- column

- PROFESSIONAL LIABILITY SPOTLIGHT

Understand your firm’s risk profile

Please note: This item is from our archives and was published in 2018. It is provided for historical reference. The content may be out of date and links may no longer function.

No service, industry, area of practice, or CPA is immune from a professional liability claim. Fortunately, information is power. This data can help CPA firms evaluate the risks in their practice and help address them appropriately. The numbers are based on claims data for 2017.

Click here to download the full infographic PDF

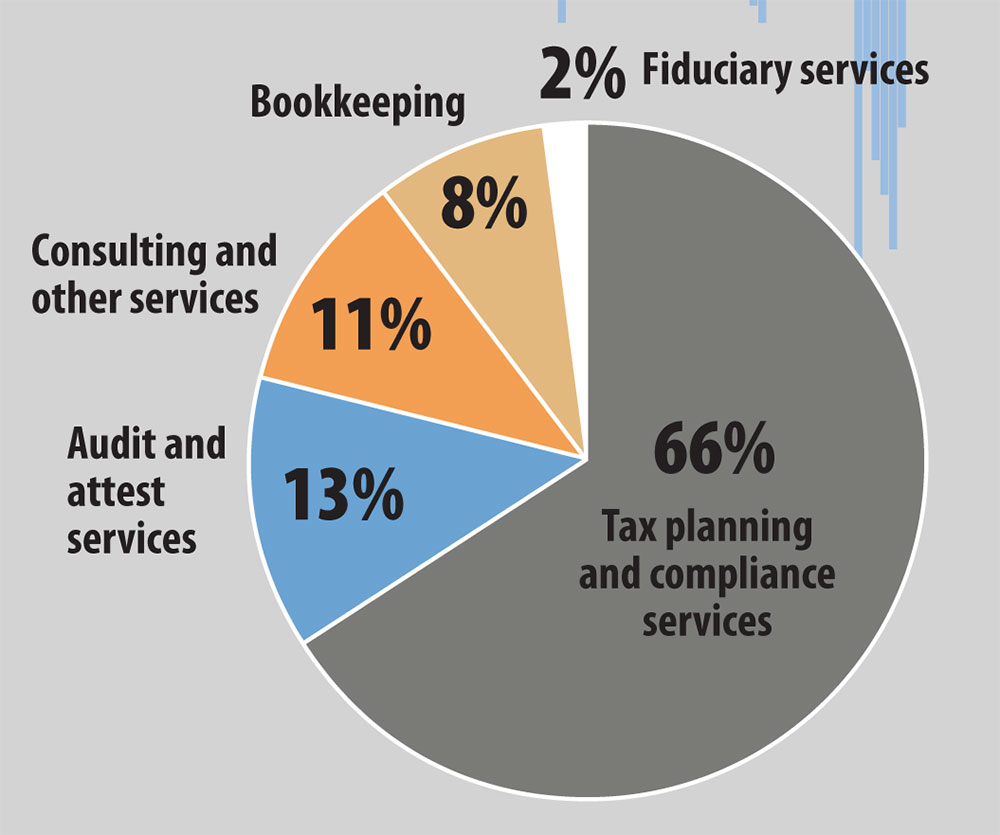

Claims asserted against CPA firms in the AICPA Professional Liability Insurance Program, by area of practice:

Percentage of 2017 claims

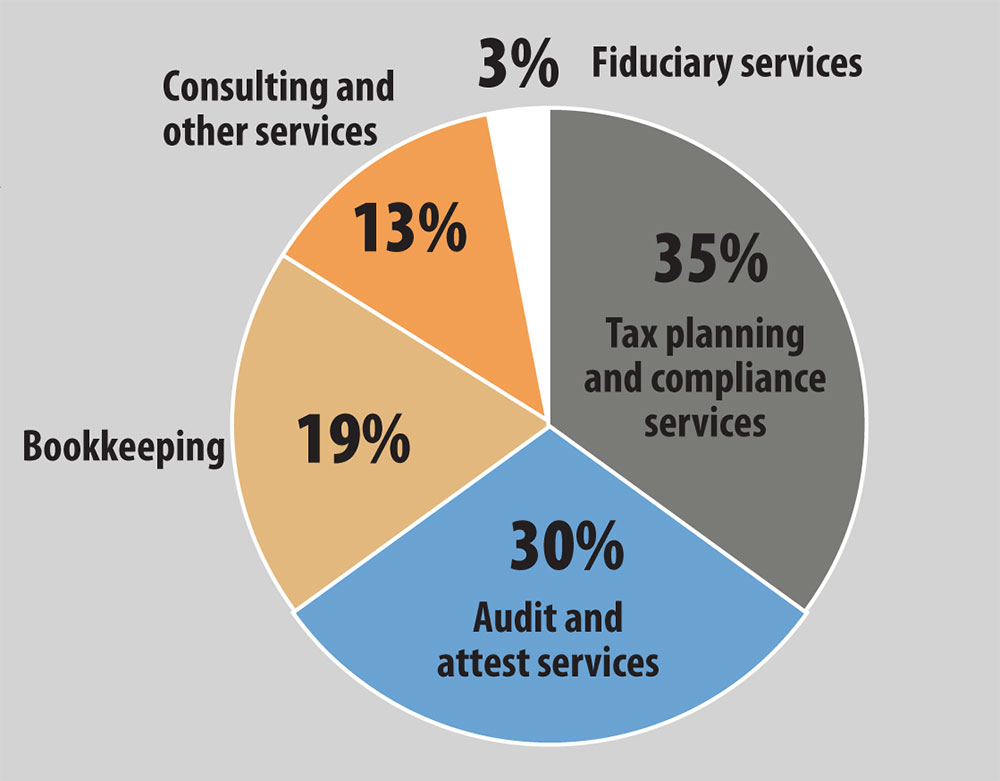

Failure to detect theft or fraud claims asserted against CPA firms in the AICPA Professional Liability Insurance Program, by area of practice:

