- feature

- FINANCIAL REPORTING

Keeping covenants: Getting debt ratios right

A 2015 FASB standard may move companies out of compliance with indebtedness thresholds.

Please note: This item is from our archives and was published in 2018. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

What CPAs should know about Trump accounts

What to know about engagement quality reviews (SQMS No. 2)

Agentic AI is handling more finance work — but can CFOs trust it?

Accurately defining and computing restrictions on indebtedness is critical to assessing a business’s compliance with debt covenant ratios. Many indentures contain covenants that rely on financial accounting numbers, such as a maximum debt-to-EBITDA ratio. For example, an indenture filed by CBS Corp. in October 2016 restricts the company from taking on additional indebtedness that would increase its debt-to-EBITDA ratio beyond 5-to-1.

For borrowers close to the restriction thresholds established in their indentures, a change made by FASB in 2015 could mean the difference between compliance with a debt covenant ratio and an apparent breach. Accounting Standards Update (ASU) No. 2015-03, Interest — Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs, requires entities to treat debt issuance costs only as a direct deduction to the amount of the related debt liability presented on the balance sheet (i.e., debt, net of debt issuance costs). Previously, companies had the option of presenting such costs as a prepaid asset, leaving the total amount of debt at the gross balance.

The updated standard affects annual financial statements starting in the 2016 fiscal year. The updated standard also affects interim financial statements starting in the 2016 fiscal year for public companies and starting in the 2017 fiscal year for private companies. Importantly, companies also are required to apply ASU No. 2015-03 retrospectively. For entities affected by the change, this means restating debt for prior years to reflect debt, net of unamortized debt issuance costs — and also potentially altering compliance with covenant ratios for those years.

To get a sense of the changes that companies may be facing, we compiled a sample of 89 indentures filed with the SEC between 2014 and 2016 by the top 20 public companies (by market capitalization) for each market sector identified in the S&P 500. We then examined the terms of the indentures to identify companies subject to covenant ratios that would be affected by restated debt amounts resulting from implementation of ASU No. 2015-03. We also looked for any language in the indentures that provided guidance on addressing changes in accounting rules that might affect the calculation of covenant ratios. We believe this analysis provides some insight into potential issues facing companies as a result of implementing ASU No. 2015-03. It’s important to note that although our sample included only public companies, our conclusions apply to private companies as well.

THE ROOT OF THE ISSUE: ASU No. 2015-03

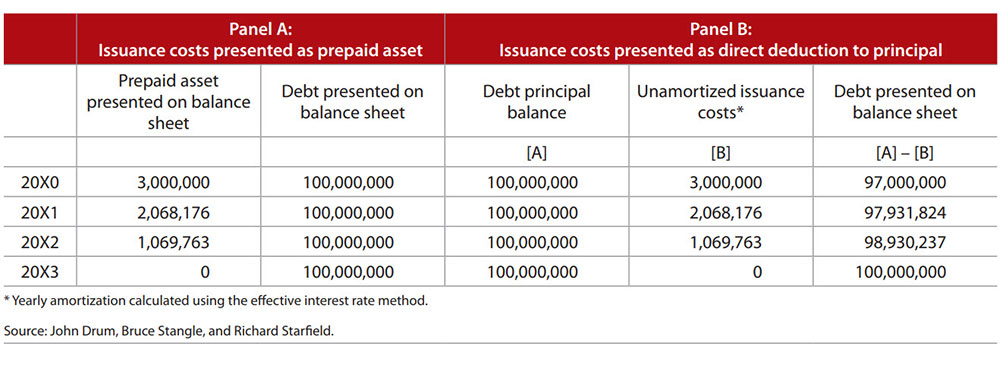

Indentures typically require that financial accounting data comply with GAAP, which is constantly evolving. In this instance, FASB issued ASU No. 2015-03 to resolve conflicting guidance on how to treat debt issuance costs. Table 1, “Debt Issuance Cost Presentation Before ASU No. 2015-03,” illustrates the different accounting treatment over time.

Table 1: Debt issuance cost presentation before ASU No. 2015-03

Before ASU No. 2015-03, some companies elected to present debt issuance costs as a prepaid asset (see Panel A in Table 1). For example, a company that issued $100 million of debt and paid $3 million in fees would have initially recognized a $100 million liability and a $3 million prepaid asset. Over the term of the debt, the entity would have amortized the $3 million prepaid asset, with the periodic amortization charge reflected as part of interest expense on the income statement.

