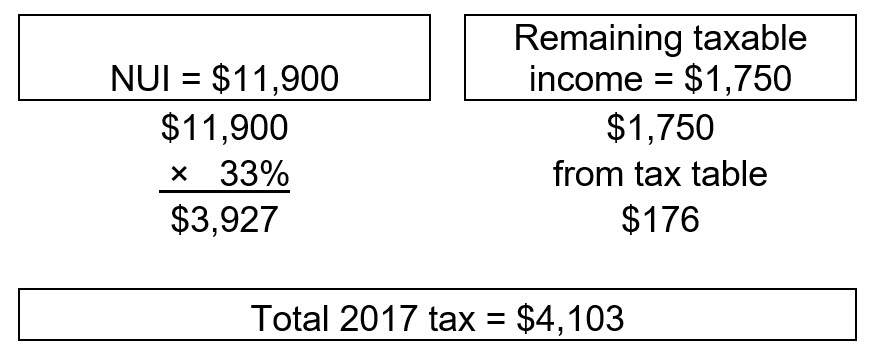

If C had the same amounts and character of taxable income in 2017 and his parents had taxable income of $250,000 and they did not owe AMT, his total tax for 2017 would have been $4,103. Under the old kiddie tax rules, his taxable income of $13,650 is bifurcated between NUI of $11,900 to be taxed at his parents’ marginal tax rate and the remaining taxable income of $1,750 to be taxed at his rates. C’s 2017 kiddie tax is summarized as follows.

TCJA changes to the kiddie tax cause C’s 2018 tax to be $1,126 lower than his 2017 liability, a decrease of roughly 27%.

Example 3

Last, but not least, B is a 16-year-old whose gross income is also made up of wages and interest income. He earns $14,000 from work and has invested in bank certificates of deposit that generate $3,000 of interest each year. His filing status is single, and he must pay federal income tax on both his earned and unearned income annually. Because B does not use any of his income for his support, he is considered his parents’ dependent and is subject to the kiddie tax. B’s state taxes are less than his standard deduction, so he will not itemize deductions. (Again B’s state tax liability is beyond the scope of this article.)

Based on the foregoing information, B’s 2018 taxable income is:

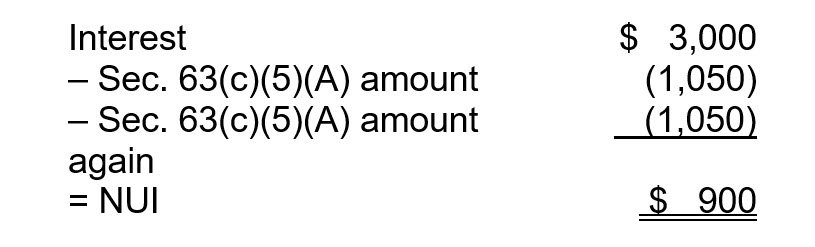

His NUI is computed as follows:

Finally, his ETI is computed as follows:

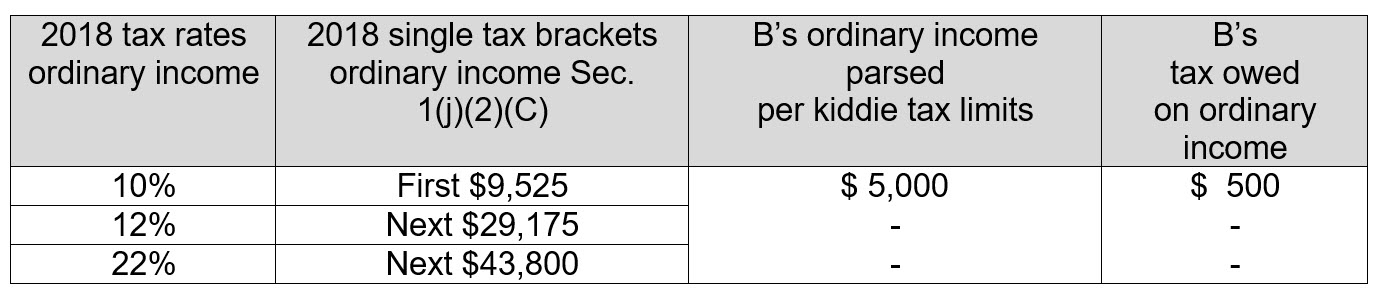

The tax on B’s taxable income is computed using a modified single tax rate table. The maximum amount of his taxable income that can be taxed at single rates below 24% is $6,650, which is the sum of $4,100 ETI plus $2,550. Since his taxable income is $5,000 and that amount fits entirely within the 10% single tax bracket, he will owe tax of $500 in 2018 as presented below.

If he had the same amount and character of taxable income in 2017, his taxable income would have been $5,650 higher than in 2018 since the standard deduction for single taxpayers was only $6,350 in 2017. Based on the foregoing information, B’s 2017 taxable income is:

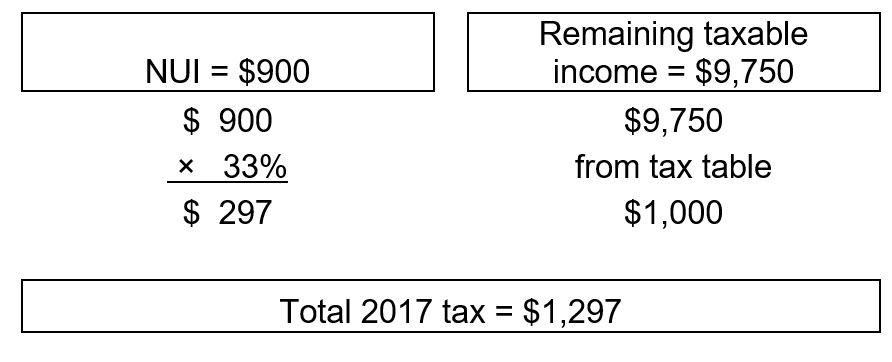

B would have the same NUI of $900 in 2017 as calculated above. If his parents have taxable income of $250,000 and are not subject to AMT, his total tax for 2017 would have been $1,297. Under the old kiddie tax rules, his taxable income of $10,650 is bifurcated between NUI of $900 to be taxed at his parents’ marginal tax rate and the remaining taxable income of $9,750 to be taxed at his rates. B’s 2017 kiddie tax is summarized as follows.

TCJA changes to the kiddie tax and the increase in the basic standard deduction cause B’s 2018 tax to be $797 lower than his 2017 liability, a decrease of roughly 61%.

While A’s example demonstrates that a child’s kiddie tax may increase as a result of the TCJA, C and B’s examples demonstrate the opposite. Children whose parents are in high marginal tax rates, and who have a higher proportion of earned or preferentially taxed unearned income, should fare better under the new law. That being said, the CPA should analyze the effect of the new law on all clients because different types and levels of gross income will yield different kiddie tax liabilities under the new law.