Percentage of 2017 claims for failure to detect theft or fraud

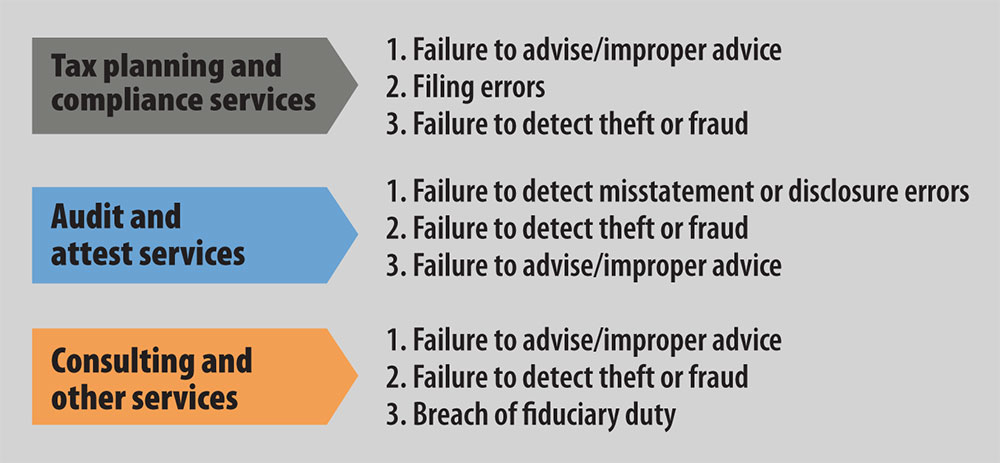

Information to help reduce the likelihood of a claim in a CPA firm:

Knowledge of the potential causes of loss for an engagement may provide the necessary awareness to help avoid those same issues, as well as the ability to plan and manage the exposure on future engagements.

Top 3 causes of loss by area of practice:

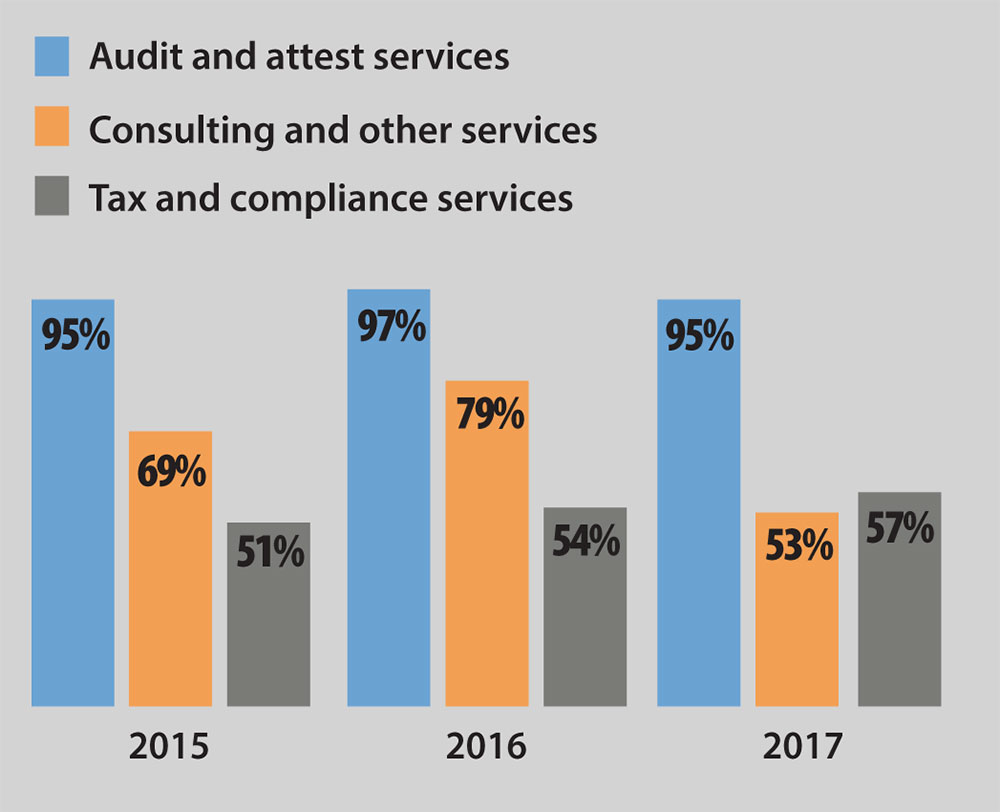

3 things that help in the defense of a claim are an engagement letter, strong documentation, and early reporting of issues.

Engagement letter usage, by area of practice, claims asserted 2015–2017:

Source: CNA Accountants Professional Liability Claim Database. Underwritten by Continental Casualty Company © 2018. All rights reserved. Charts by Tim Lee.

Daniel J. Gartland is a risk control consultant at CNA. Continental Casualty Co., one of the CNA insurance companies, is the underwriter of the AICPA Professional Liability Insurance Program. Aon Insurance Services, the National Program Administrator for the AICPA Professional Liability Insurance Program, is available at 800-221-3023 or visit cpai.com.