- column

- TECHNOLOGY Q&A

Convert your Excel PivotTable to a formula-based report

Please note: This item is from our archives and was published in 2018. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

Differentiating agentic and generative AI — and more with a Tech Q&A author

How AI is transforming the audit — and what it means for CPAs

Promises of ‘fast and easy’ threaten SOC credibility

TOPICS

Q. I usually like Excel PivotTables, but because they don’t allow me to do certain things, such as delete cells or insert new columns or rows, I’m wondering if there is a reasonable alternative?

A. Two key advantages of Excel’s PivotTables are that they are easy to create and they provide a structure that can be pivoted to reveal a multitude of report layouts. However, once your desired PivotTable is created, you are correct in that your editing options become somewhat restricted. In some cases, CPAs find they want to further refine their PivotTable reports using Excel’s full complement of editing tools, but their hands are tied by the PivotTable structure. In this situation, you might consider converting your PivotTable to a formula-based report using Excel 2016’s new Cube-based functions and conversion tools. Once converted to formulas, your report is no longer bound by the confines of the PivotTable structure, and you are free to edit the report as desired. Here’s how this is done.

1. Add your PivotTable to the Data Model. For this functionality to work, you must add the PivotTable report to the Data Model when you create the PivotTable. This is done by checking the box next to Add this data to the Data Model when creating a PivotTable, as circled in the screenshot below.

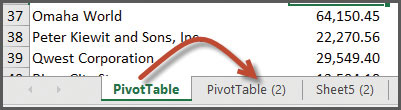

2. Make a copy of the PivotTable worksheet (optional). As an option, you can make a copy of the PivotTable worksheet by pressing the Ctrl key while dragging the PivotTable’s worksheet tab to create a copy of the PivotTable. This allows you to both retain your original PivotTable and create a formula-based version of that report from the PivotTable copy, as shown below.

3. Convert to formulas. Finally, position your cursor in the PivotTable you want to convert, and from the PivotTable Tools menu, select Analyze, OLAP Tools, Convert to Formulas, as pictured below.

This will convert the PivotTable report to a formula-based report that is still tied to the original data source, as suggested in the screenshots below. (Note that the amount 8,446.36 in the PivotTable report shown in the screenshot below has been converted to a CUBEVALUE formula in the formula-based report shown at the bottom of the next screenshot.) Thereafter, as an example, if the Total_Invoice source data for Ameritrade is changed, both the PivotTable report and formula-based report shown below will still be updated to reflect the revised amount.

The resulting formula-based report can then be freely edited and formatted using all of Excel’s editing and formatting tools. For example, columns or rows can be inserted, cells can be moved (or rearranged), and new colors, fonts, and conditional formats can be applied on a cell-by-cell basis, if desired. The formula-based report will continue to reflect the newer data upon refreshing the report after each time the source data are updated. You can download the example workbook referred to in this article at CarltonCollins.com/invoices.xlsx.

About the author

J. Carlton Collins (carlton@asaresearch.com) is a technology consultant, a conference presenter, and a JofA contributing editor.

Submit a question

Do you have technology questions for this column? Or, after reading an answer, do you have a better solution? Send them to jofatech@aicpa.org. We regret being unable to individually answer all submitted questions.