Other entities, however, would have presented debt issuance costs as a direct deduction to the principal amount of debt (see Panel B in Table 1). For example, an entity that issued $100 million in debt and incurred fees of $3 million would have initially shown a debt liability of $97 million on its balance sheet. Although no prepaid asset was presented on the balance sheet, the entity still amortized the issuance costs over time. When the debt issuance costs were presented as a direct deduction, the amount of debt shown on the entity’s balance sheet increased over time, in step with the amortization of the debt issuance cost. Panel B of Table 1 shows that as the amount of unamortized issuance cost declined, the debt presented on the balance sheet increased. The full $100 million of debt thus appeared only when the issuance costs were fully amortized.

ASU No. 2015-03 alleviated the conflicting guidance by requiring debt issuance costs to be presented only as a reduction of debt on the balance sheet (i.e., debt, net of debt issuance costs, as shown in Panel B of Table 1). ASU No. 2015-03 does not change the amount of debt issuance costs recognized on a borrower’s balance sheet. Rather, it requires those same amounts to be presented as a deduction from the amount of debt, not as a prepaid asset. Note that the amounts presented as prepaid assets in Panel A match the amounts presented as a deduction in the amount of reported debt in Panel B. ASU No. 2015-03 essentially makes the presentation of debt issuance costs consistent with the treatment of original issuance discounts, where the proceeds of the borrowing are less than the stated principal amount of the debt.

EFFECT ON DEBT COVENANT RATIO CALCULATIONS

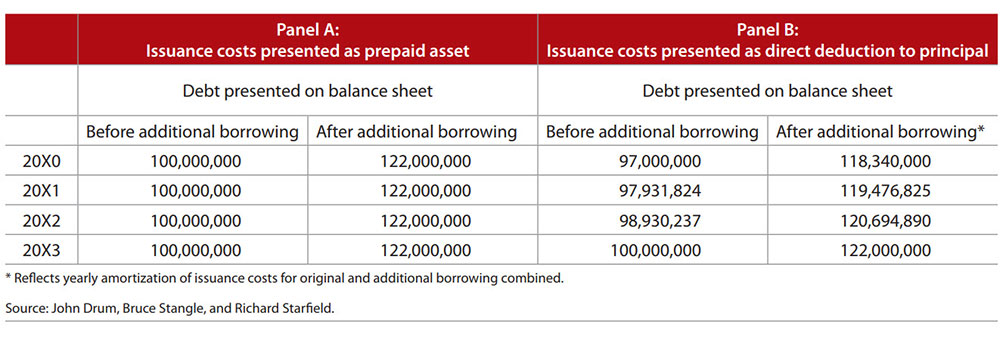

Expanding our example, now assume the $100 million indenture restricts the entity from seeking additional borrowing that would cause its debt-to-EBITDA ratio to be equal to or greater than 4-to-1. Further assume the entity generates $30 million in EBITDA per year and seeks to borrow an additional $22 million. If debt issuance costs are presented as a prepaid asset on the balance sheet — that is, the costs do not affect the total amount of debt shown — the entity’s debt in any year would run up against the covenant limit of $120 million (i.e., $30 million EBITDA × 4.0), and the entity would be prohibited from borrowing the additional $22 million. As shown in Panel A of Table 2, “The Effects of ASU No. 2015-03,” in this case the total debt after additional borrowing exceeds $120 million in each period.

Table 2: The effects of ASU No. 2015-03

On the other hand, if debt issuance costs are presented as a direct deduction to the value of debt on the balance sheet, as required under ASU No. 2015-03, borrowing an additional $22 million would not cause the entity to be in violation of the covenant in years 20X0 to 20X1. As shown in Panel B of Table 2, the total debt, including the additional borrowing, appears on the balance sheet as less than $120 million until the issuance costs have been sufficiently amortized.

However, once issuance costs are sufficiently amortized — in year 20X2, in our example — the debt appearing on the balance sheet no longer reflects the deduction of the issuance costs, and the entity would appear to be in violation of the covenant. Importantly, when issuance costs are presented as a direct reduction to the value of debt appearing on the balance sheet, apparent compliance with the covenant ratios in this example depends on the passage of time and amortization of the issuance costs. That is, even though nothing about the company changed between 20X1 and 20X2 (the principal balance of debt and the EBITDA remained constant), the entity shifted from apparent compliance to apparent noncompliance with the debt covenant ratio.

WHICH COMPANIES ARE AFFECTED?

As noted above, for any company (public or private) that previously treated debt issuance costs as a prepaid asset, the adoption of ASU No. 2015-03 could change the computation of debt covenant ratios using the amounts presented on the balance sheet. In the sample of 89 public companies we examined, about 85% disclose that ASU No. 2015-03 caused them to switch their accounting treatment for debt issuance costs from presentation as a prepaid asset to a direct deduction of the debt balance. While our sample did not include private companies, we believe it is likely that some private companies had also previously treated debt issuance costs as a prepaid asset.

More than half of the indentures in our sample (1) contained a numeric covenant that relied on debt for a covenant computation, and (2) defined debt by reference to amounts that appear on a balance sheet prepared in compliance with GAAP. For example, a September 2016 indenture restricts Crown Castle International Corp. from incurring additional borrowing if doing so would cause the amount of indebtedness secured by liens to exceed 3.5 times adjusted EBITDA. Within the definition of indebtedness, the indenture specifies that indebtedness includes amounts “if and to the extent any of the [previously listed amounts] would appear as a liability upon a balance sheet of such Person prepared in accordance with GAAP.”

Some indentures (four in our sample) included language indicating how an entity should treat debt issuance costs in computing earnings metrics (e.g., EBITDA). Again, Crown Castle defined the calculation of “Adjusted EBITDA” to consider “interest expense, whether or not accrued and whether or not capitalized (including amortization of debt issuance costs and original issue discount …).” None of the indentures, however, contained language that specified how debt issuance costs should be treated for calculating debt levels, leaving that up to the individual entity.

Interestingly, some indentures (12 in our sample) specify how to treat original issuance discounts, which receive the same accounting treatment as debt issuance costs under ASU No. 2015-03. The definition of debt contained in Crown Castle’s indenture specifies that “in the case of any Indebtedness issued with original issue discount, the amount of such Indebtedness shall be the accreted value thereof.” This is consistent with the way ASU No. 2015-03 requires debt issuance costs to be treated.

A small number of indentures (eight in our sample) include language that provides guidance on addressing the scenario in which accounting rules changes might affect the calculation of covenant ratios. For example, the indenture filed by Charter Communications Inc. in May 2016 states that in the event of a change in GAAP, the parties would enter into negotiations to amend the agreement. Alternatively, an indenture filed by CenturyLink Inc. in February 2016 grants the borrower sole discretion in modifying the calculation of covenant ratios in response to changes in GAAP. Absent such language, borrowers and lenders may not have a specified course of action to handle changes in GAAP.

Requiring a change in GAAP to be applied retroactively, as ASU No. 2015-03 does, means that companies will need to revisit financial statements they have already filed. In the event that a change in GAAP results in apparent noncompliance with debt covenants (in the current period or prior periods), and the indenture does not provide a specified course of action, it is important to consult with outside legal, financial, and accounting advisers to fully understand the issue and determine whether any further action is warranted to avoid or rectify any adversarial situations.

About the authors

John Drum (John.Drum@analysisgroup.com) is a vice president, Bruce Stangle (Bruce.Stangle@analysisgroup.com) is a co-founder, and Richard Starfield (Richard.Starfield@analysisgroup.com) is a managing principal of Analysis Group, an economics consulting firm with 13 offices worldwide.

To comment on this article or to suggest an idea for another article, contact Ken Tysiac, editorial director, at Kenneth.Tysiac@aicpa-cima.com or 919-402-2112.

AICPA resources

Article

- “FASB Issues Changes Regarding Presentation of Debt Issuance,” JofA, April 7, 2015

CPE self-study

- Debt and Equity Mix (#BLICTL3, online access; #GT-BLICTL3, group pricing)

- Financial Instruments: Mastering the New FASB Requirements (#164921, online access)

- Financial Statement Analysis: Basis for Management Advice (#733990, text; #GT-FSABM, group pricing)

Conferences

- AICPA ENGAGE, June 9—14, Las Vegas

- Financial Planning & Analysis Conference, July 16—18, Denver

For more information or to make a purchase or register, go to aicpastore.com or call the Institute at 888-777-7077.